Motorcycle Exhaust System Market Size 2025-2029

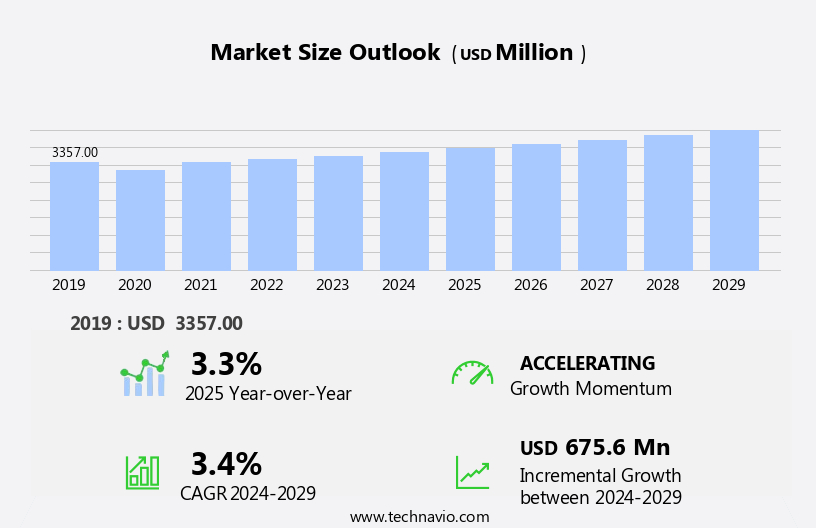

The motorcycle exhaust system market size is forecast to increase by USD 675.6 million at a CAGR of 3.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for enhanced motorcycle performance, improved sound, and distinctive appearances. A notable trend in the market is the rising adoption of titanium-based exhaust systems due to their lightweight properties, durability, and superior heat resistance. Another key development is the growing popularity of electric motorcycles, which are expected to disrupt the traditional exhaust system market as they emit zero exhaust gases and require different exhaust solutions.

- Companies in the market must adapt to these trends and challenges to capitalize on the opportunities presented. Strategic investments in research and development of advanced exhaust systems, focusing on both internal combustion engine and electric motorcycle applications, will be essential for market success. Additionally, collaborations and partnerships with motorcycle manufacturers and electric vehicle companies could provide significant growth opportunities. Overall, the market offers substantial potential for companies that can effectively address the evolving demands of consumers and the industry.

What will be the Size of the Motorcycle Exhaust System Market during the forecast period?

- The market encompasses a diverse range of products designed to optimize bike performance and reduce emissions. Key components include exhaust pipes, slip-on systems, and catalytic converters, available for various motorcycle types such as sports motorcycles. Market trends lean towards less restrictive systems, including 4-into-1 exhaust systems, which enhance power output and improve combustion byproduct management.

- Material innovations, like titanium-based and carbon fiber exhaust systems, contribute to lighter weight and improved heat management. Racing enthusiasts and on-road bikers alike seek these advanced exhaust solutions to boost performance indicators and enhance the overall riding experience.

How is this Motorcycle Exhaust System Industry segmented?

The motorcycle exhaust system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- OEMs

