Music And Video Market Size 2025-2029

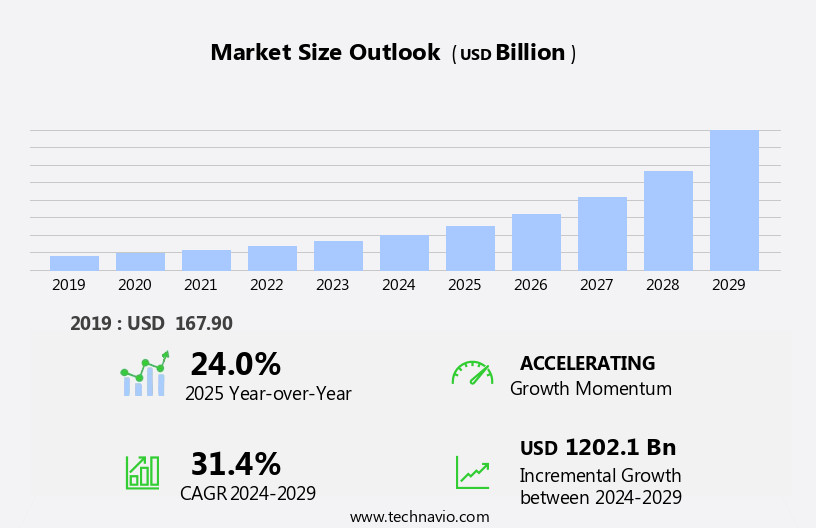

The music and video market size is forecast to increase by USD 1202.1 billion at a CAGR of 31.4% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the rising Internet and smartphone penetrations. These technological advancements have enabled the integration of advanced technologies with online streaming services, providing consumers, with unparalleled access to a vast library of music and video content. However, market expansion is not without challenges. Regulatory hurdles impact adoption in certain regions, with complex copyright laws and licensing agreements posing significant obstacles. Furthermore, video piracy issues and illegal downloading of music tracks continue to temper growth potential. Despite these challenges, opportunities abound for companies that can effectively navigate these complexities. By investing in robust digital rights management systems and collaborating with content creators and distributors, market participants can mitigate piracy risks and capitalize on the vast consumer base seeking convenient and affordable access to music and video content.

- Additionally, the integration of artificial intelligence and machine learning algorithms can enhance user experiences, offering personalized recommendations and improving content discovery. Overall, the market presents a dynamic and complex strategic landscape, requiring companies to stay informed of regulatory developments, invest in technology, and collaborate effectively to capitalize on growth opportunities and mitigate challenges. Music technology, such as digital audio workstations and music production software, enables content creators to produce high-quality music. Virtual concerts and live performances, made possible through virtual and augmented reality, offer new avenues for engaging audiences. Machine learning and data analytics play crucial roles in the markets.

What will be the Size of the Music And Video Market during the forecast period?

- In the dynamic and evolving media landscape, the markets for post-production services and music publishing continue to intersect, with sound design services playing a crucial role in enhancing multimedia content. Video editing courses equip professionals with the necessary skills to create engaging content for video sharing platforms and social media integration. Music production companies and video production companies collaborate to deliver high-quality audio and video, leveraging advanced audio codecs and video codecs for lossless and high-fidelity output. Music licensing agreements and soundtrack licensing are integral components of the media production process, facilitated by content delivery networks and royalty collection entities.

- Brand partnerships and influencer marketing campaigns further expand the reach of multimedia content, with music recommendation engines and video recommendation engines driving consumer engagement. Interactive gaming and virtual events provide new opportunities for music marketing and fan engagement, while film scoring services add emotional depth to visual storytelling. In the realm of video marketing, lossless audio and virtual events offer experiences, while music synchronization and music composition services ensure a perfect fit between visuals and audio. Streaming protocols and social media integration enable seamless content delivery and access, fostering a symbiotic relationship between the markets.

How is this Music And Video Industry segmented?

The music and video industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Platform

- Digital

- Physical

- Type

- Video

- Music

- End-user

- Individual users

- Commercial users

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Platform Insights

The digital segment is estimated to witness significant growth during the forecast period. The digital market encompasses revenue generated from the streaming and downloading of audio and video content on OTT platforms and online sites. This segment is poised for substantial growth during the forecast period, primarily due to the expanding penetration of smartphones and improved internet connectivity. The availability of affordable smartphones in emerging economies, such as India and China, as well as the proliferation of low-cost internet plans, are major catalysts for this trend. The wave in smartphone adoption has led to a notable increase in the usage of OTT platforms like Netflix, Hotstar, Amazon, and Spotify.

Music and video analytics, licensing, and distribution play crucial roles in this market, with content creators leveraging machine learning and data analytics for personalization and monetization strategies. Virtual concerts, music education, and music therapy are emerging trends, with virtual reality and augmented reality technologies enhancing user experiences. The entertainment industry, including film, music, and media, is embracing digital distribution and streaming services, leading to new opportunities for content creators and providers. Advertising revenue, copyright protection, and digital rights management are also significant aspects of this market, as it continues to evolve and adapt to the changing needs of consumers and creators alike.

The Digital segment was valued at USD 130.10 billion in 2019 and showed a gradual increase during the forecast period.

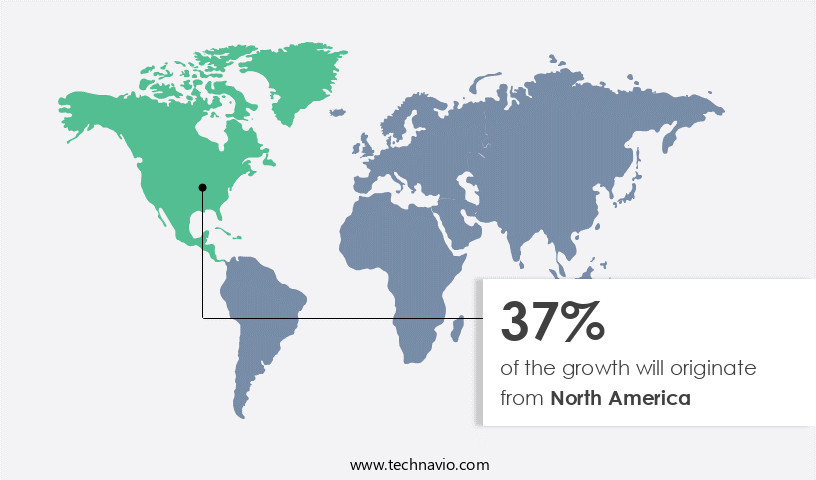

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing substantial growth due to the rising demand for over-the-top (OTT) services for video streaming. With numerous production houses in the region producing globally popular web series, movies, and animated content accessible via streaming apps, the market is thriving. Parallelly, the increasing popularity of online music streaming is also noteworthy in North America. The widespread use of smartphones and improved internet connectivity across the region are significant factors driving the demand for these services. New companies are entering the market to capitalize on the growth opportunities, offering music and video streaming, editing software, distribution, licensing, and production services.

Additionally, technology advancements, such as machine learning, artificial intelligence, and virtual reality, are enhancing user experiences, fostering content personalization and monetization strategies. The entertainment industry, including music, media, film, and advertising, is embracing these innovations, leading to a balanced blend of technology and creativity. Music education, therapy, and music festivals are also contributing to the market's expansion. Overall, the North American market is an ever-evolving landscape, offering numerous opportunities for content creators, enthusiasts, and businesses alike.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Music And Video market drivers leading to the rise in the adoption of Industry?

- The significant increase in Internet and smartphone penetration serves as the primary catalyst for market growth. The proliferation of smartphones and the expansion of global Internet penetration have led to a substantial rise in the consumption of digital media content. Approximately 400 million new users have joined the digital world in the last year, significantly increasing the demand for online streaming services. With high-end smartphones and easy Internet access, users can now enjoy music and video content anytime, anywhere. In response, streaming service providers are capitalizing on this trend by offering on-demand services through Over-The-Top (OTT) platforms. Moreover, the entertainment industry is witnessing a shift towards digital video distribution and licensing.

- This includes music licensing, video licensing, and sound design for various multimedia applications. The integration of data analytics and advanced video editing tools in digital audio workstations enables content personalization, enhancing the user experience. The media industry, including both music and video, is experiencing a paradigm shift towards digital platforms. Advertising revenue from digital media is projected to surpass traditional media in the near future. Virtual reality technology is also gaining traction in the entertainment industry, offering experiences to users. The digital media landscape is evolving rapidly, with streaming services, digital distribution, and advanced technology driving growth.

- The future of the entertainment industry lies in digital innovation, offering personalized content and experiences to users.

What are the Music And Video market trends shaping the Industry?

- Advanced technologies are increasingly being integrated with online streaming services, marking a significant market trend. This fusion of technology and streaming is transforming the way we consume media. Advanced technologies, including artificial intelligence (AI), are revolutionizing the market by enhancing streaming quality and content production. AI technology supports various aspects of video production, such as cinematography, editing, voice-overs, scriptwriting, and content discovery. Service providers utilize AI to improve video quality and provide personalized recommendations to users. The popularity of streaming platforms like Hulu and YouTube continues to rise, fueling the adoption of AI technology. Additionally, AI can detect offensive content in videos and take action without human intervention, ensuring a safe and enjoyable user experience.

- Monetization strategies, such as digital rights management and film scoring, are also being enhanced through AI and music composition. The film industry is embracing AI for film scoring and interactive experiences, creating new opportunities for innovation and growth. Overall, AI technology is transforming the market by improving content discovery, distribution, and monetization strategies.

How does Music And Video market faces challenges face during its growth?

- Unauthorized video piracy and the illegal downloading of music tracks pose significant challenges to the growth of the entertainment industry. These unlawful activities undermine the revenue streams of content creators and producers, threatening the sustainability of the industry as a whole. It is imperative that effective measures are taken to mitigate these issues and uphold intellectual property rights. The market faces significant challenges from content piracy, primarily through the use of torrenting software. Torrents, which contain metadata for digital files, enable users to download copyrighted audio and video content illegally. While the use of torrenting software itself is not unlawful, the shared content is often protected by copyright. This has led to a proliferation of free, on-demand content, reducing the incentive for users to subscribe to legitimate streaming services. Music libraries, video editing tools, music technology, live performances, music therapy, music education, digital music distribution, and video analytics are key components of the market.

Exclusive Customer Landscape

The music and video market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the music and video market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, music and video market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amazon.com Inc. - The company offers music and video such as Amazon Prime Music.The company offers music and video such as Amazon Prime Music.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amazon.com Inc.

- Apple Inc.

- Bharti Airtel Ltd.

- Deezer SA

- Disney Music Group

- Entertainment Network India Ltd.

- iHeartMedia Inc.

- Microsoft Corp.

- Netflix Inc.

- Reliance Industries Ltd.

- Sirius XM Holdings Inc.

- Sony Group Corp.

- SoundCloud Global Ltd. and Co. KG

- Spotify Technology SA

- Tencent Music Entertainment Group

- TIDAL Music AS

- Viacom18 Media Pvt. Ltd.

- Vimeo.com Inc.

- YouTube

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Music And Video Market

- In February 2024, Apple Inc. Introduced Apple Music Voice Plan, a new subscription tier for Apple Music, allowing users to access music and playlists through Siri voice commands, marking a significant advancement in voice-activated music streaming services (Apple Press Info).

- In October 2024, Spotify and Hulu announced a strategic partnership, enabling new subscribers to enjoy bundled discounts on both streaming services. This collaboration aimed to attract and retain customers by offering a comprehensive entertainment package (Spotify Investor Relations).

- In March 2025, Amazon Prime Video and MGM Studios finalized a merger deal, bolstering Amazon's video streaming library with MGM's extensive film and TV content. The acquisition also granted Amazon access to MGM's iconic intellectual properties (Amazon Press Room).

- In June 2025, YouTube Music and Google Discover launched a partnership, integrating YouTube Music into Google Discover, allowing users to access personalized music recommendations based on their search history and preferences (Google Blog).

Research Analyst Overview

The market continues to evolve, with dynamic interplays between various sectors shaping its landscape. Immersive entertainment experiences, driven by music and video, are at the forefront of this evolution. They facilitate content discovery, personalization, and monetization strategies for streaming services and advertising revenue. Music licensing and video licensing are integral components of the media industry, with copyright protection and content piracy ongoing concerns. Music education and music schools leverage technology to offer interactive experiences and music lessons through smart TV. The film industry and video production sectors utilize video editing tools and editing software to create engaging content for digital video distribution. Sound design and film scoring further enhance the overall impact of multimedia content. Live music, music therapy, and music libraries provide various applications for music in diverse sectors. Subscription models, subscription revenue, and on-demand content dominate the digital music distribution landscape. Metadata tagging ensures efficient organization and accessibility of vast music and video libraries. The entertainment industry's continuous adaptation to technological advancements and evolving consumer preferences shapes the market's ongoing dynamism. This interconnected ecosystem encompasses music, video, technology, and various sectors, offering endless opportunities for innovation and growth.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Music and Video Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 31.4% |

|

Market growth 2025-2029 |

USD 1,202.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

24.0 |

|

Key countries |

US, China, UK, Canada, Japan, Germany, India, France, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Music And Video Market Research and Growth Report?

- CAGR of the Music And Video industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the music and video market growth and forecasting

We can help! Our analysts can customize this music and video market research report to meet your requirements.