Off-Road Vehicle Braking System Market Size 2024-2028

The off-road vehicle braking system market size is forecast to increase by USD 89.3 million at a CAGR of 3.27% between 2023 and 2028.

- Off-road vehicle braking systems have witnessed significant advancements in recent years, driven by the growing adoption of disc brakes in this vehicle segment. Disc brakes offer superior braking performance and are increasingly being used in ATVs and UTVs to enhance road safety and control. Another trend influencing the market is the development of ABS-equipped off-road vehicles, which provide improved traction and stability during harsh terrain conditions. However, the design complexities associated with sophisticated braking systems pose challenges for manufacturers, requiring significant investment in research and development. These factors, along with the increasing demand for high-performance off-road vehicles, are expected to drive the growth of the market.

What will be the Size of the Off-Road Vehicle Braking System Market During the Forecast Period?

- The market encompasses the production and supply of braking systems for various off-highway vehicles, including those used in agriculture, construction, mining, forestry, and recreational applications. Two primary types of off-road vehicles are off-road motorcycles and off-road vehicles, which may employ two-wheel or four-wheel brake systems. Braking systems for these vehicles can be categorized as hydraulic or pneumatic, with disc brakes and drum brakes being common choices.

- Regulatory standards play a significant role in the market, ensuring safety and efficiency. Innovative braking solutions, such as electronic systems and the use of lightweight and durable materials, are driving market growth. Applications span beyond industrial uses, with off-road vehicles utilized for military applications, off-road sports, and adventure activities. Overall, the market is a dynamic and evolving sector, driven by technological advancements and the diverse needs of its various end-users.

How is this Off-Road Vehicle Braking System Industry segmented and which is the largest segment?

The off-road vehicle braking system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- SxS

- ATV

- Off-road motorcycle

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- Middle East and Africa

- South America

- North America

By Application Insights

- The SxS segment is estimated to witness significant growth during the forecast period.

Off-road vehicles, such as Side-by-Side (SxS) models, are four-wheel drive machines designed for rugged terrain conditions. Seating 2-6 people, SxS vehicles offer a short travel suspension, high-power motors, multiple passenger seats, and cargo space. Their lightweight design, high suspension, and short wheelbase provide superior handling and stability, making them popular for recreational activities and utility applications in agriculture, construction, mining, forestry, military, and other industries. SxS vehicles are equipped with deep-treaded pneumatic tires, bench or bucket seating, a steering wheel, and foot pedals for braking and acceleration. Advanced brake systems, including anti-lock braking systems (ABS), electronic stability control (ESC), and traction control systems, ensure safety and efficiency.

Innovative braking solutions, such as electronic braking systems and lightweight, durable materials, enhance stopping power and maneuverability on challenging terrains. Operators prioritize vehicle safety standards and environmental sustainability, leading to the adoption of cutting-edge brake systems. Rental equipment fleets and off-road recreational vehicles also incorporate telematics and connectivity solutions to improve customer preferences and satisfaction. Electronic systems, including disc brakes and drum brakes, are used in heavy commercial vehicles (HCV), light commercial vehicles (LCV), passenger cars, two-wheelers, off-road motorcycles, and off-road vehicles. Braking systems play a crucial role in ensuring safety, control, and operator confidence on diverse terrains.

Get a glance at the market report of share of various segments Request Free Sample

The SxS segment was valued at USD 222.70 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

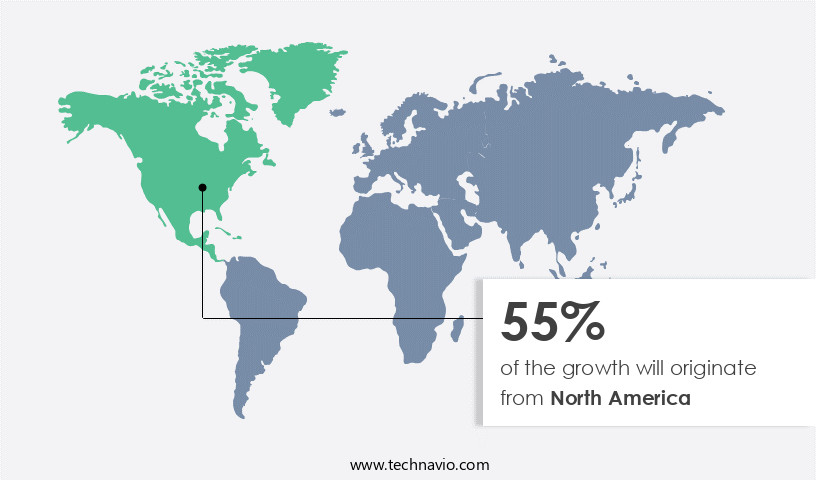

- North America is estimated to contribute 55% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market is driven by the significant sales of off-road vehicles, including ATVs, SxS, and off-road motorcycles, in countries like the US and Canada. The region's agriculture, construction, mining, forestry, military, and recreational sectors heavily utilize these vehicles, leading to increased demand for advanced braking systems. In the US, SxS vehicles dominate the market due to their widespread use in farming, hunting, and military applications. The region's off-road vehicle market is characterized by a focus on safety, efficiency, control, and operator comfort.

Cutting-edge braking solutions, such as electronic stability control, traction control systems, and anti-lock braking systems, are increasingly preferred for their ability to enhance vehicle maneuverability and stopping power on challenging terrains. Additionally, the integration of telematics, connectivity solutions, and customer preferences into marketing strategies is driving customer satisfaction and market growth. The use of lightweight and durable materials in braking systems ensures both safety and environmental sustainability.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Off-Road Vehicle Braking System Industry?

Growing adoption of disc brakes in off-road vehicles is the key driver of the market.

- Off-road vehicles, including those used in agriculture, construction, mining, forestry, military applications, and recreational purposes, predominantly utilize disc brakes due to their superior stopping power and cooling capabilities. Disc brakes, located outside the wheel, allow for efficient heat dissipation, preserving the durability of the wheels. In contrast, drum brakes, which house the brake shoes and drum inside the wheel, generate excessive friction and wear down the wheels over time. Safety is a paramount concern in off-road vehicle industries. Advanced brake systems, such as anti-lock braking systems (ABS), electronic stability control (ESC), and traction control systems, are increasingly adopted to enhance vehicle control and prevent skidding on challenging terrains.

- Operators demand efficient and reliable braking systems to ensure optimal maneuverability and wheel control during wheel lock-up and slip situations. Customer preferences and marketing strategies influence the adoption of innovative braking solutions, such as electronic braking systems and lightweight materials. Telematics and connectivity solutions enable real-time monitoring and predictive maintenance of braking systems, ensuring customer satisfaction and reducing operational costs. Brake systems for heavy commercial vehicles (HCV), light commercial vehicles (LCV), passenger cars, two-wheelers, off-road motorcycles, and off-road vehicles come in various configurations for specific applications. Front and rear wheel configurations cater to different stopping power requirements and challenging terrains, such as highway, mountain, and all-terrain off-road vehicles.

What are the market trends shaping the Off-Road Vehicle Braking System Industry?

The development of ABS-equipped ATVs is the upcoming market trend.

- Off-highway vehicles, including those used in agriculture, construction, mining, forestry, military applications, and recreational purposes, rely on strong brake systems for safety, efficiency, and control. While electronic systems such as anti-lock braking systems (ABS), electronic stability control, and traction control systems have become standard in on-road vehicles, their adoption in off-road vehicles has been limited. Off-road motorcycles were the only vehicles in this category to adopt ABS until recently. However, customer preferences for high-performance all-terrain vehicles (ATVs) in developed regions like North America and Europe are driving the adoption of safety-critical functions. For instance, BRP, a leading manufacturer, introduced the first ATV equipped with an ABS in 2017.

- They also added this feature to their 2018 Can-Am Outlander and Renegade models. The use of innovative braking solutions, such as electronic braking systems and lightweight materials, is essential to improve stopping power and maneuverability on challenging terrains. Disc brakes and drum brakes are commonly used in off-road vehicles, with HCV, LCV, passenger cars, two-wheelers, and off-road motorcycles all utilizing different brake configurations. Ensuring vehicle safety standards and customer satisfaction are crucial In the off-road vehicle market. Connectivity solutions, such as telematics, are also gaining popularity to monitor vehicle performance and maintenance.

What challenges does the Off-Road Vehicle Braking System Industry face during its growth?

Design complexities associated with sophisticated braking systems is a key challenge affecting the industry growth.

- Off-highway vehicles, including those used in agriculture, construction, mining, forestry, military, and recreational purposes, require strong braking systems to ensure safety, efficiency, and control for operators. The global market for off-road vehicle braking systems is witnessing significant growth due to the increasing demand for innovative braking solutions that cater to the unique challenges of off-road terrains. The use of advanced electronic systems, such as anti-lock braking systems (ABS), electronic stability control, and traction control systems, is becoming increasingly common in off-road vehicles. These systems help prevent skidding, improve maneuverability, and enhance stopping power on challenging terrains. ABS, in particular, is gaining popularity due to its ability to prevent wheel lock-up and wheel slip, which are common issues in off-road vehicles.

- However, the installation of ABS systems in off-road vehicles poses certain challenges due to the complexities involved in parts selection and installation. The design of the control unit for these systems must take into account different scenarios, such as varying terrain conditions. Additionally, the ideal location for installation is crucial to prevent damage to the computer chip in the control unit from excessive vibrations and noise produced by off-road vehicles. Customer preferences and marketing strategies also play a significant role In the growth of the market. Rental equipment fleets and military applications are major consumers of these systems due to their high demand for vehicle safety and operational efficiency.

Exclusive Customer Landscape

The off-road vehicle braking system market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the off-road vehicle braking system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, off-road vehicle braking system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AISIN CORP.

- BorgWarner Inc.

- Brembo Spa

- CentroMotion

- Continental AG

- EBC Brakes

- Hitachi Ltd.

- Industrias Galfer SA

- Robert Bosch GmbH

- Tenneco Inc.

- WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORP.

- Wilwood Engineering Inc.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Off-highway vehicles, also known as off-road vehicles, are utilized in various industries such as agriculture, construction, mining, forestry, and military applications. These vehicles require strong and efficient braking systems to ensure safety, control, and optimal performance on challenging terrains. The market encompasses a wide range of applications, including agriculture, construction, mining, forestry, military, and recreational vehicles. The demand for advanced braking systems is driven by the need for increased safety, efficiency, and operator comfort. In the agriculture industry, off-road vehicles are used for various tasks such as cultivation, harvesting, and transportation. Braking systems play a crucial role in ensuring the safety of operators and workers In the field.

Efficient braking systems help reduce fuel consumption and downtime, making them a valuable investment for farmers and agricultural businesses. Construction sites present unique challenges for off-road vehicle braking systems. Heavy construction vehicles, such as excavators and bulldozers, require powerful braking systems to stop quickly and effectively. Braking systems that offer excellent control and maneuverability are essential for operators working in confined spaces or navigating steep inclines. Mining operations require off-road vehicles to transport heavy loads and navigate rugged terrain. Braking systems that can withstand harsh conditions and provide reliable stopping power are essential for safety and productivity. Mining companies invest in cutting-edge braking systems to ensure the safety of their workers and reduce downtime.

In the forestry industry, off-road vehicles are used for logging, forest management, and firefighting. Braking systems that can handle the weight of heavy loads and provide excellent traction control are essential for safe and efficient operation. The military uses off-road vehicles for various applications, including reconnaissance, transportation, and rescue operations. Braking systems that offer excellent control, durability, and reliability are essential for military applications, where safety and performance are critical. Off-road recreational vehicles, such as all-terrain vehicles (ATVs) and off-road motorcycles, also require efficient braking systems. These vehicles are used for off-road sports and adventure activities, and braking systems that offer excellent stopping power and maneuverability are essential for safety and enjoyment.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

151 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.27% |

|

Market Growth 2024-2028 |

USD 89.3 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

3.13 |

|

Key countries |

US, China, Germany, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Off-Road Vehicle Braking System Market Research and Growth Report?

- CAGR of the Off-Road Vehicle Braking System industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the off-road vehicle braking system market growth of industry companies

We can help! Our analysts can customize this off-road vehicle braking system market research report to meet your requirements.