Modular Mining Systems Market Size 2024-2028

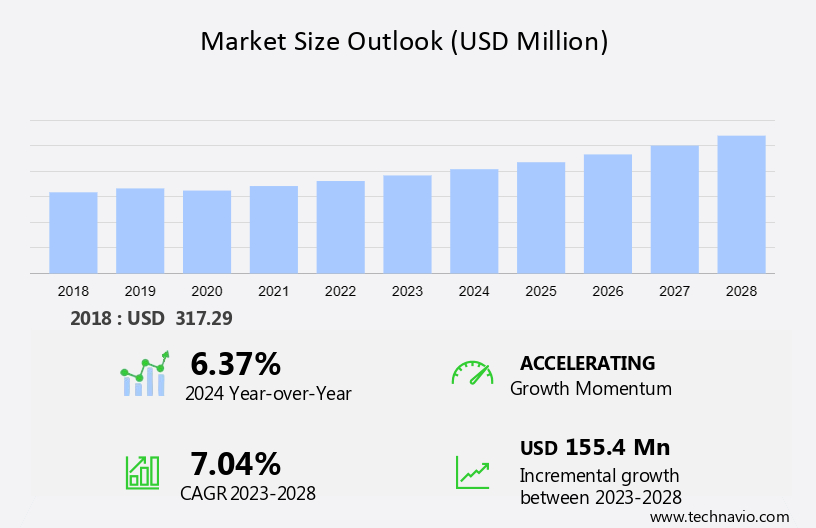

The modular mining systems market size is forecast to increase by USD 155.4 million at a CAGR of 7.04% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for metals and minerals such as aluminum, copper, iron ore, coal, and steel. This trend is driven by the digital transformation In the mining industry, which includes the adoption of advanced technologies like artificial intelligence, analytics, sensors, GPS, and automation. These technologies enable real-time data analytics, fleet management, and autonomous vehicles, leading to increased efficiency and productivity. Additionally, the integration of greenhouse sensors and digital software solutions in modular mining systems helps optimize energy consumption and reduce environmental impact. However, the high initial investments required for implementing these systems pose a challenge for small and medium-sized mining companies. Despite this, the benefits of modular mining systems, including improved safety, increased productivity, and reduced operational costs, make them an attractive investment for companies In the construction materials sector and beyond.

What will be the Size of the Market During the Forecast Period?

- The market encompasses the supply and demand for advanced, pre-fabricated mining solutions that integrate heavy machinery, predictive maintenance solutions, and digital technologies. These systems cater to various metals and minerals extraction processes, including surface mining operations utilizing backhoe excavators, power shovels, bucket wheel excavators, and dragline excavators. The mining sector's shift towards smart connected mines, digital transformation, and automated mining equipment is driving market growth. It offers benefits such as improved worker safety, enhanced fleet management, and optimized exploration techniques. These systems enable mining supervisors to monitor and control operations remotely, ensuring efficient resource utilization and reducing hazards like coal dust inhalation.

- Additionally, digital integration facilitates smart inventory management and mining analytics platforms, further streamlining mining processes in low population density areas. The market's future direction lies In the continued adoption of automated mining equipment and the integration of advanced technologies to enhance operational efficiency and productivity.

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Metal mines

- Non-metallic mines

- Type

- Open-pit mining systems

- Underground mining systems

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Application Insights

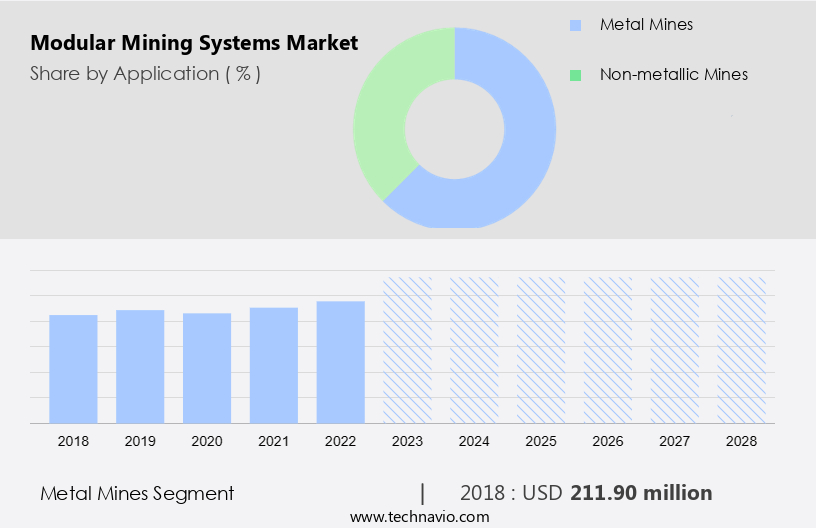

- The metal mines segment is estimated to witness significant growth during the forecast period.

