Online Footwear Market Size 2024-2028

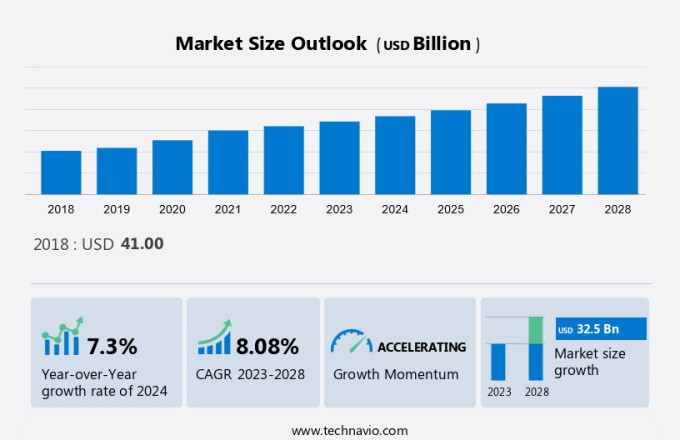

The online footwear market is forecast to increase by USD 32.5 billion and is estimated to grow at a CAGR of 8.08% between 2023 and 2028. The market is experiencing significant growth, driven by several key trends and factors. One major factor is the increasing popularity of digital payment systems, which facilitate seamless transactions and enhance customer convenience. Another trend is the rising adoption of omnichannel retailing, allowing consumers to shop for footwear across multiple channels, both online and offline. However, the market also faces challenges, such as the presence of counterfeit products, which can negatively impact brand reputation and consumer trust. Athletic Footwear is further segmented into running shoes, sports shoes, aerobic shoes, and trekking shoes. To mitigate this issue, market players are investing in advanced technologies like blockchain and AI to ensure authenticity and transparency in their supply chains. Overall, the market is poised for continued growth, fueled by these trends and the increasing preference for online shopping.

What will be the size of the Market During the Forecast Period?

To learn more about this report, Download Report Sample

Market Dynamics and Customer Landscape

The Market encompasses a wide range of footwear categories, including Leather Footwear, Athletic Footwear, Casual Shoes, and Vegan Footwear. Recycled materials like Recycled car tires and Recycled carpet padding are increasingly being used in the production of footwear, adding to the market's sustainability quotient. Cotton and Plantdyed leather are popular choices for convenient footwear, catering to both fashion and comfort needs. Online Footwear Market has experienced significant growth due to the convenience it offers. The market includes Private Label Brands, Women's and Men's footwear, and is propelled by the Athletic Shoe Industry and Online Retailing. Credit Card and Online Banking facilitate seamless transactions, further boosting the market. Fast Fashion Trends influence consumer preferences, leading to an increase in demand for various footwear styles. However, the market also faces challenges from Counterfeit Footwear Products. Overall, the Market continues to evolve, offering diverse choices to consumers. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The rising popularity of digital payment systems is a key factor driving the growth of the E-commerce footwear market. The availability of a wide range of merchandise, online payment options, online tracking of shipments, 24/7 customer support, larger Internet reach, and cheaper costs have increased the demand for online shopping. Currently, customers have several payment options, such as credit cards, cash-on-delivery (COD), Internet banking accounts, demand drafts, and cash-on-order. Consumers also rely on payment service providers such as PayPal, which allows them to pay without revealing their personal information.

Moreover, digital payment services allow consumers to make payments at the point of sale through a mobile device. The transactions can be completed in a few steps on the phone.

Significant Market Trend

The advent of smart and customized footwear is the primary trend in the global market growth. Smart and customized shoes are trending in the market. Customization and personalization are key strategies that vendors have been adopting to diversify their product portfolio. The introduction of innovative and technically advanced smart and customizable footwear also attracts and motivates consumers to invest in them. Smart footwear, such as step-counting shoes, is gaining popularity among consumers engaged in athletic and fitness activities.

In January 2018, Under Armour launched UA HOVR Phantom Connected shoes that tracks, analyzes, and store virtual information about running metric. Therefore, the high level of customization and increased demand for innovative footwear will propel the growth of the E-commerce footwear market during the forecast period.

Major Market Challenge

The presence of counterfeit products is a major challenge to the growth of the market. Over the past few years, counterfeits of leading women's footwear brands have flooded the market. These products use original brand names and are priced lower than the original products to attract customers. Therefore, counterfeit products are causing a considerable dent in the market shares of leading popular brands by damaging their reputations. However, these products are not long-lasting because they are made of poor-quality raw materials. Sometimes the low quality of nylon and polyester can affect consumers who have sensitive skin and are prone to allergies.

