Oil And Gas Refinery Maintenance Services Market Size 2025-2029

The oil and gas refinery maintenance services market size is forecast to increase by USD 965.4 million at a CAGR of 4.5% between 2024 and 2029.

- The market is driven by the surging demand for refined fuel, making it a significant market with immense potential. This demand is fueled by the increasing global population and urbanization, leading to a rise in transportation and industrial activities. Another key trend in the market is the adoption of modular mini refineries, which offer cost-effective and efficient solutions for refining oil and gas. However, the market also faces challenges, including the stringent presence of health, safety, and environment (HSE) regulations. Data security is a growing concern, as digitalization increases the need for robust cybersecurity measures.

- Compliance with these regulations adds to the operational costs and complexity of refinery maintenance services. Companies operating in this market must navigate these challenges while also capitalizing on the opportunities presented by the growing demand for refined fuel and the adoption of modular mini refineries. Effective strategic planning and innovative solutions will be crucial for businesses seeking to thrive in this dynamic market. Technology adoption in this sector is on the rise, with digital twins and advanced safety systems, such as pressure relief valves, explosion protection, and flame arrestors, becoming increasingly common.

What will be the Size of the Oil And Gas Refinery Maintenance Services Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market encompasses a range of essential services to ensure the optimal performance and compliance of refineries. Key areas include inventory management and maintenance scheduling to prevent equipment downtime and reduce costs. Shutdown management, a critical aspect, requires adherence to industry standards and the integration of fluid handling, emissions control, and process equipment. Fugitive emissions and safety culture are paramount, necessitating the implementation of advanced security systems and regulatory compliance. Maintenance contracts often include field service, remote support, and electrical systems maintenance, as well as process automation and reliability engineering. Technological advancements have led to the adoption of innovation in areas like process control, catalyst regeneration, and separation technologies.

Fire protection systems and root cause analysis are crucial for minimizing risks and improving plant optimization. Spare parts management, wastewater treatment, and control panels are integral components of maintenance planning. Value engineering and best practices are essential for maintaining a competitive edge in the market. Regulatory compliance, pressure vessels, and sour water stripping are areas where technical expertise is indispensable. Power distribution and piping systems require ongoing maintenance to ensure efficient energy usage and prevent leaks. Performance-based contracting is a growing trend, as it incentivizes service providers to focus on maximizing plant uptime and minimizing costs. The integration of advanced technologies such as automation, IoT, and predictive analytics can enhance operational efficiency and improve the overall competitiveness of these companies in the market.

How is this Oil And Gas Refinery Maintenance Services Industry segmented?

The oil and gas refinery maintenance services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Small scale refinery

- Medium scale refinery

- Large scale refinery

- Type

- Turnaround

- Maintenance and repair

- Application

- Downstream

- Midstream

- Upstream

- Geography

- North America

- US

- Canada

- Europe

- Germany

- Russia

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

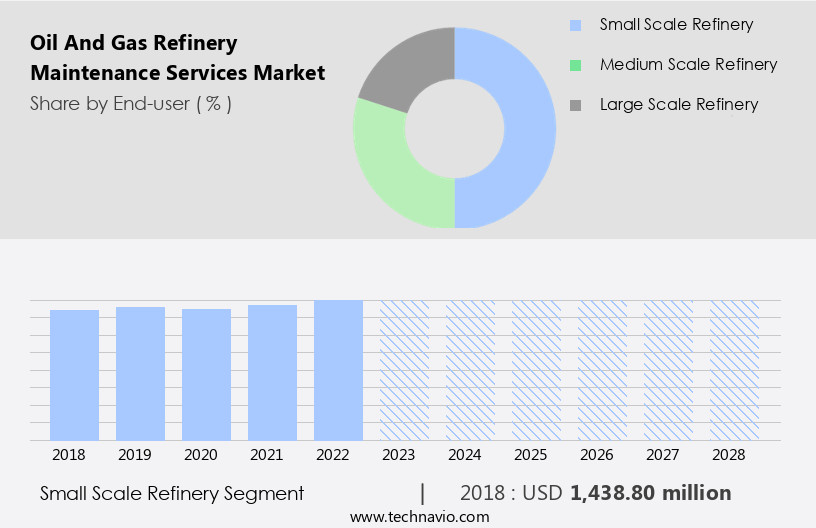

The Small scale refinery segment is estimated to witness significant growth during the forecast period. In the oil and gas industry, refinery maintenance services play a crucial role in ensuring the safe, efficient, and reliable operation of refineries, encompassing various activities from small-scale facilities to larger ones. These services include routine inspections, repairs, replacements, and upgrades for essential equipment and processes. Although small-scale refineries may have lower processing capacities and fewer resources than larger facilities, they share the common goal of operational excellence. Renewable energy and carbon footprint regulations are also influencing the market, as companies seek to minimize their environmental impact and explore alternative energy sources. Small refineries often have closer connections to their local communities, opening possibilities for collaborative initiatives. Workforce training, environmental sustainability efforts, and safety practices are some areas where these partnerships could prove beneficial.

Instrumentation maintenance, work management systems, and environmental compliance are integral components of refinery maintenance. Crude oil processing, corrosion control, and mechanical maintenance are also essential, while digital transformation, project management, and compressor services contribute to process optimization. Data analytics and process control systems facilitate predictive and preventive maintenance, ensuring energy efficiency and asset integrity management. Petroleum products, compliance audits, and downstream operations are other key areas requiring maintenance attention. Maintenance software, non-destructive testing, quality assurance, turnaround services, safety management systems, and corrective maintenance are all essential elements of a comprehensive maintenance strategy.

The Small scale refinery segment was valued at USD 1,477.60 million in 2019 and showed a gradual increase during the forecast period.

The Oil and Gas Refinery Maintenance Services Market is expanding steadily as operators prioritize operational efficiency, safety, and asset longevity. Many refineries are increasingly opting for maintenance outsourcing to specialized service providers, ensuring cost-effective, expert-led upkeep of critical infrastructure. A key focus in this market is comprehensive failure analysis, which identifies root causes of equipment issues and prevents unplanned shutdowns. Additionally, refineries are accelerating innovation adoption, integrating predictive maintenance tools, AI-driven monitoring, and digital inspection technologies to enhance operational reliability. Continuous technological advancement in inspection drones, non-destructive testing, and real-time data analytics is reshaping maintenance strategies.

Modular construction and contractor management help streamline maintenance processes. Artificial intelligence and machine learning enhance predictive analytics, while safety training and process safety ensure a safe working environment. Jet fuel and refinery maintenance are interconnected, with asset management systems playing a vital role in optimizing refining capacity and maintaining quality control. Boiler services, refractory repair, and heat exchanger services are crucial for maintaining refinery infrastructure.

Regional Analysis

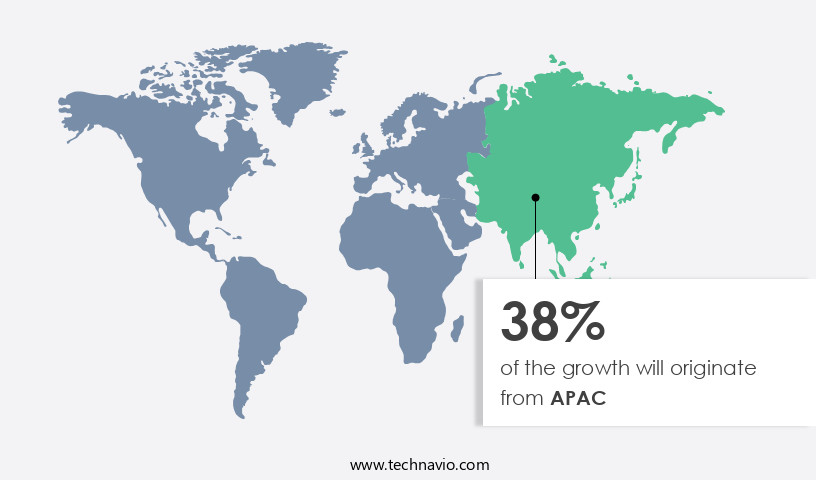

APAC is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the market, APAC holds a significant share due to its substantial refining capacity. Countries like India, China, South Korea, and Japan, which are among the top refining capacity holders worldwide, are heavily reliant on imported crude oil. With increasing crude oil imports, there is a growing trend towards expanding refining capacities in APAC. Over the last nine years, refining capacity in India, China, and South Korea has been consistently increasing. This expansion necessitates regular maintenance and repair services for refineries, making the demand for refinery maintenance services robust in the region. The refinery maintenance services market encompasses various aspects, including Instrumentation Maintenance, Work Management Systems, Environmental Compliance, Asset Management Systems, Refractory Repair, and Refining Capacity, among others.

As the refining capacity in APAC continues to grow, the demand for these services is expected to remain strong. Additionally, the integration of advanced technologies such as Machine Learning, Artificial Intelligence, and Digital Transformation is revolutionizing the refinery maintenance services market, leading to improved efficiency, safety, and sustainability. Despite the challenges posed by Risk Management and Compliance Audits, the market is expected to remain dynamic and innovative. Overall, the market is dynamic, with continuous innovation and regulatory changes driving the need for adaptability and expertise.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Oil And Gas Refinery Maintenance Services market drivers leading to the rise in the adoption of Industry?

- The rising demand for refined fuel serves as the primary driver in the market, underscoring its significance as a key market trend. The market is witnessing significant growth due to the increasing demand for petroleum products in various sectors, particularly transportation and power generation. Developing countries, especially in Asia, are expected to drive this demand, with growing middle-class populations leading to an increase in the number of in-use vehicles. Maintaining the efficiency and safety of refineries is crucial to meet the rising demand for refined products. Project Management plays a vital role in ensuring effective maintenance and turnaround services.

- Compliance Audits and Quality Assurance are necessary for adhering to regulatory requirements and maintaining the highest safety standards. Non-Destructive Testing and Maintenance Software are integral to identifying potential issues before they become major problems. Safety Management Systems are essential for ensuring the safety of refinery personnel and the surrounding community. Turnaround Services are critical for extended maintenance periods, ensuring refineries operate at optimal efficiency upon restart.

What are the Oil And Gas Refinery Maintenance Services market trends shaping the Industry?

- The adoption of modular mini refineries is an emerging market trend. This approach to refining oil is becoming increasingly popular due to its efficiency and cost-effectiveness. The market is witnessing significant growth due to various factors. One key driver is the increasing adoption of modular construction for mini refineries, particularly in developing economies. These mini refineries offer flexibility and cost-effectiveness to oil producers in remote areas, enabling them to process smaller quantities of crude oil more efficiently. Another factor fueling market growth is the emphasis on risk management and industrial inspection to ensure safety and compliance with environmental regulations.

- The integration of advanced technologies such as artificial intelligence (AI) and remote monitoring is transforming maintenance operations, improving predictive maintenance capabilities and reducing unplanned downtime. Environmental sustainability is a growing concern in the refining industry, with a focus on reducing emissions and minimizing waste. Skid-mounted packages and energy-efficient technologies are increasingly being adopted to meet these goals. The market is undergoing significant changes, driven by factors such as the adoption of modular construction, risk management, industrial inspection, contractor management, environmental sustainability, and technological advancements.

How does Oil And Gas Refinery Maintenance Services market face challenges during its growth?

- The implementation of stringent health, safety, and environmental (HSE) regulations poses a significant challenge to the industry's growth trajectory. Companies must adhere to these regulations to ensure the wellbeing of their workforce and the protection of the environment, which can add complexity and cost to operations. However, compliance with HSE regulations is essential for maintaining a responsible business and building trust with stakeholders. Therefore, while the regulations may present challenges, they also serve to promote best practices and drive industry progress. In the oil and gas industry, adherence to Health, Safety, and Environmental (HSE) regulations is paramount.

- These technologies enable preventive maintenance, ensuring equipment operates efficiently and safely. Electrical maintenance and process safety are other critical areas that require continuous attention. Quality Control plays a pivotal role in refining capacity and product quality. Refractory repair is essential to maintain the performance of heat exchangers and other critical equipment. Asset Management Systems facilitate effective planning, scheduling, and execution of maintenance activities. Safety training is an ongoing process to ensure workers are equipped with the necessary knowledge and skills to perform their duties safely. Process safety and jet fuel production are integral parts of refinery operations, requiring constant monitoring and maintenance.

Exclusive Customer Landscape

The oil and gas refinery maintenance services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the oil and gas refinery maintenance services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, oil and gas refinery maintenance services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AECOM - The company specializes in oil and gas refinery maintenance, providing expertise in program management for maintenance and pipeline upkeep. Their services ensure optimal refinery performance and safety.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AECOM

- Aegion Corp.

- APTIM

- Chiyoda Corp.

- CIC Group Inc.

- Envent Corp.

- Fluor Corp.

- Intertek Group Plc

- KBR Inc.

- Matrix Service Co.

- MedEuropa Refining Group

- Pioneer Industrial Corp.

- Saipem S.p.A.

- STI Group

- Turner Industries Group

- Zachry Brands Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Oil And Gas Refinery Maintenance Services Market

- In January 2024, Saudi Aramco, the world's largest oil company, announced a strategic partnership with Siemens Energy to deploy digital solutions for predictive maintenance in its refineries. This collaboration aimed to enhance operational efficiency and reduce downtime, according to a company press release.

- In March 2024, LyondellBasell Industries, a leading refining and petrochemicals company, completed the acquisition of A. Schulman, a global supplier of high-performance plastic compounds. The acquisition expanded LyondellBasell's capabilities in the polymer industry and strengthened its position in the refinery maintenance services market, as stated in the company's SEC filing.

- In May 2024, Shell and BP, two major oil and gas companies, signed a memorandum of understanding to collaborate on hydrogen production and utilization. The partnership focused on developing low-carbon hydrogen production technologies and integrating them into their refineries for maintenance and upgrades, as reported by Reuters.

- In April 2025, Baker Hughes, a leading oilfield services company, announced the successful deployment of its advanced digital maintenance solution, LeanAssets, in a refinery owned by ExxonMobil. The implementation of this technology aimed to optimize maintenance operations, reduce costs, and improve overall plant performance, according to Baker Hughes' press release.

Research Analyst Overview

The market is characterized by its continuous evolution, with dynamic market activities unfolding across various sectors. Refineries require regular upkeep to ensure optimal performance and compliance with environmental regulations. Corrosion control, mechanical maintenance, and pump services are essential for crude oil processing, while process control systems and turbine services are vital for upstream operations. Industrial inspection, risk management, and boiler services play a crucial role in maintaining asset integrity and safety. Modular construction and energy efficiency initiatives are driving innovation, with contractor management systems streamlining operations. Environmental sustainability is a growing concern, with increasing emphasis on compliance audits and digital transformation.

Artificial intelligence and machine learning are revolutionizing maintenance strategies, enabling predictive analytics and process optimization. Heat exchanger services, skid mounted packages, and remote monitoring are integral to refinery operations, ensuring efficient production of petroleum products. Safety management systems, corrective maintenance, and quality assurance are essential for maintaining refinery performance and ensuring regulatory compliance. Compressor services and process safety are critical for downstream operations, with maintenance software and non-destructive testing facilitating preventive measures. Electrical maintenance, safety training, asset management systems, refractory repair, and refining capacity expansion are ongoing priorities for refineries. The market's evolving patterns reflect the industry's commitment to improving efficiency, reducing costs, and enhancing sustainability.

The market's growth is further fueled by advancements in technology, such as automated inspection techniques and predictive maintenance solutions. The market is a dynamic and evolving industry, driven by the increasing demand for petroleum products and the need for efficient, safe, and compliant refinery operations. Compressor Services and Process Optimization are essential components of refinery maintenance, utilizing Data Analytics to improve performance and reduce downtime. These trends are shaping the future of the industry and presenting new opportunities for service providers. Boiler services and heat exchanger maintenance are critical areas of focus to ensure energy efficiency and minimize downtime.

Contractor management is also a significant consideration for refinery operators, with the need for effective communication, coordination, and performance monitoring. These guidelines cover various aspects, such as equipment safety, worker protection, emergency response, waste management, and emissions control. Compliance is crucial to prevent accidents, minimize environmental impact, and ensure the well-being of employees and nearby communities. Refineries, with their intricate processes and hazardous materials, necessitate stringent safety measures during maintenance activities. Maintenance tasks often entail high-risk activities, including confined space entry, hot work (welding, cutting), working at heights, and handling hazardous chemicals. To mitigate risks and optimize refinery maintenance, advanced technologies like Predictive Analytics and Asset Integrity Management are increasingly being adopted.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Oil And Gas Refinery Maintenance Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

216 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2025-2029 |

USD 965.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

US, China, India, Japan, Canada, Germany, Saudi Arabia, South Korea, Russia, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Oil And Gas Refinery Maintenance Services Market Research and Growth Report?

- CAGR of the Oil And Gas Refinery Maintenance Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the oil and gas refinery maintenance services market growth of industry companies

We can help! Our analysts can customize this oil and gas refinery maintenance services market research report to meet your requirements.