The market plays a significant role In the metals and minerals sector, particularly in mining operations for extracting valuable metal ores. Modular Mining Systems, a key component of modern mining, employ advanced technologies and heavy machinery to optimize metal extraction processes and ensure sustainable mining practices. These systems consist of Automated Drilling and Blasting Systems, which use modern drill rigs equipped with autonomous features and real-time monitoring capabilities for precise blast-hole drilling and accurate fragmentation. Additionally, Smart Connected Mines, Digital Transformation, and Worker Safety are integral to the mining sector's evolution. This includes Remote Operating Systems, Fleet Management, and Asset Tracking for enhanced productivity and efficiency.

Get a glance at the Modular Mining Systems Industry report of share of various segments Request Free Sample

The metal mines segment was valued at USD 211.90 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

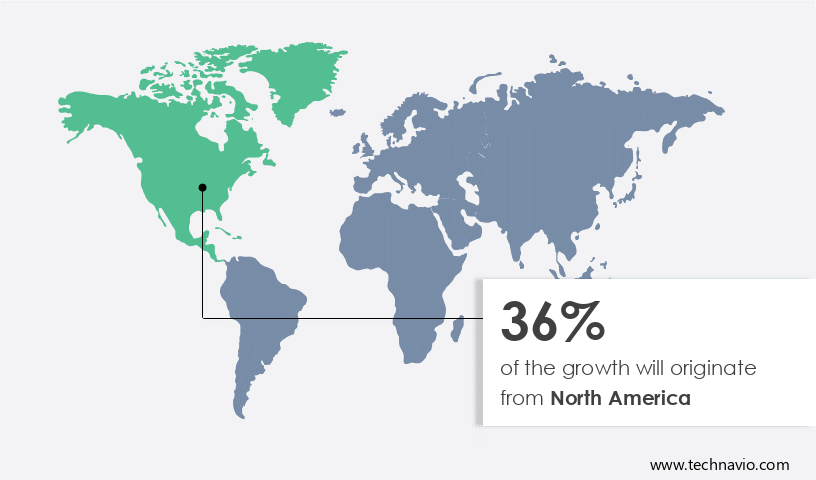

- North America is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market experienced significant growth in North America in 2023, driven by the increasing demand for metals and minerals In the region. With the expansion of large-scale residential construction projects, there has been an increase In the requirement for construction materials such as iron, steel, sand, and stones. This demand has led to an increase in mining activities for these resources, resulting in a heightened need for it to support the growing industry. Furthermore, North America is home to some of the world's largest coal mines, necessitating the use of it to execute extensive mining operations.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Modular Mining Systems Industry?

Rising demand for metals and minerals is the key driver of the market.

- The global mining sector is witnessing a significant increase in demand for it due to the growing requirement for metals and minerals in various industries. This trend is driven by urbanization and infrastructure development, particularly in emerging economies such as China, India, and Brazil, which necessitate an increased supply of construction materials. To meet this demand, mining operations must improve their efficiency, productivity, and sustainability. Modular Mining Systems offer solutions through the integration of heavy machinery, such as backhoe excavators, power shovels, bucket wheel excavators, and dragline excavators, with smart connected mines, digital transformation, and autonomous vehicles. These advancements prioritize worker safety, mining supervisors' remote operating systems, fleet management, resources and minerals industrialization, automation, machine learning, mining equipment performance, and sustainable mining practices.

- Additionally, digitization enables air quality monitoring, proximity detection, payload monitoring, asset tracking, geological information exploration techniques, and smart inventory management. The market dynamics further prioritize the importance of automated mining equipment, modular mobile machines, mining analytics platforms, and digital integration. Environmental concerns, including the destruction of habitats and the emission of carbon dioxide and greenhouse gases, are addressed through sustainable mining practices and ecosystem preservation.

What are the market trends shaping the Modular Mining Systems Industry?

Technological advancements in modular mining systems is the upcoming market trend.

