Motorcycle Navigation System Market Size 2025-2029

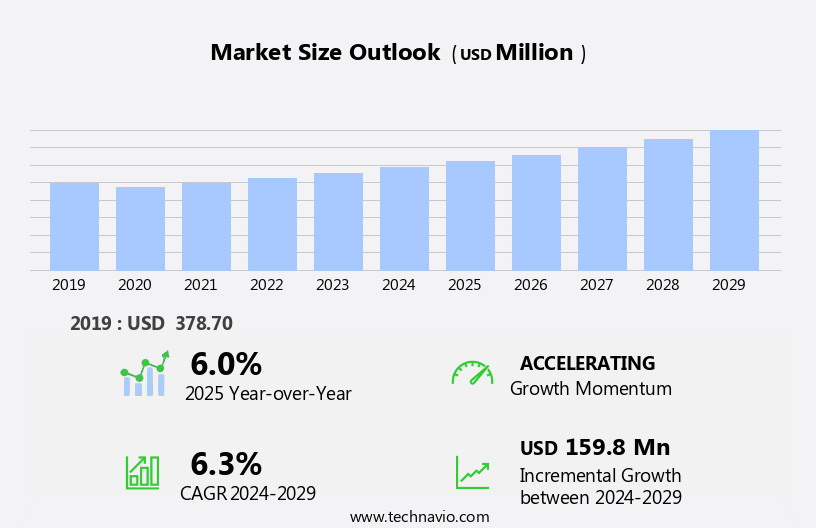

The motorcycle navigation system market size is forecast to increase by USD 159.8 million, at a CAGR of 6.3% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of motorcycles and the development of advanced technologies. Motorcycle sales have been on the rise, fueled by factors such as rising disposable income, urbanization, and the desire for a more eco-friendly mode of transportation. This trend is creating a growing demand for motorcycle navigation systems that offer real-time traffic information, route planning, and other advanced features. Another key driver in the market is the development of fully integrated Heads-Up Display (HUD) connected helmets with built-in GPS technology. These innovative solutions provide riders with critical information, such as speed, direction, and distance to the next turn, without having to take their eyes off the road.

- However, the high cost of these advanced systems poses a significant challenge for market growth. As technology continues to evolve, it is essential for market players to focus on developing affordable and user-friendly solutions to cater to the increasing demand from the motorcycling community. Companies that can successfully navigate these challenges will be well-positioned to capitalize on the growing opportunities in the market.

What will be the Size of the Motorcycle Navigation System Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and the growing demand for enhanced riding experiences. These systems offer a range of features designed to improve safety, convenience, and performance for motorcyclists. Bluetooth connectivity enables riders to pair their devices with their navigation systems, allowing for hands-free calling and music streaming. Daylight visibility ensures clear and easy-to-read displays, while ride tracking allows riders to monitor their journey and share their location with others. Screen size and charging time are important considerations, with larger displays offering better visibility and faster charging ensuring longer trips. Over-the-air updates keep software and map data current, while speed limits and safety features help ensure a safe riding experience.

Touchscreen displays offer intuitive user interfaces, and map data and traffic updates provide real-time information to help riders navigate efficiently. Data plans and mount options offer flexibility, while navigation history allows riders to review past rides. Battery life, water resistance, shock resistance, and cloud synchronization are essential features for long-distance riding. Cellular connectivity and satellite coverage ensure reliable signal reception, while user interface, headphone jack, and anti-theft protection add convenience and security. Turn-by-turn directions, real-time traffic, and route planning help riders navigate urban commuting and off-road terrain. Adventure touring and third-party integrations offer expanded functionality, while ride sharing platforms and group ride navigation enhance the social aspect of motorcycling.

Vibration feedback, GPS accuracy, and GPS navigation provide essential information for safe and efficient riding. Navigation apps, audio playback, temperature resistance, and smartphone integration offer additional convenience. IP ratings, weather forecasts, motorcycle-specific maps, trip logging, voice guidance, USB charging, dust resistance, music streaming, nighttime readability, helmet mount, voice control, and route sharing are just a few of the many features that continue to shape the market. The ongoing integration of these features ensures that motorcycle navigation systems remain an essential tool for riders, providing safety, convenience, and performance enhancements for all types of riding experiences.

How is this Motorcycle Navigation System Industry segmented?

The motorcycle navigation system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Integrated system

- Portable system

- End-user

- OEM

- Aftermarket

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

.

By Type Insights

The integrated system segment is estimated to witness significant growth during the forecast period.

Integrated motorcycle navigation systems are advanced technologies designed for seamless operation with motorcycles, often included as original equipment in high-end bikes. These systems provide riders with essential features such as turn-by-turn directions, real-time traffic updates, and voice-guided navigation, all accessible through the motorcycle's dashboard or handlebars. Integration with Bluetooth connectivity enables hands-free phone usage and music streaming. Safety features, including speed limits and rider alerts, are also common. Touchscreen displays ensure daylight visibility, while long charging times are mitigated through over-the-air software updates. Safety-conscious riders appreciate features like anti-theft protection and collision alerts. Off-road enthusiasts may opt for shock and water resistance, while adventure tourers require extensive map data and route planning capabilities.

Integrated systems support third-party integrations with ride sharing platforms and navigation apps, enhancing convenience and functionality. Smartphone integration allows for trip logging, voice guidance, and music streaming. Riders can also benefit from weather forecasts, motorcycle-specific maps, and trip planning tools. Battery life, charging time, and user interface are crucial considerations. Riders may prefer handlebar or tank bag mounts for optimal placement and ease of use. Navigation software updates ensure accurate GPS navigation and real-time traffic information. Innovative features like vibration feedback, nighttime readability, and group ride navigation further distinguish integrated motorcycle navigation systems in the evolving market.

The Integrated system segment was valued at USD 205.80 million in 2019 and showed a gradual increase during the forecast period.

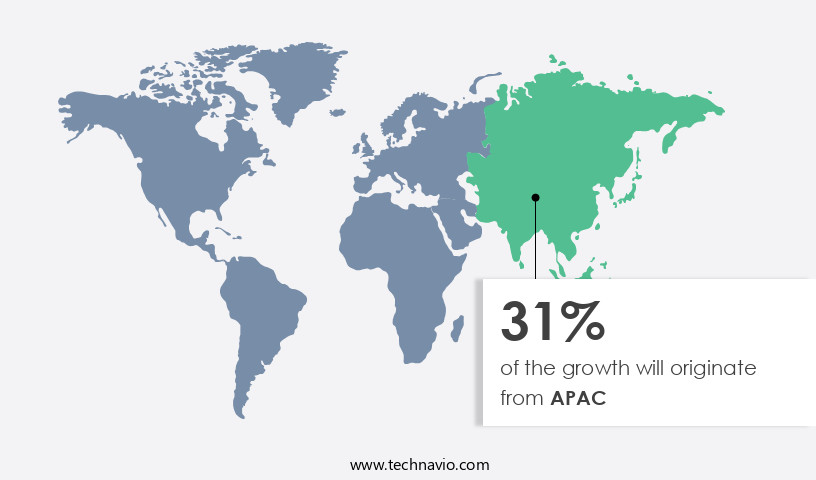

Regional Analysis

APAC is estimated to contribute 31% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In Europe, the market is characterized by a strong culture of motorcycling and advanced road infrastructure, making it a significant market for these technologies. With countries like Germany, France, Italy, the UK, and Spain being major hubs for leisure and long-distance motorcycle travel, the demand for accurate, multilingual, and cross-country compatible navigation systems is on the rise. These systems ensure safe and seamless riding experiences by providing real-time traffic updates, speed limit alerts, and turn-by-turn directions. Bluetooth connectivity enables riders to receive calls and messages hands-free, while touchscreen displays offer ease of use. Safety features, such as anti-theft protection and vibration feedback, add peace of mind.

Navigation software can be updated over-the-air, and systems offer various mount options, including handlebar and tank bag mounts. Motorcycle-specific maps and weather forecasts cater to the unique needs of riders. Long-distance riders benefit from extended battery life, while adventure touring enthusiasts appreciate off-road navigation capabilities. Smartphone integration, voice control, and group ride navigation further enhance the user experience. Waterproof and shock-resistant designs ensure durability, while cloud synchronization enables data backup and access from multiple devices. The market is also witnessing the integration of ride sharing platforms, third-party applications, and music streaming services.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Motorcycle Navigation System Industry?

- The significant increase in motorcycle adoption is the primary factor fueling market growth. (Maintaining a professional tone, ensuring grammatical correctness, and adhering to the 100-word limit)

- The global motorcycle market experienced significant growth in 2024, with sales reaching a record high of approximately 61 million units. This expansion was driven by the increasing adoption of motorcycles, particularly in countries like India, where they offer affordability, fuel efficiency, and maneuverability in densely populated areas. Leading manufacturers, such as Honda, played a crucial role in this growth, selling around 19.4 million units and achieving a 6 percent year-over-year increase. Motorcycle navigation systems have gained popularity due to the need for advanced technology on the road. These systems offer motorcycle-specific maps, trip logging, voice guidance, USB charging, dust resistance, music streaming, nighttime readability, helmet mounts, voice control, route sharing, and group ride navigation.

- With a waterproof design, these systems ensure durability and reliability, making them essential for riders. Navigation software is a key component, enabling real-time traffic updates and rerouting options. These features enhance the riding experience and contribute to the growing demand for motorcycle navigation systems.

What are the market trends shaping the Motorcycle Navigation System Industry?

- The integration of Head-Up Displays (HUD) and GPS technology in helmets is becoming a significant market trend. Fully developed HUD-connected helmets with built-in GPS systems are the future of transportation technology.

- The market is witnessing significant advancements with the integration of head-up display (HUD) technology into motorcycle helmets. This trend signifies a shift towards rider-centric innovation, merging augmented reality (AR), real-time data processing, and GPS navigation into a single, wearable interface. In March 2024, Yamaha unveiled a next-generation AR helmet, showcasing this technological evolution. The helmet boasts a HUD that projects navigation data and performance metrics onto the visor, ensuring riders maintain focus on the road while accessing essential information. Equipped with multiple cameras and AR glasses, the helmet delivers a layered visual experience, enhancing environmental awareness and promoting safer decision-making.

- Other key features include daylight visibility, Bluetooth connectivity, ride tracking, screen size, charging time, over-the-air updates, speed limits, safety features, software updates, touchscreen display, map data, traffic updates, data plans, and mount options. These features cater to the evolving needs of motorcyclists, providing an immersive and harmonious riding experience.

What challenges does the Motorcycle Navigation System Industry face during its growth?

- The integration of advanced motorcycle navigation system technology, known for its high cost, poses a significant challenge to the growth of the industry.

- Motorcycle navigation systems provide riders with essential features for long-distance journeys, such as turn-by-turn directions, satellite coverage, and real-time traffic alerts. These systems ensure optimal performance under various conditions with features like water resistance, shock resistance, and long-life batteries. However, their premium pricing, typically ranging from USD300 to USD1000, limits accessibility to some consumers. Advanced models offer additional features like transflective displays, glove-compatible interfaces, and smart notifications.

- Some systems provide lifetime map updates, while others require additional fees. Motorcycle navigation systems also prioritize user experience with headphone jacks, anti-theft protection, and intuitive user interfaces. Cloud synchronization and cellular connectivity enable seamless integration with smartphones and other devices. Despite their advantages, affordability remains a significant challenge for widespread adoption.

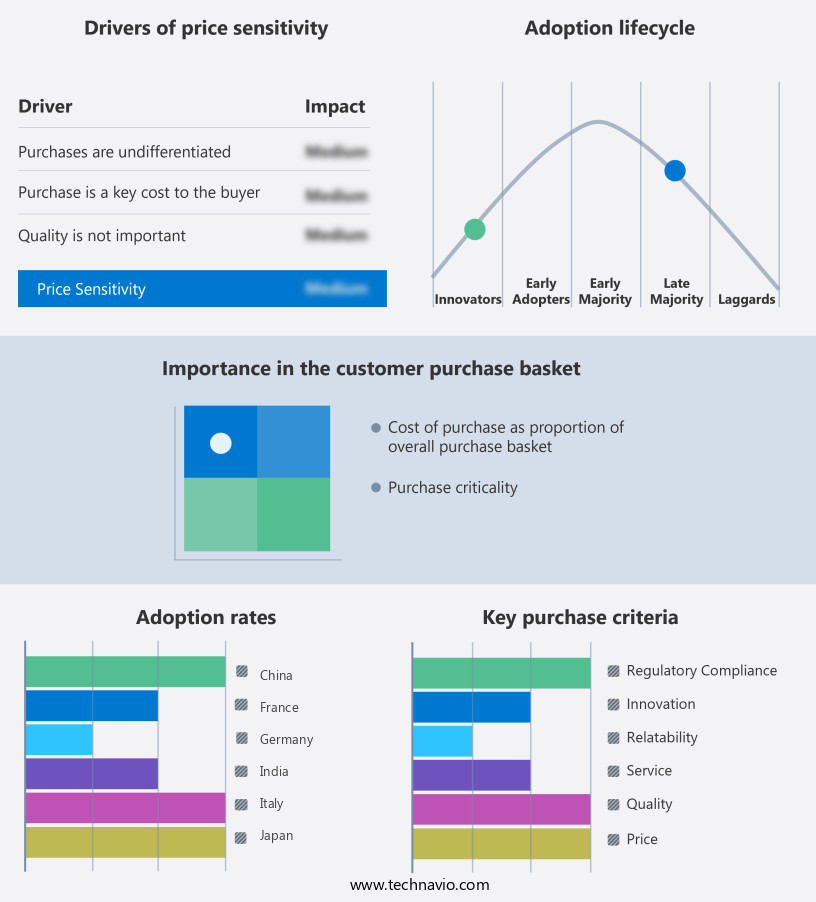

Exclusive Customer Landscape

The motorcycle navigation system market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the motorcycle navigation system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, motorcycle navigation system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bajaj Auto Ltd. - This company specializes in advanced motorcycle navigation systems.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bajaj Auto Ltd.

- BMW Motorrad

- Ducati Motor Holding S.p.A

- Garmin Ltd.

- Harley Davidson Inc.

- HERE Global BV

- Hero MotoCorp Ltd.

- Honda Motor Co. Ltd.

- MiTAC Holdings Corp.

- Polaris Inc.

- Robert Bosch GmbH

- Royal Enfield

- Suzuki Motor USA, LLC

- TomTom NV

- Triumph Motorcycles Ltd.

- Yamaha Motor Co. Ltd.

- Zero Motorcycles Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Motorcycle Navigation System Market

- In March 2023, TomTom, a leading location technology specialist, announced the launch of its latest motorcycle navigation system, "Rider 550" (TomTom.Com). This advanced device offers real-time traffic updates, 3D maps, and voice-guided navigation, catering to the growing demand for connected and safer motorcycle journeys.

- In July 2024, Garmin, a prominent player in the navigation systems market, entered into a strategic partnership with Harley-Davidson, the iconic motorcycle manufacturer (Garmin.Com). This collaboration aimed to integrate Garmin's navigation systems into Harley-Davidson motorcycles, providing riders with enhanced features and seamless integration.

- In November 2024, Magellan Navigation, an Australian navigation technology company, secured a significant investment of USD 20 million from a leading venture capital firm (BusinessWire.Com). This funding will be utilized to expand its product portfolio, including motorcycle navigation systems, and strengthen its market presence.

- In February 2025, the European Union passed a new regulation mandating the installation of motorcycle navigation systems with integrated safety features, such as lane assistance and collision warnings, in all new motorcycles (EU.Europa.Eu). This regulatory push is expected to significantly boost the demand for advanced motorcycle navigation systems in Europe.

Research Analyst Overview

- The market is witnessing significant growth, driven by the integration of advanced safety features and the increasing demand for convenience and efficiency on the road. Traffic data providers play a crucial role in this market, offering real-time traffic information to help riders avoid congestion and reach their destinations faster. Motorcycle navigation software, equipped with features such as lane departure warning, blind spot monitoring, and rider safety alerts, is becoming increasingly popular. Navigation accessories, including motorcycle-specific mount kits and power adapters, are also gaining traction. Navigation system retailers cater to this demand, offering a range of options from navigation data providers and manufacturers.

- Motorcycle-specific features, such as navigation for sidecars, trikes, scooters, and emergency SOS, are also driving market growth. Emergency braking and map data updates are essential add-ons that enhance the functionality of these systems. Motorcycle navigation system manufacturers continue to innovate, integrating new technologies and improving user experience to meet the evolving needs of riders.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Motorcycle Navigation System Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

215 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.3% |

|

Market growth 2025-2029 |

USD 159.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.0 |

|

Key countries |

US, China, Germany, UK, India, France, Mexico, Japan, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Motorcycle Navigation System Market Research and Growth Report?

- CAGR of the Motorcycle Navigation System industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the motorcycle navigation system market growth of industry companies

We can help! Our analysts can customize this motorcycle navigation system market research report to meet your requirements.