Catalyst Market Size 2024-2028

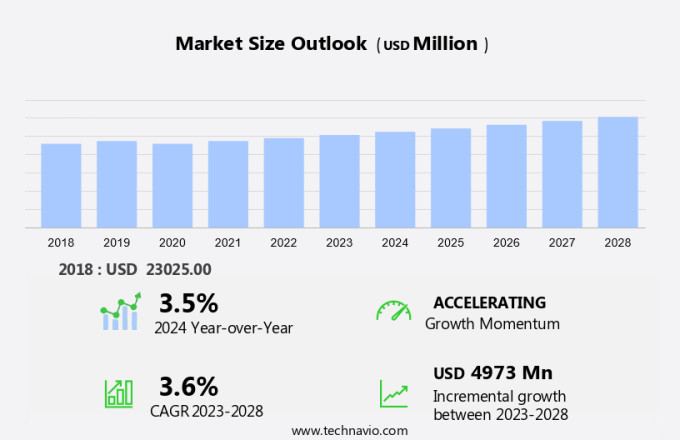

The catalyst market size is forecast to increase by USD 4.97 billion, at a CAGR of 3.6% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing industrialization in emerging economies and the rising demand for biocatalysts in various industries. Biodiesel production is a major driver of this market, with transesterification being the primary process utilizing heterogeneous catalysts such as silicon dioxide and titanium dioxide. Additionally, the growing preference for eco-friendly and sustainable manufacturing processes is boosting the adoption of biocatalysts, which offer several advantages over traditional catalysts. However, the market faces challenges that could hinder its growth. Stringent regulations and policies regarding the use of certain catalysts, particularly those containing heavy metals, are becoming more stringent. Companies must invest in research and development to create alternative catalysts that meet regulatory requirements while maintaining performance levels.

- Furthermore, the high cost of producing biocatalysts remains a significant barrier to entry for some players. To overcome this challenge, companies must focus on scaling up production and optimizing processes to reduce costs and improve profitability.

What will be the Size of the Catalyst Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in materials science and chemical engineering. Catalyst production involves the synthesis of various catalyst types, including single-atom catalysts, metal nitrides, and metal nanoparticles, each offering unique benefits for process control and industrial applications. Enzyme catalysis and porous materials play a crucial role in catalyst supports, enabling improved catalyst activity and selectivity. Computational catalysis and process simulation facilitate the design and optimization of catalysts, while process monitoring and control ensure stability and activity enhancement. Metal carbides and metal oxides are among the many catalyst materials under exploration, with potential applications in homogeneous and heterogeneous catalysis.

Industrial catalysis spans various sectors, from automotive to chemical synthesis, requiring economic analysis and life cycle assessment for sustainability and environmental impact. Catalyst deactivation and regeneration are ongoing areas of research, as are catalyst inhibitors and stability improvement. Bimetallic catalysts and alloy catalysts expand the catalyst landscape, offering enhanced performance and selectivity. Metal sulfides and metal sulfides are also gaining attention due to their potential in reaction mechanisms and catalytic converters. The field of catalysis is dynamic, with ongoing research in areas such as surface science, reaction kinetics, and reactor design, ensuring continuous innovation and progress.

How is this Catalyst Industry segmented?

The catalyst industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Heterogeneous catalyst

- Homogeneous catalyst

- Raw Material

- Metals (Precious Metals, Base Metals)

- Zeolites

- Chemical Compounds

- Ceramics

- Others

- Application

- Petroleum Refining

- Chemical Synthesis

- Polymerization

- Environmental (Automotive Emission Control, Industrial Emission Control)

- Fuel Cells

- Food & Beverages

- End-use Industry

- Oil & Gas

- Chemicals

- Automotive

- Pharmaceuticals

- Food & Beverages

- Environmental

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

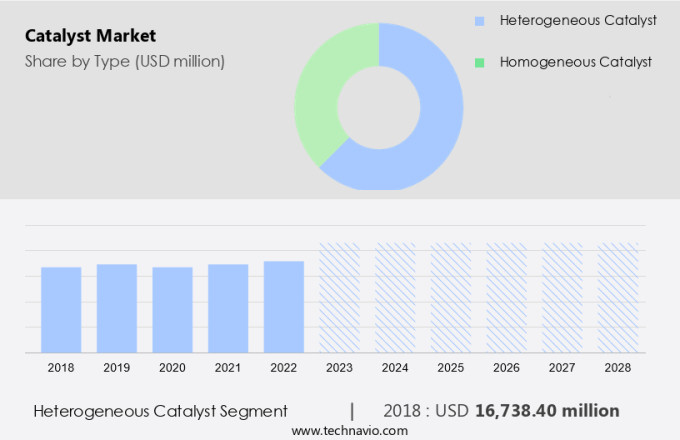

The heterogeneous catalyst segment is estimated to witness significant growth during the forecast period.

The market is driven by the extensive utilization of heterogeneous catalysts, particularly in the petrochemical, refining, and environmental industries. Heterogeneous catalysts, which exist in a different phase from reactants, offer advantages such as easier separation and recovery, making them cost-effective and sustainable. In refining, they are indispensable for processes like hydrocracking and catalytic cracking, transforming heavier crude oil fractions into valuable lighter products, such as gasoline and diesel. In the petrochemical industry, heterogeneous catalysts are employed to generate essential chemicals, including methanol, ammonia, and olefins, which are fundamental building blocks in various chemical processes. Process control, a crucial aspect of catalyst production, ensures optimal catalyst performance and longevity.

Single-atom catalysts, a recent advancement, offer enhanced activity and selectivity due to their unique active sites. Metal nitrides and metal nanoparticles are popular catalyst supports, while computational catalysis and molecular modeling aid in catalyst design and optimization. Porous materials, such as metal carbides and metal oxides, are employed as catalyst supports due to their large surface areas and chemical stability. Bimetallic catalysts, which consist of two or more metals, offer improved catalytic activity and selectivity. Industrial catalysis, an essential application segment, is further segmented into petrochemicals, pharmaceuticals, and food and beverages. Economic analysis and process simulation are essential tools for catalyst optimization and stability improvement.

Catalyst regeneration and deactivation, crucial aspects of catalyst lifecycle management, are addressed through various methods, including thermal and chemical regeneration. Catalyst selectivity, a critical factor in industrial processes, is controlled through catalyst design, promoters, and reaction engineering. Homogeneous catalysis, while offering high activity and selectivity, poses challenges in separation and recovery. Heterogeneous catalysis, on the other hand, offers advantages in this regard. Catalyst characterization techniques, such as surface science and spectroscopy, provide valuable insights into catalyst structure and performance. Process monitoring and reactor modeling are essential for optimizing catalytic processes and improving stability. Environmental impact, a growing concern, is addressed through green chemistry and sustainable catalysis.

Catalytic converters, a significant application area, employ catalysts to reduce emissions in the automotive industry. Catalyst recycling and reuse are essential for minimizing waste and reducing costs. In conclusion, The market is characterized by the extensive use of heterogeneous catalysts, particularly in the petrochemical, refining, and environmental industries. Advancements in catalyst design, production, and characterization continue to drive market growth and innovation. Process control, optimization, and stability improvement are crucial aspects of catalyst application and management. The market's future growth is expected to be influenced by factors such as increasing demand for cleaner and more efficient industrial processes, advancements in materials science and nanotechnology, and the growing focus on sustainability and environmental impact reduction.

The Heterogeneous catalyst segment was valued at USD 16.74 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

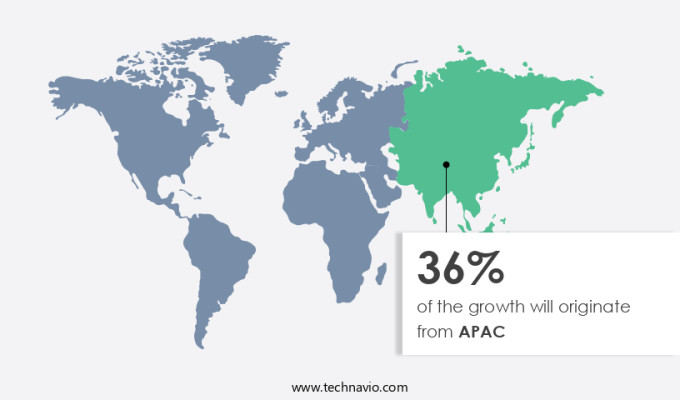

APAC is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific (APAC) is experiencing substantial growth, fueled by the rapid industrialization and increasing demand for agrochemicals, petrochemicals, food additives, and pharmaceuticals in countries such as China, Japan, India, Vietnam, South Korea, Malaysia, and Australia. The region's economic development and population growth are significant factors contributing to this expansion. In China, Japan, South Korea, and India, the demand for catalysts is particularly high due to their robust manufacturing sectors. The use of catalysts in various industries, including food and beverage, pharmaceuticals, and chemical manufacturing, is driving market growth. For instance, the rising demand for processed food products in APAC, particularly carbonated beverages, is boosting the market for food additives, which require catalysts for their production.

Additionally, the increasing adoption of catalysts in the production of agrochemicals and petrochemicals is expected to further fuel market growth. Single-atom catalysts, metal nitrides, metal nanoparticles, and metal carbides are among the supported catalysts gaining popularity due to their high activity and selectivity. Porous materials, catalyst supports, and catalyst synthesis are essential components of catalyst production. Computational catalysis and process simulation are critical tools for optimizing catalyst design and improving catalyst stability and activity. Industrial catalysis, homogeneous catalysis, and heterogeneous catalysis are key areas of application for catalysts, with each offering unique advantages. Process control, process monitoring, and catalyst regeneration are essential aspects of catalyst use in various industries.

Economic analysis, life cycle assessment, and environmental impact studies are crucial for understanding the sustainability and long-term viability of catalyst applications. Catalyst inhibitors, catalyst promoters, and catalyst characterization techniques are essential for optimizing catalyst performance and preventing catalyst deactivation. Bimetallic catalysts, metal oxides, metal sulfides, and alloy catalysts are among the various types of catalysts used in APAC. Catalyst recycling and catalyst synthesis are essential for reducing production costs and minimizing waste. Reactor design, reactor modeling, and surface science are critical areas of research for improving catalyst performance and efficiency. Catalytic converters, active sites, and carbon materials are essential components of catalytic processes used in automotive applications.

In conclusion, the market in APAC is poised for significant growth due to the increasing demand for catalysts in various industries, including food and beverage, pharmaceuticals, and chemical manufacturing. The use of single-atom catalysts, metal nitrides, metal nanoparticles, and metal carbides is gaining popularity due to their high activity and selectivity. Process control, process optimization, and catalyst regeneration are essential for maximizing catalyst performance and efficiency. Catalyst inhibitors, catalyst promoters, and catalyst characterization techniques are crucial for understanding catalyst behavior and improving catalyst design. The market's future growth will depend on continued research and development in catalyst synthesis, catalyst design, and catalyst application technologies.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a diverse range of products that play a crucial role in various industries, including petrochemicals, pharmaceuticals, and food processing. Catalysts are essential additives used to increase the efficiency and selectivity of chemical reactions. Their applications span from enhancing the production of polymers, improving the refining process in petroleum industries, and facilitating the synthesis of complex organic compounds in pharmaceuticals. Catalysts can be classified based on their function, such as homogeneous, heterogeneous, and enzyme catalysts. Additionally, they can be categorized based on their active components, including metal catalysts, acid catalysts, and biocatalysts. The market is driven by factors such as increasing industrialization, stringent environmental regulations, and the need for energy efficiency. Innovations in catalyst technology continue to shape the market landscape, with research focusing on developing catalysts with higher activity, selectivity, and stability.

What are the key market drivers leading to the rise in the adoption of Catalyst Industry?

- The escalating industrialization rate in emerging economies serves as the primary catalyst for market growth.

- The market encompasses various industries, including oil and gas, polymer synthesis, chemicals, and consumer goods. The market's expansion is significantly driven by the global industrialization trend, particularly in emerging economies in the Asia Pacific (APAC) region. Countries like India, China, Indonesia, Malaysia, and Thailand are experiencing rapid development and economic growth, making them attractive destinations for manufacturers, especially automobile manufacturers. These economies are witnessing substantial foreign direct investments, fostering economic growth during the forecast period. Moreover, the increasing population and disposable income in APAC countries have compelled major manufacturers to establish production facilities in the region.

- In the automotive sector, catalytic converters play a crucial role in reducing harmful emissions. Catalyst synthesis and reactor design are essential aspects of catalyst production, with reaction kinetics and stability improvement being key focus areas. Surface science and catalytic promoters, such as carbon materials, play a significant role in enhancing catalyst selectivity and overall process engineering efficiency. The advancements in catalyst technology continue to emphasize improved performance, longevity, and cost-effectiveness.

What are the market trends shaping the Catalyst Industry?

- The market trend indicates a significant increase in demand for biocatalysts. This growing need is driven by their efficiency, specificity, and eco-friendly nature, making biocatalysts an attractive alternative to traditional catalysts.

- Biocatalysts have gained significant attention in various industries due to their effectiveness in chemical synthesis processes. These biocatalysts, including enzymes such as cellulase, xylenes, and amylase, are utilized in applications like biofuel production, starch processing, detergent manufacturing, food and beverages production, and pharmaceuticals. The food and beverages sector employs biocatalysts in dairy, bakery, and beverages production for diverse applications. Moreover, biocatalysts are increasingly being adopted in agriculture, pulp and paper, textile, leather, and personal care and cosmetics industries. The expansion of end-user industries has fueled the demand for biocatalysis in recent years. In industrial catalysis, supported catalysts like single-atom catalysts, metal nanoparticles, and bimetallic catalysts are widely used.

- Porous materials and catalyst supports are essential in maintaining process control. Computational catalysis plays a crucial role in the design and optimization of catalysts. Economic analysis is vital in understanding the market dynamics of industrial catalysis. Catalyst poisoning is a significant challenge that requires continuous research and development to mitigate its impact. Enzyme catalysis, a type of biocatalysis, offers advantages such as high selectivity, mild reaction conditions, and eco-friendly nature. However, challenges like catalyst stability, cost, and product inhibition must be addressed for its widespread adoption. In conclusion, the biocatalysis market is experiencing growth due to the increasing demand from various industries.

- The use of advanced catalysts, process control, and computational catalysis are driving innovation in this field. Despite challenges like catalyst poisoning and cost, the potential benefits of biocatalysis make it an attractive alternative to traditional catalysis.

What challenges does the Catalyst Industry face during its growth?

- The stringent regulations and policies pose a significant challenge to the industry's growth, necessitating continuous compliance and adaptation to ensure business success.

- The market faces regulatory challenges due to stringent environmental regulations, particularly those imposed by the US Environmental Protection Agency (EPA) and the European Union's Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) on the volatile organic compound (VOC) content of specialty chemicals, including catalysts used in various industries such as paints and coatings, adhesives, and sealants. For instance, in August 2013, the Massachusetts Department of Environmental Protection (MassDEP) imposed strict VOC guidelines on adhesives and sealants. The US regulation 310 CMR 7.18(30) sets a VOC limit for adhesives used in industrial and commercial applications.

- Similarly, California has set VOC limits for various products, including adhesives and sealants. These regulations necessitate process optimization, catalyst design, and regeneration to enhance catalyst activity and stability while minimizing VOC emissions. Additionally, process simulation and homogeneous and heterogeneous catalysis are essential for improving catalyst performance and reducing catalyst deactivation. The market dynamics revolve around the need for activity enhancement, catalyst stability, and cost-effective solutions for process optimization.

Exclusive Customer Landscape

The catalyst market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the catalyst market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, catalyst market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Albemarle Corporation - The company specializes in the production of catalysts for various industries, including oil refining, polyolefins, basic organic raw materials, and coal chemicals.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Albemarle Corporation

- BASF SE

- Clariant AG

- Evonik Industries AG

- ExxonMobil Corporation

- Grace (W. R. Grace & Co.)

- Haldor Topsøe A/S

- Honeywell International Inc.

- Johnson Matthey Plc

- Kawaken Fine Chemicals Co., Ltd.

- Mitsui Chemicals, Inc.

- Nanostart AG

- Novozymes A/S

- PQ Corporation

- Sinopec Group

- Solvay S.A.

- Sumitomo Chemical Co., Ltd.

- UOP LLC (Honeywell)

- Zeolyst International (PQ Corporation, Catalysts & Chemicals Industries Co., Ltd.)

- Zhejiang Hailiang Co., Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Catalyst Market

- In January 2024, Catalyst Corporation announced the launch of their revolutionary new product, the Catalyst X1, a high-performance catalyst designed for the petrochemical industry, at the annual American Chemical Society conference (Source: Catalyst Corporation press release).

- In March 2024, Catalyst Corporation formed a strategic partnership with leading chemical manufacturer, ChemTech Industries, to expand their market reach and enhance their product offerings (Source: ChemTech Industries press release).

- In April 2025, Catalyst Corporation secured a significant investment of USD50 million in a Series C funding round, led by prominent venture capital firm, GreenTech Ventures, to accelerate research and development efforts (Source: GreenTech Ventures press release).

- In May 2025, the company received a key regulatory approval from the Environmental Protection Agency (EPA) for their new catalyst technology, which is expected to reduce greenhouse gas emissions by up to 30% in the petrochemical industry (Source: EPA press release).

Research Analyst Overview

- In the dynamic market, solid-state synthesis techniques, such as sol-gel and hydrothermal methods, are gaining popularity for their ability to produce high-performing catalysts with precise crystal structures and controlled particle size distributions. Waste minimization is a significant trend, with researchers focusing on catalyst lifetime and surface modification to reduce the amount of waste generated during inorganic and organic synthesis. Flow chemistry and high-throughput screening are also driving process intensification, enabling the rapid testing of catalyst formulations and reaction pathways for improved energy efficiency. Operando spectroscopy techniques, including mass spectrometry (MS), gas chromatography (GC), infrared spectroscopy (IR), Raman spectroscopy, and thermodynamic analysis, are essential tools for in situ characterization and catalyst screening.

- Kinetic modeling and x-ray diffraction (XRD) are used to optimize catalyst preparation and understand reaction mechanisms. Thermogravimetric analysis (TGA) and pore size distribution analysis are crucial for evaluating catalyst cost and performance in continuous processing applications, such as microreactor technology.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Catalyst Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.6% |

|

Market growth 2024-2028 |

USD 4973 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.5 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Catalyst Market Research and Growth Report?

- CAGR of the Catalyst industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the catalyst market growth of industry companies

We can help! Our analysts can customize this catalyst market research report to meet your requirements.