Motor Driver Ics Market Size 2025-2029

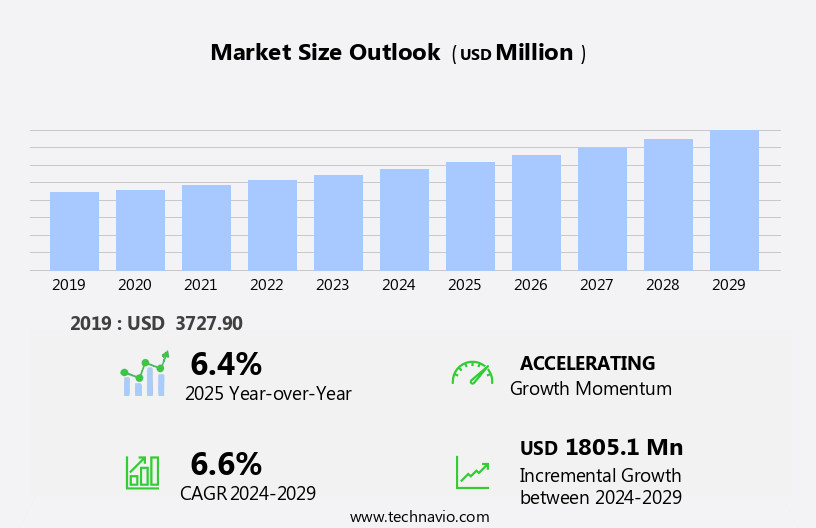

The motor driver ics market size is forecast to increase by USD 1.81 billion, at a CAGR of 6.6% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing adoption of electric vehicles (EVs). This shift towards electrification presents a substantial opportunity for market participants, as the demand for efficient and powerful motor driver ICs to power EV motors continues to rise. Furthermore, companies are responding to this trend by introducing new products to cater to the evolving needs of the market. However, the market is not without challenges. Regulatory compliance and safety remain key concerns, as stringent regulations governing the automotive industry and the need for high safety standards necessitate the development of advanced motor driver ICs.

- Ensuring these components meet the necessary safety requirements and regulatory guidelines is essential for market success. Additionally, the increasing complexity of motor driver ICs, driven by the integration of advanced features and the need for higher power density, poses a significant challenge for manufacturers. Navigating these challenges while capitalizing on the growth opportunities will require strategic planning and a focus on innovation.

What will be the Size of the Motor Driver Ics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The motor driver IC market continues to evolve, driven by the ever-growing demand for precise and efficient motion control in various sectors. Power mosfets, a key component in motor driver ICs, enable power efficiency and effective current control. Integrated circuits, such as encoder feedback and power supplies, ensure seamless communication and power management. Field-oriented control (FOC) and stepper motor applications dominate the market, with consumer electronics and industrial automation sectors driving growth. Position control and high-speed control are essential in consumer electronics, while precision motion and real-time control are crucial in industrial automation. Open-loop control and sensor integration have gained traction, enhancing motion control capabilities and enabling feedback control.

Power efficiency and thermal management are ongoing concerns, with heat sinks and advanced cooling solutions addressing these challenges. Safety standards, such as over-temperature protection and EMC compliance, are increasingly important. Gate drivers, current limiting, and torque control are other essential features, ensuring load capacity and optimal motor performance. Motion control applications span from home appliances to medical devices and servo motors, with DC motors and AC induction motors catering to diverse requirements. The market's continuous dynamism underscores the importance of ongoing research and innovation.

How is this Motor Driver Ics Industry segmented?

The motor driver ics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- AC motor drive IC

- DC motor drive IC

- Stepper motor drive IC

- Others

- End-user

- Automotive

- Industrial automation

- Consumer electronics

- Healthcare

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

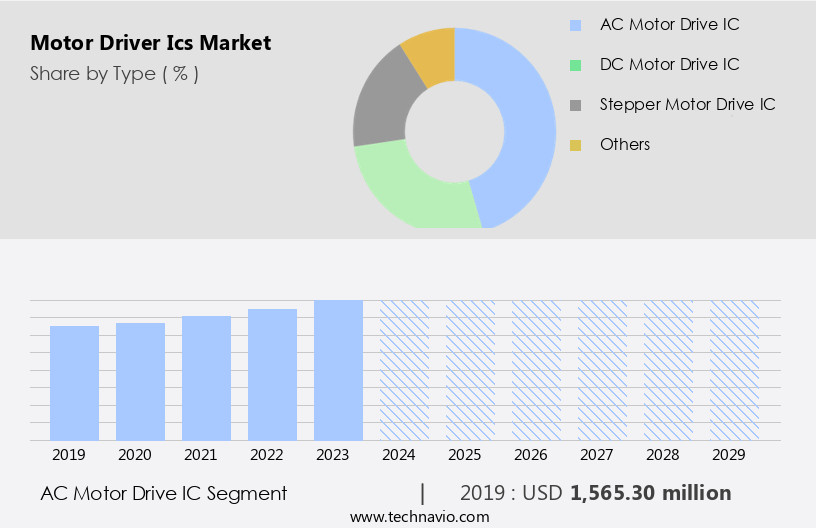

The ac motor drive ic segment is estimated to witness significant growth during the forecast period.

AC motor drive Integrated Circuits (ICs) are essential components in managing the speed, direction, and torque of alternating current motors for diverse applications. These ICs come in single-phase and three-phase variants, catering to the extensive industrial and consumer market demands. By transforming fixed-frequency AC power into adjustable-frequency outputs, AC motor drive ICs facilitate precise motor control, thereby improving overall efficiency and performance. The growing preference for these ICs is fueled by their energy savings, cost-effectiveness, and compatibility with Industry 4.0 technologies. Single-phase AC motor drive ICs predominantly serve low-power applications, such as fans, pumps, and home appliances, due to their compact size, affordability, and ease of implementation.

In the realm of consumer electronics, their utilization is increasingly common. Real-time control, encoder feedback, and safety standards are integral features of these ICs, ensuring smooth operation and enhancing system reliability. Power efficiency, EMC compliance, and power supplies are other essential considerations in their design. Field-oriented control (FOC), torque control, load capacity, and thermal management are advanced features that further expand their applications in industrial automation, motion control, and power conversion systems. Hall effect sensors, current sensing, and current limiting are additional features that ensure accurate motor control and protection against over-current conditions. AC motor drive ICs are also integral to the operation of servo motors, brushless DC motors, and stepper motors, enabling high-speed control, position control, and closed-loop control.

In summary, AC motor drive ICs are indispensable in various industries, offering precise motor control, energy savings, and advanced features to meet the evolving demands of modern applications.

The AC motor drive IC segment was valued at USD 1.57 billion in 2019 and showed a gradual increase during the forecast period.

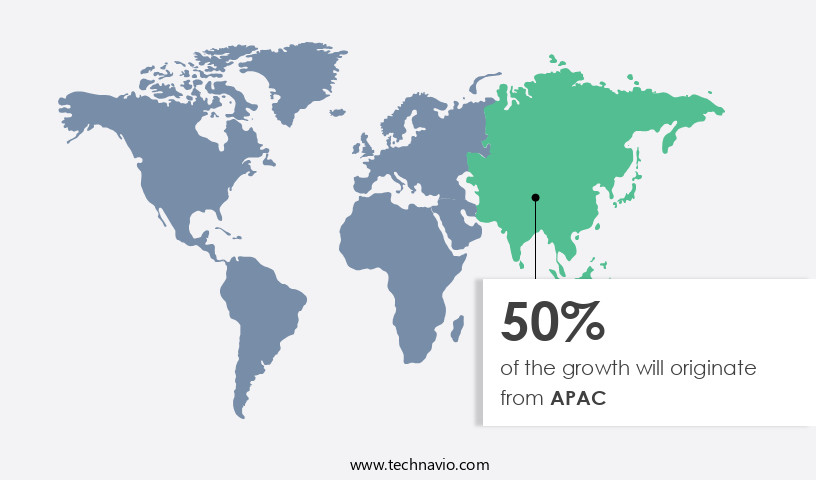

Regional Analysis

APAC is estimated to contribute 50% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, particularly in the Asia-Pacific (APAC) region. Driven by the automotive and electronics industries in countries like China, India, and Japan, this region is a major contributor to the market. China, in particular, is a global leader in automotive manufacturing, with annual sales and output projected to surpass 30 million units by 2025. This massive production capacity fuels demand for motor driver ICs, which are integral to various applications, including electric vehicles (EVs), advanced driver-assistance systems (ADAS), and power steering systems. In addition, the region's electronics manufacturing sector is thriving, further boosting demand for motor driver ICs in consumer electronics, industrial automation, and robotics.

The market is also shaped by trends such as real-time control, precision motion, speed control, current sensing, encoder feedback, and power efficiency. Integrated circuits, power mosfets, and gate drivers are key components in motor driver ICs, ensuring compliance with safety standards, thermal management, and electromagnetic compatibility (EMC). Motor types, including servo motors, stepper motors, dc motors, and brushless dc motors, as well as ac induction motors, are all served by the market. Market players focus on innovations in field-oriented control (FOC), torque control, load capacity, and current limiting to meet the evolving needs of various industries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a diverse range of semiconductor components essential for controlling and driving various types of motors in numerous applications. These integrated circuits (ICs) offer features such as adjustable speed, current limiting, and protection against overheating and overloading. Motor driver ICs are integral to industries like automotive, industrial automation, robotics, and consumer electronics, where motor control is crucial. Brushless DC (BLDC), stepper motors, and DC motors are commonly driven using motor driver ICs. Advanced motor driver ICs support communication interfaces like CAN, LIN, and PWM, enabling motor control in complex systems. Energy efficiency, miniaturization, and high power density are key trends shaping the market.

