Online Video Platform Market Size 2025-2029

The online video platform market size is forecast to increase by USD 2.39 billion, at a CAGR of 20.7% between 2024 and 2029.

- The market is experiencing significant growth due to several key trends. The rise In the number of streaming platforms is a major factor driving market growth. Consumers now have an abundance of choices when it comes to video streaming, leading to increased demand for high-quality content. Another trend is the live streaming of videos, which has gained popularity among audiences due to its interactive nature. Additionally, the availability of free open-source video platforms is making it easier for businesses and individuals to enter the market and offer their content. These trends are expected to continue shaping the market In the coming years.

- The market analysis report provides an in-depth exploration of emerging trends and their impact on industry growth. It also addresses key challenges, such as competition from well-established players and the constant need for innovation to align with shifting consumer preferences. Overall, the market remains a dynamic and promising space, offering numerous opportunities for expansion and innovation.

What will be the Online Video Platform Market Size During the Forecast Period?

- The market is experiencing significant growth, driven by the increasing popularity of live streaming and the proliferation of smart phones and handheld devices. Consumers now prefer watching video content on-demand, leading streaming services to monetize channels through advertising and subscription fees. Live streams, in particular, have gained traction due to their real-time engagement and interactivity. Wireless telecom networks, including 4G and the emerging 5G network, enable seamless internet access for streaming services, further fueling market growth. Television is no longer confined to traditional broadcasting; it's now being managed and published online, allowing for video-based marketing content to be transcoded and tracked for targeted advertising.

How is this Online Video Platform Industry segmented and which is the largest segment?

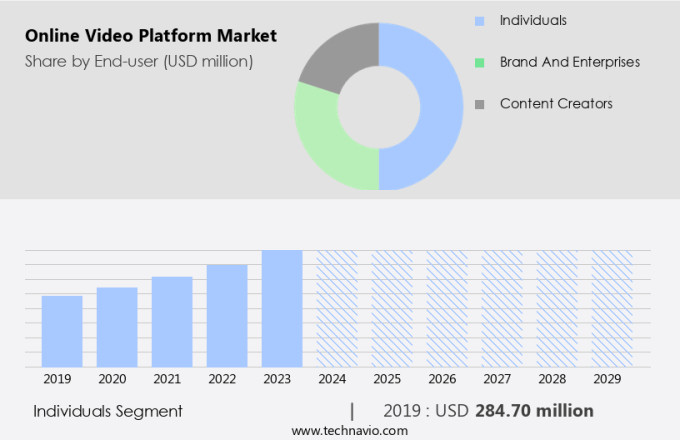

The online video platform industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Individuals

- Brand and enterprises

- Content creators

- Type

- UGC

- DIY

- SaaS

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- South America

- Middle East and Africa

- APAC

By End-user Insights

- The individuals segment is estimated to witness significant growth during the forecast period.

Online Video Platforms (OVPs) have become essential tools for individuals to share user-generated content, which is increasingly trusted by 80-85% of the global population over branded content. Individuals create videos for various purposes, including entertainment, education, and opinions on goods and services. Positive user-generated content can significantly boost product usage. OVPs monetize this trend by hosting and streaming individual Internet videos, contributing to market expansion. The trust in user-generated videos poses a threat to established brands, making OVPs a profitable venture.

OVPs offer interfaces (APIs) for easy upload, embedding, and tracking of videos. They support playback on desktops, smartphones, and tablets, making them accessible via wireless telecom networks, including 4G and the upcoming 5G. Video analytics provide valuable insights for content creators and businesses In the e-learning sector and video-based marketing. OVPs ensure data security and offer transcode and transcoding services for seamless video consumption.

Get a glance at the Online Video Platform Industry report of share of various segments Request Free Sample

The individuals segment was valued at USD 284.70 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 40% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific (APAC) region leads the market, driven by China, South Korea, and Japan as significant revenue contributors. The market's expansion is primarily due to the increasing Internet access and the popularity of online videos in Southeast Asia. With growing Internet penetration and the widespread use of smartphones, countries like China, Thailand, Indonesia, and Vietnam offer substantial growth opportunities. In 2023, half of India's population became active internet users, leading to a rise in mobile video consumption. This trend significantly contributed to the APAC market's substantial revenue generation. Online video platforms enable content creators to monetize their content through advertising, subscriptions, and pay-per-view models.

Further, these platforms offer features such as video analytics, content management, and hosting services' websites for easy access. As the market evolves, investment issues and data security threats remain critical concerns. APAC's online video platforms support 4G and emerging 5G networks, ensuring seamless streaming on desktops, smartphones, tablets, and other devices. Content creators can use interfaces (APIs) and embed codes to track and monetize their streams while streaming services offer links for easy playback and transcode for optimal video quality.

Market Dynamics

Our online video platform market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of the Online Video Platform Industry?

An increase in number of streaming platforms is the key driver of the market.

- The market has experienced significant growth due to advancements in wireless telecom networks, such as 4G and the upcoming 5G, enabling seamless video streaming on smartphones and tablets. This shift towards mobile video consumption has led to an increase in demand for commercial video platforms, allowing content creators to monetize their video content through advertising, subscriptions, and pay-per-view models. Moreover, the e-learning business has also contributed to the market's expansion, with hosting services like Panopto and Bambuser providing video content management, analytics, and tracking features for educational institutions. Open-source interfaces (API) and embed codes have made it easier for individuals and businesses to integrate video content into their websites and store, upload, and transcode videos for playback.

- Data security threats have become a concern for video content management, leading to investment issues in implementing secure private server-structured systems. Video analytics and video-based marketing content have become essential tools for businesses to understand consumer behavior and preferences, leading to profitable opportunities In the market. With the Internet becoming an integral part of our daily lives, the consumption of online videos continues to grow, making it a lucrative market for streaming services and hosting providers. The market dynamics are constantly evolving, with new players entering the market and existing ones adapting to the changing consumer preferences and technological advancements.

What are the market trends shaping the Online Video Platform Industry?

Live streaming of videos is the upcoming market trend.

- The market has experienced significant growth due to the increasing usage of 4G and 5G networks for Internet access. This development has enabled the consumption of online videos on smartphones and tablets, leading to an increase in demand for commercial video platforms. Channel owners, content creators, and individual users alike have benefited from hosting services' websites, which offer embed codes for easy integration into desktops and websites. Monetization of video content has become profitable through advertising, subscriptions, and pay-per-view models. Live streaming has emerged as a popular trend, with platforms like Bambuser and Panopto providing interfaces (API) for seamless integration.

- Video analytics and tracking are essential features for video content management and sharing, allowing businesses to understand their audience's preferences and behavior. Data security threats are a concern, necessitating investment issues in encryption and secure servers, such as a private server-structured system. E-learning businesses and video-based marketing content have seen a rise in popularity, making streaming services a large-scale industry. Video content management and sharing have become essential for businesses to engage with their customers effectively. Transcoding and uploading videos for playback on various devices is a crucial aspect of video content management. The Internet's ubiquity and the increasing usage of wireless telecom networks have made video content consumption an integral part of our daily lives.

What challenges does the Online Video Platform Industry face during its growth?

The free open-source video platform is a key challenge affecting the industry growth.

- The market is experiencing significant growth as Internet access becomes more widespread, particularly through 4G and soon-to-be 5G networks. This trend is driving an increase in video content consumption across various devices, including smartphones and tablets. Content creators are capitalizing on this trend by monetizing their video content through commercial platforms like Bambuser, Panopto, and others. These platforms offer features such as video analytics, video content management, and video sharing, making it easier for users to track and manage their content. Despite the benefits, there are challenges, such as data security threats and investment issues.

- To mitigate these risks, hosting services provide interfaces (API) for secure uploading, transcode, and playback of videos. Additionally, private server-structured systems offer increased security and control. E-learning businesses and video-based marketing content are significant contributors to the market's growth. Streaming services are also driving demand for high-quality video content. Open-source solutions are gaining popularity due to their cost-effectiveness and flexibility. Embed codes and links enable easy integration of videos into websites, making video content easily accessible to users. Monetization through advertising, subscriptions, and pay-per-view models is a profitable venture for content creators.

Exclusive Customer Landscape

The online video platform market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the online video platform market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, online video platform market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Adobe Inc. - The company offers online video platform through its subsidiary Frame.io Inc.The company offers an online video platform through its subsidiary Frame.io Inc.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akamai Technologies Inc.

- Alphabet Inc.

- Bharti Airtel Ltd.

- Brightcove Inc.

- Comcast Corp.

- Dacast Inc.

- International Business Machines Corp.

- Kaltura Inc.

- MediaMelon Inc.

- MediaPlatform Inc.

- Panopto Inc.

- Piksel srl

- Samba Mobile Multimidia SA

- Telstra Corp. Ltd.

- Viacom18 Media Pvt. Ltd.

- Vimeo.com Inc.

- Viostream

- Wistia Inc.

- Youku Tudou Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to experience significant growth as businesses and individuals seek new ways to create, manage, and share video content. This market encompasses a range of solutions, from commercial platforms designed for monetization to e-learning tools and private server-structured systems. At the core of this market are the technological advancements that enable the creation, transmission, and consumption of video content over the Internet. The increasing prevalence of high-speed internet access, coupled with the proliferation of smartphones and tablets, has fueled the demand for online video platforms. One key trend in this market is the shift towards live streaming.

Further, live streams offer real-time engagement and interaction, making them an attractive option for various applications, including events, education, and entertainment. This trend is further fueled by the advancements in wireless telecom networks, which enable high-quality live streaming even on mobile devices. Another trend is the increasing importance of video content management and analytics. As the volume of video content continues to grow, there is a need for effective tools to manage, organize, and analyze this content. Video analytics can provide valuable insights into viewer behavior, engagement, and performance metrics, helping businesses optimize their video strategies. The market for online video platforms is also characterized by its dynamic nature.

Moreover, new players and innovations are constantly emerging, and existing players are continually updating their offerings to stay competitive. This competition can create investment issues for businesses, as they seek to choose the most profitable and effective solutions for their specific needs. Despite the many opportunities presented by online video platforms, there are also challenges to consider. Data security threats are a growing concern, as video content can contain sensitive information that needs to be protected. Transcoding and uploading large-scale video files can also be time-consuming and resource-intensive.

|

Online Video Platform Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.7% |

|

Market Growth 2025-2029 |

USD 2.39 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

16.9 |

|

Key countries |

US, China, Germany, Canada, UK, India, Japan, France, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Online Video Platform Market Research and Growth Report?

- CAGR of the Online Video Platform industry during the forecast period

- Detailed information on factors that will drive the Online Video Platform Market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the online video platform market growth of industry companies

We can help! Our analysts can customize this online video platform market research report to meet your requirements.