Online Data Science Training Programs Market Size 2025-2029

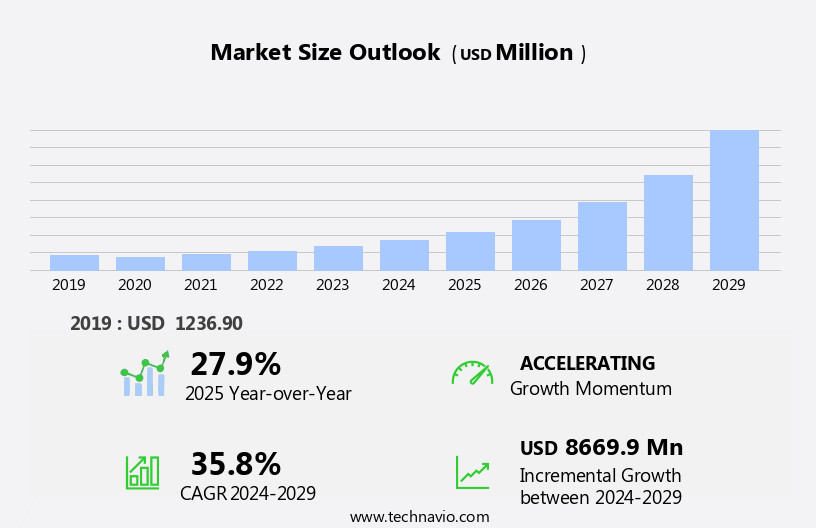

The online data science training programs market size is forecast to increase by USD 8.67 billion, at a CAGR of 35.8% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for data science professionals in various industries. The job market offers lucrative opportunities for individuals with data science skills, making online training programs an attractive option for those seeking to upskill or reskill. Another key driver in the market is the adoption of microlearning and gamification techniques in data science training. These approaches make learning more engaging and accessible, allowing individuals to acquire new skills at their own pace. Furthermore, the availability of open-source learning materials has democratized access to data science education, enabling a larger pool of learners to enter the field.

- However, the market also faces challenges, including the need for continuous updates to keep up with the rapidly evolving data science landscape and the lack of standardization in online training programs, which can make it difficult for employers to assess the quality of graduates. Companies seeking to capitalize on market opportunities should focus on offering up-to-date, high-quality training programs that incorporate microlearning and gamification techniques, while also addressing the challenges of continuous updates and standardization. By doing so, they can differentiate themselves in a competitive market and meet the evolving needs of learners and employers alike.

What will be the Size of the Online Data Science Training Programs Market during the forecast period?

The online data science training market continues to evolve, driven by the increasing demand for data-driven insights and innovations across various sectors. Data science applications, from computer vision and deep learning to natural language processing and predictive analytics, are revolutionizing industries and transforming business operations. Industry case studies showcase the impact of data science in action, with big data and machine learning driving advancements in healthcare, finance, and retail. Virtual labs enable learners to gain hands-on experience, while data scientist salaries remain competitive and attractive. Cloud computing and data science platforms facilitate interactive learning and collaborative research, fostering a vibrant data science community.

Data privacy and security concerns are addressed through advanced data governance and ethical frameworks. Data science libraries, such as TensorFlow and Scikit-Learn, streamline the development process, while data storytelling tools help communicate complex insights effectively. Data mining and predictive analytics enable organizations to uncover hidden trends and patterns, driving innovation and growth. The future of data science is bright, with ongoing research and development in areas like data ethics, data governance, and artificial intelligence. Data science conferences and education programs provide opportunities for professionals to expand their knowledge and expertise, ensuring they remain at the forefront of this dynamic field.

How is this Online Data Science Training Programs Industry segmented?

The online data science training programs industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Professional degree courses

- Certification courses

- Application

- Students

- Working professionals

- Language

- R programming

- Python

- Big ML

- SAS

- Others

- Method

- Live streaming

- Recorded

- Program Type

- Bootcamps

- Certificates

- Degree Programs

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

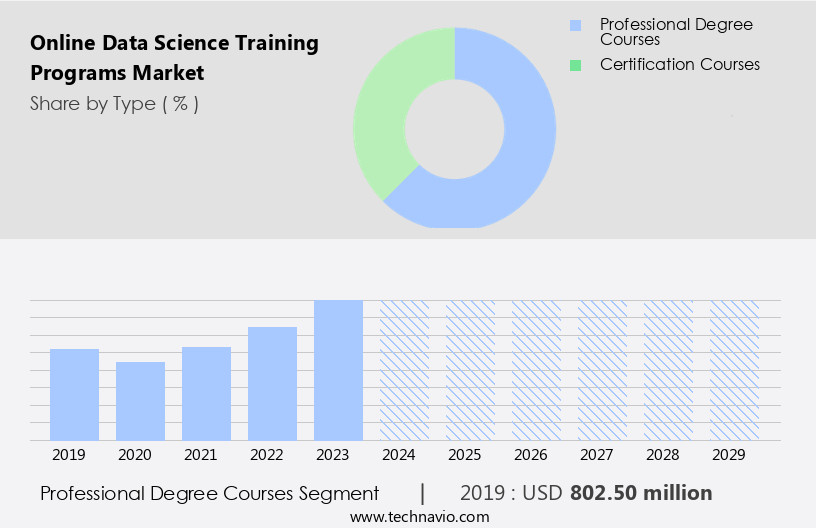

The professional degree courses segment is estimated to witness significant growth during the forecast period.

The market encompasses various segments catering to diverse learning needs. The professional degree course segment holds a significant position, offering comprehensive and in-depth training in data science. This segment's curriculum covers essential aspects such as statistical analysis, machine learning, data visualization, and data engineering. Delivered by industry professionals and academic experts, these courses ensure a high-quality education experience. Interactive learning environments, including live lectures, webinars, and group discussions, foster a collaborative and engaging experience. Data science applications, including deep learning, computer vision, and natural language processing, are integral to the market's growth. Data analysis, a crucial application, is gaining traction due to the increasing demand for data-driven decision-making in various industries.

Data science's impact on industries is profound, leading to a thriving data science community. Data security and privacy are essential considerations in the market, with data governance and ethics playing significant roles. Data science platforms, online courses, and virtual labs facilitate accessible and flexible learning opportunities. Predictive analytics, data mining, and statistical modeling are essential skills for data scientists, driving the demand for data science training. The future of data science is promising, with trends such as cloud computing, big data, and artificial intelligence shaping the market. Data science projects and portfolios showcase professionals' expertise and innovation, making them essential components of the market.

Data science certifications add credibility to professionals' skills and knowledge, enhancing their value in the industry. Machine learning, a critical data science technique, is transforming industries, leading to increased demand for data scientists. Data science research and industry case studies provide valuable insights into the practical applications of data science. Data cleaning and data visualization are essential data science skills, ensuring data accuracy and effective communication of insights. Data science tools and libraries, such as TensorFlow, Scikit-learn, and Keras, enable efficient and effective data analysis. Data science conferences and blogs provide opportunities for professionals to stay updated on the latest trends and developments in the field.

Data ethics and data science education are crucial for ensuring responsible and ethical use of data. In conclusion, the market is dynamic and evolving, driven by the increasing demand for data science skills and applications. The market's growth is fueled by advancements in technology, the need for data-driven decision-making, and the transformative impact of data science on industries.

The Professional degree courses segment was valued at USD 802.50 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

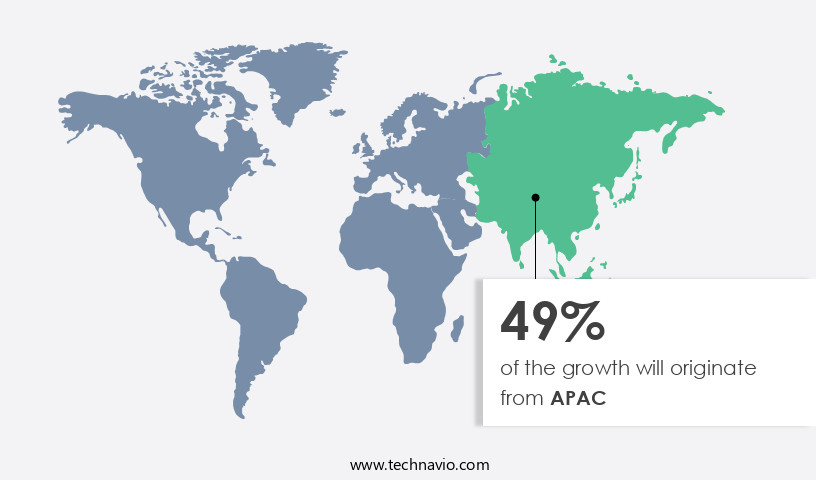

APAC is estimated to contribute 49% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The online data science training market in North America is witnessing significant expansion due to the escalating need for data science expertise in sectors such as retail, finance, healthcare, and technology. Numerous training providers offer comprehensive and adaptable courses to cater to both aspiring data scientists and professionals aiming to enhance their skill set. These programs encompass a diverse curriculum, incorporating subjects like statistical modeling, machine learning, data visualization, and programming languages such as Python and R. Participants delve into the fundamentals of data science, leveraging a blend of theoretical instruction and interactive learning experiences in virtual labs.

