Tunable Laser Market Size 2024-2028

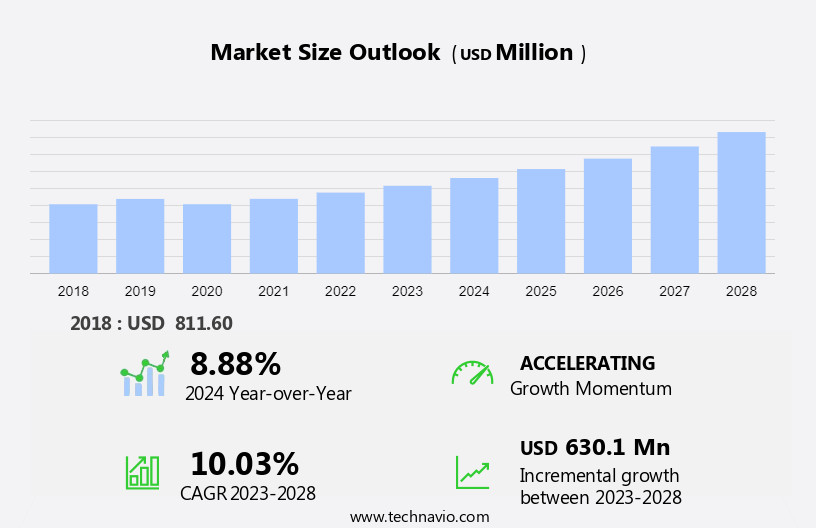

The tunable laser market size is forecast to increase by USD 630.1 million at a CAGR of 10.03% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for advanced microscopy applications in various industries, including quantum research. Tunable lasers offer superior wavelength accuracy and mechanical stability, making them indispensable in microscopy and other precision measurement applications. These lasers utilize an active species within an insulating dielectric crystal, glass, or semiconductor material to generate a tunable beam. Furthermore, the market is driven by the rapid advancements in technology, particularly In the field of quantum research, where mode hop-free tunable lasers are essential for achieving high temperature sensitivity. The availability of alternative pump sources and gain media is, however, posing a challenge to market growth. In the US, the market is expected to witness steady growth, driven by the increasing adoption of nanotechnology and the development of autonomous vehicle technology, which relies heavily on tunable lasers for LiDAR applications.

What will be the Size of the Tunable Laser Market During the Forecast Period?

- Tunable laser systems have gained significant importance in various scientific and industrial applications due to their ability to generate coherent light at specific wavelengths. These systems utilize different technologies, including dye lasers, optical parametric oscillators (OPOs), free electron lasers, and titanium sapphire crystals, to produce tunable light. Spectroscopic applications, such as absorption, emission, and Raman spectroscopy, are major areas where tunable laser systems play a crucial role. In spectroscopy, these systems enable the analysis of materials by measuring the interaction between light and matter at specific wavelengths. Interferometry, microscopy, and holography are other fields that benefit from tunable laser systems due to their high wavelength accuracy and mechanical stability. Nonlinear optical effects, such as frequency doubling, are essential in tunable laser systems. These effects allow the generation of single-frequency laser light at various wavelengths by converting the input light into higher frequencies. The wavelengths generated by tunable laser systems range from the ultraviolet to the infrared spectrum, making them versatile tools for various applications.

- Further, tunable laser systems' performance is influenced by several factors, including wavelength accuracy, temperature sensitivity, mechanical stability, and pump source. Wavelength accuracy is crucial for precise spectroscopic measurements, while temperature sensitivity affects the system's stability and performance. Mechanical stability is essential for maintaining the laser's focus and ensuring consistent results. The choice of pump source and gain medium significantly impacts the system's efficiency and tuning range. Dye lasers and titanium sapphire crystals are common gain media used in tunable laser systems. Dye lasers offer a broad tuning range and high power output, making them suitable for various applications. Titanium sapphire crystals, on the other hand, provide a narrower tuning range but offer excellent wavelength stability and are commonly used in high-precision applications. Optical resonators are essential components of tunable laser systems. They help to maintain the laser's optical length and provide feedback to the system, ensuring stable and consistent output.

