Automotive Exhaust System Market Size 2024-2028

The automotive exhaust system market size is valued to increase USD 23.5 billion, at a CAGR of 7.04% from 2023 to 2028. Increasing use of lightweight and advanced alloys will drive the automotive exhaust system market.

Major Market Trends & Insights

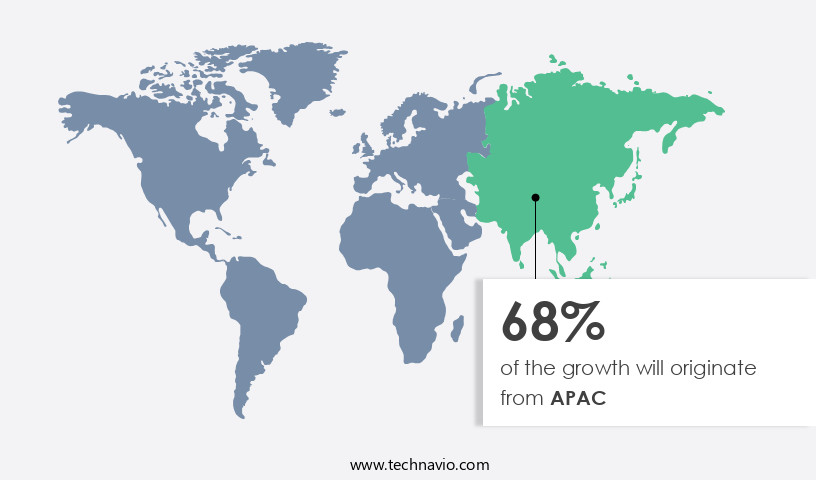

- APAC dominated the market and accounted for a 68% growth during the forecast period.

- By Application - Passenger vehicles segment was valued at USD 41.90 billion in 2022

- By Fuel Type - Gasoline segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 64.31 billion

- Market Future Opportunities: USD 23.50 billion

- CAGR : 7.04%

- APAC: Largest market in 2022

Market Summary

- The market encompasses the production, sales, and installation of exhaust systems for various types of automobiles. Core technologies and applications, such as the increasing use of lightweight and advanced alloys, are driving market growth. For instance, the adoption of active exhaust systems by automotive OEMs has gained significant traction, providing improved fuel efficiency and reduced emissions. However, the high cost associated with exhaust systems remains a major challenge.

- According to a recent study, the exhaust system market is expected to account for over 20% of the total automotive aftermarket revenue by 2025. Regulations, such as stringent emission norms, are also shaping market trends, with Europe and North America leading the way in adoption.

What will be the Size of the Automotive Exhaust System Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Automotive Exhaust System Market Segmented and what are the key trends of market segmentation?

The automotive exhaust system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger vehicles

- Commercial vehicles

- Fuel Type

- Gasoline

- Diesel

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The passenger vehicles segment is estimated to witness significant growth during the forecast period.

The market experiences significant growth, driven by the expanding passenger vehicle sector in emerging economies like India, China, and the Association of Southeast Asian Nations (ASEAN). This trend is fueled by the increasing demand for passenger cars worldwide. Strict vehicular emission regulations have led to the widespread adoption of advanced exhaust systems, particularly catalytic converters. These systems effectively reduce harmful emissions, ensuring compliance with stringent industry standards. Exhaust system components, such as particulate filters, sensors, and catalytic converters, undergo continuous innovation to enhance their performance. For instance, sensors enable real-time monitoring of back pressure, temperature, and emissions, while converter loading and thermal management systems optimize catalytic converter efficiency.

