Real Time Bidding Market Size 2024-2028

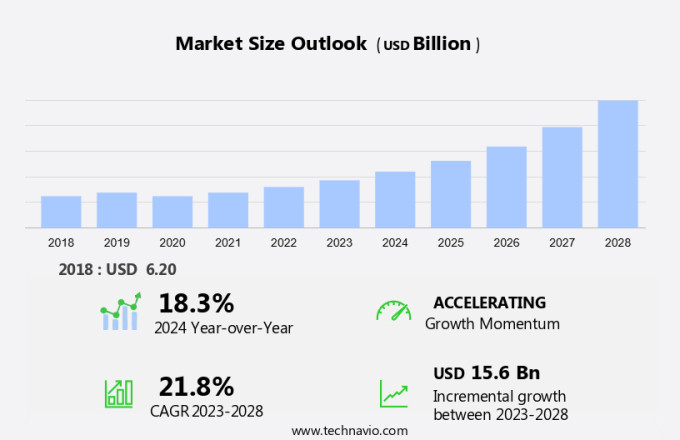

The real time bidding market size is forecast to increase by USD 15.6 billion at a CAGR of 21.8% between 2023 and 2028.

- Real-time bidding (RTB) is a dynamic online bidding process that enables advertisers to purchase ad inventory in real time through an auction. This market is witnessing significant growth due to the digital transformation and increasing participation of overseas buyers in e-commerce. However, the possibility of fraud in RTB is a major challenge. Demand-Side Platforms (DSPs) and Supply-Side Platforms (SSPs) play crucial roles in this process, facilitating programmatic buying through the exchange of cookie data. Mobile games are a significant sector for RTB, as they offer a large and engaged user base. Advertisers leverage DSPs to target specific audiences, while SSPs provide inventory from various sources. RTB's auction-based model ensures efficient ad placement and maximizes returns for both buyers and sellers. This streamlined process is essential for businesses looking to effectively reach their target audience in today's digital marketplace.

What will be the Size of the Market During the Forecast Period?

- Real-Time Bidding (RTB) is a programmatic advertising technology that revolutionizes the way advertisers purchase online ad impressions. This method enables automated, real-time auctions for online ad inventory, allowing advertisers to place bids on individual impressions based on specific targeting criteria. In the context of e-commerce and digital media, RTB is increasingly popular among advertisers due to its efficiency and precision. The DSP represents the advertisers and their advertising campaigns, while the SSP manages the inventory of online content available for auction. The automated auction process is initiated when an ad impression becomes available on a website or mobile application. The SSP sends a bid request to multiple DSPs, which then use computer-based algorithms to evaluate the potential value of the impression based on the advertiser's targeting criteria. Advertisers can employ various strategies, such as open auctions, private auctions, or hybrid auction models, to participate in the bidding process. In an open auction, all DSPs can bid on the impression, while private auctions limit participation to selected DSPs. The hybrid auction model combines elements of both open and private auctions. Once the bidding process concludes, the highest bidder secures the ad impression. This real-time, automated process ensures that advertisers reach their target audience efficiently and effectively, minimizing media wastage and optimizing campaign performance.

- Moreover, RTB is not limited to desktop websites; it is also applicable to mobile applications and mobile games. This versatility makes RTB an essential tool for advertisers seeking to engage with consumers across various digital platforms. In summary, Real-Time Bidding (RTB) is a game-changing technology in digital advertising. It enables automated, real-time auctions for online ad inventory, allowing advertisers to target their desired audience with precision and efficiency. The use of computer-based algorithms, open and private auctions, and hybrid models ensures that advertisers optimize their digital ad spend and minimize media wastage. RTB is applicable to various digital platforms, including websites, mobile applications, and mobile games. Advertisers can leverage cookie data and demographics to target their desired audience, reducing media wastage and optimizing digital ad spend. The RTB process begins with a demand-side platform (DSP) and a supply-side platform (SSP).

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Open auction

- Invitation-only auction

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

By Type Insights

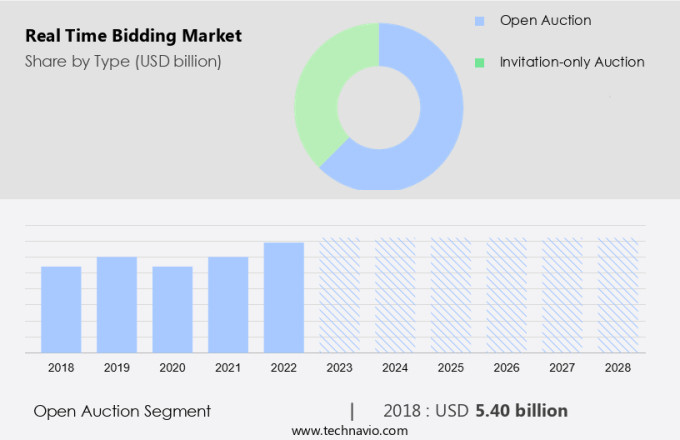

- The open auction segment is estimated to witness significant growth during the forecast period.

