Motion Sickness Drugs Market Size 2024-2028

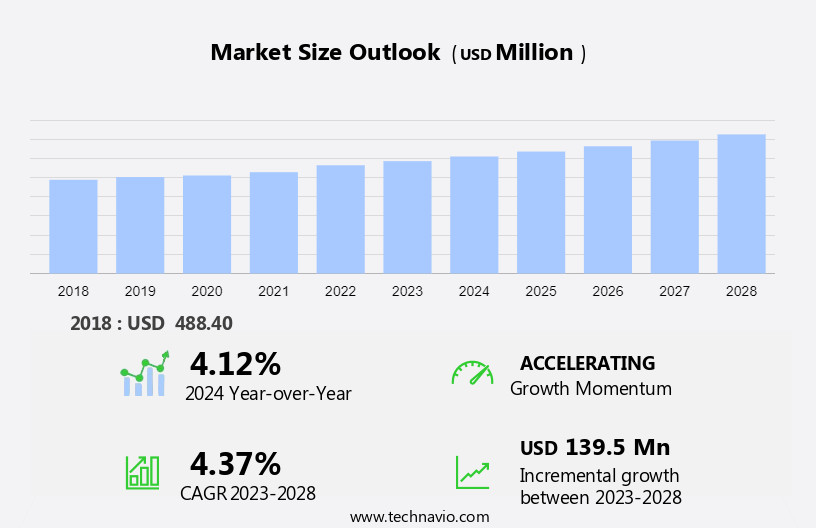

The motion sickness drugs market size is forecast to increase by USD 139.5 million at a CAGR of 4.37% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. Firstly, the availability of over-the-counter (OTC) medications for self-treatment is a major trend driving market expansion. Ginger, a popular natural remedy for motion sickness, is increasingly being used in various forms such as ginger chews, ginger tea, and ginger oil. Moreover, advancements in technology have led to the development of wearable devices and home care solutions for motion sickness. These devices, which use sensors to detect motion and provide real-time feedback, are gaining popularity in various industries such as gaming, education, virtual reality, adventure tourism, and sports. Another trend In the market is the increasing use of nonpharmacological countermeasures to treat motion sickness. These include acupressure, breathing exercises, and visual fixation techniques.

What will be the Size of the Market During the Forecast Period?

- The market caters to the unmet healthcare needs of individuals experiencing discomfort and anxiety due to multi-axial motion, acceleration, and sensation resulting from various causes such as travel, cancer treatments, coronavirus-induced vertigo, and virtual reality experiences. This medical condition, characterized by temporary sensations of nausea, dizziness, and vomiting, affects a significant population, particularly females and travelers. The market encompasses a range of medicines, including prescription drugs and over-the-counter options, administered through various routes like transdermal and oral.

- Wearable relief bands, such as ReliefBand and ReliefBand Sport, have gained popularity due to their convenience and effectiveness. Traditional medicines, like acupressure and acupuncture, also play a role In the market. The demand dynamics for motion sickness drugs are influenced by factors like healthcare systems, individual preferences, and the ongoing development of new treatments and technologies.

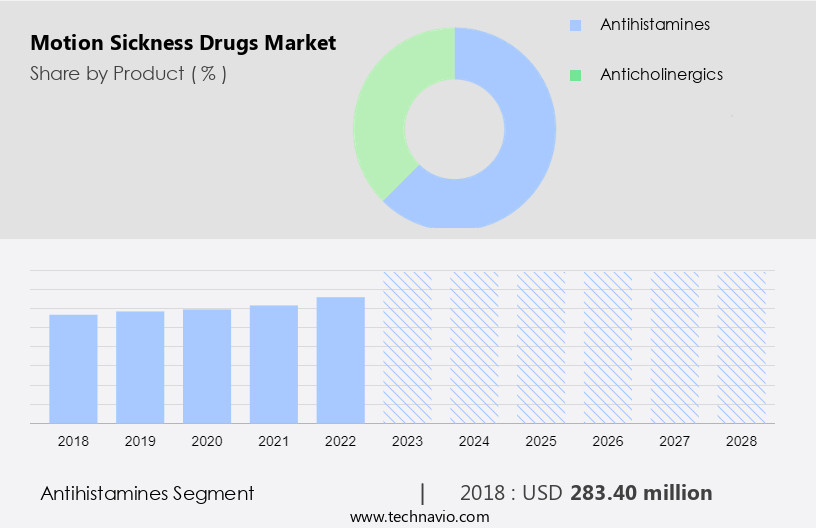

How is this Industry segmented and which is the largest segment?

The motion sickness drugs industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Antihistamines

- Anticholinergics

- Distribution Channel

- Offline

- Online

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By Product Insights

The antihistamines segment is estimated to witness significant growth during the forecast period.Motion sickness, characterized by symptoms such as nausea, increased salivation, belching, sweating, and discomfort, affects individuals during multi-axial motion or acceleration. The condition, which can cause temporary sensation and anxiety, particularly impacts pregnant women, children, and cancer patients undergoing chemotherapy. Antihistaminic and anticholinergic drugs, including Cinnarizine, promethazine hydrochloride, promethazine teoclate, and meclizine, are commonly used for motion sickness treatment. These drugs, part of the oral pharmaceuticals segment, act by blocking histamine 1 (H1) receptors and muscarinic receptors, thereby alleviating symptoms. The market for motion sickness drugs is served by these antihistamines, with Cinnarizine being a piperazine derivative that takes effect two to three hours after administration and has a half-life of three to six hours.

Get a glance at the market report of share of various segments Request Free Sample

The antihistamines segment was valued at USD 283.40 million in 2018 and showed a gradual increase during the forecast period.

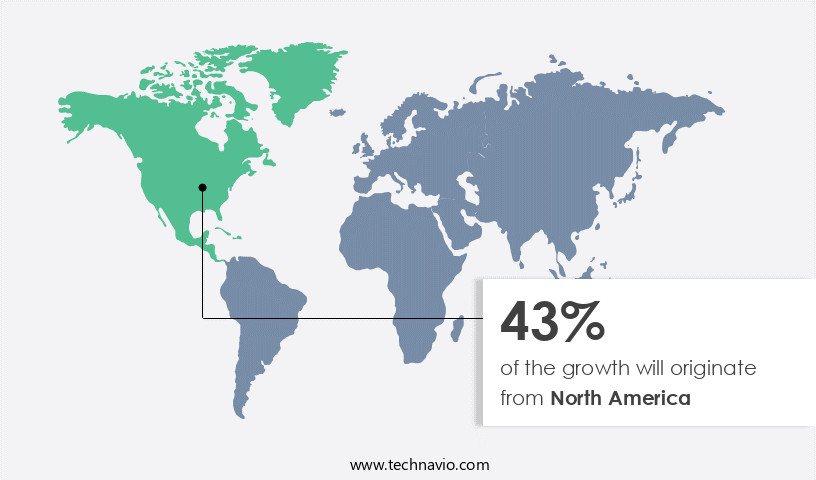

Regional Analysis

North America is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Motion sickness, characterized by nausea, increased salivation, belching, sweating, hyperventilation, and discomfort, affects individuals during multi-axial motion or acceleration. The condition, which can cause temporary sensation and anxiety, particularly impacts pregnant women, children, and cancer patients. Pharmacological therapies, including antihistaminic drugs and anticholinergics, are commonly used for motion sickness treatment. These drugs, available in oral and transdermal forms, can be obtained from hospital pharmacies, online providers, and retail pharmacies. The North American market for motion sickness drugs is significant due to the presence of large pharmaceutical companies, a proper regulatory framework, and increasing tourism and adventure sports. Additionally, rising disposable income and R&D investments by key companies are driving market growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Motion Sickness Drugs Industry?

- Availability of over-the-counter (OTC) drugs is the key driver of the market. The market primarily caters to unmet healthcare needs in managing the discomfort and anxiety caused by motion sickness. Motion sickness is a medical condition characterized by temporary sensations of nausea, increased salivation, belching, sweating, and hyperventilation, often resulting from multi-axial motion or acceleration. Anticholinergic and antihistamine drugs are the primary pharmacological therapies for motion sickness treatment. Antihistamines, such as dimenhydrinate, meclizine, and prochlorperazine, and anticholinergics, like scopolamine, are widely used to prevent and suppress symptoms. These drugs are available in various forms, including oral medications and transdermal patches, such as the Scopolamine patch. OTC antihistamines are accessible and affordable, providing patients with the freedom to self-medicate for minor symptoms.

- Pediatric patients and pregnant women often use these drugs to alleviate motion sickness symptoms. The availability of OTC drugs from hospital pharmacies, online providers, and retail pharmacies further increases their accessibility. Cancer patients and travelers, including those In the Virgin Islands and Saint Maarten, also benefit from these medications. The demand dynamics for motion sickness drugs are driven by the prevalence of the medical condition and the need for effective relief. Wearable relief bands, such as Reliefband and Reliefband Sport, are also gaining popularity as alternative treatments.

What are the market trends shaping the Motion Sickness Drugs Industry?

- Advent of nauseogenic information technology is the upcoming market trend. Motion sickness, a medical condition characterized by a temporary sensation of discomfort and anxiety caused by multi-axial motion or acceleration, affects a significant number of individuals, particularly pregnant women, children, and travelers. The symptoms, which include nausea, increased salivation, belching, sweating, and hyperventilation, can be debilitating and limit an individual's ability to travel. Despite the availability of pharmacological therapies, such as antihistaminic drugs and anticholinergic drugs, the current treatment options remain unsatisfactory for many. The market for motion sickness drugs includes both oral and transdermal drugs, available through hospital pharmacies, online providers, medicines, and retail pharmacies. Advances in neuroscience research have led to a better knowledge of the neurological mechanisms underlying motion sickness and its symptoms.

- Techniques such as traditional neurophysiology, pathway mapping, and magnetic resonance imaging (MRI) have improved our knowledge of the brain's response to motion and its protective mechanisms. The development of potent anti-motion sickness drugs is a promising area of research, with a focus on targeting specific neurotransmitters such as acetylcholine. Innovations in drug delivery systems, such as wearable relief bands like Reliefband and Reliefband Sport, offer non-pharmacological alternatives for motion sickness relief. Cancer patients and individuals with the Coronavirus are among the populations that are particularly vulnerable to motion sickness and may benefit from the development of more effective treatments.

What challenges does the Motion Sickness Drugs Industry face during its growth?

- Nonpharmacological countermeasures to treat motion sickness is a key challenge affecting the industry growth. Motion sickness, a medical condition characterized by temporary sensation of discomfort and anxiety caused by multi-axial motion or acceleration, affects a significant number of individuals, particularly pregnant women, children, and cancer patients. The symptoms, which include nausea, increased salivation, belching, sweating, and hyperventilating, can be debilitating and negatively impact quality of life. Pharmacological therapies are commonly used for motion sickness treatment, with antihistaminic drugs and anticholinergic drugs being the primary drug classes. Antihistamines, such as dimenhydrinate and meclizine, and anticholinergics, like scopolamine and prochlorperazine, are available in various forms, including oral and transdermal drugs. These medications work by blocking the action of specific neurotransmitters, thereby reducing the sensation of motion sickness.

- In addition to pharmacological therapies, nonpharmacological countermeasures, such as habituation training and behavioral training, can be effective in managing motion sickness. Habituation training involves exposing individuals to prolonged periods of motion stimulation to induce motion sickness habituation, which can take several weeks to achieve. This training stimulates sensory conflict In the brain, preparing the individual for provocative motion environments. For instance, astronauts undergo habituation training using parabolic flight, horizontal suspension, and neural buoyancy stimulation to prevent motion sickness and disorientation during space travel. Online pharmacies, hospital pharmacies, and retail pharmacies offer these medications, making them easily accessible to individuals seeking relief.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Amneal Pharmaceuticals Inc.

- Baxter International Inc.

- CVS Health Corp.

- DM Pharma Marketing Pvt. Ltd.

- GlaxoSmithKline Plc

- Hylands

- Lupin Ltd.

- Merck KGaA

- Myungmoon Pharm Co. Ltd.

- Novartis AG

- Perrigo Co. Plc

- Prestige Consumer Healthcare Inc.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Tivic Health Systems Inc.

- Viatris Inc.

- WellSpring Pharmaceutical Corp.

- Zenomed Healthcare Pvt. Ltd.

- Zydus Lifesciences Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Motion sickness, a medical condition characterized by temporary sensations of discomfort and anxiety caused by multi-axial motion or acceleration, affects a significant portion of the global population. The symptoms, which include nausea, increased salivation, belching, sweating, and hyperventilation, can be particularly debilitating for certain groups, such as pregnant women and children. The unmet healthcare needs In the motion sickness market are substantial, with many individuals seeking effective and convenient relief options. Pharmacological therapies have long been the go-to solution for managing motion sickness symptoms. Two primary classes of drugs, antihistaminic and anticholinergic, have been widely used for this purpose.

In addition, antihistamines, a subclass of antihistaminic drugs, work by blocking histamine receptors In the body, thereby reducing the symptoms of motion sickness. Anticholinergic drugs, on the other hand, inhibit the action of acetylcholine, a neurotransmitter, to alleviate motion sickness symptoms. Both oral and transdermal formulations of these drugs are available in various healthcare systems, including hospital pharmacies and online providers. In recent years, wearable relief bands have gained popularity as an alternative to traditional medicines. These devices use electrical stimulation to disrupt the signals that cause motion sickness symptoms. The demand for motion sickness treatments has been driven by several factors.

Furthermore, the increasing prevalence of motion sickness among cancer patients undergoing chemotherapy and the growing number of travelers, particularly those using virtual reality technology, have contributed to the market's growth. Females, particularly those in developing economies, have also shown a high demand for motion sickness treatments due to their increased susceptibility to the condition. The coronavirus pandemic has further fueled the demand for motion sickness treatments, as more individuals have turned to virtual experiences and travel restrictions have limited their access to traditional treatments. Despite the availability of various motion sickness treatments, there remains a need for more effective and convenient options.

Moreover, the route of administration, cost, and side effects are key considerations for patients when choosing a motion sickness treatment. The market dynamics are shaped by various factors, including demographics, technological advancements, and healthcare systems. As the demand for effective and convenient motion sickness treatments continues to grow, it is essential for stakeholders to stay informed of market trends and developments.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.37% |

|

Market growth 2024-2028 |

USD 139.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.12 |

|

Key countries |

US, Canada, UK, China, and Germany |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Motion Sickness Drugs industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.