Furthermore, emission control systems, including vibration damping and noise reduction techniques, contribute to improved fuel efficiency and reduced emissions. The market also focuses on system integration, ensuring seamless interaction between various components, such as oxygen sensors, lambda sensors, and onboard diagnostics (OBD). Maintenance scheduling and repair procedures are essential aspects of the market, with aftertreatment technologies, such as selective catalytic reduction (SCR) and lean NOx trap (LNT), extending component lifespan and reducing maintenance costs. Exhaust system manufacturers invest in research and development to address challenges, such as catalyst degradation and exhaust system weight. Innovations in resonator design, exhaust pipe material, and flow rate optimization contribute to more efficient and durable exhaust systems.

The market's future growth is expected to be robust, with a projected increase in demand for advanced exhaust systems in the electric vehicle (EV) sector. Additionally, the integration of advanced technologies, such as sensor failure detection and tailpipe emissions testing, will further drive market expansion.

The Passenger vehicles segment was valued at USD 41.90 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 68% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Automotive Exhaust System Market Demand is Rising in APAC Request Free Sample

The market experiences significant growth in the Asia Pacific (APAC) region due to the increasing penetration of automobiles and stringent emission regulations. Major countries like China, Japan, South Korea, ASEAN, and India are driving market expansion. Automakers in these nations provide commercial vehicles equipped with advanced exhaust systems, reducing pollutant emissions. Moreover, many economies in APAC are revising emission standards, aligning them with developed automotive markets.

Japan and South Korea, in particular, have mature automotive industries, contributing to market growth in the region. The market in APAC is poised for substantial development, with automakers and governments collaborating to promote eco-friendly technologies and regulations.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a critical component of the automobile industry, focusing on the design, manufacturing, and implementation of systems that manage and treat exhaust gases from internal combustion engines. This market encompasses various technologies and strategies, including exhaust system design optimization techniques, catalytic converter efficiency improvement strategies, and diesel particulate filter regeneration methods. Selective catalytic reduction systems (SCR) and exhaust gas recirculation (EGR) systems are at the forefront of exhaust technology, with SCR systems accounting for a significantly larger share in terms of emission control. Noise reduction techniques and vibration damping strategies are essential for enhancing passenger comfort, while thermal management of exhaust system components is crucial for maintaining optimal performance and longevity.

Exhaust system component lifespan prediction, onboard diagnostics for exhaust system issues, and emission control system regulatory compliance are key concerns for manufacturers and consumers alike. Catalytic converter degradation modeling and exhaust system repair and maintenance procedures are essential for minimizing downtime and ensuring long-term reliability. More than 70% of research and development efforts in this market focus on improving exhaust gas composition analysis methods and catalytic converter efficiency. Pressure drop calculation in exhaust manifolds and oxygen sensor performance monitoring are critical aspects of exhaust system optimization, with the industrial application segment accounting for a larger share in the market due to the higher demand for heavy-duty vehicles.

Despite the growing emphasis on electric vehicles, the internal combustion engine market continues to dominate, with exhaust systems remaining a vital component in ensuring engine performance and environmental compliance.

What are the key market drivers leading to the rise in the adoption of Automotive Exhaust System Industry?

- The market's growth is primarily attributed to the rising adoption of lightweight and advanced alloys due to their increasing use in various industries.

- The market is characterized by the extensive use of steel-made exhaust systems due to their high durability and efficiency. In particular, tubular steel exhaust manifolds are gaining popularity among automakers for entry-level vehicles, contributing to the overall enhancement of exhaust systems' performance. An exhaust manifold is a crucial component that gathers exhaust fumes post-combustion in an engine. Consequently, the selection of suitable materials for manufacturing exhaust manifolds significantly influences the reliability and longevity of the exhaust system. Advanced high-strength steels, such as austenitic and ferritic stainless steel, are increasingly being adopted in exhaust manifolds.

- These materials offer superior strength, thermal resistance, and resistance to corrosion. Moreover, various grades of aluminized steel are being employed due to their high thermal expansion coefficient and durability. The ongoing trend towards lightweighting in the automotive industry is also driving the adoption of aluminized steel exhaust manifolds, as they help reduce vehicle weight and improve fuel efficiency. These advancements underscore the continuous evolution of the market and its applications across diverse sectors.

