Muffins Market Size 2025-2029

The muffins market size is forecast to increase by USD 1.6 billion, at a CAGR of 3.6% between 2024 and 2029. The market is experiencing significant growth due to the increasing preference for portion-sized snacking options.

Major Market Trends & Insights

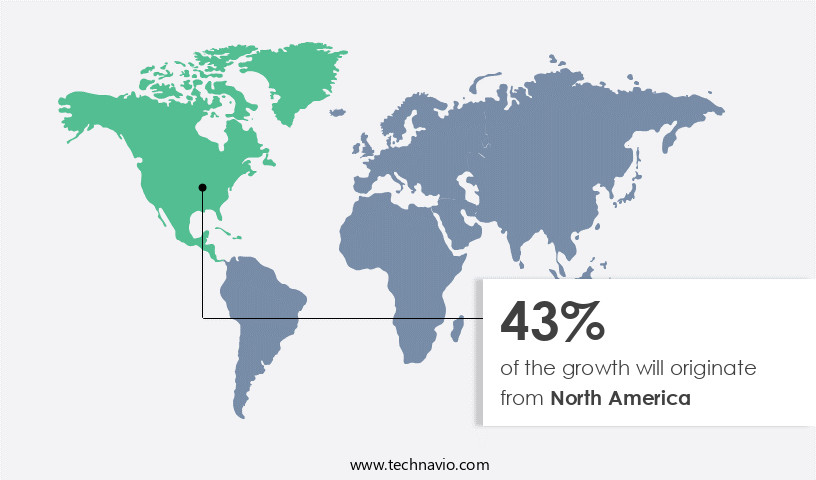

- North America dominated the market and accounted for a 43% share in 2023.

- The market is expected to grow significantly in Europe region as well over the forecast period.

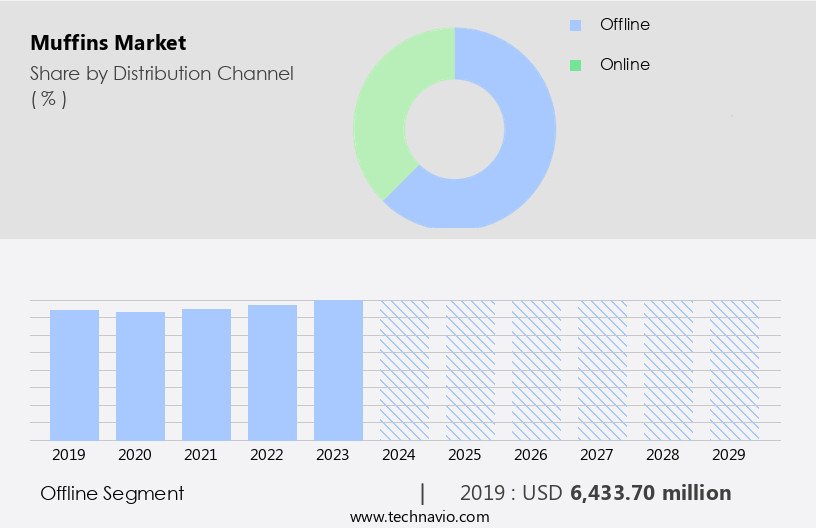

- Based on the Distribution Channel, the offline segment led the market and was valued at USD 6.88 billion of the global revenue in 2023.

- Based on the Product, the artisanal muffins segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2024 Market Size: USD 8.17 Billion

- Future Opportunities: USD 1.59 Billion

- CAGR (2024-2029): 3.6%

- North America: Largest market in 2023

The muffin market continues to evolve, shaped by various market dynamics that influence its growth and development. Product differentiation remains a key driver, with bakers and manufacturers exploring innovative flavor profiles and ingredient sourcing to cater to diverse consumer preferences. Economic conditions and distribution channels also play a significant role, as consumers seek out affordable and convenient muffin options, whether through food service establishments or retail outlets. Food safety and quality control are paramount in the muffin industry, with leavening agents such as baking powder and baking soda ensuring consistent rise and texture. Vanilla extract adds a desirable flavor, while calorie count and health and wellness trends influence the use of reduced-sugar and gluten-free ingredients.

What will be the Size of the Muffins Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

Seasonal demand and home baking also impact the muffin market, with consumers turning to muffins as a versatile and delicious option for various occasions. Commercial baking operations prioritize shelf life, waste management, and production processes to maintain efficiency and profitability. Ingredient costs and food trends continue to shape the muffin market, with chocolate chips and other add-ins adding value and appeal. Muffin batter preparation and cooling processes are essential to ensure optimal texture and taste, while portion size and nutritional information cater to evolving consumer expectations. Baking tools, such as muffin tins, baking cups, mixing bowls, and cooling racks, are crucial to the muffin-making process, ensuring consistent quality and presentation. The online segment is the second largest segment of the distribution channel and was valued at USD 1.01 billion in 2023.

Packaging materials also play a vital role in preserving freshness and extending shelf life. Overall, the muffin market remains dynamic and responsive to various market forces and consumer demands, with ongoing innovation and adaptation shaping its future.

This trend is particularly prominent in developed markets, where consumers seek convenient, on-the-go food solutions. However, the market faces challenges in emerging economies, where the high cost and limited availability of muffins compared to alternative, locally produced snacks pose obstacles to growth. Moreover, the rising demand for healthier food alternatives is driving companies to innovate and introduce muffins with reduced sugar, whole grains, and other nutritious ingredients to gain market share.

To capitalize on these opportunities and navigate challenges effectively, market players must focus on product differentiation, pricing strategies, and expanding their distribution networks in both developed and emerging markets. Additionally, partnerships with health and wellness organizations and strategic collaborations with local producers in emerging economies could help companies mitigate the impact of competition from substitute snacks and tap into new consumer segments.

How is this Muffins Industry segmented?

The muffins industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Artisanal muffins

- Packaged muffins

- Flavor

- Chocolate

- Blueberry

- Banana

- Savory (Cheese, Herb)

- Product Type

- Standard Muffins

- Gluten-Free Muffins

- Low-Calorie Muffins

- Savory Muffins

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 6.88 billion in 2023. It continued to the largest segment at a CAGR of 3.06%.

In the dynamic food market, muffins have emerged as a popular choice for consumers, with various players engaging in product differentiation to cater to diverse preferences. Economic conditions influence consumer behavior, leading to increased demand for healthier options, driving the use of baking soda and other leavening agents in muffin batter. The distribution channels, including department stores, supermarkets, hypermarkets, convenience stores, and coffee shops, employ promotional strategies such as branding and discounts to boost sales. Retailers like Walmart and Walgreens have long stocked muffins, contributing to their widespread availability. The organized retail sector's expansion and the proliferation of retail locations have fueled sales growth in this segment.

Shelf life, ingredient sourcing, and waste management are crucial considerations in commercial baking. Food trends, such as seasonal demand and health and wellness, impact muffin production processes, with an emphasis on nutritional information and portion size. Food safety and quality control are essential aspects of recipe development, ensuring the use of high-quality ingredients and adherence to food safety regulations. Food service establishments, including restaurants and cafes, also contribute significantly to muffin sales. Muffin tins, baking cups, baking sheets, and cooling racks are essential equipment for both home baking and commercial production. Ingredient costs, including those for chocolate chips, vanilla extract, baking powder, and baking soda, impact production processes and profitability.

Flavor profiles and food trends influence recipe development, with consumers increasingly seeking unique and innovative offerings. In the realm of ingredient sourcing, companies prioritize sustainability and ethical practices, ensuring the ethical sourcing of ingredients and minimizing waste in production processes. Packaging materials are also a consideration, with an emphasis on eco-friendly options that extend shelf life and maintain product freshness. Overall, the muffin market is a vibrant and evolving landscape, shaped by consumer preferences, economic conditions, and technological advancements.

The Offline segment was valued at USD 6.43 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the North American market, the United States, Mexico, and Canada lead in muffin consumption. The health-conscious consumer trend is driving the demand for healthier bakery goods, including muffins, in response to rising obesity rates and a focus on wellness. Data suggests that the future opportunities for growth in the North America region estimates to be around USD 1.59 billion. Muffins, due to their high calorie content from ingredients like flour, butter, and sugar, are undergoing reformulation. Producers are experimenting with alternative, lower-fat and lower-calorie ingredients. The shift towards healthier options is evident in the increased usage of multigrain or whole-wheat flour in muffin production. Product differentiation is a key strategy for businesses in this competitive landscape.

Economic conditions influence consumer behavior, with retail outlets and food service providers adapting to changing market dynamics. Shelf life, waste management, and food safety are crucial considerations for commercial baking. Seasonal demand, flavor profiles, and ingredient sourcing also impact production processes. Food trends, such as the inclusion of chocolate chips or recipe development, add variety to the market. Quality control, leavening agents, and baking powders ensure consistent product output. Consumer preferences dictate portion size and packaging materials. Ingredient costs, baking sheets, cooling racks, and muffin tins are essential components of muffin production. Overall, the muffin market in North America is dynamic, with producers addressing consumer demands for healthier options while maintaining product quality and efficiency.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Muffins Industry?

- The increasing preference for convenient, portion-controlled snacking options is the primary factor fueling market growth in this sector.

- Muffins have gained significant popularity in recent times due to the increasing demand for convenient, single-serving snacks. With a growing awareness of health and wellness, consumers are opting for portion-controlled baked goods as an alternative to larger, high-calorie desserts. This trend has led to an uptick in demand for muffins, particularly in the retail sector. Bakers and confectioners have responded to this shift by offering a wider variety of flavors while maintaining nutritional information. Commercial baking operations have implemented measures to ensure longer shelf life and effective waste management. The convenience of home baking using baking cups has also contributed to the muffins' rising popularity.

- Despite the high butter and sugar content, consumers are willing to make informed choices, recognizing the importance of balancing taste and nutrition. This market dynamic is expected to continue, as people prioritize health and convenience in their daily lives. The baking industry is adapting to these changing preferences, offering innovative products that cater to the evolving needs of consumers.

What are the market trends shaping the Muffins Industry?

- The trend in the market is shifting towards offering healthy options to attract and retain customers. As a professional and knowledgeable assistant, I can help you explore strategies to incorporate these choices in your business plan.

- The muffin market has experienced significant growth due to consumers' increasing focus on health and wellness. Companies are differentiating their products by incorporating whole wheat, whole grains, or multigrain flour and adding nutritious extras such as fruits and chia seeds. This enhances the muffins' nutritional value while reducing calorie content. Production processes involve making muffin batter using these healthy ingredients and baking them on baking sheets or cooling racks. Ingredient sourcing is crucial, ensuring the highest quality and health benefits.

- Food trends continue to influence the market, with a preference for immersive and harmonious flavor profiles. Chocolate chips remain a popular addition, offering a delightful sweetness without compromising nutritional value. Companies prioritize preserving the integrity of the ingredients to maintain the health benefits and appeal to health-conscious consumers.

What challenges does the Muffins Industry face during its growth?

- In emerging economies, the snack industry faces significant challenges due to escalating production costs and the availability of affordable substitute snack options.

- Muffins are a popular bakery item in Western countries, with companies setting prices based on consumer spending power. However, there is a minimum profit threshold, and price increases can impact production costs and overall sales. Economies of scale and scope are crucial for businesses to remain competitive. In contrast, street food culture and authentic snacks dominate in developing countries of Asia and Africa. Effective recipe development is essential for muffin production, ensuring food safety and consistent quality. Leavening agents, such as baking powder and vanilla extract, play a significant role in the baking process. The use of high-quality ingredients and proper mixing techniques in large, sturdy mixing bowls is vital for producing consistent batches.

- Packaging materials are another crucial aspect of muffin production. Proper packaging ensures the product's freshness and protects it during transportation and storage. Companies invest in research and development to create innovative and sustainable packaging solutions. Consumer preferences continue to evolve, with a growing demand for healthier, gluten-free, and vegan muffin options. Meeting these demands requires ongoing research and adaptation, as well as strict adherence to food safety regulations. By focusing on quality control and innovation, muffin producers can differentiate themselves in a competitive market.

Exclusive Customer Landscape

The muffins market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the muffins market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, muffins market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alpha Baking Co. Inc. - This company specializes in producing a variety of muffins, including the white wheat blueberry option. Their muffins are known for their high-quality ingredients and appealing flavors, making them a popular choice for consumers seeking delicious and nutritious baked goods. The white wheat blueberry muffin, in particular, offers a delightful blend of sweet and tangy flavors, making it a standout option in the market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alpha Baking Co. Inc.

- ARYZTA AG

- Associated British Foods Plc

- BAB Inc.

- Bakeline Snc

- Britannia Industries Ltd.

- Corporativo Bimbo SA de CV

- EDEKA ZENTRALE Stiftung and Co. KG

- Einstein Noah Restaurant Group Inc.

- FlapJacked

- Flowers Foods Inc.

- GrainCorp Ltd.

- McCain Foods Ltd.

- McKee Foods

- Mondelez International Inc.

- Prager Brothers

- Promise Gluten Free

- Sprightlite Foods Pvt. Ltd.

- The Hershey Co.

- Warburtons Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Muffins Market

- In January 2024, General Mills, a leading food corporation, announced the launch of new muffin flavors under its popular brand, "Cinnamon Toast Crunch." This expansion aimed to cater to the growing consumer demand for innovative and indulgent muffin varieties (General Mills Press Release).

- In March 2024, Dunkin' Brands Group, the parent company of Dunkin' Donuts, entered into a strategic partnership with Blue Apron Holdings, a meal kit company. This collaboration enabled Dunkin' Donuts to offer ready-to-bake muffin kits in Blue Apron meal boxes, expanding its reach in the convenience food market (Dunkin' Brands Group Press Release).

- In May 2024, Frito-Lay North America, a subsidiary of PepsiCo, acquired a majority stake in the muffin manufacturer, "Bakery Now." This acquisition was aimed at strengthening Frito-Lay's position in the baked goods market and expanding its product offerings (Frito-Lay North America Press Release).

- In April 2025, the European Union approved the use of a new natural preservative, "NaturalPlus," for muffins and other baked goods. This approval is expected to boost the growth of the European the market, as it allows manufacturers to produce longer-lasting, preservative-free muffins (European Commission Press Release).

Research Analyst Overview

- In the dynamic breakfast the market, ingredient innovation plays a pivotal role in catering to various dietary restrictions and consumer preferences. Supply chain efficiency is crucial for manufacturers to ensure timely delivery and maintain brand loyalty. Pricing strategies are carefully formulated based on production yield and manufacturing efficiency. Consumer insights drive new product development, with customizable recipes and mini muffins gaining popularity. Automated baking systems and advertising campaigns enhance production capacity and reach. Sustainability initiatives, such as ingredient traceability and waste reduction, resonate with environmentally-conscious customers. Retail partnerships and storage solutions expand distribution channels and preserve product freshness.

- Target audience segmentation and promotional activities, including muffin toppers and dessert muffins, boost sales. Sales forecasts rely on production automation and allergen information to meet demand and maintain customer relationships. Transport logistics and online sales channels streamline distribution and reach a wider audience. Bakery equipment advances enable the production of giant muffins and snack muffins, further expanding market offerings.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Muffins Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.6% |

|

Market growth 2025-2029 |

USD 1595.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.5 |

|

Key countries |

US, Canada, UK, Germany, China, France, Italy, The Netherlands, Japan, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Muffins Market Research and Growth Report?

- CAGR of the Muffins industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the muffins market growth of industry companies

We can help! Our analysts can customize this muffins market research report to meet your requirements.