- The market is witnessing significant technological advancements, revolutionizing traditional mining operations. Autonomous vehicles, real-time data analytics, IoT, and advanced sensing technologies are key innovations driving efficiency, productivity, and safety. Autonomous haulage trucks, drilling systems, and loading equipment are increasingly adopted for optimization and enhanced safety. These vehicles employ sensors, GPS, and AI for precise navigation, task execution, and improved efficiency. Additionally, the integration of digital technologies facilitates remote operations, fleet management, and skilled workforce management. Mining companies prioritize worker safety, resource management, and environmental sustainability. Technological advancements include mining analytics platforms, digital integration, and automation, employing machine learning and smart algorithms.

- Furthermore, the implementation of autonomous vehicles, such as unmanned autonomous haul trucks and tunneling equipment, contributes to reduced carbon dioxide and greenhouse gas emissions, promoting sustainable mining practices. The digitization of mines ensures a connected and digitally enabled workplace, enabling smart inventory management, automated mining equipment, and data management. Safety concerns, such as hazards from coal dust inhalation and power supplies, are addressed through emission management software and proximity detection systems.

What challenges does the Modular Mining Systems Industry face during its growth?

High initial investments in modular mining systems is a key challenge affecting the industry growth.

- The global market for Modular Mining Systems has experienced growth due to the integration of advanced technologies In the metals and minerals mining sector. Modular Mining Systems, which include heavy machinery such as backhoe excavators, power shovels, bucket wheel excavators, and dragline excavators, are being transformed into Smart connected mines through Digital transformation. This transformation focuses on enhancing worker safety, improving mining supervision through remote operating systems, and optimizing fleet management. They offer industrialization and automation through machine learning and mining equipment performance analysis. However, the high initial investment required for implementing these systems remains a significant barrier.

- Remote operations and the digitally enabled workplace are also key factors In the market's growth. Additionally, connected equipment, smart algorithms, and fleet management systems enable efficient data management, asset tracking, geological information, and exploration techniques. The market also focuses on workforce management, ensuring a skilled workforce, and maintaining air quality monitoring, proximity detection, payload monitoring, and emission management software.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Aspen Technology Inc.

- Atlas Copco AB

- Caterpillar Inc.

- Dassault Systemes SE

- Emerson Electric Co.

- Hexagon AB

- Hitachi Ltd.

- Komatsu Ltd.

- Maptek Pty Ltd.

- Rockwell Automation Inc.

- Sandvik AB

- Schneider Electric SE

- Symboticware Inc.

- Trimble Inc.

- Yokogawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The mining sector continues to evolve, with modular mining systems gaining significant traction In the metals and minerals industry. Modular mining systems, a subset of mining equipment, are self-contained, pre-engineered units designed for efficient and flexible mining operations. These systems integrate various components, including heavy machinery such as backhoe excavators, power shovels, bucket wheel excavators, and dragline excavators, to streamline mining processes. The mining sector's digital transformation is driving the adoption of modular mining systems. Smart connected mines, enabled by digital technologies, are revolutionizing mining operations. Digitalization is facilitating real-time data collection, analysis, and decision-making, leading to improved mining equipment performance and increased productivity.

In addition, safety is a critical concern In the mining sector. They offer advanced safety features, such as remote operating systems, which allow mining supervisors to monitor and control mining operations from a safe distance. Furthermore, fleet management systems facilitate proactive maintenance, reducing the risk of equipment failure and ensuring worker safety. Environmental concerns are increasingly important In the mining industry. Modular mining systems contribute to sustainable mining practices by minimizing environmental degradation and destruction of habitats. These systems enable efficient use of resources and minerals, reducing the carbon footprint and greenhouse gas emissions. Automation and machine learning are key trends In the mining sector.

Furthermore, these are being integrated with autonomous vehicles, such as autonomous haul trucks and unmanned autonomous vehicles, to optimize mining operations. Tunneling equipment and surface mines are also being digitized, enabling remote operations and increasing efficiency. The mining sector's industrialization is driving the demand for modular mining systems. These systems offer a digitally enabled workplace, with smart algorithms and connected equipment facilitating data management, air quality monitoring, proximity detection, payload monitoring, asset tracking, geological information, and exploration techniques. The use of it is particularly beneficial in low population density areas, where the availability of skilled labor may be limited.

In addition, smart inventory management and automated mining equipment enable efficient and effective mining operations, reducing the need for a large workforce. However, the adoption of it also presents challenges. The implementation of these systems requires significant investment and expertise. Moreover, the integration of digital technologies raises concerns regarding data security and privacy.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

176 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.04% |

|

Market growth 2024-2028 |

USD 155.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.37 |

|

Key countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Modular Mining Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the modular mining systems market growth of industry companies

We can help! Our analysts can customize this modular mining systems market research report to meet your requirements.