What are the market trends shaping the Automotive Exhaust System Industry?

- The adoption of active exhaust systems is becoming a prominent trend among automotive Original Equipment Manufacturers (OEMs).

- The automotive exhaust systems market has witnessed substantial advancements in response to the global focus on reducing vehicle emissions. Modern exhaust systems have become increasingly efficient, significantly decreasing emission levels and resulting in quieter vehicles. However, this development poses a challenge for high-performance car enthusiasts who value the distinctive engine sounds. Consequently, there has been a surge in demand for aftermarket high-performance exhaust systems.

- In response, automotive OEMs have introduced active exhaust system technology for high-performance models, allowing for improved performance and regulatory compliance. This technology caters to the demands of customers who seek the engine sound experience while adhering to emission regulations. The after-sales fitment market for these systems has experienced remarkable growth due to this trend.

What challenges does the Automotive Exhaust System Industry face during its growth?

- The high cost of exhaust systems poses a significant challenge to the industry's growth trajectory. This expense is a key consideration for manufacturers and consumers alike, potentially hindering advancements and innovation within the sector.

- The global automotive industry is undergoing significant transformations, with the integration of automotive electronics, advanced materials, and advanced processes becoming increasingly prevalent. These advancements have led to the production of safer, more energy-efficient, and fuel-efficient vehicles. However, these trends come with an added cost, as evidenced by the evolving global the market. Exhaust systems, comprised of components like catalytic converters and mufflers, have seen design advancements and the adoption of new materials.

- The cost variation of these components depends on the specific vehicle make and model. The automotive industry's continuous evolution underscores the importance of staying informed about emerging trends and advancements.

Exclusive Technavio Analysis on Customer Landscape

The automotive exhaust system market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive exhaust system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Automotive Exhaust System Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, automotive exhaust system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Akrapovic d.d. - This company specializes in manufacturing and supplying advanced automotive exhaust systems, including Slip On Line and Evolution Line, enhancing vehicle performance and reducing emissions through innovative design and technology.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akrapovic d.d.

- Benteler International AG

- Berkshire Hathaway Inc.

- Bosal Nederland BV

- Eberspacher Gruppe GmbH and Co.KG

- Eisenmann Exhaust Systems GmbH

- Faurecia SE

- Friedrich Boysen GmbH and Co. KG

- Futaba Industrial Co. Ltd.

- Hexadex Ltd.

- Hirotec Corp.

- Honda Motor Co. Ltd.

- Klarius Products Ltd.

- Marelli Holdings Co. Ltd.

- Munjal Auto Industries Ltd.

- REMUS Innovation GmbH

- Sango Co. Ltd.

- Sejong Industrial Co. Ltd.

- Tenneco Inc.

- Thunder Exhaust System Co. Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Exhaust System Market

- In January 2024, Magna International, a leading automotive supplier, announced the launch of its new lightweight exhaust system for electric vehicles (EVs) at the Consumer Electronics Show (CES). This innovative system, made primarily from aluminum and high-strength steel, reduces vehicle weight and enhances EV range (Magna International Press Release).

- In March 2024, Bosch and CATL (Contemporary Amperex Technology Co. Limited), the world's largest lithium-ion battery manufacturer, formed a strategic partnership to develop and produce exhaust gas aftertreatment systems for EVs. This collaboration aims to improve the efficiency and reduce the size of these systems, making EVs more competitive with traditional internal combustion engine vehicles (Bosch Press Release).

- In May 2024, Tenneco, a leading global supplier of emission control and ride performance products, completed the acquisition of Federal-Mogul Powertrain from Icahn Enterprises. This acquisition expanded Tenneco's portfolio and strengthened its position in The market (Tenneco Press Release).

