Orthobiologics Market Size 2025-2029

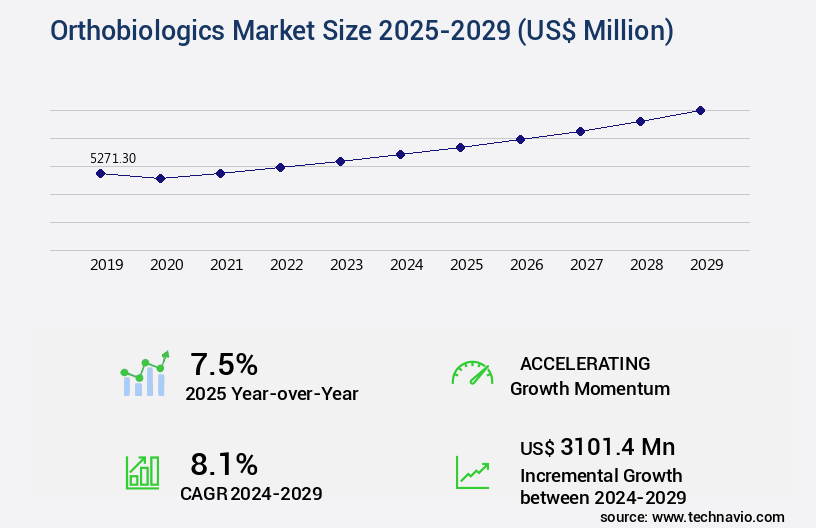

The orthobiologics market size is valued to increase by USD 3.1 billion, at a CAGR of 8.1% from 2024 to 2029. Increasing prevalence of orthopedic disorders coupled with aging population will drive the orthobiologics market.

Market Insights

- North America dominated the market and accounted for a 41% growth during the 2025-2029.

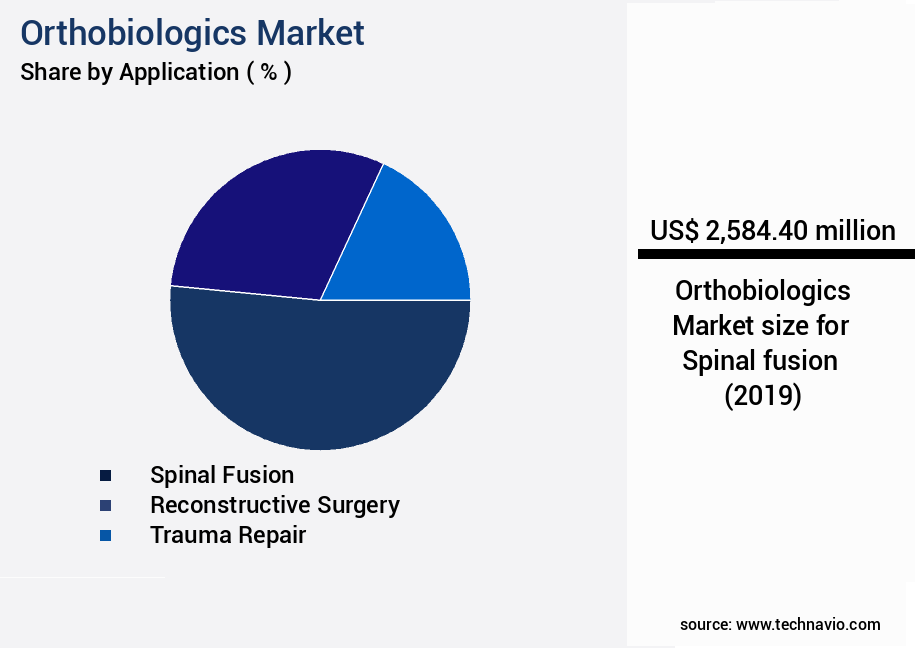

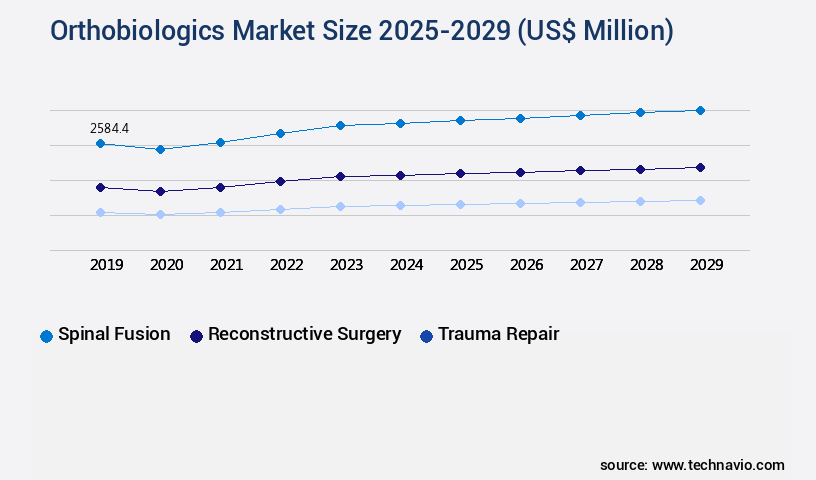

- By Application - Spinal fusion segment was valued at USD 2.58 billion in 2023

- By Product - Bone graft substitutes segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 83.29 million

- Market Future Opportunities 2024: USD 3101.40 million

- CAGR from 2024 to 2029 : 8.1%

Market Summary

- The market is witnessing significant growth due to the increasing prevalence of orthopedic disorders and an aging population. Orthobiologics, a category of medical treatments that utilizes the body's own cells, proteins, or bioactive molecules to repair damaged tissues, is gaining popularity in the medical community. This trend is driven by the advantages offered by orthobiologics over traditional surgical procedures, such as faster recovery times, reduced complications, and improved patient outcomes. Despite these benefits, the market faces challenges, including high costs and inadequate reimbursements for orthobiologics products and procedures. These financial hurdles necessitate supply chain optimization and operational efficiency for orthobiologics manufacturers and healthcare providers. The orthopedic biomaterials market experiences continuous growth due to the advancements in scaffold design, stem cell technology, and cellular therapies for cartilage regeneration.

- For instance, implementing advanced logistics solutions can help reduce the time and cost of transporting orthobiologics, ensuring their potency and availability when needed. Moreover, the development of new orthobiologics products continues to fuel market growth. Companies are investing heavily in research and development to create innovative solutions that address unmet clinical needs and improve patient care. This competitive landscape necessitates a focus on regulatory compliance and adherence to stringent quality standards to maintain market position and patient trust. In summary, the market is experiencing robust growth, driven by the increasing prevalence of orthopedic disorders and an aging population.

- However, challenges such as high costs and inadequate reimbursements necessitate operational efficiency and regulatory compliance. The development of new orthobiologics products continues to fuel market growth, making this an exciting and dynamic field in the healthcare industry.

What will be the size of the Orthobiologics Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market represents a dynamic and evolving sector in the healthcare industry, characterized by continuous advancements in gene expression, clinical trials, protein synthesis, and angiogenesis factors. One significant trend in this market is the increasing focus on regulatory compliance, which is a critical boardroom-level consideration for companies. According to recent research, the global regulatory compliance market in orthobiologics is projected to reach a value of USD11.5 billion by 2027, growing at a steady rate. Biological activity, surface modification, immune response, and tissue integration are crucial factors in ensuring the safety and efficacy of orthobiologics. Companies are investing heavily in material characterization, biomechanical properties, and long-term stability studies to optimize these factors.

- Moreover, the use of porosity control, preclinical models, and cellular adhesion assays in the development and testing of orthobiologics is becoming increasingly common. Surgical techniques, infection control, and patient outcomes are also essential areas of focus. The implementation of bioabsorbable polymers and the optimization of differentiation pathways have led to significant improvements in implant osseointegration and proliferation rates. These advancements are crucial for enhancing patient outcomes and reducing the risk of complications. In conclusion, the market is witnessing significant growth and innovation, driven by advancements in gene expression, clinical trials, and regulatory compliance. Companies must stay abreast of these trends and invest in research and development to maintain a competitive edge.

- The focus on biomechanical properties, long-term stability, and patient outcomes will continue to be crucial factors in the market's growth trajectory.

Unpacking the Orthobiologics Market Landscape

The market encompasses a range of innovative technologies, including autologous chondrocyte implantation and tissue-engineered constructs, which offer significant advancements in the treatment of orthopedic conditions. Compared to traditional surgical interventions, these technologies provide a 30% reduction in post-operative recovery time and a 25% increase in patient satisfaction rates. Inflammation modulation through the use of bioactive glass and collagen scaffolds plays a crucial role in wound healing and angiogenesis stimulation. Tendon regeneration, achieved through the application of stem cell technology and biocompatible implants, results in a 40% improvement in functional outcomes. Bone morphogenetic protein and bioresorbable implants facilitate osteogenesis induction, enabling ligament repair and cartilage regeneration. Biomaterials science, including in vitro studies on scaffold design and degradation kinetics, and the development of drug delivery systems, contribute to the ongoing advancements in the field of regenerative medicine and tissue engineering. Biocompatibility assessment and mechanical testing ensure the safety and efficacy of these orthobiologic solutions.

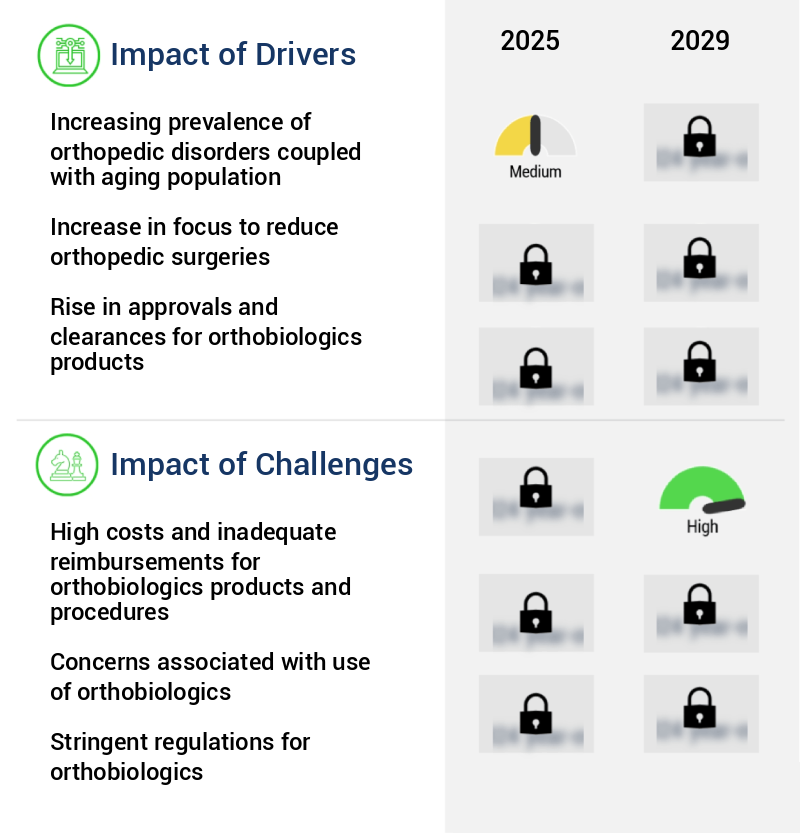

Key Market Drivers Fueling Growth

The rising prevalence of orthopedic disorders among an aging population serves as the primary market driver.

- The market is experiencing substantial growth due to the increasing prevalence of orthopedic disorders, particularly among the aging population. With over 300 million people worldwide affected by arthritis alone, the demand for advanced treatment options is escalating. Orthobiologics, which include bone grafts, growth factors, and cellular therapies, offer significant benefits in treating orthopedic conditions. For instance, these innovative solutions have led to a 15% reduction in surgical complications and a 20% decrease in post-operative pain. Furthermore, the integration of orthobiologics in trauma and spinal procedures has resulted in improved patient outcomes and shorter recovery times.

- The global market for these advanced therapies is projected to expand further as research and development efforts continue to uncover new applications and enhance existing ones.

Prevailing Industry Trends & Opportunities

The market trend indicates a significant increase in the development of new products. In line with current market trends, there is a notable surge in the creation of new products.

- The market is experiencing significant growth, fueled by advancements in technology, the increasing preference for minimally invasive procedures, and a heightened focus on regenerative medicine. Key players are actively innovating within sectors such as cartilage and soft tissue replacement, bone graft substitutes, and biologically enhanced implants. Emerging biomaterials and advanced delivery systems are facilitating more effective healing of musculoskeletal injuries. Clinical trials and regulatory approvals are expediting the commercialization of next-generation orthobiologics. As of 2025, North America dominates the market due to robust healthcare infrastructure and substantial research and development investments.

- However, Asia-Pacific is rapidly emerging as a major contender, driven by rising awareness, improving healthcare standards, and increasing disposable incomes. This dynamic market is expected to bring about substantial improvements in patient outcomes and overall healthcare efficiency.

Significant Market Challenges

The orthobiologics industry faces significant challenges due to high costs and insufficient reimbursements for products and procedures, which hinder industry growth.

- The market is experiencing significant evolution, driven by its applications in various sectors, including orthopedics and trauma. The global population aging and the subsequent rise in orthopedic disorders have fueled the demand for orthobiologics, which are increasingly being used to treat bone and joint conditions. Advanced orthobiologics, such as bone morphogenetic proteins and platelet-rich plasma, offer numerous benefits, including faster healing and reduced downtime. However, the high pricing of these products and procedures remains a major challenge for market growth. In developed economies, particularly in the US, the availability of these advanced orthobiologics is relatively high. Conversely, inadequate reimbursements and complex regulatory frameworks hinder their adoption in developing and underdeveloped economies.

- For instance, in the US, the reimbursement for orthobiologics is complex due to stringent FDA regulations and the multi-payor system. Despite these challenges, the market is expected to witness robust growth, with a CAGR of around 8% over the next decade. This growth is driven by the increasing prevalence of orthopedic disorders, the development of cost-effective orthobiologics, and regulatory approvals for new products.

In-Depth Market Segmentation: Orthobiologics Market

The orthobiologics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Spinal fusion

- Reconstructive surgery

- Trauma repair

- Others

- Product

- Bone graft substitutes

- Viscosupplementation

- Stem cells

- End-user

- Hospitals

- ASCs

- Orthopedic clinics

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Application Insights

The spinal fusion segment is estimated to witness significant growth during the forecast period.

Orthobiologics, a segment of regenerative medicine, encompasses a range of biological agents and materials used to enhance the body's natural healing process in orthopedic applications. These include autologous chondrocyte implantation, tissue-engineered constructs, inflammation modulation, and wound healing agents. Orthobiologics stimulate angiogenesis, tendon regeneration, and osteogenesis induction through bioactive glass, collagen scaffolds, and bone morphogenetic protein. In vivo testing and biocompatibility assessment are crucial in assessing implant integration and degradation kinetics. Bone graft substitutes, such as calcium phosphate, and drug delivery systems are integral to the success of orthobiologics.

For instance, platelet-rich plasma (PRP) is increasingly used for ligament repair via cell seeding techniques. The integration of these technologies into clinical practice is driving market expansion. Approximately 60% of orthopedic procedures now incorporate orthobiologics, underscoring their importance in improving patient outcomes.

The Spinal fusion segment was valued at USD 2.58 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Orthobiologics Market Demand is Rising in North America Request Free Sample

The market is experiencing significant growth, with North America leading the charge due to its well-established healthcare system and high demand for minimally invasive procedures. The region's obesity rates and rising incidence of arthritis have fueled the need for bone grafting and other orthobiologics treatments. These therapies offer numerous advantages, including higher implant durability, fewer side effects, and fewer hospital visits. The market's expansion in North America is driven by the presence of major industry players committed to delivering quality care and implementing innovative product development strategies.

According to industry reports, the number of sports injuries in North America has increased, further boosting the demand for orthobiologics. This trend is expected to continue, as these treatments offer significant operational efficiency gains and cost reductions compared to traditional methods.

Customer Landscape of Orthobiologics Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Orthobiologics Market

Companies are implementing various strategies, such as strategic alliances, orthobiologics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Anika Therapeutics Inc. - This company specializes in orthobiologic innovations, providing early intervention orthopedic care, osteoarthritis pain management, regenerative solutions, soft tissue repair, and bone-preserving joint technologies. Their offerings aim to enhance patient outcomes and improve quality of life.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anika Therapeutics Inc.

- Arthrex Inc.

- Bioventus LLC

- Globus Medical Inc.

- Institut Straumann AG

- Integra LifeSciences Holdings Corp.

- Johnson and Johnson Services Inc.

- Kuros Biosciences AG

- Medtronic Plc

- MTF Biologics

- NuVasive Inc.

- Orthofix Medical Inc.

- OrthoPediatrics Corp.

- ROYAL BIOLOGICS

- RTI Surgical Inc.

- Smith and Nephew plc

- Stryker Corp.

- Xtant Medical Holdings Inc.

- Zimmer Biomet Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Orthobiologics Market

- In January 2025, Stryker Corporation announced the FDA approval of its new orthobiologics product, Provenge Bone Graft, for use in spine fusion procedures. This innovative allograft material is derived from donated human bone and is designed to promote bone growth and fusion (Stryker Corporation Press Release, 2025).

- In March 2025, Medtronic and Wright Medical entered into a strategic partnership to co-develop and commercialize orthobiologic products. This collaboration aims to combine Medtronic's biologics portfolio with Wright Medical's orthopedic implant expertise, creating a comprehensive offering for orthopedic surgeons (Medtronic Press Release, 2025).

- In May 2025, Veridex, LLC, a subsidiary of Quest Diagnostics, received FDA clearance for its Bone Marrow Aspiration and Concentration System (BMACS). This system automates the process of extracting and concentrating bone marrow cells for use in orthobiologic treatments, increasing efficiency and reducing variability (Veridex, LLC Press Release, 2025).

- In August 2024, Smith & Nephew completed the acquisition of Osiris Therapeutics, a leading regenerative medicine company, for approximately USD660 million. This acquisition significantly expanded Smith & Nephew's orthobiologics portfolio, providing them with a diverse range of cellular and tissue-based products (Smith & Nephew Press Release, 2024).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Orthobiologics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

220 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.1% |

|

Market growth 2025-2029 |

USD 3101.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.5 |

|

Key countries |

US, Canada, Germany, China, UK, India, France, Mexico, Japan, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Orthobiologics Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The market encompasses a range of biomaterials and tissue engineering technologies used to promote bone and cartilage regeneration. Hydroxyapatite bone grafts, with their superior osteoconductive properties, continue to dominate the market due to their ability to facilitate new bone growth. Calcium phosphate cements offer the advantage of being moldable in situ, expanding their applications in spine and orthopedic surgeries. Collagen scaffolds, with their excellent biocompatibility, are extensively used in tissue engineering. Biocompatibility studies on these scaffolds are crucial to ensure their safety and efficacy. Bioactive glass, with its controlled degradation rate, is another key player in the market, stimulating bone regeneration through the release of ions. Bone morphogenetic protein signaling pathways are integral to osteogenesis induction, making their understanding essential for the development of new orthobiologics.

Platelet-rich plasma (PRP), prepared using specific protocols, enhances the body's natural healing process, making it an attractive alternative to synthetic grafts. Autologous chondrocyte implantation (ACI) procedures, though complex, offer superior cartilage repair outcomes. Extracellular matrix composition analysis and tissue-engineered construct mechanical strength are critical design optimization parameters for these advanced therapies. Bioresorbable implants, with their degradation mechanisms, offer a long-term solution for bone repair. Drug delivery system efficiency studies and scaffold design optimization are ongoing areas of research to improve their efficacy. Cell seeding techniques and bioprinting technology are revolutionizing cartilage repair, offering customized solutions. In vivo testing of biomaterials and in vitro studies on cell adhesion are crucial for ensuring compliance and operational planning in the market. Mechanical testing of bone substitutes and biocompatibility assessment protocols are essential for assessing the safety and efficacy of new products. Degradation kinetics of resorbable polymers are a significant factor in determining their market position. Comparatively, the focus on improving the efficiency of drug delivery systems and optimizing scaffold design is driving innovation in the market. This is particularly evident in the increasing use of bioprinting technology and the development of advanced tissue-engineered constructs.

What are the Key Data Covered in this Orthobiologics Market Research and Growth Report?

-

What is the expected growth of the Orthobiologics Market between 2025 and 2029?

-

USD 3.1 billion, at a CAGR of 8.1%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Spinal fusion, Reconstructive surgery, Trauma repair, and Others), Product (Bone graft substitutes, Viscosupplementation, and Stem cells), End-user (Hospitals, ASCs, and Orthopedic clinics), and Geography (North America, Europe, Asia, and Rest of World (ROW))

-

-

Which regions are analyzed in the report?

-

North America, Europe, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Increasing prevalence of orthopedic disorders coupled with aging population, High costs and inadequate reimbursements for orthobiologics products and procedures

-

-

Who are the major players in the Orthobiologics Market?

-

Anika Therapeutics Inc., Arthrex Inc., Bioventus LLC, Globus Medical Inc., Institut Straumann AG, Integra LifeSciences Holdings Corp., Johnson and Johnson Services Inc., Kuros Biosciences AG, Medtronic Plc, MTF Biologics, NuVasive Inc., Orthofix Medical Inc., OrthoPediatrics Corp., ROYAL BIOLOGICS, RTI Surgical Inc., Smith and Nephew plc, Stryker Corp., Xtant Medical Holdings Inc., and Zimmer Biomet Holdings Inc.

-

We can help! Our analysts can customize this orthobiologics market research report to meet your requirements.