- Aftermarket

- Type

- Single exhaust system

- Dual exhaust system

- Geography

- APAC

- Australia

- China

- India

- Japan

- South Korea

- North America

- US

- Canada

- Europe

- France

- Germany

- South America

- Brazil

- Middle East and Africa

- APAC

By Application Insights

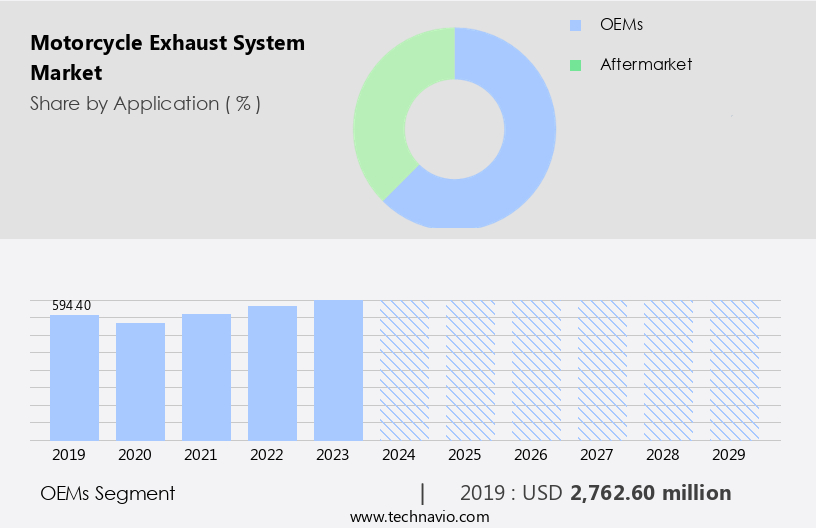

The OEMs segment is estimated to witness significant growth during the forecast period. The market is driven primarily by the OEM segment, which accounted for the largest share in 2024. Exhaust systems are essential for motorcycles as they route hot gases from the engine after combustion, ensuring safety. These systems convert harmful gases, such as carbon monoxide, into less harmful carbon dioxide through catalytic converters. Given their standard fitment on all ICE-based motorcycles, their adoption is directly linked to new motorcycle sales. Exhaust systems come in various types, including slip-on and Titanium-based systems, catering to racing enthusiasts and sports motorcycles. Performance indicators like power output, heat dissipation, and weight reduction are key considerations.

Advanced materials like carbon fiber and lightweight metals are used to create less restrictive systems, enhancing both performance and aesthetic appeal. Environmentally friendly solutions, such as low-emission exhaust systems, are gaining traction due to stringent emission norms and concerns over air pollution. Adventure sports and electric vehicles are emerging segments, offering opportunities for innovation. The market is expected to grow, driven by the increasing popularity of motorcycles and the continuous development of sophisticated exhaust systems.

Get a glance at the market report of share of various segments Request Free Sample

The OEMs segment was valued at USD 2.76 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

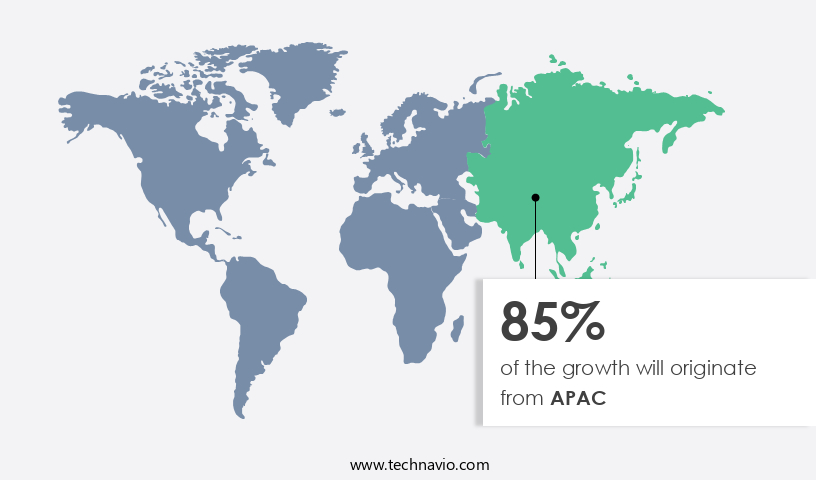

APAC is estimated to contribute 85% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is driven by the increasing popularity of motorcycles, particularly in the Asia Pacific (APAC) region. In 2024, APAC accounted for the largest market share and is projected to maintain this position throughout the forecast period. India is a significant contributor to this market due to the growing adoption of motorcycles. China, Indonesia, and Thailand also play crucial roles due to their high motorcycle production volumes. Motorcycle exhaust systems enhance performance, reduce weight, and improve heat dissipation and noise reduction. They consist of slip-on exhaust systems, catalytic converters, and both single and dual exhaust systems.

Titanium-based exhaust systems and carbon fiber components are increasingly used for their lightweight properties and improved power output. Motorcycle exhaust systems must comply with stringent emission norms to reduce air pollution and meet environmental sustainability standards. Performance indicators include system weight, lifetime, fuel efficiency, and customizable designs. Motorcycle enthusiasts value the aesthetic appeal and sound quality of these systems, making them a fashion statement and a desirable upgrade for sports motorcycles and adventure sports bikes. The market trends include the development of less restrictive systems, environmentally friendly solutions, and the integration of filtering technology.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Motorcycle Exhaust System Industry?

- The growing demand for better sound, appearance, and performance is the key driver of the market. Aftermarket exhaust systems have gained popularity among sports motorcycle owners due to their performance-enhancing capabilities. The rising number of racing enthusiasts is driving the demand for components that improve the on-road performance of motorcycles. These aftermarket systems offer several benefits, including an improved aesthetic appeal, better sound, and performance enhancement, making them an attractive choice for sports motorcycle owners.

- However, cost constraints may lead some riders to opt for aftermarket slip-on fitments, which provide the first two benefits at a lower cost. Overall, the demand for aftermarket exhaust systems is increasing due to their ability to enhance the riding experience for sports motorcycle owners.