- In April 2025, the European Union (EU) announced the approval of new emission standards (EU6d) for heavy-duty vehicles, which includes stringent requirements for exhaust gas aftertreatment systems. This regulatory development is expected to drive demand for advanced exhaust systems and catalytic converters in the European market (European Commission Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Exhaust System Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.04% |

|

Market growth 2024-2028 |

USD 23.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.38 |

|

Key countries |

China, US, Germany, Japan, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving industry, characterized by continuous advancements in technology and regulatory requirements. One significant trend shaping this market is the emphasis on emission control systems, with a focus on particulate filter regeneration and sensor failure detection. Back pressure measurement and tailpipe emissions testing are crucial aspects of ensuring compliance with pollution control standards. Exhaust system durability is another essential consideration, with manufacturers investing in advanced materials, such as lightweight exhaust pipes, to improve component lifespan and reduce exhaust system weight. Thermal management systems are also gaining prominence, as they help optimize catalytic converter efficiency and reduce catalyst degradation.

- Advancements in emission control technologies include aftertreatment systems, which enhance exhaust gas composition and improve fuel efficiency. Muffler acoustics and noise reduction techniques are also essential, as they contribute to overall vehicle comfort and performance. Vibration damping and system integration are crucial aspects of exhaust system design, ensuring smooth operation and minimizing the impact on vehicle dynamics. OBD (On-Board Diagnostics) systems enable real-time monitoring of emission control systems, allowing for maintenance scheduling based on lambda sensor readings and pressure drop calculations. Exhaust system components, including converters, resonators, and sensors, undergo rigorous testing and development to ensure optimal performance and durability.

- Repair procedures and maintenance schedules are also essential, with manufacturers and aftermarket providers offering various solutions to cater to the evolving needs of the automotive industry. In conclusion, the market is a vibrant and ever-changing landscape, driven by advancements in technology, regulatory requirements, and consumer demand for improved fuel efficiency and reduced emissions.

What are the Key Data Covered in this Automotive Exhaust System Market Research and Growth Report?

-

What is the expected growth of the Automotive Exhaust System Market between 2024 and 2028?

-

USD 23.5 billion, at a CAGR of 7.04%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Passenger vehicles and Commercial vehicles), Fuel Type (Gasoline and Diesel), and Geography (APAC, Europe, North America, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increasing use of lightweight and advanced alloys, High cost associated with exhaust system

-

-

Who are the major players in the Automotive Exhaust System Market?

-

Akrapovic d.d., Benteler International AG, Berkshire Hathaway Inc., Bosal Nederland BV, Eberspacher Gruppe GmbH and Co.KG, Eisenmann Exhaust Systems GmbH, Faurecia SE, Friedrich Boysen GmbH and Co. KG, Futaba Industrial Co. Ltd., Hexadex Ltd., Hirotec Corp., Honda Motor Co. Ltd., Klarius Products Ltd., Marelli Holdings Co. Ltd., Munjal Auto Industries Ltd., REMUS Innovation GmbH, Sango Co. Ltd., Sejong Industrial Co. Ltd., Tenneco Inc., and Thunder Exhaust System Co. Ltd

-

Market Research Insights

- The market encompasses a complex network of components, each designed to optimize emission reduction strategies, enhance fluid dynamics, and ensure regulatory compliance. Two key aspects of this market are the continuous evolution of catalytic converter technology and the increasing focus on cost reduction measures. For instance, catalytic converters have seen a significant improvement in scr catalyst efficiency, reducing harmful emissions by up to 95%. Simultaneously, manufacturers are exploring lightweight materials for exhaust system components, such as titanium and aluminum, to decrease system weight and improve fuel efficiency.

- These advancements underscore the dynamic nature of the market, with ongoing research in areas like thermal stress analysis, failure analysis, and design optimization. Additionally, exhaust flow modeling and vibration isolation are critical considerations for ensuring system durability and noise cancellation. With stringent emission standards continually evolving, the market for exhaust system components will remain a focal point for innovation and growth.

We can help! Our analysts can customize this automotive exhaust system market research report to meet your requirements.