Moreover, China is a key source of counterfeit products, which are shipped to developed markets such as the US, the UK, Japan, South Korea, and Germany, and to emerging markets such as Brazil and India, where they are primarily sold online. For instance, according to the Organization for Economic Co-operation and Development (OECD), the footwear industry is the second-largest market in the top trade of counterfeit goods. This is expected to hamper the growth of the market during the forecast period.

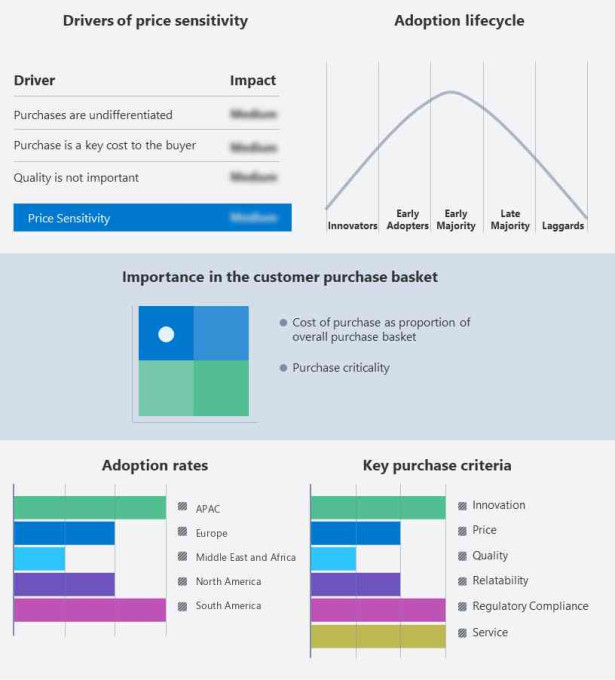

Market Customer Landscape

The report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Market Customer Landscape

Who are the Major Market Players?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Bata - The company offers online footwear under the brand's Power, North Star, and Bubble Gummers. Also, the company offers footwear, bags, and apparel.

The report also includes detailed analyses of the competitive landscape of the market and information about 15 market players, including:

- adidas AG

- Alibaba Group Holding Ltd.

- Amazon.com Inc.

- Clarks Reliance Footwear Pvt. Ltd.

- Dolce and Gabbana S.r.l.

- eBay Inc.

- Fila Holdings Corp

- Flipkart Internet Pvt. Ltd.

- Geox Spa

- Kohls Corp.

- Macys Inc.

- Michael Kors Switzerland GmbH

- Net Distribution Services Pvt. Ltd.

- New Balance Athletics Inc.

- Nike Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize vendors as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize vendors as dominant, leading, strong, tentative, and weak.

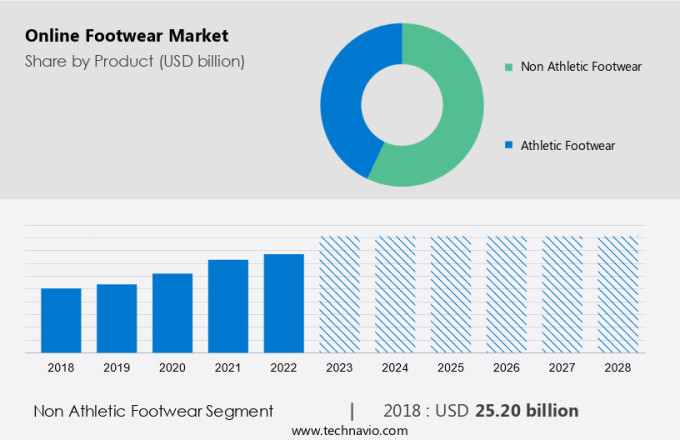

What is the Fastest-Growing Segment in the Market?

The market share growth by the non athletic footwear segment will be significant during the forecast period. The market segment includes casual, fancy, and formal/office footwear. The growth of the global market by non-athletic footwear is because of the rising demand for products from this category globally.