Real-time Bidding (RTB) refers to the automated process of buying online advertising inventory in real time through an auction held on a Demand-Side Platform (DSP) or Supply-Side Platform (SSP). In this marketplace, advertisers bid on impressions for specific audiences based on cookie data and other demographic information. Open auctions, where companies allow multiple bidders to participate, accounted for the largest share of the global RTB market in 2023. However, other categories, such as private marketplaces and programmatic direct, are anticipated to gain more traction in the future, potentially impacting the market share of open auctions.

Furthermore, companies aim to provide more personalized selling of their inventory, which is a significant demand in the e-Commerce and mobile game industries. DSPs and SSPs facilitate this process through programmatic buying, enabling real-time bidding and efficient ad placement.

Get a glance at the market report of share of various segments Request Free Sample

The open auction segment was valued at USD 5.40 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

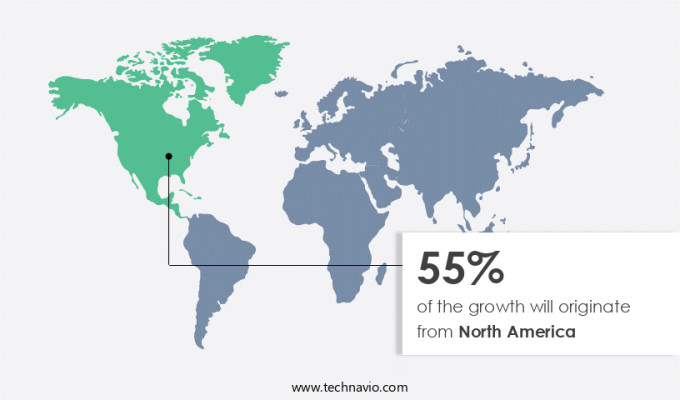

- North America is estimated to contribute 55% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the United States, the expanding consumer base with disposable income and widespread use of Internet-connected devices is driving the shift towards digital advertising and the adoption of real-time bidding (RTB). RTB, an automated auction process for buying ad impressions in real-time, is gaining traction in North America due to its efficiency and precision. Key players such as Meta Platform and PubMatic are capitalizing on this trend. Demographic, interest-based, and behavioral targeting are integral components of RTB, enabling advertisers to reach their desired audience effectively. Ad exchanges function as stock exchanges for digital ad inventory, allowing buyers to bid on impressions in real-time.

Furthermore, computer-based algorithms facilitate automated auctions, ensuring the most relevant and valuable ads are displayed. As the number of time-strapped and cost-conscious consumers continues to grow in the US, the demand for online advertisements is expected to rise. Advertising campaigns are increasingly being optimized using RTB, making it an essential tool for businesses seeking to reach their target audience in real-time. The market for RTB in North America is poised for significant growth during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Real Time Bidding Market?

Digital transformation is the key driver of the market.

- In today's digital age, businesses are shifting their focus towards marketing strategies that offer immediate results and higher ROI. The rise of digital platforms has led to a significant increase in digital ad spend, with digital marketing campaigns surpassing traditional methods. According to studies, digital marketing campaigns are viewed three times more frequently than traditional ads, making them an attractive option for small and medium-sized businesses. Traditional advertising methods, on the other hand, can be time-consuming and require substantial investments with uncertain outcomes. Real-time bidding (RTB) is a digital marketing strategy that allows advertisers to bid on ad inventory in real time based on specific audience data. This data is derived from various sources, including data analytics and machine learning algorithms, enabling precise ad targeting. RTB campaigns offer campaigners the ability to monitor their ad effectiveness in real time, ensuring optimal campaign performance and reducing media wastage.

- Moreover, digital marketing encompasses various formats, such as mobile advertising, video advertising, dynamic ads, and interactive ads. These formats offer unique opportunities to engage with consumers in real-time, making them essential components of a successful digital marketing strategy. However, digital marketing also faces challenges such as ad fraud, which can negatively impact campaign performance. To mitigate these risks, it is crucial to employ strong data analytics and fraud detection tools to ensure the integrity of digital marketing campaigns.

