NDT in Oil And Gas Market Size 2024-2028

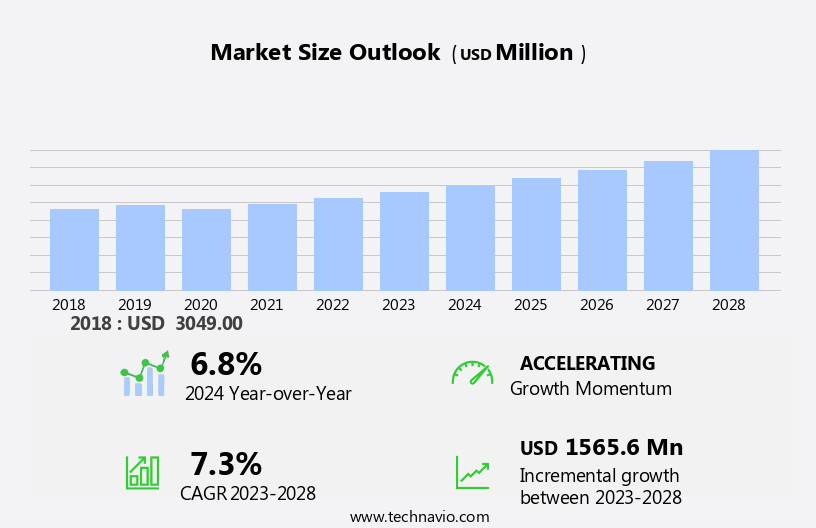

The non-destructive testing in oil and gas market size is forecast to increase by USD 1.57 billion at a CAGR of 7.3% between 2023 and 2028. The non-destructive testing (NDT) market in the Oil and Gas industry is experiencing significant growth due to the increasing demand for efficient and accurate inspection methods. Remote inspection technologies, such as drone inspection and portable NDT devices, are gaining popularity for their ability to inspect hard-to-reach areas and reduce the need for costly shutdowns. Volumetric inspection techniques, including ultrasonic testing and radiographic testing, are essential for detecting internal and external corrosion in pipelines and storage tanks. The integration of artificial intelligence (AI) and machine learning (ML) in NDT devices is revolutionizing the industry by enabling faster and more accurate inspections.

What will be the Size of the Market During the Forecast Period?

The Non-Destructive Testing market plays a vital role in ensuring the safety and reliability of critical infrastructure in various industries, including oil and gas. NDT is a technique used to evaluate the material integrity of components without causing damage. This method is essential in detecting both internal and surface defects, ensuring the continued safe operation of equipment. Two primary NDT processes are widely used in the oil and gas industry: Ultrasonic Testing (UT) and Radiographic Testing (RT). UT employs high-frequency sound waves to inspect the internal structure of materials, making it suitable for detecting internal corrosion, cracks, and other defects. RT, on the other hand, uses radiation to produce images of the internal structure of components, revealing defects that may not be visible through other methods. Advanced NDT processes, such as Industrial CT scanners and Automated Crawlers, are increasingly being adopted to enhance the efficiency and accuracy of inspections. These technologies provide detailed, three-dimensional images of components, allowing for more precise defect detection and analysis. NDT is not limited to the oil and gas industry. It is also extensively used in the aerospace sector and defense industry for fault detection and material integrity assessment. Robotics and automated crawlers are increasingly being integrated into NDT processes to improve inspection speed, accuracy, and safety.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Method

- Traditional methods

- Advanced methods

- Type

- Services

- Equipment

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- India

- Japan

- Middle East and Africa

- South America

- North America

By Method Insights

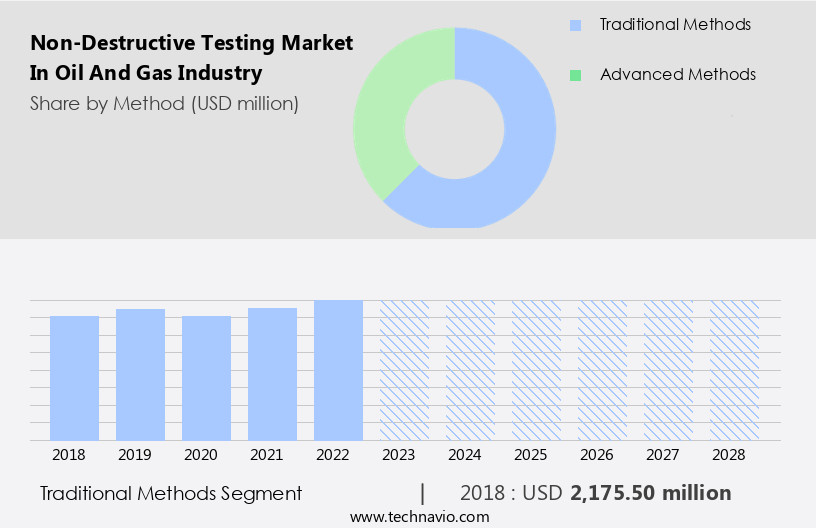

The traditional methods segment is estimated to witness significant growth during the forecast period. The Non-Destructive Testing (NDT) market plays a significant role in ensuring the safety and integrity of infrastructure in the oil and gas industry. This market encompasses various traditional testing methods, each offering unique capabilities for detecting defects and maintaining asset reliability. Among these methods are ultrasonic testing (UT), liquid penetrant testing (PT), magnetic particle testing (MT), radiographic testing (RT), and eddy current testing (ET). Ultrasonic testing, for instance, uses high-frequency sound waves to inspect assets. When these sound waves encounter an irregularity within the material, a portion of the sound is reflected, signaling a potential defect. This method is akin to using a sonar fish finder but for detecting flaws in pipelines, pressure systems, steam turbines, gas turbines, and other critical components.

Similarly, liquid penetrant testing involves applying a penetrating liquid to the surface of the component, which then seeps into any surface-breaking cracks or defects. Once the excess liquid is removed, a developer is applied, revealing the defects through the appearance of a visible indicator. Magnetic particle testing, on the other hand, uses magnetic fields to detect surface and near-surface defects. When a magnetic field is applied to the component, any defects cause a disturbance in the magnetic field, which is then visualized using iron filings or other magnetic particles. These testing methods are essential for the oil and gas industry, as they enable early detection and prevention of potential failures in pipelines, pressure systems, steam turbines, gas turbines, and nuclear power plants.

Get a glance at the market share of various segments Request Free Sample

The traditional methods segment accounted for USD 2.18 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

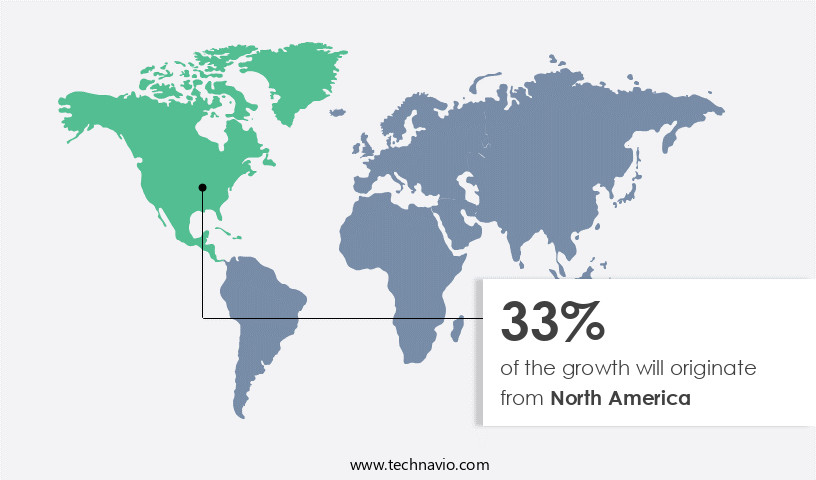

North America is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American oil and gas industry relies heavily on Non-Destructive Testing to maintain the integrity and safety of critical infrastructure. With significant shale and tight reserves in the US, such as the 3.04 billion barrels of technically recoverable shale oil resources reported by the US Energy Information Administration (US EIA) in 2023, the demand for advanced NDT techniques is on the rise. These techniques include ultrasonic testing using ultrasonic equipment and advanced NDT processes like industrial CT scanners. The oil and gas industry's extensive use of NDT is also driven by ongoing offshore exploration projects. Other sectors, such as the aerospace and defense industries, also utilize NDT for fault detection. Radiographic testing is another NDT method commonly employed for critical component inspections. By implementing these testing methods, companies can ensure the reliability and safety of their operations while minimizing downtime and maintenance costs.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increased demand for NDT in oil and gas transportation is the key driver of the market. The oil and gas industry's expansion and development of intricate pipeline networks have led to a notable rise in the demand for Non-Destructive Testing (NDT). This trend is fueled by major projects and collaborations aimed at improving the efficiency and safety of oil and gas transportation. For example, in May 2023, the South Asia Gas Enterprise (SAGE), a consortium focusing on deepwater pipeline projects, requested the assistance of the Ministry of Petroleum and other stakeholders to construct a 2,000-kilometer undersea gas pipeline from the Gulf to India.

Further, component testing is a crucial aspect of NDT, ensuring the detection of internal defects and maintaining the structural soundness of pipelines. Traditional NDT methods, such as ultrasonic testing and radiography, have been widely used in the industry. However, advancements in technology, including robotics and automated crawlers, are revolutionizing NDT processes. These innovative techniques offer increased accuracy, efficiency, and safety, making them indispensable in power generation and shale oil applications. As the oil and gas sector continues to evolve, NDT will remain a vital tool in ensuring the reliability and longevity of infrastructure.

Market Trends

Integration of AI and ML in NDT devices is the upcoming trend in the market. The oil and gas industry's Non-Destructive Testing (NDT) market is undergoing significant transformation with the adoption of advanced technologies such as remote inspection techniques, portable NDT devices, drone inspection, and volumetric inspection. These innovations aim to improve inspection accuracy, efficiency, and predictive capabilities in maintaining critical infrastructure. Automation plays a pivotal role in enhancing NDT processes. Automated systems enable continuous monitoring and real-time data analysis, ensuring potential issues are identified and addressed promptly. They also facilitate the handling of large data volumes, essential for comprehensive inspections and maintenance activities. Artificial Intelligence (AI) is another game-changer in NDT. By analyzing extensive data, AI can identify patterns and predict potential failures before they become major problems.

This proactive approach to maintenance significantly reduces downtime and operational costs. Training programs are essential to ensure the effective implementation and utilization of these advanced NDT technologies. Providing continuous education and upskilling opportunities for industry professionals is crucial to staying competitive and maintaining the highest standards in the oil and gas sector. Beyond the oil and gas industry, these NDT advancements are also gaining traction in the power industry, where the prevention of internal and external corrosion is critical. By adopting these cutting-edge technologies, businesses can ensure the safety, reliability, and longevity of their infrastructure.

Market Challenge

The high initial cost of NDT is a key challenge affecting the market growth. The oil and gas industry relies heavily on Non-Destructive Inspection (NDI), Non-Destructive Examination (NDE), and Non-Destructive Evaluation (NDE) techniques to identify surface defects in their infrastructure. Advanced NDT equipment is crucial for ensuring the safety and integrity of assets, particularly in the aerospace and construction sectors. However, the high cost of acquiring such technology poses a significant challenge, especially for smaller companies and those with limited budgets.

This substantial investment can deter companies from adopting this critical technology, despite its importance in maintaining the safety and efficiency of their operations. To address this challenge, virtual training programs and rental options for NDT equipment have emerged as viable alternatives for companies seeking to minimize their upfront costs while still benefiting from the advanced capabilities of NDT technology.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Acuren Corp. - The company offers NDT services in the oil and gas industry which includes Liquid Penetrant Testing, Ground Penetrating Radar, and others.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amerapex Corp.

- Applus Services Technologies SL

- Ashtead technology

- Baker Hughes Co.

- Bureau Veritas

- Dakota Ultrasonics Corp.

- Dexon Technology PLC

- Eddyfi Technologies

- Evident Corp

- FORCE Technology

- Intertek Group Plc

- Magnaflux

- Mistras Group Inc.

- Phoenix Inspection Systems Ltd

- SGS SA

- Sonatest Ltd

- Team Inc

- TUV Rheinland AG

- Vibrant NDT Services

- Videray Technologies Inc.

- Zetec Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The non-destructive testing market in the oil and gas industry plays a crucial role in ensuring material integrity and detecting defects without causing damage to the assets. Ultrasonic testing, using ultrasonic equipment, is a widely used NDT process for fault detection in this sector. Advanced NDT processes, such as radiographic testing using industrial CT scanners, are also employed to identify internal defects. The aerospace sector and defense industry are significant consumers of NDT, utilizing robotics and automated crawlers for component testing. Traditional NDT methods, including radiographic testing and liquid penetrant inspection, continue to be used alongside modern techniques. Power generation, including shale oil and gas, relies on NDT for pipeline inspection, pressure system testing, and volumetric inspection to maintain the integrity of infrastructure and prevent system failures.

Further, NDT is also essential in the power industry for inspecting steam turbines, gas turbines, and nuclear power plants, ensuring the safety and efficiency of these critical systems. NDT equipment, including portable devices and drone inspection, offers flexibility and cost savings. Virtual training and remote inspection technologies enable efficient and effective NDT practices. Training programs and continuous learning are essential for NDT professionals to stay updated with the latest techniques and technologies. NDT is vital in various industries, including construction, automotive and transportation, and healthcare, for flaw detection and maintaining the safety and reliability of assets. NDT techniques are employed to detect internal corrosion, external corrosion, and other defects in pressure systems, fuel rods, instrumentation, probes, software, and various components.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.3% |

|

Market growth 2024-2028 |

USD 1.57 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.8 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 33% |

|

Key countries |

US, China, Saudi Arabia, India, Canada, UK, UAE, Germany, Russia, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Acuren Corp., Amerapex Corp., Applus Services Technologies SL, Ashtead technology, Baker Hughes Co., Bureau Veritas, Dakota Ultrasonics Corp., Dexon Technology PLC, Eddyfi Technologies, Evident Corp, FORCE Technology, Intertek Group Plc, Magnaflux, Mistras Group Inc., Phoenix Inspection Systems Ltd, SGS SA, Sonatest Ltd, Team Inc, TUV Rheinland AG, Vibrant NDT Services, Videray Technologies Inc., and Zetec Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch