Online Auction Market Size 2025-2029

The online auction market size is forecast to increase by USD 3.98 billion, at a CAGR of 14% between 2024 and 2029.

- The market is experiencing significant shifts in consumer preferences, with an increasing trend towards digital platforms over traditional auction houses. This transition is driven by the convenience and accessibility that online auctions offer, allowing participants to bid from anywhere at any time. However, this market is not without challenges. One major concern is the emergence of AI-based online auctions, which raises questions about fairness and transparency. Some buyers and sellers may feel uneasy about the role of artificial intelligence in setting bids and prices.

- Another challenge is the rise in shill bidding during online auctions, which can artificially inflate prices and create an unfair advantage for certain participants. Companies looking to capitalize on the opportunities presented by the market must navigate these challenges carefully, ensuring transparency and fairness in their platforms while providing a user-friendly experience that caters to the evolving needs and preferences of consumers.

What will be the Size of the Online Auction Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities shaping its intricate landscape. Seamlessly integrated auction rules govern the bidding process, allowing for real-time, automated bidding and proxy bidding. Online bidding is accessible via web interfaces and mobile apps, enabling users to participate in auctions from anywhere. Social media integration and user reviews foster community engagement, while data analytics provide valuable insights for sellers and buyers alike. Legal compliance and buyer authentication are essential components, ensuring secure transactions and protecting against fraud. API integration and bidding software streamline processes, enabling third-party integrations for payment gateways, shipping logistics, and inventory management.

Image hosting and affiliate marketing expand reach, while notification systems keep users informed of auction closing times and bid updates. Data encryption and security protocols safeguard sensitive information, and dispute resolution mechanisms address any conflicts that may arise. Rating systems, bid history, and feedback systems promote transparency and trust. Filtering options and search functionality facilitate efficient item categorization and seller registration. Performance monitoring ensures optimal system functionality and user experience. In this ever-changing market, market dynamics continue to unfold, with emerging trends shaping the future of online auctions. From automated bidding and real-time bidding to email marketing and commission rates, the market remains a vibrant and evolving ecosystem.

How is this Online Auction Industry segmented?

The online auction industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Collectibles

- Electronics

- Artistic goods

- Jewelry

- Others

- Platform

- Web-based

- Application-based

- Product Category

- Electronics

- Vehicles

- Collectibles

- Real Estate

- Services

- Auction Format

- Standard auctions

- Reserve price auctions

- No reserve auctions

- Sealed-bid auctions

- Dutch auctions

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

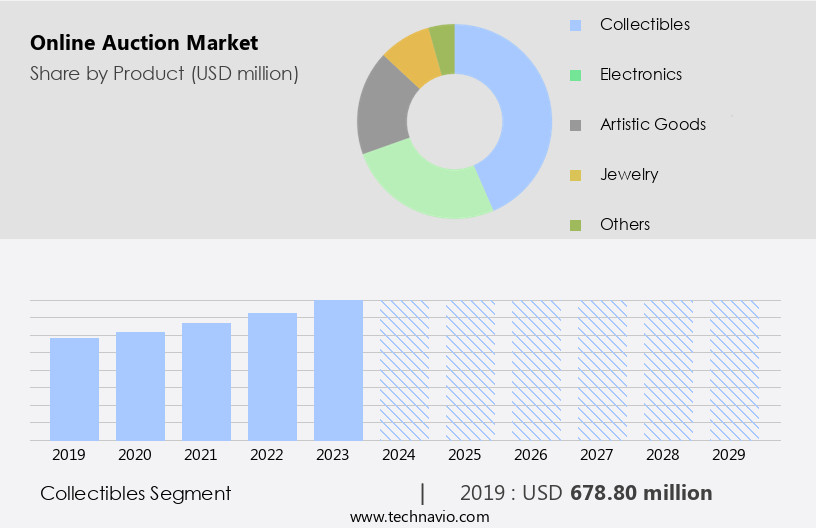

The collectibles segment is estimated to witness significant growth during the forecast period.

In the dynamic world of online auctions, various entities play integral roles in facilitating seamless transactions and enhancing user experience. The auction listing process allows sellers to showcase their collectibles with detailed information, images, and histories, increasing transparency and trust. Payment processing ensures secure and efficient financial transactions, while pay-per-click advertising attracts potential buyers through targeted online campaigns. Terms of service and shipping logistics provide clarity on expectations and delivery details, fostering confidence in buyers. The auction platform serves as the marketplace where bidding takes place, with mobile apps and social media integration expanding reach and accessibility.

User reviews offer valuable insights, data analytics provide market trends, and legal compliance ensures a secure and fair environment. Buyer authentication, API integration, bidding software, image hosting, and affiliate marketing streamline the bidding process. Notification systems keep users informed, while auction closing, auction catalogs, and security protocols ensure a transparent and secure transaction. Fraud prevention, data encryption, proxy bidding, and real-time bidding protect both buyers and sellers. Automated bidding, search functionality, item categorization, seller registration, third-party integrations, web interface, rating system, bidding increments, feedback system, user profiles, and performance monitoring further enhance the online auction experience. Email marketing and reserve prices offer additional tools for sellers to attract potential buyers and manage their inventory effectively.

The Collectibles segment was valued at USD 678.80 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the increasing preference for finding, comparing, and purchasing rare and antique products online among time-strapped and cost-conscious consumers. Key entities driving this market include auction platforms such as eBay Inc., U.S. Auction Online, and Webstore.Com. These companies offer features like payment processing, pay-per-click advertising, inventory management, payment gateway integration, and transaction fees, ensuring a seamless buying experience. The market's evolution is marked by the integration of various advanced technologies.

Performance monitoring is crucial for companies to maintain a competitive edge, ensuring the seamless functioning of these advanced features. The market's growth is further fueled by the increasing popularity of automated bidding, real-time bidding, and filtering options, making the auction process more efficient and convenient for buyers. Overall, the market in North America is poised for continued growth, driven by the increasing number of consumers embracing the convenience and accessibility of online auctions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global online auction market size and forecast projects growth, driven by online auction market trends 2025-2029. B2B online auction platforms leverage AI-driven auction software for seamless bidding. Online auction market growth opportunities 2025 include online auctions for collectibles and B2B auction platforms for businesses, meeting diverse needs. Auction management software optimizes operations, while online auction market competitive analysis highlights key platforms. Sustainable online auction practices align with eco-friendly auction trends. Online auction regulations 2025-2029 shapes online auction demand in North America 2025. Real-time bidding solutions and premium auction market insights boost engagement. Online auctions for luxury goods and customized auction platforms target niches. Online auction market challenges and solutions address security, with direct procurement strategies for auction software and auction pricing strategy optimization enhancing profitability. Data-driven auction market analytics and mobile-friendly auction trends drive innovation.

What are the key market drivers leading to the rise in the adoption of Online Auction Industry?

- The significant shift in consumer preference towards online auctions, as opposed to the conventional auction model, serves as the primary market driver.

- The markets have gained significant traction in recent times due to their numerous benefits for both sellers and buyers. Convenience is a key factor, as bidders can participate from anywhere, at any time, reducing the need for travel and physical presence. Sellers, on the other hand, can directly connect with potential buyers, eliminating intermediaries and reducing logistical costs. Online auction platforms offer marketing automation tools, enabling sellers to effectively promote their auction listings through pay-per-click (PPC) advertising. Payment processing is streamlined through payment gateway integration, ensuring secure and efficient transactions. The terms of service provide transparency and structure, while inventory management tools help sellers manage their listings efficiently.

- Dispute resolution mechanisms are in place to handle any issues that may arise, and customer support is readily available to address any queries or concerns. Transaction fees and auction fees are clearly outlined, ensuring a fair and transparent marketplace. Overall, the markets offer a convenient, efficient, and trustworthy solution for buying and selling goods, making them an attractive alternative to traditional auction methods.

What are the market trends shaping the Online Auction Industry?

- The emergence of AI-based online auctions represents a significant market trend in the digital business landscape. Artificial intelligence technology is increasingly being adopted to streamline and optimize online auction processes, enhancing efficiency and user experience.

- Online auctions have experienced significant growth with the integration of Artificial Intelligence (AI) technology. AI platforms utilize machine learning and algorithms to streamline the bidding process, offering clear and actionable intelligence to participants. This innovation reduces administrative costs by automating various processes, including internal operations, customer service inquiries, equipment packaging, and delivery. Moreover, social media integration, mobile app usage, and user reviews are becoming essential features in online auctions. To ensure legal compliance, buyer authentication, API integration, and bidding software are crucial components. Image hosting and affiliate marketing are other essential elements that enhance the user experience.

- Notification systems keep bidders updated on the latest developments in real-time. Data analytics plays a vital role in understanding market trends and making informed decisions. TradeRev, a KAR Auction Services Inc. Subsidiary, showcases the potential of AI in online auctions with their AI-driven automated condition report visualization tool, H, which was launched in March 2018 to facilitate dealer-to-dealer vehicle auctions. Overall, AI-based online auctions offer a more efficient, cost-effective, and immersive bidding experience.

What challenges does the Online Auction Industry face during its growth?

- The escalating prevalence of shill bidding in online auctions poses a significant challenge to the industry's growth trajectory. Shill bidding, a deceptive practice involving collusive bidding, undermines the integrity of the auction process and can artificially inflate prices. Addressing this issue requires robust regulatory frameworks and stringent enforcement mechanisms to ensure fair competition and transparency in online auctions.

- Online auctions have gained significant traction in the business world due to their convenience and accessibility. However, the rise of online auctions has also brought about the challenge of shill bidding. Shill bidding is an unlawful practice where a seller or their associates place bids to manipulate the price of an item. This can artificially inflate the price in forward auctions or lower it in reverse auctions. Given the anonymous nature of online platforms, it is challenging to identify and investigate shill bidding activities. To mitigate this risk, auction management systems employ robust security protocols and monitoring tools.

- These systems track bid history, implement automated bidding with bidding increments, and offer search functionality with item categorization. Moreover, seller registration and third-party integrations add an extra layer of security. Rating systems enable users to evaluate sellers based on their past performance, further deterring shill bidding. By maintaining a professional and secure environment, the marketplaces ensure fair and transparent bidding processes.

Exclusive Customer Landscape

The online auction market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the online auction market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, online auction market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

A One Salasar Pvt. Ltd - This company specializes in online auctions, featuring Forward, Reverse, and Dutch auction formats, enhancing marketplace efficiency and transparency.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A One Salasar Pvt. Ltd

- Auction House UK Ltd.

- Auction Technology Group PLC

- BCL Auction

- Biddingo

- Bonanza Portfolio Ltd.

- Catawiki BV

- eBay Inc.

- eBid Ltd.

- eCRATER

- Invaluable LLC

- John Pye and Sons Ltd.

- Liquidity Services Inc.

- SDL Auctions Ltd.

- Sothebys

- UKauctioneers.com

- U.S. Auction Online

- Webstore.com

- Williams and Williams Marketing Services Inc.

- Wilsons Auctions Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Online Auction Market

- In January 2024, leading online auction platform, GavelNow, announced the launch of its new mobile application, expanding its reach to over 5 million potential bidders (GavelNow Press Release).

- In March 2024, Proxibid, another major player, formed a strategic partnership with the National Rifle Association to offer firearms auctions, significantly increasing its market share in the specialized auction segment (Proxibid Press Release).

- In May 2024, Heritage Auctions, the largest collectibles auctioneer, raised USD100 million in a funding round led by Blackstone Growth, enabling the company to expand its technology offerings and global presence (Bloomberg).

- In April 2025, LiveAuctioneers, a prominent the marketplace, secured a major regulatory approval from the European Union, allowing it to expand its services to EU countries, boosting its international presence (LiveAuctioneers Press Release).

Research Analyst Overview

- In the dynamic the market, various auction formats cater to diverse consumer preferences. Sealed-bid auctions for low-value items, such as electronics or collectibles, ensure privacy and convenience for customers. Vintage and high-value items, including real estate, often undergo English or live auctions, where bidders engage in competitive bidding in real-time. Compliance regulations and legal consultations are essential for market players, ensuring adherence to appraisal services, risk management, and data security standards. Customer retention and acquisition strategies are crucial in this competitive landscape. User experience (UX) optimization, logistics providers, and payment processors contribute to a seamless bidding process. Performance optimization and UX design enhance the auction analytics, conversion rates, and bounce rates, providing a competitive advantage.

- Brand building is essential for auctioneer services, offering unique items, appraisal services, and valuation expertise. Dutch auctions and reverse auctions cater to specific industries, such as luxury goods, where time auctions and silent auctions offer discreet bidding opportunities. Security audits and compliance regulations ensure a secure transaction environment, fostering trust and confidence among buyers and sellers.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Online Auction Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

201 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14% |

|

Market growth 2025-2029 |

USD 3981.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.2 |

|

Key countries |

US, Japan, Germany, UK, China, Canada, India, France, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Online Auction Market Research and Growth Report?

- CAGR of the Online Auction industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the online auction market growth of industry companies

We can help! Our analysts can customize this online auction market research report to meet your requirements.