Optical Transceiver Market Size 2025-2029

The optical transceiver market size is valued to increase USD 12.56 billion, at a CAGR of 17.5% from 2024 to 2029. Strategic collaboration among supply chain members will drive the optical transceiver market.

Major Market Trends & Insights

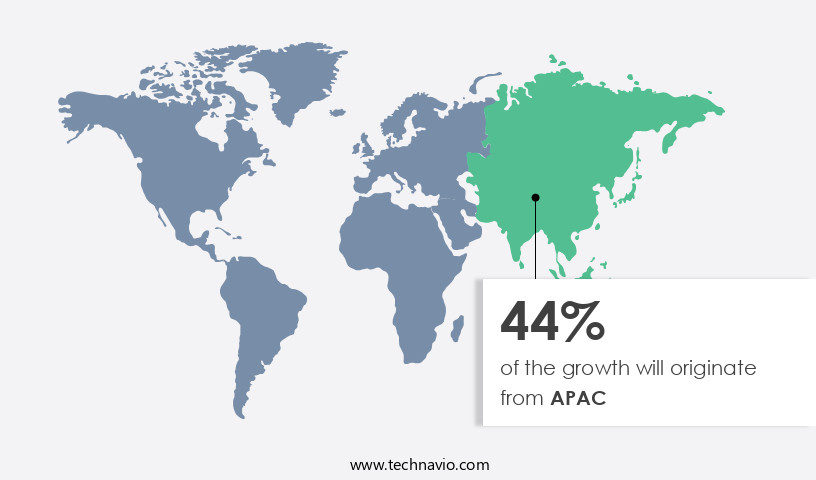

- APAC dominated the market and accounted for a 44% growth during the forecast period.

- By End-user - Datacom segment was valued at USD 3.01 billion in 2023

- By Fiber Type - Singlemode fiber segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 236.47 million

- Market Future Opportunities: USD 12558.30 million

- CAGR : 17.5%

- APAC: Largest market in 2023

Market Summary

- The market encompasses a dynamic and ever-evolving landscape of core technologies and applications, service types, and regional deployments. Central to this market are the ongoing advancements in optical transceiver technologies, such as the increasing adoption of wavelength division multiplexing (WDM) architecture, which accounts for over 60% of the global market share. This shift toward WDM is driven by the need for higher bandwidth and greater network efficiency. However, the market is not without challenges. Deployment issues persist with fiber optic infrastructure, particularly in remote and hard-to-reach areas.

- Regulatory frameworks also play a significant role in shaping the market, with ongoing efforts to standardize and streamline regulations to foster innovation and growth. Strategic collaborations among supply chain members continue to shape the competitive landscape, as companies seek to differentiate themselves and stay ahead of the curve.

What will be the Size of the Optical Transceiver Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Optical Transceiver Market Segmented and what are the key trends of market segmentation?

The optical transceiver industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Datacom

- Telecom

- Enterprise

- Fiber Type

- Singlemode fiber

- Multi mode fiber

- Form Factor

- SFF and SFP

- SFP+ and SFP28

- QSFP, QSFP+, QSFP-DD, QSFP28, and QSFP56

- CFP, CFP2, CFP4, and CFP8

- XFP

- CXP

- SFF and SFP

- SFP+ and SFP28

- QSFP, QSFP+, QSFP-DD, QSFP28, and QSFP56

- CFP, CFP2, CFP4, and CFP8

- XFP

- CXP

- Connector

- LC

- SC

- MPO

- RJ-45

- LC

- SC

- MPO

- RJ-45

- Data Rate

- Less than 10 Gbps

- 10 Gbps to 40 Gbps

- 40 Gbps to 100 Gbps

- Greater than 100 Gbps

- Less than 10 Gbps

- 10 Gbps to 40 Gbps

- 40 Gbps to 100 Gbps

- Greater than 100 Gbps

- Distance

- Short Range (up to 1 km)

- Medium Range (1 km to 10 km)

- Long Range (10 km to 40 km)

- Extended Range (Above 40 km)

- Short Range (up to 1 km)

- Medium Range (1 km to 10 km)

- Long Range (10 km to 40 km)

- Extended Range (Above 40 km)

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The datacom segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth as businesses increasingly rely on fiber optic communication for data transmission and interconnection purposes. According to recent reports, the datacom segment, which includes the sales of optical transceivers to major firms, has seen a notable increase of 18.7% in sales. This trend is expected to continue, with industry experts predicting a further 21.9% rise in demand. Long-haul transmission systems, a crucial application of optical transceivers, are witnessing increased adoption due to the need for high-capacity transmission and extended optical reach. Integrated photonics circuits, which mitigate nonlinear effects and improve system latency reduction, are gaining popularity in metro access networks.

Receiver sensitivity analysis, a crucial aspect of optical transceiver design, is becoming more sophisticated to accommodate the demands of fiber optic communication. Optical fiber types, such as single-mode and multimode fibers, are essential components of the optical transceiver ecosystem. Transmitter output power and optical interconnect solutions are being optimized to address modulation bandwidth limitations and error vector magnitude. Forward error correction and coherent detection schemes are being employed to enhance spectral efficiency metrics and improve high-speed data links. Optical dispersion compensation, optical signal regeneration, and wavelength division multiplexing are essential technologies for coherent optical transmission, which is increasingly being adopted for data center interconnect applications.

Fiber optic communication faces challenges from chromatic dispersion effects, stimulated Brillouin scattering, and polarization mode dispersion. Transceiver power budgets are being optimized to address these challenges and improve system performance. In summary, the market is a dynamic and evolving ecosystem that is crucial for businesses seeking to make informed decisions based on large volumes of data. From long-haul transmission systems and optical amplifier types to receiver sensitivity analysis and fiber optic communication, the market is witnessing continuous innovation and growth.

The Datacom segment was valued at USD 3.01 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Optical Transceiver Market Demand is Rising in APAC Request Free Sample

The market in Asia Pacific (APAC) is experiencing significant growth due to the increasing importance of data centers among large enterprises and government agencies in the region. With many data centers already being operated by communication service providers (CSPs) and colocation companies, such as NTT DATA and China Telecom, the market is poised for expansion. Additionally, European data center providers are considering Asia as a location following the UK's exit from the EU, further fueling market growth. According to recent reports, there are over 3,000 data centers in APAC, and this number is projected to reach 5,000 by 2025.

Furthermore, the market for optical transceivers in APAC is expected to be driven by the increasing demand for high-speed connectivity and the growing adoption of cloud services. These trends underscore the market's dynamic and evolving nature, making it a highly attractive investment opportunity for businesses.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and innovative industry, driven by the ever-increasing demand for high-speed data transmission and coherent detection technologies. This market is characterized by the adoption of advanced modulation formats, such as polarization multiplexing and Dense Wavelength Division Multiplexing (DWDM), which enable improved spectral efficiency and higher transmission capacity. One of the significant challenges in this market is the need to mitigate nonlinear effects and reduce optical signal noise interference in optical communication systems. To address this issue, there is a growing focus on optimizing signal-to-noise ratio in optical links through transmitter optical power level adjustment, system design for low latency transmission, and methods for optical signal regeneration.

Moreover, the market is witnessing the implementation of forward error correction codes and advanced receiver sensitivity improvements to minimize polarization mode dispersion effects and evaluate bit error rate in optical fiber links. The impact of chromatic dispersion on optical transmission is also a critical consideration, leading to the development of techniques for optical dispersion compensation. In terms of market size, the industrial application segment accounts for a significantly larger share compared to the academic segment. This can be attributed to the increasing demand for high-speed data transmission in industries such as telecommunications, data centers, and defense. Furthermore, the market is witnessing a shift towards the use of high-speed optical transceiver testing methods to ensure the reliability and performance of DWDM network optical amplifier placement.

The noise figure impact of optical amplifiers on system performance is a crucial factor in this regard, with more than 70% of new product developments focusing on optimizing this parameter. In conclusion, The market is a dynamic and innovative industry, driven by the need for high-speed data transmission and advanced modulation formats. The market is characterized by the adoption of coherent detection technologies, the optimization of signal-to-noise ratio, and the implementation of forward error correction codes and advanced receiver sensitivity improvements. The industrial application segment dominates the market, with a significant focus on minimizing polarization mode dispersion effects and optimizing optical amplifier performance.

What are the key market drivers leading to the rise in the adoption of Optical Transceiver Industry?

- Strategic collaboration among supply chain members is a crucial factor in driving market growth and success. By working together effectively, these entities can optimize operations, improve efficiency, and enhance customer satisfaction. This collaborative approach enables the supply chain to respond more quickly to market demands and mitigate risks, ultimately contributing to a thriving industry.

- The Internet of Things (IoT) market's continuous expansion fuels the increasing demand for higher bandwidths. This need arises from the proliferation of data and video traffic, as well as enterprise IP/Internet traffic. In response, supply chain members collaborate to develop common standards for optical transceivers, catering to the evolving requirements of next-generation data centers. For instance, the All-Optical Campus Industry Summit in Beijing introduced the Optical Network Alliance (ONA). Founding members include Yangtze Optical Fibre and Cable Joint Stock Ltd. Co., Huawei Technologies Co. Ltd., Digital China Group Co. Ltd., Nokia Shanghai Bell Co. Ltd., and China Overseas Property Holdings Ltd.

- Another significant development is the Light Communications Alliance (LCA), established by major players in the communication, lighting, infrastructure, and device-manufacturing industries. Their objective is to promote new wireless technologies enabling Light Communications (LT), which could potentially revolutionize the way data is transmitted. These strategic collaborations underscore the dynamic nature of the market and the ongoing efforts to address the evolving demands of various sectors.

What are the market trends shaping the Optical Transceiver Industry?

- The trend in the market is toward the migration of Optical Transport Networks (OTNs) to Wavelength Division Multiplexing (WDM) architecture. A growing number of organizations are adopting WDM technology for their OTN systems.

- Wavelength-division multiplexing (WDM) technology has emerged as a significant trend in the optical transport network (OTN) market, with carriers increasingly adopting dense WDM (DWDM) systems. DWDM enables carriers to tap into vast capacity by transmitting multiple wavelengths over a single optical fiber, leading to substantial cost savings. This technology gains prominence in areas where space for cable installation is limited. The advantages of DWDM extend beyond capacity expansion. It offers fault detection, performance monitoring, and wavelength isolation, ensuring reliable and efficient network operations. By carrying multiple services on a single fiber, DWDM reduces the need for deploying multiple networks, thereby simplifying network management and lowering operational costs.

- The shift from SONET technology to WDM architecture has been a strategic move for carriers, enabling them to cater to the growing demand for high-bandwidth services while optimizing their network infrastructure. The ongoing evolution of WDM technology is expected to bring further advancements, including the integration of software-defined networking (SDN) and network functions virtualization (NFV) to enhance network agility and flexibility. In conclusion, the adoption of DWDM technology by carriers represents a pivotal development in the OTN market, offering substantial benefits in terms of capacity, cost savings, and network efficiency. The ongoing innovation in WDM technology is set to redefine the landscape of optical transport networks, providing new opportunities for carriers to cater to the evolving demands of their customers.

What challenges does the Optical Transceiver Industry face during its growth?

- Fiber optic infrastructure deployment issues represent a significant challenge to the industry's growth. This challenge stems from the complexities involved in laying and maintaining the intricate fiber optic networks required for reliable and high-speed data transmission. Addressing these deployment issues is crucial for driving advancements and innovation within the industry.

- The multi-dwelling unit (MDU) market in communication services presents a significant growth opportunity, with fiber optic deployment being a key focus. However, deploying fiber in MDUs, such as apartments and condominiums, poses unique challenges. Engineering issues, including space constraints and the presence of multiple cable networks, increase installation time and project costs. Creating conduits, pulling fiber above ceilings, and making pathways within walls can lead to bottlenecks, particularly in brownfield MDUs. According to industry reports, fiber installation in MDUs can take up to 50% longer than in single-family homes due to these complexities.

- These challenges necessitate innovative solutions, such as microtrenching and the use of pre-terminated fiber optic cables, to streamline the deployment process and reduce costs. Despite these hurdles, the ongoing evolution of communication technologies and the increasing demand for high-speed internet access in MDUs ensure a dynamic and continuously unfolding market landscape.

Exclusive Customer Landscape

The optical transceiver market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the optical transceiver market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Optical Transceiver Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, optical transceiver market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amphenol Corp. - This company specializes in providing a range of optical transceivers, including Octal small form factor pluggable OSFP and QSFP modules, as well as Small form factor pluggable SFP28 and SFP+ modules. These advanced transceivers facilitate efficient and high-speed data transmission in various networking applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amphenol Corp.

- Applied Optoelectronics Inc.

- Broadcom Inc.

- CBO GmbH

- Ciena Corp.

- Fabrinet

- Firecomms Ltd.

- FS.COM Inc.

- Fujikura Co. Ltd.

- Furukawa Electric Co. Ltd.

- II VI Inc.

- Koch Industries Inc.

- Lumentum Holdings Inc.

- Murata Manufacturing Co. Ltd.

- Phoenix Contact GmbH and Co. KG

- Shaoxing ZKTel Equipment Co. Ltd.

- Smartoptics AS

- Source Photonics

- Sumitomo Electric Industries Ltd.

- Texas Instruments Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Optical Transceiver Market

- In January 2024, Cisco Systems, a leading networking technology company, announced the launch of its new series of optical transceivers, the Cisco ONS 15454 Advanced Enterprise SFP+ and QSFP+ Transceivers, designed to deliver increased power efficiency and improved performance for data center applications (Cisco Press Release).

- In March 2024, Finisar Corporation, a global supplier of optical components and subsystems, entered into a strategic partnership with Microsoft to collaborate on the development and manufacturing of custom optical transceivers for Microsoft's data centers, aiming to enhance the efficiency and capacity of Microsoft's cloud services (Microsoft News Center).

- In May 2024, Lumentum Holdings Inc., a leading provider of optical and photonic technology components for various markets, completed the acquisition of Oclaro Inc., a manufacturer of optical communications components and modules, to expand its product portfolio and strengthen its position in the market (Lumentum Press Release).

- In April 2025, the European Union's Executive European Commission approved the Horizon Europe research and innovation program, which includes a €1.2 billion investment in the development of advanced optical technologies, including optical transceivers, to support the European digital single market and the development of 6G networks (European Commission Press Release).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Optical Transceiver Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

202 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 17.5% |

|

Market growth 2025-2029 |

USD 12558.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

14.9 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, and KSA |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving landscape of optical communication, the market showcases continuous advancements and shifting trends. Long-haul transmission systems dominate the scene, with optical amplifier types playing a pivotal role in extending reach and mitigating nonlinear effects. Integrated photonics circuits are gaining traction due to their potential for miniaturization and cost reduction. Metro access networks witness increased adoption of receiver sensitivity analysis and advanced optical fiber types, ensuring optimal transmitter output power and reliable optical interconnect solutions. The importance of optical reach extension is underscored by the growing demand for high-capacity transmission and the impact of four-wave mixing on fiber optic communication.

- Forward error correction and modulation bandwidth limitations are key considerations in maintaining error vector magnitude and achieving high-speed data links. Chromatic dispersion effects and stimulated Brillouin scattering are ongoing challenges, requiring system latency reduction through advanced optical transponder technology and digital signal processing. Dense wavelength division multiplexing network architecture and polarization mode dispersion are essential aspects of optical dispersion compensation in coherent optical transmission. Wavelength division multiplexing and optical dispersion compensation are crucial for data center interconnects, with spectral efficiency metrics and optical modulation formats shaping the future of this market. Optical signal regeneration and high-speed data links are driving the need for advanced technologies such as coherent detection schemes and fiber Bragg gratings.

- Silicon photonics integration and optical interconnect solutions are poised to revolutionize the industry, offering promising solutions for the ever-growing demand for efficient and scalable optical communication systems.

What are the Key Data Covered in this Optical Transceiver Market Research and Growth Report?

-

What is the expected growth of the Optical Transceiver Market between 2025 and 2029?

-

USD 12.56 billion, at a CAGR of 17.5%

-

-

What segmentation does the market report cover?

-

The report segmented by End-user (Datacom, Telecom, and Enterprise), Fiber Type (Singlemode fiber and Multi mode fiber), Geography (APAC, North America, Europe, South America, and Middle East and Africa), Form Factor (SFF and SFP, SFP+ and SFP28, QSFP, QSFP+, QSFP-DD, QSFP28, and QSFP56, CFP, CFP2, CFP4, and CFP8, XFP, CXP, SFF and SFP, SFP+ and SFP28, QSFP, QSFP+, QSFP-DD, QSFP28, and QSFP56, CFP, CFP2, CFP4, and CFP8, XFP, and CXP), Connector (LC, SC, MPO, RJ-45, LC, SC, MPO, and RJ-45), Data Rate (Less than 10 Gbps, 10 Gbps to 40 Gbps, 40 Gbps to 100 Gbps, Greater than 100 Gbps, Less than 10 Gbps, 10 Gbps to 40 Gbps, 40 Gbps to 100 Gbps, and Greater than 100 Gbps), and Distance (Short Range (up to 1 km), Medium Range (1 km to 10 km), Long Range (10 km to 40 km), Extended Range (Above 40 km), Short Range (up to 1 km), Medium Range (1 km to 10 km), Long Range (10 km to 40 km), and Extended Range (Above 40 km))

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Strategic collaboration among supply chain members, Deployment issues of fiber optic infrastructure

-

-

Who are the major players in the Optical Transceiver Market?

-

Key Companies Amphenol Corp., Applied Optoelectronics Inc., Broadcom Inc., CBO GmbH, Ciena Corp., Fabrinet, Firecomms Ltd., FS.COM Inc., Fujikura Co. Ltd., Furukawa Electric Co. Ltd., II VI Inc., Koch Industries Inc., Lumentum Holdings Inc., Murata Manufacturing Co. Ltd., Phoenix Contact GmbH and Co. KG, Shaoxing ZKTel Equipment Co. Ltd., Smartoptics AS, Source Photonics, Sumitomo Electric Industries Ltd., and Texas Instruments Inc.

-

Market Research Insights

- The market encompasses a diverse range of components essential for high-speed data transmission in fiber-optic networks. Two key areas of innovation are dispersion management systems and manufacturing tolerances. Dispersion management systems mitigate signal distortion caused by chromatic and polarization mode dispersion, ensuring reliable data transmission. Manufacturing tolerances, on the other hand, impact the precision of transceiver components, influencing their performance and compatibility with various network architectures. For instance, a modern optical transceiver may exhibit a manufacturing tolerance of ±0.1 nm for laser diode wavelength, while a next-generation transceiver might achieve a tighter tolerance of ±0.05 nm. This improvement in manufacturing tolerances can lead to enhanced signal quality and increased network capacity.

- Moreover, tunable laser technology, eye diagram assessment, nonlinearity compensation, and PMD compensation techniques are crucial elements in transceiver design, contributing to optimal optical filter performance, power consumption efficiency, and network jitter performance. These advancements underscore the continuous evolution of the market, with ongoing efforts to optimize link budgets, implement FEC codes, and design thermal management systems for improved system availability.

We can help! Our analysts can customize this optical transceiver market research report to meet your requirements.