Data science applications, including deep learning, computer vision, natural language processing, predictive analytics, and data mining, are integral components of these programs. Data security, privacy, ethics, and governance are also addressed to ensure professionals are well-versed in these essential aspects. Industry case studies provide valuable insights into real-world applications, fostering a strong data science community. Data science transformation is further facilitated through the use of cloud computing, data science platforms, and libraries. Data storytelling is another crucial skill taught to help data scientists effectively communicate insights to stakeholders. The market's evolution is driven by the future potential of data science, with trends like data visualization, innovation, and trends shaping the industry.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Online Data Science Training Programs Industry?

- The primary factor fueling market growth is the enhancement of employment opportunities for individuals.

- In today's business landscape, data science has become a crucial component in driving strategic decision-making and gaining a competitive edge. Consequently, there is a significant demand for professionals with expertise in data science and analytical skills. The finance and insurance sector, professional services, and IT industry are leading the charge in hiring data science professionals. In response to this growing demand, individuals are turning to online data science training programs to enhance their skills and expand their career opportunities. These programs offer flexibility and affordability, making them an attractive option for those seeking to upskill.

- Key data science competencies include proficiency in machine learning and big data analysis. Online training providers offer professional degrees and certification courses that cater to these skill areas, enabling individuals to build robust and harmonious data science portfolios.

What are the market trends shaping the Online Data Science Training Programs Industry?

- Market trends indicate a heightened focus on microlearning and gamification. These approaches, which involve delivering content in bite-sized pieces and incorporating game elements, respectively, are increasingly popular in professional development and education.

- The market experiences a growing interest in microlearning as the preferred format for data science education. Microlearning delivers content in concise, easily digestible segments, typically lasting 5-10 minutes, through various formats such as videos, audios, texts, presentations, and infographics. This flexibility and accessibility make microlearning an attractive choice for businesses to train their workforce in data science. The proliferation of mobile devices, including tablets and smartphones, further enhances microlearning's appeal, enabling employees to learn on-the-go. Video learning and infographics are the most popular microlearning formats in data science training programs. By offering bite-sized, interactive, and harmonious learning experiences, microlearning significantly contributes to the data science community's growth and impact.

- It emphasizes deep learning, data analysis, data engineering, computer vision, and data science applications, ensuring a comprehensive understanding of the subject matter. Ultimately, microlearning plays a pivotal role in addressing the evolving needs of the data science industry by providing secure, accessible, and engaging online courses.

What challenges does the Online Data Science Training Programs Industry face during its growth?

- The emergence of open-source learning materials poses a significant challenge to the growth of the industry, as it disrupts traditional business models and increases competition.

- The global online data science training market faces a significant challenge from the proliferation of open-source data science learning materials. These resources, which include free courses, video lectures, and massive open online courses (MOOCs), are provided by various entities, such as Udacity, and offer learners foundational data science education at no cost. The open-source data science masters course, maintained by the Data Science Masters, is another free, comprehensive collection of open-source materials and resources available online. While these offerings are beneficial for learners seeking to gain a foundational understanding of data science, they may hinder the growth of the online data science training market as they reduce the demand for paid, advanced courses.

- Other market dynamics include the increasing adoption of big data, cloud computing, and machine learning in industries, leading to a data science transformation. Data privacy concerns, data storytelling, data mining, and the use of data science libraries are also key trends driving market growth. Virtual labs and data science blogs serve as valuable resources for learners, providing hands-on experience and real-world insights, respectively. In conclusion, while the availability of free data science learning materials poses a challenge, the growing demand for data science skills and the increasing adoption of data-driven technologies continue to fuel market growth.

