Modular Instruments Market Size 2024-2028

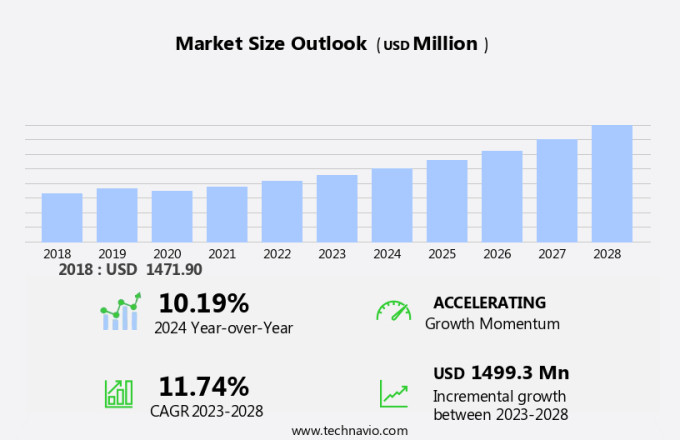

The modular instruments market size is forecast to increase by USD 1.5 billion at a CAGR of 11.74% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for automation in various industries. Hardware devices, such as functional cards, are becoming increasingly popular as they offer flexibility and ease of use in benchtop tests and measurements. The trend towards faceless instruments, which prioritize functionality over user interface, is also driving market growth.

- Modular instruments are hardware devices designed for measurement and automation applications in various sectors, including telecommunications, electronics, and semiconductors. Interoperability in telecommunications and testing equipment is another key factor, as price-sensitive and multiple technology solutions are necessary for businesses to remain competitive. The report provides an in-depth analysis of these market growth factors and more, offering valuable insights for stakeholders in the modular instruments industry.

What will be the Modular Instruments Market Size During the Forecast Period?

- The market is witnessing significant growth due to the increasing demand for advanced measurement and automation solutions in various industries. These instruments offer flexibility, scalability, and functionality, making them an essential component of modern technology infrastructures. They consist of functional cards that can be interconnected using sole instrument buses to create customized measurement systems. These instruments facilitate benchtop tests, data transfer, and communication between different devices. Communication and networking play a crucial role in the market.

- Furthermore, the integration of wireless technologies like LTE and mobile data traffic has led to the development of smart devices that require sophisticated measurement solutions. Modular instruments offer seamless communication capabilities, enabling real-time data transfer and analysis. The user interface of modular instruments is another critical factor driving the market growth. Faceless instruments, which offer a high degree of customization and ease of use, are gaining popularity. A test program can be implemented on these instruments, allowing users to perform various measurements and automate testing processes. Scalability is another essential aspect of modular instruments. These instruments can be easily upgraded or expanded as per the changing requirements of an organization.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Semiconductor and electronics

- Telecommunication

- Aerospace and defense

- Others

- Product

- PXI platform

- VXI platform

- AXIe platform

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By End-user Insights

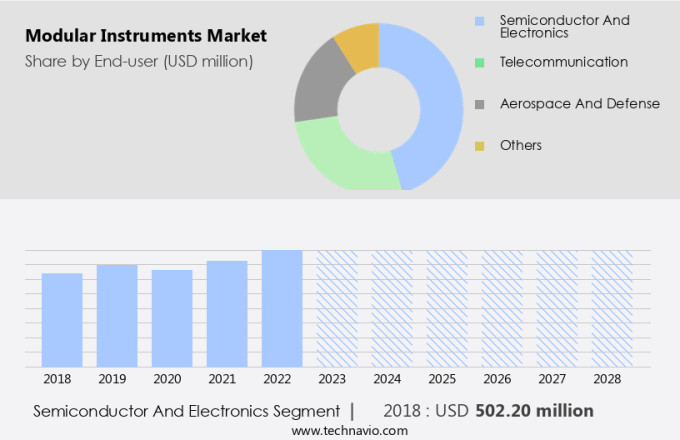

- The semiconductor and electronics segment is estimated to witness significant growth during the forecast period.

In the realm of semiconductors and electronics, various applications utilize modular instruments for advancements in mechanical and electrical engineering, submicron and nano-precision technology, photonics production, and nanotechnology. Circuit board manufacturing holds significant importance due to its role in introducing new, quicker, and more precise manufacturing techniques. This progression is anticipated to generate demand for modular instruments. The persistent expansion of the electronics sector and the quest for advanced technology will fuel research and development activities, thereby amplifying the demand for modular instruments. Additionally, China's imports of semiconductors, valued at over USD200 billion, are essential for the production of smart devices, consumer electronics, and computing products.

Get a glance at the market report of share of various segments Request Free Sample

The semiconductor and electronics segment was valued at USD 502.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

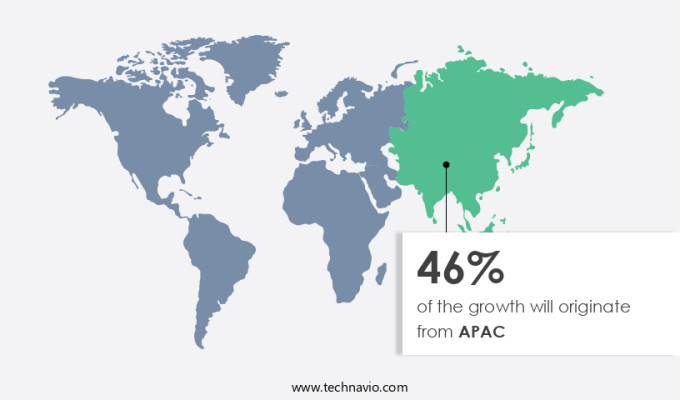

- APAC is estimated to contribute 46% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

In the electronic devices sector, communication and networking technologies, including Long-Term Evolution (LTE) and Fourth Generation (4G) wireless technologies, are driving growth in the market in the Asia Pacific (APAC) region. Modular instruments are increasingly being utilized in smart devices and mobile data traffic applications due to their flexibility and ease of integration. APAC countries are significantly investing in modular instruments for the IoT (Internet of Things) and defense and aviation industries. China, Japan, and South Korea are at the forefront of modular instrument production in APAC, with numerous companies in these countries manufacturing cost-effective, advanced test equipment for defense and aerospace applications.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Modular Instruments Market?

Growth in communication sector in APAC is the key driver of the market.

- The market is experiencing substantial expansion due to the increasing adoption of communication solutions by various industries, including telecommunications, aerospace and defense, and automotive and transportation. Telecommunication service providers hold a prominent position in the communication market, contributing significantly to its growth. In the telecommunications sector, modular instruments enable high-quality and high-performance services, making them indispensable for mobile device manufacturers, network equipment manufacturers, and telecommunication service providers. The Asia Pacific (APAC) region presents lucrative opportunities for modular communication equipment. The region's rapid growth in the communication sector, driven by the increasing demand for high-speed connectivity and advanced communication systems, is fueling the adoption of modular communication instruments.

- Moreover, China, in particular, is a major contributor to the global communication sector and the largest market for modular communication equipment in APAC. Ethernet and fiber optics are the primary technologies driving the market in various industries. PXI, AXIe, and VXI are the most commonly used standards in modular instruments for communication applications. These standards ensure interoperability and compatibility among various components, making it easier for manufacturers to design and build modular communication systems. In conclusion, the market is witnessing a strong growth due to the increasing demand for high-performance communication systems in various industries. Telecommunication service providers are the major consumers of modular communication instruments, while APAC is the fastest-growing market for these instruments.

What are the market trends shaping the Modular Instruments Market?

Interoperability in T and M equipment is the upcoming trend in the market.

- In today's electronic and electrical landscape, the interoperability of test and measurement (T&M) equipment is crucial for end-users to ensure seamless integration of various devices from different manufacturers. This challenge applies to both heterogeneous sets of products, such as home security systems, video monitors, and networking equipment, as well as homogeneous sets, like routers and switches. End-users often encounter compatibility issues between T&M devices, which can hinder their ability to use a diverse range of products. This issue poses a significant challenge for companies, as it may deter potential customers from purchasing their equipment. To address this problem, hardware devices in the T&M market are evolving to include functional cards and user-friendly interfaces.

- Moreover, these advancements enable benchtop tests and measurements to be conducted more efficiently and accurately. Moreover, faceless instruments with advanced test programs are increasingly popular, as they offer automated solutions to complex testing scenarios. These developments aim to streamline the testing process, ensuring that T&M equipment functions optimally in various environments. As the demand for interoperability grows, companies are investing in research and development to create more compatible solutions, ultimately benefiting end-users and the industry as a whole.

What challenges does Modular Instruments Market face during the growth?

Necessity for price-sensitive and multiple technology solutions is a key challenge affecting market growth.

- The electronics and semiconductor industry continues to advance, driving the development of innovative modular instruments. IoT, 5G, LTE Advanced, LTE gateways, access points, machine vision, and motion control technologies are leading the charge in this evolution. However, the increasing reliance on raw materials sourced from China and the subsequent rise in production costs due to import duties pose a challenge for manufacturers. This, in turn, impacts the affordability of modular instruments for price-sensitive end-users.

- Moreover, For instance, local Chinese companies offer digital ultrasonic flow detectors at significantly lower prices, around USD1,000, compared to those sold by major suppliers. In the competitive landscape, companies must maintain a balance between innovation and affordability to cater to the evolving needs of consumers.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ADLINK Technology Inc.

- AMETEK Inc.

- Aplab Ltd

- Astronics Corp.

- Chroma ATE Inc.

- Coolisys Technology Inc.

- EXFO Inc.

- Fortive Corp.

- GOPEL electronic GmbH

- Guzik Technical Enterprises

- Keysight Technologies Inc.

- National Instruments Corp.

- Pickering Interfaces Ltd.

- Rohde and Schwarz GmbH and Co. KG

- Sulzer Ltd.

- Teledyne Technologies Inc.

- Teradyne Inc.

- The Marvin Group

- Viavi Solutions Inc.

- Yokogawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Modular instruments have gained significant traction in various industries due to their flexibility and scalability. These electronic devices are widely used in communication and networking applications, particularly in the context of LTE, 4G, and 5G wireless technologies. Modular instruments play a crucial role in facilitating data transfer and communication in smart devices, IoT, and telecommunications. The use of modular instruments extends beyond wireless technologies, with applications in sectors such as aerospace and defense, automotive and transportation, electronics and semiconductor, and machine vision. Modular instruments enable synchronized measurements, benchtop tests, and functional card implementation in various industrial test benches. Modular instruments come in various forms, including PXI, VXI, and AXIE, and can be integrated with hardware devices such as PCIe, USB, and Ethernet.

Moreover, their deployment capabilities make them suitable for various applications, from portable chassis to industrial-scale systems. Modular instruments offer high data transfer rates and system compatibility, making them ideal for implementing test programs and user interfaces. Their use in automation and motion control applications is also increasing due to their scalability and functional capabilities. In summary, modular instruments are essential components in various industries, enabling communication, data transfer, and measurement applications in the context of wireless technologies, industrial test benches, and automation systems. Their flexibility, scalability, and compatibility make them indispensable tools for implementing advanced technologies such as LTE advanced, 5G, and IoT devices.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

179 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.74% |

|

Market growth 2024-2028 |

USD 1.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.19 |

|

Key countries |

US, China, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch