Nonstick Cookware Market Size 2024-2028

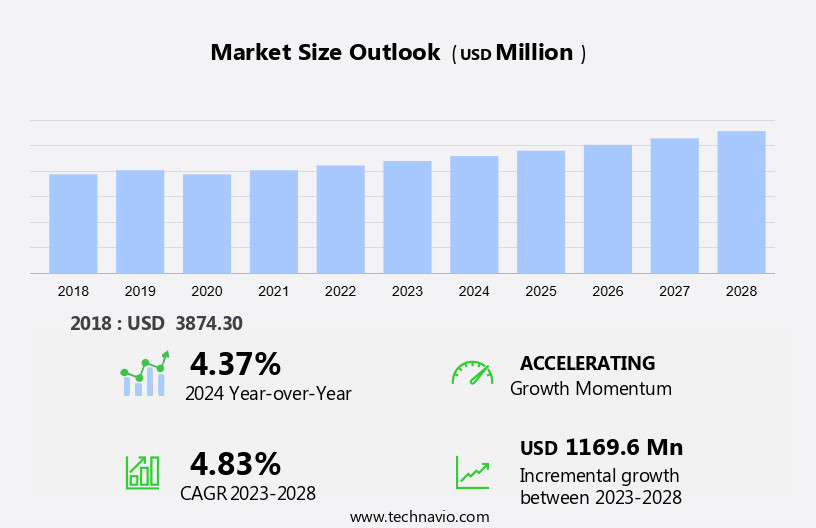

The nonstick cookware market size is forecast to increase by USD 1.17 billion at a CAGR of 4.83% between 2023 and 2028.

- Nonstick cookware continues to gain popularity in the market due to the convenience and health benefits it offers for preparing fresh food. Key materials used in nonstick cookware production include aluminum, steel, tin, copper, and stainless steel, with catalysts such as diamonds added to enhance the nonstick coating. The market is witnessing a rise in online sales, driven by the growth of e-commerce and online grocery. However, logistics challenges and volatility in raw material prices pose significant challenges to market growth. Consumers increasingly prefer nonstick cookware for its ability to promote healthy cooking practices by reducing the need for oil and butter. The market is expected to grow steadily, with trends such as the development of innovative nonstick coatings and the increasing demand for sustainable and eco-friendly cookware.

What will be the Size of the Nonstick Cookware Market During the Forecast Period?

- The market encompasses a wide range of products used in both domestic and commercial settings, including households, restaurants, hotels, and commercial kitchens. This market has experienced significant growth due to increasing health consciousness among consumers, leading to a shift away from cooking with excessive oil and fat. Modern cooking techniques, such as air frying and sous vide, further expand the application of nonstick cookware. Nonstick coatings, primarily made of polytetrafluoroethylene (PTFE), have long been the go-to choice for this market. However, safety concerns, including potential health risks from toxic fumes released during overheating, have driven the search for safer alternatives.

- Ceramic and silicone coatings have emerged as popular options, offering durability and cooking performance while mitigating safety concerns. Stainless steel, cast iron, and copper cookware have also gained traction In the market due to their environmental credentials and the perception of being healthier alternatives. Despite these trends, it remains a staple due to its convenience and versatility, with nonstick pans and bakeware continuing to dominate the market. Overall, the market is poised for continued growth as consumers and businesses seek efficient, healthy, and sustainable cooking solutions.

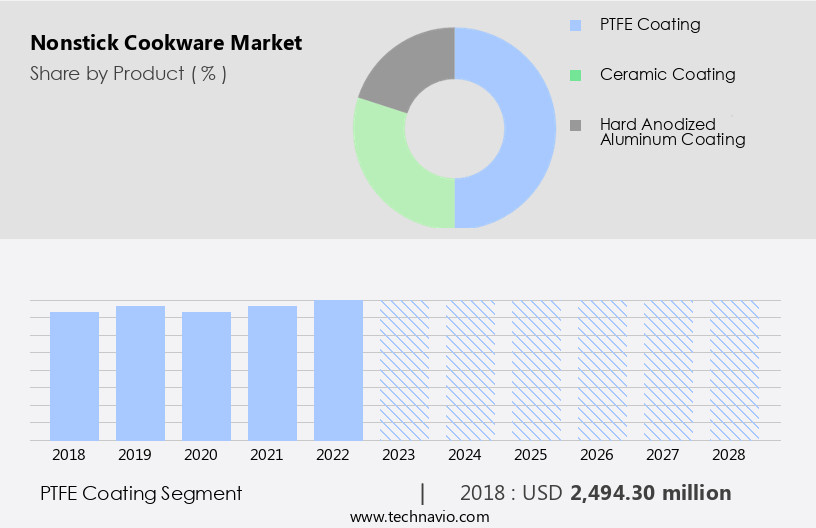

How is this Nonstick Cookware Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- PTFE coating

- Ceramic coating

- Hard anodized aluminum coating

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

By Product Insights

- The PTFE coating segment is estimated to witness significant growth during the forecast period.

The market encompasses various types of cookware designed for health-conscious consumers seeking to minimize oil and fat usage In their cooking practices. Modern cooking techniques and the increasing popularity of nonstick pans in households, restaurants, hotels, and commercial kitchens have driven market growth. However, concerns over health risks associated with PTFE coatings, including toxic fumes and potential environmental concerns, have led to the exploration of safer alternatives. Ceramic and silicone coatings, stainless steel, cast iron, and copper are increasingly popular options. These alternatives offer comparable durability and cooking performance to PTFE-coated cookware. They comes in various forms, including pans, bakeware, and baking trays, catering to diverse cooking needs.

The market includes manufacturers focusing on product innovation, such as ergonomic handles, heat-resistant materials, and multi-functional cookware. The distribution channels include physical stores, specialty kitchenware shops, departmental stores, and online platforms. The market's future growth is influenced by factors like increasing internet penetration, brand reputation, and the availability of sustainable, PTFE-free coatings. Consumers are increasingly adopting healthier cooking practices, such as reduced fat intake, and safer nonstick coatings, including diamond-infused coatings. Sustainability remains a key focus In the kitchenware industry, with an emphasis on eco-friendly materials and manufacturing processes.

Get a glance at the Industry report of share of various segments Request Free Sample

The PTFE coating segment was valued at USD 2.49 billion in 2018 and showed a gradual increase during the forecast period.

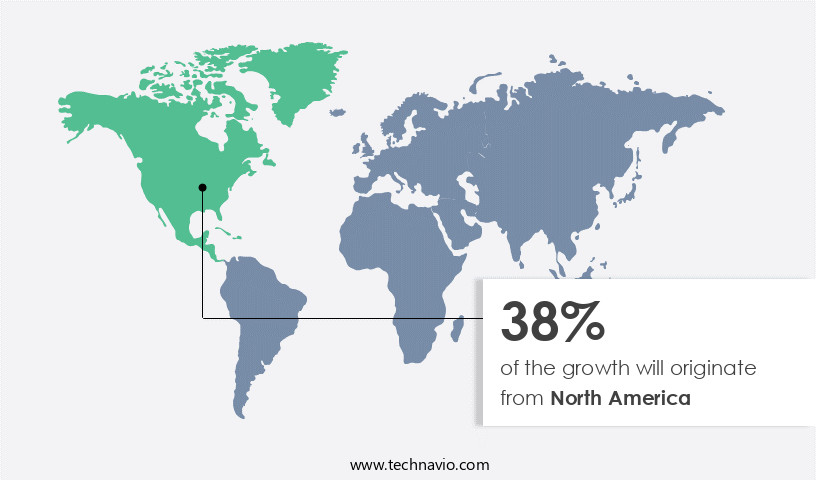

Regional Analysis

- North America is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market is experiencing moderate growth, driven by the increasing number of households and the shift towards healthier and more convenient cooking practices. Consumers are increasingly prioritizing fresh food over ready-made options, leading to a rise in demand for nonstick cookware. This trend is fueled by the widespread availability of information and groceries through the internet. THey offer several advantages, including reduced use of oil and fat during cooking and ease of cleaning. Modern cooking techniques, such as high heat cooking and commercial kitchen practices, also require them for optimal performance. Health concerns, including the release of toxic fumes and potential health risks associated with traditional nonstick coatings like Polytetrafluoroethylene (PTFE), have led to the adoption of safer alternatives.

Ceramic and silicone coatings, stainless steel, cast iron, and copper are gaining popularity as safer and more sustainable options. Manufacturers are focusing on product innovation, including ergonomic handles, heat-resistant materials, and multi-functional cookware. Distribution channels, including physical stores, specialty kitchenware shops, departmental stores, and online platforms, are expanding to meet the growing demand. The market is dominated by pans, bakeware, frying pans, sauté pans, cake pans, muffin tins, cookie sheets, and baking trays.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Nonstick Cookware Industry?

Increasing awareness about healthy and convenient cooking practices is the key driver of the market.

- Nonstick cookware has gained popularity globally due to its health benefits and convenience. Health-conscious consumers prefer nonstick cookware for oil-free cooking, which is essential for maintaining a balanced diet and reducing health risks associated with high cholesterol levels. Unlike traditional cookware such as stainless steel and cast iron, nonstick cookware offers nonstick properties, enabling food to be cooked with minimal oil. This not only preserves the taste of the food but also reduces the need for excessive use of oil and fat. Moreover, nonstick cookware is easy to clean and scratch-resistant, making it a preferred choice for both domestic and commercial settings, including households, restaurants, hotels, and commercial kitchens.

- Modern cooking techniques require high heat, and nonstick cookware can withstand such temperatures without compromising the safety or the environment. The manufacturers are focusing on product innovation, introducing safer alternatives to Polytetrafluoroethylene (PTFE) coatings. Ceramic and silicone coatings are becoming increasingly popular due to their sustainability and health benefits. These coatings offer the same nonstick properties as PTFE but are free from toxic fumes and other health risks. The kitchenware industry is witnessing a shift towards ergonomic handles, heat-resistant materials, and multi-functional cookware. Nonstick pans, bakeware, frying pans, sauté pans, cake pans, muffin tins, cookie sheets, and baking trays are some of the popular products. The dominant segment of the market includes physical stores, specialty kitchenware shops, and departmental stores, with an increasing presence on e-commerce platforms and internet penetration.

What are the market trends shaping the Nonstick Cookware Industry?

Increasing online sales of nonstick cookware is the upcoming market trend.

- Nonstick cookware has gained popularity among health-conscious consumers due to its ability to reduce the use of oil and fat in cooking practices. Modern cooking techniques have led to an increased demand for nonstick cookware in households, restaurants, hotels, and commercial kitchens. However, concerns over health risks such as toxic fumes released during high heat use and environmental concerns have led consumers to seek safer alternatives. Ceramic and silicone coatings are increasingly being used as safer alternatives to Polytetrafluoroethylene (PTFE) in nonstick cookware. Brands offer PTFE-free coatings made from plant-based materials, promoting healthier cooking practices and reduced fat intake.

- The market includes various products such as pans, bakeware, frying pans, sauté pans, cake pans, muffin tins, cookie sheets, and baking trays. The dominant segment is pans, which account for the largest share of the market. The availability has increased significantly due to the growing internet penetration. Consumers can now access premium and global brands through physical stores, specialty kitchenware shops, departmental stores, and online distribution channels on e-commerce platforms. The online distribution channel offers convenience, competitive pricing, and easy access to product information, making it a preferred choice for consumers. The industry is focused on product innovation, with ergonomic handles, heat-resistant materials, and multi-functional cookware being popular trends.

What challenges does the Nonstick Cookware Industry face during its growth?

Volatility in raw material prices is a key challenge affecting the industry growth.

- Nonstick cookware is a popular choice for both households and commercial settings due to its health-conscious benefits, which include the use of less oil and fat in cooking practices. Modern cooking techniques have increased the demand in various applications, including frying pans, sauté pans, cake pans, muffin tins, cookie sheets, and baking trays. The dominant segment of the market includes pans and bakeware. Health risks associated with nonstick cookware, such as toxic fumes released at high heat and potential leaching of chemicals, have led consumers to seek safer alternatives. Ceramic and silicone coatings have gained popularity as safer alternatives to polytetrafluoroethylene (PTFE) coatings.

- Other materials, such as stainless steel, cast iron, and copper, are also used in nonstick cookware production for their durability and cooking performance. The kitchenware industry has responded to consumer concerns by introducing product innovations, such as ergonomic handles, heat resistant materials, and multi-functional cookware. The distribution channels for nonstick cookware include physical stores, specialty kitchenware shops, departmental stores, and online distribution channels on e-commerce platforms. The increasing internet penetration has led to a significant shift towards online sales. Nonstick cookware manufacturers prioritize brand reputation and sustainability In their product offerings. For instance, some brands, such as GreenPan, offer PTFE-free coatings made from plant-based materials.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, nonstick cookware market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Berndes Cookware USA

- Bhalaria Metal Craft Pvt. Ltd.

- Bradshaw Home Inc.

- Cuisinart

- GreenPan

- Hawkins Cookers Ltd.

- Le Creuset

- Maspion Group

- Meyer Corp.

- Neoflam

- Newell Brands Inc.

- Nirlep Appliances Pvt. Ltd.

- Pigeon Corp.

- SCANPAN USA Inc.

- SEB Developpement SA

- Swiss Made Brands USA Inc.

- The Cookware Co.

- TTK Prestige Ltd.

- Usha Shriram Enterprises Pvt. Ltd.

- Vinod Cookware

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market caters to the needs of both households and commercial settings, including restaurants and hotels, as consumers increasingly prioritize health-conscious cooking practices. Traditional cooking methods that rely heavily on oil and fat are being replaced by modern techniques that minimize the use of these substances. This shift in cooking practices has led to a significant increase in demand for nonstick cookware. Nonstick cookware is particularly popular in households due to its convenience and ease of use. It allows for minimal oil usage during cooking, resulting in healthier meals. In commercial settings, nonstick cookware is valued for its ability to save time and resources, as well as its durability and cooking performance.

Moreover, the market encompasses a wide range of products, including pans, bakeware, and other kitchen essentials. Frying pans, sauté pans, cake pans, muffin tins, cookie sheets, and baking trays are among the most common types of nonstick cookware. The dominant segment of the market is accounted for by physical stores, including specialty kitchenware shops and departmental stores. However, online distribution channels, particularly e-commerce platforms, is experiencing rapid growth due to increasing internet penetration. Despite the benefits of nonstick cookware, there are concerns regarding its safety and environmental impact. Polytetrafluoroethylene (PTFE) coatings, which are commonly used in nonstick cookware, have been linked to health risks, including the release of toxic fumes when overheated.

Additionally, some studies have raised concerns about the potential release of microplastics from nonstick coatings into food. In response to these concerns, there is a growing trend towards safer alternatives, such as ceramic and silicone coatings. These coatings offer similar nonstick properties without the health and environmental risks associated with PTFE. Stainless steel, cast iron, and copper are also popular alternatives for those who prefer traditional cooking materials. Manufacturers In the nonstick cookware industry are responding to these trends by innovating new products. Ergonomic handles, heat resistant materials, and multi-functional cookware are among the features that are becoming increasingly popular.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

142 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.83% |

|

Market Growth 2024-2028 |

USD 1.17 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.37 |

|

Key countries |

US, China, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.