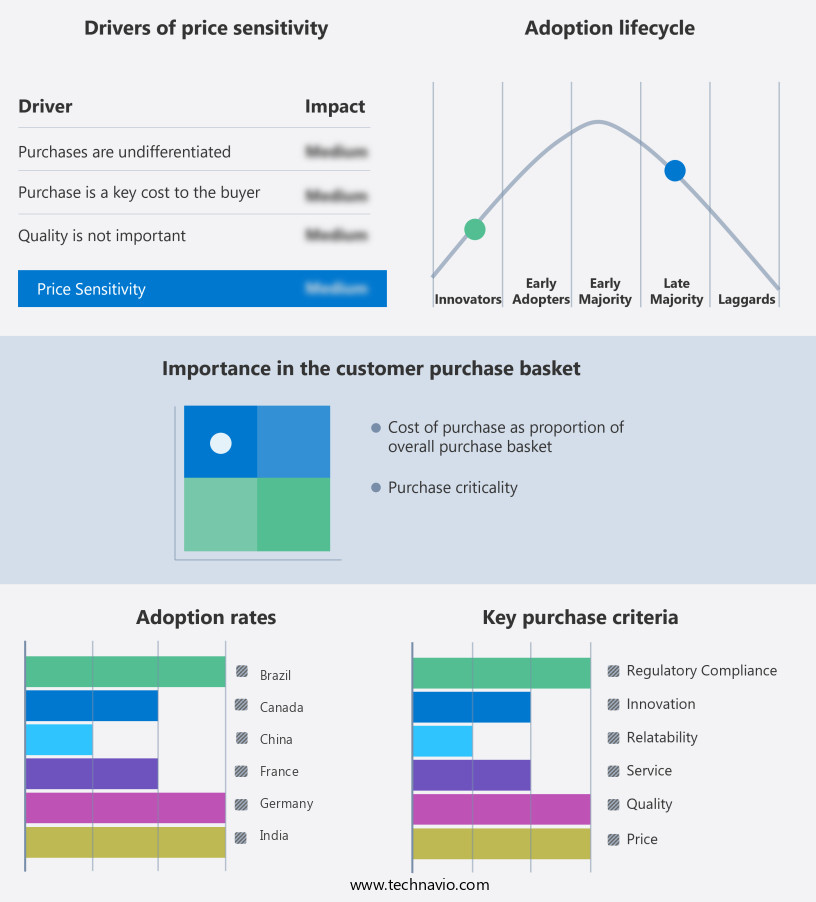

Exclusive Customer Landscape

The online data science training programs market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the online data science training programs market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, online data science training programs market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

365 Data Science - The company delivers online data science training, encompassing specialized programs like data analysis for life sciences and essentials. These courses equip learners with essential skills in data collection, presentation, description, and inference. Through interactive and comprehensive instruction, participants gain a solid foundation in data analysis techniques and applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 365 Data Science

- BrainStation

- Coursera Inc.

- DataCamp Inc.

- Databricks Academy

- edX Inc.

- General Assembly

- Great Learning

- IBM Skills Network

- Jigsaw Academy

- Metis (Kaplan)

- Pluralsight Inc.

- Simplilearn Solutions Pvt. Ltd.

- Springboard

- Thinkful (Chegg)

- Udacity Inc.

- Udemy Inc.

- UpGrad Education Pvt. Ltd.

- W3Schools

- Wharton Online (University of Pennsylvania)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Online Data Science Training Programs Market

- In January 2023, Microsoft announced the integration of its Azure Machine Learning platform with LinkedIn Learning's Data Science learning paths (Microsoft Press Release). This collaboration aims to provide a seamless learning-to-implement experience for professionals, bridging the gap between education and application in data science.

- In March 2024, IBM and Google Cloud formed a strategic partnership to offer joint data science training programs (IBM Press Release). The collaboration combines IBM's industry expertise and data science curriculum with Google Cloud's advanced data analytics tools, creating a comprehensive learning solution for professionals.

- In June 2024, Coursera raised USD120 million in a Series E funding round, valuing the company at USD4.3 billion (TechCrunch). The investment will support the expansion of its data science training offerings and the development of new features to enhance the learning experience.

- In October 2025, Amazon Web Services (AWS) launched SageMaker Studio, an integrated development environment for machine learning, deep learning, and data science (AWS Press Release). The platform offers pre-built Jupyter notebooks, interactive development tools, and a code editor, enabling users to build, train, and deploy machine learning models more efficiently.

Research Analyst Overview

- In the dynamic data science marketplace, various opportunities cater to professionals seeking to enhance their skills and advance their careers. Meetups, such as Data Science Meetup, foster collaboration and knowledge sharing among peers. Certifications, including Data Science Certifications, validate expertise and increase marketability. Projects, showcased in Data Science Portfolios, demonstrate practical application. Curriculum, offered through Data Science Workshops and mentorship programs, provides structured learning. Degrees, like Data Science Master's and PhDs, offer comprehensive education. Specializations, available through bootcamps and online courses, focus on specific areas. Competitions, such as Data Science Competitions, test problem-solving abilities. Conferences, including Data Science Conferences, provide industry insights.

- Webinars offer convenient learning opportunities. Blogs, like Data Science Blog, provide valuable insights and resources. Networking events, such as Data Science Networking, expand professional connections. Capstone projects, integral to Data Science Degrees and Master's programs, test real-world application. Application processes for Data Science Jobs often require a combination of these elements.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Online Data Science Training Programs Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

233 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 35.8% |

|

Market growth 2025-2029 |

USD 8669.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

27.9 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Online Data Science Training Programs Market Research and Growth Report?

- CAGR of the Online Data Science Training Programs industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the online data science training programs market growth of industry companies

We can help! Our analysts can customize this online data science training programs market research report to meet your requirements.