What are the key market drivers leading to the rise in the adoption of Motor Driver Ics Industry?

- The significant expansion of the electric vehicle (EV) market is primarily attributed to the robust growth of this technology, with EVs serving as the primary catalyst for market development.

- The market experiences significant growth due to the increasing adoption of electric vehicles (EVs). In 2023, electric car sales reached 14 million units, accounting for 18% of total car sales, marking a 35% year-on-year increase. China, Europe, and the United States accounted for 90% of these sales, with China leading the market at 60%, followed by Europe at 25%, and the United States at 10%. This regional distribution underscores the robust demand for EVs in these regions, driven by supportive government policies, advancements in battery technology, and growing consumer consciousness towards environmental sustainability.

- Motor driver ICs are essential components in EVs, enabling precise speed control, current sensing, and position feedback through optical or magnetic encoders. Additionally, real-time control and over-temperature protection features are crucial for the reliable operation of servo motors in various applications, including home appliances and medical devices. The demand for motor driver ICs that comply with EMC regulations is also increasing to ensure electromagnetic compatibility and minimize electromagnetic interference.

What are the market trends shaping the Motor Driver Ics Industry?

- The introduction of new products by companies is a current market trend. This continuous innovation reflects the dynamic nature of various industries.

- The market is experiencing notable growth due to the introduction of advanced products that prioritize power efficiency and integration capabilities. For instance, STMicroelectronics, a leading company based in Geneva, Switzerland, recently launched the EVLDRIVE101-HPD motor-drive reference design. This innovative product integrates the new STDRIVE101 3-phase gate driver IC and an STM32G0 microcontroller into a compact 50mm diameter board. The design offers high-performance motor control options, such as trapezoidal and field-oriented control, and features a 750W power stage. Notably, it boasts low power consumption in sleep mode, below 1µA, making it suitable for various applications, including home appliances, drones, robots, and industrial equipment.

- The integration of encoder feedback and power supplies further enhances the design's position control and high-speed control capabilities. Overall, the market is driven by the demand for motor driver ICs that offer improved power efficiency, advanced control options, and compact designs.

What challenges does the Motor Driver Ics Industry face during its growth?

- Ensuring regulatory compliance and maintaining safety standards is a critical issue that significantly impacts the growth of the industry. This challenge necessitates a deep commitment from organizations to adhere to regulations and prioritize the well-being of their stakeholders.

- The market encounters substantial challenges in adhering to regulatory compliance and safety standards, notably in the automotive sector. Ensuring motor driver ICs adhere to stringent safety and reliability regulations is essential to prevent catastrophic consequences, such as loss of vehicle control or accidents. A critical standard in the automotive industry is ISO 26262, which emphasizes the functional safety of electrical and electronic systems in vehicles. Motor driver ICs utilized in electric vehicles must comply with this standard to guarantee reliable operation under all conditions. Compliance with this global standard necessitates rigorous testing and validation procedures to confirm the ICs can manage various operational scenarios without failure.

- Over-voltage protection, sensor integration, feedback control, and current limiting are essential features for motor driver ICs to meet safety standards. Additionally, thermal management and torque control are crucial factors for load capacity management. In closed-loop control systems, resolver feedback is essential for precise motor control and positioning.

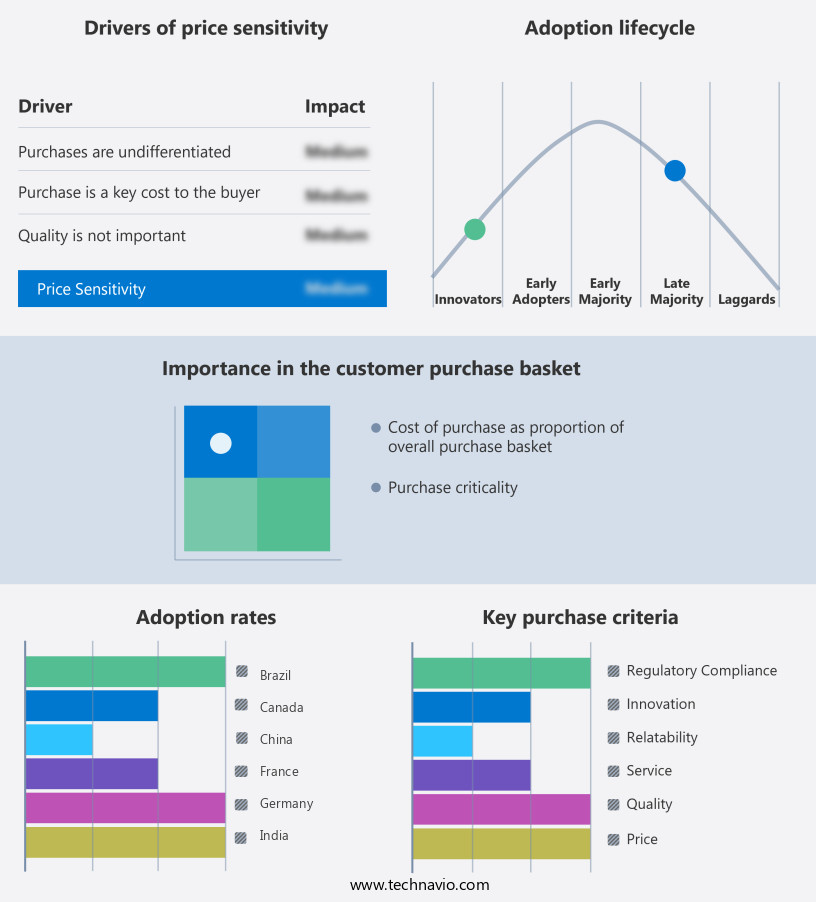

Exclusive Customer Landscape

The motor driver ics market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the motor driver ics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, motor driver ics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Allegro MicroSystems Inc. - This company specializes in manufacturing motor driver ICs for various motor types, including brushless DC, brush DC, and stepper motors, enhancing efficiency and performance in motor applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allegro MicroSystems Inc.

- AMETEK Inc.

- Analog Devices Inc.

- Delta Electronics Inc.

- Diodes Inc.

- Infineon Technologies AG

- Microchip Technology Inc.

- Mitsubishi Electric Corp.

- Monolithic Power Systems Inc.

- NXP Semiconductors NV

- ON Semiconductor Corp.

- Panasonic Holdings Corp.

- Power Integrations Inc.

- Qualcomm Inc.

- Renesas Electronics Corp.

- ROHM Co. Ltd.

- STMicroelectronics NV

- Texas Instruments Inc.

- Toshiba Corp.

- Vishay Intertechnology Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Motor Driver Ics Market

- In January 2024, Infineon Technologies AG, a leading provider of semiconductor solutions, announced the launch of its new 650V and 100V automotive motor driver ICs, expanding its portfolio for electric and hybrid vehicle applications (Infineon press release). These new offerings aim to address the increasing demand for efficient and reliable motor control solutions in the automotive sector.

- In March 2024, Texas Instruments Inc. And NXP Semiconductors N.V. Announced their strategic collaboration to co-develop motor driver ICs for industrial applications, combining their expertise in power management and automotive semiconductors (TI press release). This partnership aims to deliver innovative motor control solutions for various industries, including renewable energy, transportation, and manufacturing.

- In May 2024, ON Semiconductor Corporation announced the acquisition of Sensirion's power management business, including its motor driver IC product line, for approximately USD1.1 billion (ON Semiconductor press release). This acquisition significantly strengthens ON Semiconductor's power management portfolio, enabling the company to cater to a broader range of applications and industries.

- In April 2025, STMicroelectronics N.V. Unveiled its new 1200V motor driver IC, featuring integrated gate drivers and gate protection, designed for industrial and renewable energy applications (STMicroelectronics press release). This technological advancement enables higher power density and improved efficiency, making it a significant development in the motor driver IC market.

Research Analyst Overview

- The motor driver IC market experiences dynamic activity, driven by stringent safety testing and supply chain management requirements. Industry standards, such as compliance certification and environmental testing, play a crucial role in shaping market trends. Firmware development and technical support are essential for ensuring product lifecycle management and maintaining a price-performance ratio that appeals to customers. Analog and digital control techniques continue to influence motor driver IC design, with emerging technologies in software development and simulation software pushing the boundaries of system integration and reliability testing. Customer support, sales, and distribution channels are critical components of marketing strategies, while intellectual property protection and quality assurance are key differentiators.

- Product development relies on design tools, training, and education, with motor control algorithms and testing and validation playing a pivotal role. Failure analysis, data sheets, application notes, and technical documentation are indispensable resources for engineers and designers. Packaging technologies and price-performance ratio remain essential factors in the competitive landscape, as motor driver ICs continue to power various industrial, automotive, and consumer applications.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Motor Driver Ics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

224 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.6% |

|

Market growth 2025-2029 |

USD 1805.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.4 |

|

Key countries |

US, China, Japan, Germany, South Korea, France, Canada, India, UK, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Motor Driver Ics Market Research and Growth Report?

- CAGR of the Motor Driver Ics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the motor driver ics market growth of industry companies

We can help! Our analysts can customize this motor driver ics market research report to meet your requirements.