India Online Home Decor Market Size 2025-2029

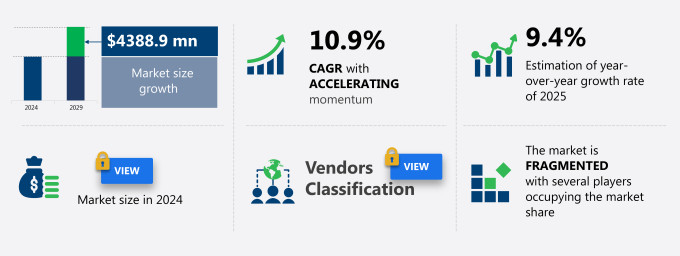

The India online home decor market size is forecast to increase by USD 4.39 billion, at a CAGR of 10.9% between 2024 and 2029.

- The market is witnessing significant growth due to several key factors. The increasing trend of online shopping and the widespread use of smartphones have led to a rise in spending on home decor items through online stores. Moreover, there is a growing demand for eco-friendly home decor products, particularly in the areas of flooring and wall decor. Home textiles and floor coverings are popular categories in this market. However, the criticality of logistics management in ensuring timely delivery of these often bulky and heavy items results in high overhead costs for online home decor retailers. To remain competitive, players in this market need to focus on optimizing their logistics networks and offering a seamless online shopping experience to customers. Additionally, collaborations with gift shops and premium home decor brands can help expand their customer base and boost sales.

What will be the Size of the Market During the Forecast Period?

- The market has witnessed significant growth in recent years, fueled by the increasing popularity of online sales platforms and the influence of social media on interior design trends. This sector encompasses a wide range of products, including furniture, lighting, textiles, wall art, home textiles, floor coverings, decorative items, and ornamentation. Online sales platforms have revolutionized the way consumers shop for home decor in India. With the convenience of shopping from the comfort of their homes, customers can easily browse through a vast array of options, compare prices, and make purchases at their leisure. The market is expected to continue its upward trajectory, driven by the growing penetration of smartphones and the increasing preference for contactless shopping. Social media platforms have also played a pivotal role in shaping home decor trends in India. With the rise of influencer marketing and DIY home decor ideas, social media has become a go-to source of inspiration for consumers looking to revamp their homes.

- Social media platforms have become essential tools for home decor brands to reach their audience and showcase their offerings. Festivals and celebrations continue to be a significant driver of sales in the home decor market in India. With the country's rich cultural heritage, festivals like Diwali, Eid, and Christmas provide an opportunity for consumers to add new decorative items to their homes. Premium and specialty stores catering to this segment have seen a rise in demand, as consumers look for unique and high-quality decorative pieces to enhance their personal style. The home decor market in India is expected to grow at a steady pace, driven by the increasing disposable income of consumers and the growing awareness of the importance of creating a comfortable and aesthetically pleasing living environment. The market for online sales of home decor is expected to continue its growth trajectory, as consumers increasingly turn to the convenience and wide range of options offered by online sales platforms.

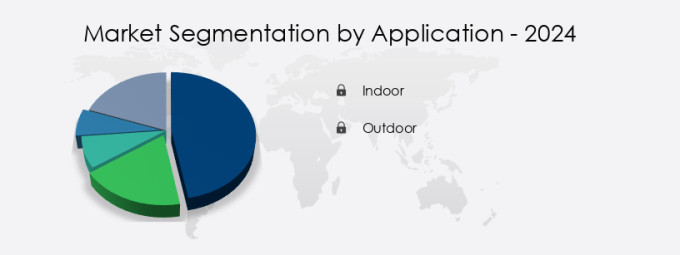

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Indoor

- Outdoor

- Product Type

- Home furniture

- Home furnishings

- Others

- Price

- Mass

- Premium

- Geography

- India

By Application Insights

- The indoor segment is estimated to witness significant growth during the forecast period.

The market encompasses various product categories, including bedroom furniture, carpets and rugs, bed and linen, and more. Among these, the bedroom furniture segment exhibits a high degree of fragmentation due to the presence of numerous local craft-based firms. These companies specialize in mass-volume production and retailing. Innovations like flat-pack and ready-to-assemble (RTA) furniture have made mass production a viable option, with companies catering to the medium-priced segment, while solid-wood furniture sellers target the premium market. The higher profit margins in this sector are attributed to the average Indian household having more than one bedroom. Festivals and celebrations play a significant role in the market, particularly during key occasions such as Diwali and weddings.

E-commerce platforms and social media platforms have emerged as essential channels for reaching customers, enabling easy access to a wide range of home decor options. Companies are continually exploring new ways to engage consumers through personalized recommendations and interactive experiences. In summary, the market is a fast-growing sector, with bedroom furniture being a key segment. Local craft-based firms dominate the market, with innovations driving mass production and catering to various price points. Festivals and celebrations continue to influence consumer behavior, while e-commerce and social media platforms provide a convenient shopping experience.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the market?

The rise in online spending and smartphone penetration is the key driver of the market.

- The market has experienced significant growth due to the increasing use of e-commerce platforms for shopping. The widespread availability of the Internet and the rise of mobile-commerce have made online shopping a popular choice for homeowners and property investors. Tablets, in particular, have become a preferred device for purchasing home furniture and textiles due to their larger interfaces, which enhance the decision-making process.

- E-retailers provide comprehensive product information, ensuring customers are well-informed about quality, safety measures, and usage guidelines. These factors have contributed to the increasing demand for online home decor shopping in India. With the convenience of shopping from the comfort of one's home, it's no wonder that more and more consumers are turning to e-commerce for their home decor needs.

What are the market trends shaping the market?

Growing demand for eco-friendly home decor items is the upcoming trend in the market.

- In India, the market is witnessing significant growth as consumers become increasingly conscious of the need for eco-friendly products. Brands are responding to this trend by producing sustainable home decor items, such as eco-friendly furniture and furnishings. Rising environmental concerns and stringent government regulations for monitoring the use of non-recyclable items are compelling brand owners to adopt eco-friendly products. The increasing consciousness of a healthy environment has increased the demand for eco-friendly furniture and other furnishings. This has motivated various home decor manufacturers to go green and provide eco-friendly home decor items.

- For instance, some companies offer sustainably made bedding and linens and package them in fabric bags to reduce the use of non-recyclable plastic packaging. Other businesses specialize in resale furniture and vintage home goods, which are considered much more sustainable than manufacturing new products. Additionally, some companies sell organic linens, towels, bedding, and apparel, focusing on water-recycling production methods.

What challenges does the market face during the growth?

The criticality of logistics management leading to high overhead costs is a key challenge affecting the market growth.

- In the realm of online home decor in India, challenges in supply chain management, such as inadequate postal addresses and complex delivery logistics, can significantly impact market growth. These issues lead to increased overhead costs and narrowed profit margins for home decor stores, floor-covering retailers, home textile sellers, and even gift shops operating online. The absence of reliable delivery services can also harm a company's brand reputation, potentially reducing its customer base.

- International online retailers often face substantial losses due to these complications. To improve delivery services, many companies hire additional field workers, which adds to their labor expenses. This added cost is typically borne by companies, eroding their profitability.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Amazon.com Inc. - The company offers online home decor such as furniture, lighting, and decorative accessories, providing a vast selection of styles and brands to suit diverse customer preferences.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Century Furniture LLC

- Chumbak Design Pvt. Ltd

- D decor

- Elvy Lifestyle Pvt. Ltd.

- Fabindia Overseas Pvt. Ltd.

- Forbo Management SA

- Godrej Consumer Products Ltd.

- Golden Leaf

- Inter IKEA Holding BV

- Mohawk Industries Inc.

- MyStyle Label Creation Pvt. Ltd.

- Pepperfry Pvt. Ltd.

- Praxis Home Retail Ltd.

- Reliance Industries Ltd.

- Secret Label India Apparels LLP

- Shivalik Metaplast Industries

- The Crafty Angels

- Wooden Street

- Yellow Verandah

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing urbanization and the rising demand for aesthetically pleasing and contemporary home interiors. The market includes various sub-categories such as bedroom furniture, carpets and rugs, bed and linen, lighting, ornamentation, wall art, accessories, and decorative items. Indian consumers are increasingly turning to e-commerce platforms and social media platforms like Instagram and Pinterest for inspiration and purchasing home decor items. The real estate sector's growth and the increasing trend of home ownership and property investments have also fueled the demand for home furniture, home textiles, flooring, and wall decor. The online sales platforms offer a wide range of options for homeowners looking for space-saving and multifunctional furniture, suitable for smaller homes.

Further, the middle-class population's growing disposable income and the desire for personal style have made home decor a fast-growing segment in India. Festivals and celebrations are also driving the demand for home decor items, with many consumers purchasing new decorative items for their homes during these occasions. The market includes both premium and mass segments, with specialty stores and gift shops catering to niche markets. The market's slow-growing segments include traditional and ethnic home decor items, which are losing popularity among the younger generation. The market's future growth is expected to be driven by the increasing awareness of the benefits of home decor and the convenience of online shopping.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.9% |

|

Market Growth 2025-2029 |

USD 4.39 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.4 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across India

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.