- Thus, holographic optical elements (HOEs) can be used to control the laser's mode hopping, improving the system's tuning range and stability. Thus, tunable laser systems continue to be a vital technology in various scientific and industrial applications due to their ability to generate coherent light at specific wavelengths. The technological advancements in tunable laser systems, such as improvements in wavelength accuracy, mechanical stability, and tuning range, have expanded their applicability in fields like spectroscopy, interferometry, microscopy, and holography.

How is this Tunable Laser Industry segmented and which is the largest segment?

The tunable laser industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Solid state

- Free electron laser

- Gas

- Others

- Geography

- APAC

- China

- Japan

- South Korea

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Type Insights

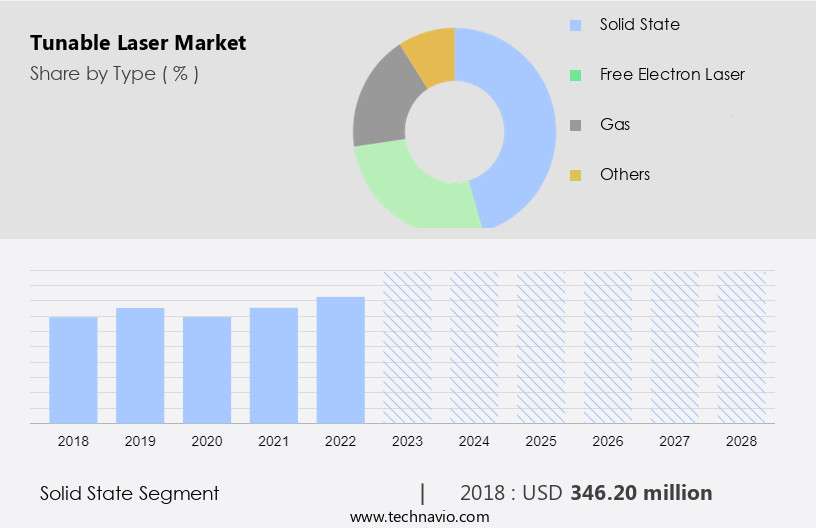

- The solid state segment is estimated to witness significant growth during the forecast period.

Solid-state tunable lasers are essential optical sources in various industries, including spectroscopy, metal processing, medical applications, and environmental instrumentation. The spectral width of solid-state tunable laser sources ranges from 230 nm to 670 nm with a typical FWHM of 3 nm. Organic solid-state lasers (OSSLs) represent an attractive alternative to conventional solid-state and dye lasers, offering the benefits of both while maintaining a lower cost. Brillouin scattering and Raman spectroscopy applications require mid-IR sources, which are efficiently provided by solid-state tunable lasers.

Optical components, such as fibers, play a crucial role in enhancing the functionality and versatility of these lasers. Solid-state tunable lasers have found extensive applications in diverse sectors. In metal processing, they are employed for cutting, welding, and surface treatment. In the medical field, they are utilized in eye surgeries, such as LASIK and cataract surgery. For red, green, and blue (RGB) light sources in laser printers and projectors, solid-state tunable lasers are indispensable. In environmental instrumentation, they are used for gas sensing, pollution monitoring, and trace gas analysis. Thus, solid-state tunable lasers, with their broad tunability and versatility, are indispensable tools in various industries.

From spectroscopy to metal processing, medical applications, and environmental instrumentation, these lasers play a vital role in advancing technological innovations. The integration of optical components, such as fibers, further expands their capabilities, making them indispensable in numerous applications.

Get a glance at the Tunable Laser Industry report of share of various segments Request Free Sample

The solid state segment was valued at USD 346.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

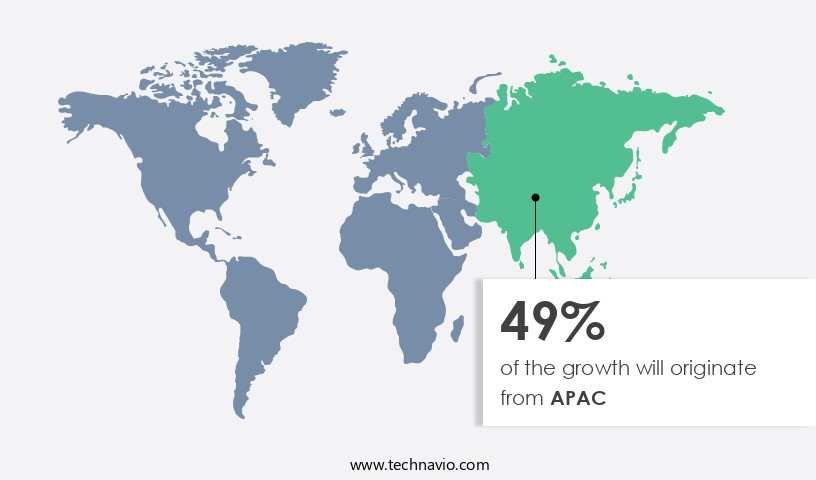

- APAC is estimated to contribute 49% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

In the market, the largest market share was held by a specific region in 2023. The primary driver of demand for tunable lasers in this region is the semiconductor industry. With a significant concentration of semiconductor manufacturing companies in this region, particularly in countries like China, Taiwan, and South Korea, the demand for semiconductor integrated circuits (ICs) is experiencing growth. This expansion is due to the increasing utilization of electronic components in various industries, including automotive, consumer electronics, and telecommunications.

Additionally, advancements in wired and wireless communication technologies, a surge in research and development activities in artificial intelligence, and substantial investments in Industry 4.0 are contributing factors to the growth of the market in this region. According to recent studies, the semiconductor industry is expected to continue its growth trajectory, further boosting the demand for tunable lasers.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Tunable Laser Industry?

Growth in adoption of nanotechnology across sectors is the key driver of the market.

- Nanotechnology, encompassing particles sized between 1-100 nanometers, is poised for significant expansion during the forecast period. The integration of nanotechnology in various research domains, including life sciences, has led to innovative spectroscopic applications and advanced materials. In the healthcare sector, this technology's adoption has surged due to the increasing demand for sophisticated diagnostic systems. companies specializing in diagnostic instruments and machinery are focusing on nanotechnology's integration to expedite the diagnostic process. This alignment with the primary objective of diagnostics - to identify medical issues swiftly - is a significant advantage. Advancements in nonlinear optical effects, such as Raman shifting and optical parametric oscillators, are driving the market. These effects enable precise wavelength manipulation, which is crucial in numerous applications, including spectroscopy and material processing. Free electron lasers, another advanced technology, offer tunability across a broad spectral range, making them indispensable in scientific research.

- Tunable laser systems, which enable wavelength tuning, are essential in various industries, including telecommunications, spectroscopy, and material processing. These systems' versatility and ability to deliver high-power, stable, and tunable laser beams make them invaluable in numerous applications. companies are investing heavily in research and development to enhance the performance and functionality of these systems, ensuring their continued relevance In the market. Thus, the nanotechnology-driven advancements in tunable laser systems, with their applications in spectroscopic research, material processing, and telecommunications, are expected to fuel the market's growth. The integration of nonlinear optical effects, such as Raman shifting and optical parametric oscillators, and advanced technologies like free electron lasers, will further bolster the market's expansion.

What are the market trends shaping the Tunable Laser Industry?

Rapid developments in autonomous vehicle technology are the upcoming market trend.

- Companies like Continental AG and Robert Bosch GmbH are leading the way in advancing autonomous driving technology, which is increasingly gaining acceptance in both the passenger and commercial vehicle markets. Self-driving cars may become a common sight on roads within the next several years, and by the end of the forecast period, a substantial number of autonomous vehicles are expected to be in use. Major automotive industry players are making significant strides towards realizing this future reality. In the realm of LiDAR (Light Detection and Ranging) technology, which is crucial for autonomous vehicles, tunable lasers play a pivotal role.

- These lasers offer advantages such as microscopic precision in microscopy and high quantum research capabilities. Their mode hop functionality ensures mechanical stability, while their wavelength accuracy and temperature sensitivity make them an ideal choice for use in pump sources and gain media. The burgeoning demand for autonomous vehicles is set to propel the market forward during the forecast period.

What challenges does the Tunable Laser Industry face during its growth?

The availability of substitutes for tunable lasers is a key challenge affecting the industry's growth.

- The market faces a limitation due to the widespread usage of alternative technologies, such as zirconia, mercury, and paramagnetic analyzers, for isotope ratio measurements in various industries. These traditional lasers are favored by market participants for their suitability in measuring parts per million (ppm) to % levels of gases like oxygen (O2) in industrial applications.

- For instance, zirconia-based lasers are extensively used by industrial gas producers, industrial gas users, and food packaging companies for their ability to provide specific point measurements with a higher level of accuracy and true calibration. This feature is particularly valuable in small-scale furnaces. Intracavity beam expansion and grazing-incident grating designs are employed in tunable laser oscillators to expand the coherent light's spectral bandwidth, enabling wavelengths to cover a broader range in spectroscopy and interferometry applications.

Exclusive Customer Landscape

The tunable laser market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the tunable laser market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, tunable laser market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agilent Technologies Inc.

- AT and T Inc.

- Emcore Corp.

- EXFO Inc.

- Focused Photonics Inc.

- Fujitsu Ltd.

- HUBNER GmbH and Co. KG

- II VI Inc.

- Leonardo Spa

- Lucent Technology Ltd.

- Lumentum Holdings Inc.

- Luminar Technologies Inc.

- Luna Innovations Inc.

- Mettler Toledo International Inc.

- MKS Instruments Inc.

- Santec Corp.

- TOPTICA Photonics AG

- Viavi Solutions Inc.

- Yokogawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Tunable lasers are essential optical sources used in various applications, including spectroscopy, interferometry, microscopy, quantum research, and more. These lasers offer the ability to tune the wavelength, providing versatility in addressing different spectral regions. The tunability is achieved through nonlinear optical effects, such as Raman shifting, optical parametric oscillators, and free electron lasers. Dye lasers and titanium sapphire crystals are common gain media used in tunable laser systems. The wavelength accuracy and mechanical stability are crucial factors In these applications, with tuning ranges spanning nanometers in various bands, such as O-band, E-band, C-band, L-band, and U-band. Coherent light from tunable lasers enables high-precision measurements in isotope ratio measurements and other spectroscopic applications.

Thus, the tunable laser oscillators provide single-frequency laser light through techniques like intracavity beam expansion, grazing-incidence grating design, and side-mode suppression ratio. Pump sources and gain media play a significant role in tunable lasers, with frequency doubling and second harmonic generation used to generate specific wavelengths. Temperature sensitivity and wavelength accuracy are essential considerations for these systems, ensuring optimal performance. Optical components, including fibers, are integral to the design and functionality of tunable lasers. Applications in quantum research and other advanced fields require high coherence and narrow spectral line widths, which can be achieved through careful engineering and design.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.03% |

|

Market growth 2024-2028 |

USD 630.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.88 |

|

Key countries |

US, China, Germany, South Korea, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Tunable Laser Market Research and Growth Report?

- CAGR of the Tunable Laser industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the tunable laser market growth of industry companies

We can help! Our analysts can customize this tunable laser market research report to meet your requirements.