What are the market trends shaping the Motorcycle Exhaust System Industry?

- The growing popularity of titanium-based exhaust systems is the upcoming market trend. Titanium-based exhaust systems are gaining popularity due to their lightweight and aesthetic appeal. As the lightest material used in exhaust system manufacturing, titanium reduces the overall weight, enhancing motorcycle performance. This characteristic is particularly attractive to premium sport motorcycle riders seeking to improve both the appearance and performance of their vehicles.

- Moreover, the growing preference among baby boomers for high-end motorcycles, driven by their increased purchasing power, is fueling the demand for these advanced exhaust systems. Consequently, the market for titanium-based exhaust systems is experiencing significant growth.

What challenges does the Motorcycle Exhaust System Industry face during its growth?

- The rising adoption of electric motorcycles is a key challenge affecting the industry growth. The market faces a substantial challenge due to the rising adoption of electric motorcycles. Electric motorcycles, which operate using batteries instead of internal combustion engines, do not necessitate exhaust systems. Governments worldwide are encouraging the use of electric vehicles (EVs) through incentives, subsidies, and infrastructure development, leading to a shift from traditional motorcycles and their associated components.

- Major motorcycle manufacturers, such as Harley-Davidson and Yamaha, are expanding their electric motorcycle offerings to cater to evolving consumer preferences. This transition towards electrification is diminishing the demand for conventional motorcycles and their components, including exhaust systems.

Exclusive Customer Landscape

The motorcycle exhaust system market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the motorcycle exhaust system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, motorcycle exhaust system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arrow Special Parts S p A: The company offers motorcycle exhaust system such as Competition exhausts.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akrapovic d.d.

- Arrow Special Parts SpA

- Bassani Manufacturing

- Bos Exhaust GmbH

- British Customs LLC

- Cobra Engineering Inc.

- FMF Racing Inc.

- Graves Motorsports

- Llexeter Ltd.

- M4 Products LLC

- MIVV SpA

- REMUS Innovation GmbH

- SAKURA KOGYO Co. Ltd.

- Sankei Giken Kogyo Co. Ltd.

- Toro Exhausts

- Two Brothers Racing Inc.

- Vance and Hines

- Voodoo Industries

- Yoshimura R and D of America Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of components designed to manage combustion byproducts and exhaust gases in two-wheeled vehicles. These systems play a crucial role in optimizing engine performance, ensuring compliance with stringent emission norms, and enhancing the aesthetic appeal of motorcycles. Exhaust systems are available in various configurations, including slip-on and aftermarket systems, which offer less restrictive options for racing enthusiasts and those seeking improved power output and sound quality. On-road bikes often come equipped with stock exhausts, while adventure sports motorcycles may require more strong and durable systems to withstand off-road conditions. Manufacturers continually innovate to meet the evolving demands of the market, exploring advanced materials such as titanium-based systems and lightweight metals like carbon fiber.

These solutions offer significant benefits, including heat dissipation, weight reduction, and noise reduction techniques. Environmentally friendly solutions are increasingly important in the market, as emission regulations continue to evolve and address air pollution concerns. Low-emission exhaust systems and filtering technology are becoming essential components of modern motorcycle designs. The market dynamics are influenced by several factors, including the growing popularity of motorcycles as fashion statements, the demand for customizable designs, and the integration of configurable features and design alternatives. Motorcycle enthusiasts value the performance enhancement and aesthetic appeal that high-quality exhaust systems provide. The automotive exhaust system market, which includes motorcycle exhausts, is expected to experience steady growth due to the increasing demand for advanced technologies and the ongoing trend towards environmental sustainability.

Emission laws and regulations continue to shape the market, driving innovation and the adoption of sophisticated materials and creative designs. In the market, catalytic converters play a vital role in reducing harmful emissions, while dual and single exhaust systems offer varying benefits in terms of power output and weight reduction. The market is diverse, catering to various motorcycle segments, including sports motorcycles, dirt bikes, and adventure sports motorcycles. The market for motorcycle exhaust systems is driven by a combination of factors, including the desire for improved performance, compliance with emission regulations, and the pursuit of aesthetically beautiful designs. As the market continues to evolve, manufacturers will continue to explore new materials, technologies, and design concepts to meet the evolving demands of motorcycle enthusiasts.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

194 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.4% |

|

Market growth 2025-2029 |

USD 675.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.3 |

|

Key countries |

China, India, Japan, South Korea, US, Australia, Brazil, Germany, France, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.