Get a glance at the market contribution of various segments Request a PDF Sample

The non-athletic footwear segment was valued at USD 25.20 billion in 2018 and continued to grow by 2022. The global market for non-athletic footwear is expected to grow during the forecast period. This is mostly because of the high demand for non-athletic footwear compared with athletic footwear. The demand for trendy non-athletic footwear from Generation Z and millennials, backed by the rise of eCommerce companies, will drive the growth of the market segment during the forecast period. The high demand for leather footwear for formal and official purposes is further strengthening the growth of the market. For instance, the size of the leather footwear market in India is expected to double during the forecast period compared with 2020. This is expected to strengthen the growth of the global market by non-athletic footwear during the forecast period.

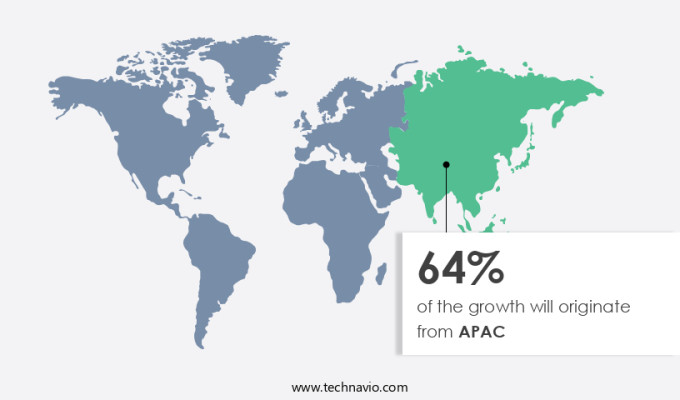

Which are the Key Regions for the Market?

For more insights on the market share of various regions Request PDF Sample now!

APAC is estimated to contribute 64% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. APAC is experiencing the fastest CAGR with respect to revenue in the market due to rising urbanization, which has prompted people to adopt different lifestyles and cultures. Steady economic development in countries such as Australia, New Zealand, Japan, China, India, Singapore, Malaysia, Vietnam, and South Korea has improved the purchasing power of consumers who are now willing to spend more on lifestyle products. Furthermore, the rapidly increasing rate of urbanization in APAC is driving the growth of the market; this results in increasing dual household income that enhances the purchasing power of people for recreational activities. Besides, APAC will maintain the highest growth during the forecasted period due to the high population, online retail growth, increased disposable income, a wide array of product offerings, and growth in online retail. China and India are the most populous countries in the world and are expected to be the major markets for the market by volume during the forecast period.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Product Outlook

- Non-athletic footwear

- Athletic footwear

- End-User Outlook

- Men

- Women

- Children

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

Market Analyst Overview

The Market is witnessing significant growth due to the increasing popularity of convenient footwear shopping online. This market includes various categories such as Leather Footwear, Athletic Footwear, Casual Shoes, and Vegan Footwear. Athletic Footwear, including running shoes, sports shoes, and aerobic shoes, is a major segment due to the Fast Fashion Trend and the Athleisure Footwear craze. Key materials used in the production of footwear are Recycled car tires, Recycled carpet padding, Cotton, Plantdyed leather, and Renewable Materials. Consumers' preference for Sustainable Materials and Fashion Trends is driving the market. Ecommerce platforms like Online Retailing, Credit card, Online banking, and Mobile wallets, smartphone have made purchasing footwear more accessible. Private Label Brands are also gaining popularity in this sector. However, the market faces challenges from Counterfeit Footwear Products. The Athletic Shoe Industry is a significant contributor to the market's growth. Consumer Trends favor Comfortable Footwear and Stylish Footwear, driving demand for High End Brands. The market is expected to continue its growth trajectory, with continuous innovation and consumer preferences shaping its future.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.08% |

|

Market growth 2024-2028 |

USD 32.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.3 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 64% |

|

Key countries |

China, US, India, Germany, and Indonesia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Adidas AG, Alibaba Group Holding Ltd., Amazon.com Inc., Bata, Clarks Reliance Footwear Pvt. Ltd., Dolce and Gabbana S.r.l., eBay Inc., Fila Holdings Corp., Flipkart Internet Pvt. Ltd., Geox S.p.A, Kohls Inc, Macys Inc., Michael Kors Switzerland GmbH, Net Distribution Services Pvt. Ltd., New Balance Athletics Inc., Nike Inc., Pentland Brands Ltd., PUMA SE, VALENTINO Spa, and VF Corp. |

|

Market dynamics |

Parent market analysis, market trends, market growth analysis, market research and growth, market forecasting, market forecast, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2023 and 2028.

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the market industry across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about vendors

- Comprehensive analysis of factors that will challenge the growth of market players

We can help! Our analysts can customize this report to meet your requirements. Get in touch