What are the market trends shaping the Real Time Bidding Market?

The growing participation of overseas buyers is the upcoming trend in the market.

- Real-time bidding (RTB) market allows buyers to select from a vast array of offerings, while sellers benefit from access to a multitude of potential purchasers, including those from international markets. Online auctions erase geographical constraints, expand sales reach, and capture the interest of a vast digital audience, thereby broadening the pool of prospective bidders. This dynamic creates a marketplace where numerous sellers can engage in transactions with numerous buyers for the same products. Notably, leading online auction companies have reported an uptick in international buyer participation.

- Advanced marketing technologies, such as the hybrid auction model, Exchange Bidding, and private auctions, facilitate this real-time buying and selling process. These methods enable efficient and effective campaign performance for advertisers, while accommodating various AD formats and device types. By leveraging these tools, online content companies can optimize their offerings and cater to diverse buyer preferences. This dynamic marketplace fosters growth and innovation, making it an attractive proposition for businesses seeking to expand their reach and maximize revenue. Thus, such trends will shape the growth of the market during the forecast period.

What challenges does Real Time Bidding Market face during its growth?

The possibility of fraud in real time bidding is a key challenge affecting the market growth.

- Real Time Bidding (RTB) is a programmatic advertising method utilized by advertisers to purchase ad inventory in real time based on specific targeting criteria. Location-based targeting is a popular metric in RTB, allowing advertisers to reach consumers in-app or on mobile applications within certain geographic areas. Advertisers employ various formats, such as text, image, video, or audio, in their advertisements during open or invitation-only auctions. The media and entertainment, retail and e-commerce, games, travel and luxury industries are significant users of RTB.

- However, the market's growth is under threat due to the issue of unreliable data from fraudulent RTB systems. Up to 40%-60% of digital advertising spending may be wasted on fake impressions and clicks, which can significantly impact an advertiser's budget. To mitigate this issue, advertisers demand higher standards of inventory quality to minimize fraud. Adhering to these standards is essential for maintaining trust and confidence in the RTB market. In conclusion, the RTB market is a vital component of digital advertising, enabling advertisers to reach their target audience effectively. However, the prevalence of fraudulent RTB systems poses a significant challenge, with up to half of digital advertising spending potentially wasted on fake impressions and clicks. Advertisers must insist on higher inventory quality standards to combat this issue and preserve the integrity of the RTB market.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Adobe Inc.

- Alphabet International GmbH

- Beeswax

- Criteo SA

- Magnite Inc.

- Match2One AB

- MediaMath Inc.

- Meta Platforms Inc.

- MOLOCO Inc.

- OpenX Technologies Inc.

- PubMatic Inc.

- Salesforce Inc.

- Simplifi Holdings Inc.

- Smaato Inc.

- Upsolver Ltd.

- Verizon Communications Inc.

- WPP Plc

- X Corp.

- Xandr Inc.

- Yandex NV

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Real-time bidding (RTB) is a revolutionary methodology in the digital advertising industry that enables advertisers to purchase online ad inventory through automated auctions in real time. In this process, demand-side platforms (DSPs) and supply-side platforms (SSPs) interact in an open auction environment to determine the winning bid for each ad impression. This real-time bidding market is particularly relevant for e-commerce, mobile games, and various digital media sectors, including over-the-top (OTT) and connected TV (CTV). Advertisers can leverage cookie data, audience targeting, and various targeting parameters such as demographics, interests, and behaviors to reach their desired audience. Programmatic buying through RTB has gained significant traction due to its ability to minimize media wastage and optimize digital ad spend across various digital platforms.

Furthermore, the real-time bidding market encompasses various ad formats, including mobile advertising, video advertising, dynamic ads, interactive ads, in-app advertising, and more. Advanced marketing technologies like machine learning and data analytics play a crucial role in campaign effectiveness, while ad fraud prevention measures ensure the authenticity of ad impressions. The hybrid auction model, exchange bidding, private auction, and invitation auction are some of the key components of the real-time bidding market. This market caters to various industries, including media and entertainment, retail and e-commerce, games, travel and luxury, and mobile applications. Electronic devices, such as smartphones, are essential for media consumption, making real-time bidding a vital aspect of digital advertising.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

137 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 21.8% |

|

Market growth 2024-2028 |

USD 15.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

18.3 |

|

Key countries |

US, China, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch