Regenerative Medicine Market Size 2025-2029

The regenerative medicine market size is valued to increase USD 125.83 billion, at a CAGR of 28.1% from 2024 to 2029. Increasing prevalence of chronic diseases will drive the regenerative medicine market.

Major Market Trends & Insights

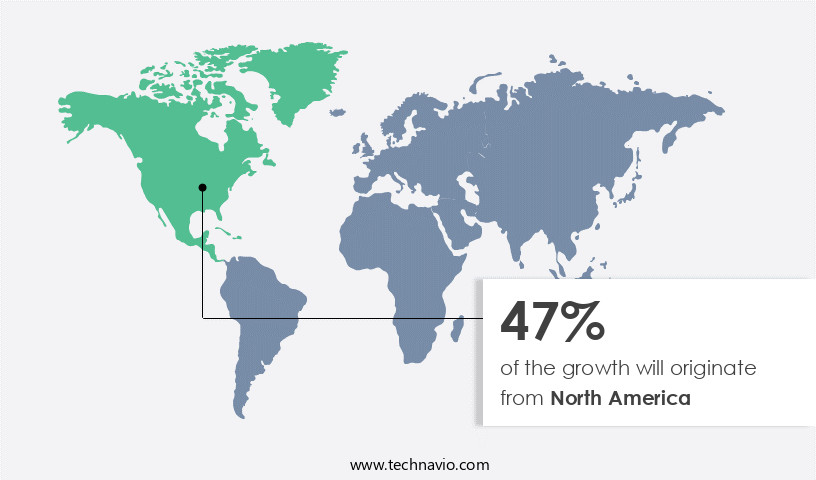

- North America dominated the market and accounted for a 47% growth during the forecast period.

- By Application - Oncology segment was valued at USD 6.69 billion in 2023

- By Technology - Stem Cell Technology segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 840.17 million

- Market Future Opportunities: USD 125827.00 million

- CAGR : 28.1%

- North America: Largest market in 2023

Market Summary

- The market encompasses a dynamic and evolving landscape, driven by advancements in core technologies and applications. These include stem cell therapy, tissue engineering, and gene therapy, which are revolutionizing healthcare by offering potential cures for various diseases and injuries. The market's growth is fueled by the increasing prevalence of chronic diseases and the rising number of clinical trials. However, uncertain regulatory approval for regenerative medicine products poses a significant challenge.

- For instance, according to a report by GlobalData, the stem cell market is projected to account for over 40% of the total the market by 2025. Despite regulatory hurdles, the market continues to expand, offering ample opportunities for stakeholders.

What will be the Size of the Regenerative Medicine Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Regenerative Medicine Market Segmented and what are the key trends of market segmentation?

The regenerative medicine industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Oncology

- Orthopedic

- Musculoskeletal Disorders

- Diabetes

- Dermatology

- Neurology

- Cardiovascular

- Ophthalmology

- Wound Healing

- Autoimmune Diseases

- Others

- Technology

- Stem Cell Technology

- Biomaterials

- Cell and tissue-based

- Gene therapy

- Tissue Engineering

- 3D Bioprinting

- Nanotechnology

- Immunotherapy

- End-user

- Hospitals

- Clinics

- Research Institutes

- Ambulatory Surgical Centers

- Academic Institutions

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- The Netherlands

- UK

- Middle East and Africa

- UAE

- APAC

- China

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The oncology segment is estimated to witness significant growth during the forecast period.

The regenerative medicines market is experiencing substantial expansion, particularly in the oncology application segment. Factors contributing to this trend include the increasing incidence of cancer, with the World Health Organization (WHO) reporting an estimated 14.1 million new cases worldwide in 2022, representing a crude incidence rate of 100.4 per 100,000. This number is projected to grow, with 7.5 million of these cases expected to be among women. Another significant factor driving market growth is the advancement of technologies in the field. For instance, cell signaling pathways and cellular senescence research are paving the way for innovative bioink compositions and 3D bioprinting techniques.

These advancements have led to improvements in cell viability, proliferation, and differentiation assays, enabling the development of more effective cell sheet engineering and implant integration solutions. Moreover, the integration of gene therapy, translational research, and disease modeling in regenerative medicine is fostering a shift towards personalized medicine. This approach allows for more precise treatments and better patient outcomes. Additionally, the ongoing research in biomaterial scaffolds, stem cell therapy, and drug delivery systems is contributing to the market's growth. Furthermore, the market is witnessing the emergence of new techniques, such as organoid cultures, in vivo imaging, and bioreactor systems, which are revolutionizing the field.

These advancements are expected to lead to significant progress in tissue engineering, scaffold degradation rates, and implant integration. According to recent industry reports, the regenerative medicines market is expected to grow by 18.6% in terms of revenue by 2026. Furthermore, the market is projected to expand by 15.9% in terms of volume during the same period. These growth expectations are attributed to the increasing prevalence of chronic diseases, the growing demand for minimally invasive treatments, and the continuous advancements in technology. In conclusion, the regenerative medicines market is experiencing significant growth, driven by the rising incidence of cancer, advancements in technology, and the shift towards personalized medicine.

These trends are expected to continue, leading to substantial growth in the market during the forecast period.

The Oncology segment was valued at USD 6.69 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 47% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Regenerative Medicine Market Demand is Rising in North America Request Free Sample

In North America, approximately 510 companies are actively engaged in the production and development of regenerative medicines. Notable market players like Integra LifeSciences, MiMedx, Organogenesis, and Zimmer Biomet Holdings Inc., with their strong regional presence, significantly influence the growth of the North American the market. These companies continually innovate by launching new products and restructuring their sales forces to expand their market reach.

Factors such as the increasing prevalence of chronic and acute diseases, the aging population's rapid growth, high awareness of regenerative therapies among end-users, the adoption of cell and tissue-based therapies and gene therapies, the presence of tissue banks, and a strong focus on regenerative medicine are propelling the market forward in the region.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a diverse range of technologies and applications, all aimed at restoring or establishing the normal function of damaged or diseased cells, tissues, or organs. Key areas of focus include scaffold material biocompatibility testing, ensuring the optimal interaction between engineered tissues and the host body. Another critical aspect is the optimization of stem cell differentiation protocols, enabling the transformation of stem cells into specialized cell types for tissue repair. In the realm of bioreactor design, parameters such as resolution and accuracy in 3D bioprinting are under constant investigation to create functional, complex tissue structures.

The market also demands a deep understanding of in vivo biomaterial degradation kinetics to ensure the efficacy of stem cell therapy on cartilage repair and other applications. Gene therapy is a burgeoning field within regenerative medicine, with a strong focus on viral vector design and controlled release mechanisms for drug delivery systems. The selection criteria for tissue engineering biomaterials are rigorous, considering factors like biocompatibility, mechanical properties, and immunomodulation therapy for autoimmune diseases. Preclinical testing models and clinical trial endpoints for tissue regeneration are essential for evaluating the safety and efficacy of new regenerative medicine products. Bioprinting bioink viscosity control and cell viability and proliferation assays are crucial aspects of the bioprinting process.

Angiogenesis stimulation factors and pathways play a vital role in promoting tissue growth and vascularization, while extracellular matrix composition analysis and growth factor delivery optimization are essential for creating functional tissue constructs. Patient stratification for personalized medicine and regulatory guidelines for cell-based therapies are significant challenges in the market. Commercialization strategies for regenerative products require a deep understanding of market dynamics, competition, and regulatory requirements. Notably, more than 60% of research and development efforts in the field focus on therapeutic applications for orthopedic conditions, highlighting the significant market potential in this area. This represents a substantial shift from the historical emphasis on academic research, with industrial applications accounting for an increasingly larger share of the market.

What are the key market drivers leading to the rise in the adoption of Regenerative Medicine Industry?

- The rising prevalence of chronic diseases serves as the primary market driver, significantly expanding the market's scope.

- In the US, a substantial portion of the population deals with one or more chronic health conditions, including heart disease, diabetes, stroke, cancer, obesity, and arthritis. These diseases pose a considerable challenge for patients and healthcare systems. Unhealthy lifestyle habits, such as insufficient physical activity, unhealthy diets, and substance abuse, including alcohol and tobacco, significantly contribute to the development of chronic diseases. Meanwhile, the global prevalence of acute and chronic wounds, including surgical and traumatic wounds (abrasion, puncture, laceration, and incision) and chronic wounds like venous ulcers, diabetic ulcers, and pressure ulcers, is on the rise.

- These wounds present a substantial healthcare concern, necessitating ongoing attention and innovative solutions. Unhealthy lifestyle choices are major risk factors for both chronic diseases and wounds. The importance of maintaining a healthy lifestyle cannot be overstated, as it can significantly reduce the likelihood of developing chronic diseases and complications from wounds. By prioritizing physical activity, proper nutrition, and avoiding harmful substances, individuals can contribute to better health outcomes and alleviate the burden on healthcare systems. In summary, the global prevalence of chronic diseases and wounds necessitates a focus on maintaining a healthy lifestyle to reduce risk factors and improve overall health.

- By prioritizing physical activity, proper nutrition, and avoiding harmful substances, individuals can contribute to better health outcomes and alleviate the burden on healthcare systems.

What are the market trends shaping the Regenerative Medicine Industry?

- The number of clinical trials is on the rise, representing an emerging market trend. (Formal tone, sentence case)

- The market is experiencing a notable expansion, marked by an escalating number of clinical trials. This trend is driven by growing initiatives and financial backing from international and domestic organizations. As of July 2023, over 1,400 companies are actively involved in regenerative medicine research and development worldwide. These companies are not only focusing on geographical expansions but also on expanding indications for their approved products. As a result, the number of clinical trials is increasing significantly. In the discovery and preclinical phase, there are numerous ongoing trials.

- Additionally, there are a substantial number of trials in the mid-stage and late stages. Regenerative medicine encompasses a diverse range of products, from cell therapies to tissue engineering and gene therapies. This dynamic field continues to evolve, offering immense potential for transformative treatments and cures.

What challenges does the Regenerative Medicine Industry face during its growth?

- The growth of the regenerative medicine industry is significantly impacted by the uncertain regulatory approval process for related products.

- Regenerative medicine, encompassing gene therapy, cell therapy, and tissue engineering, has seen significant advancements in recent years. Despite decades of research and development, the clinical application of these technologies remains a relatively new phenomenon, with regulatory approvals and market penetration varying across developed and developing countries. For instance, the European Union and the United States have approved numerous regenerative medicine products, while other regions are still in the early stages of adoption. The clinical impact of some products may not be immediately apparent, as it can take years to fully understand their therapeutic benefits. However, the market faces challenges, with stringent regulations and uncertainty surrounding regulatory approval being major hurdles for companies.

- Regenerative medicine products must undergo rigorous testing and clinical trials before gaining approval for commercialization. Despite these challenges, the ongoing research and development in this field hold immense promise for transforming healthcare and addressing unmet medical needs.

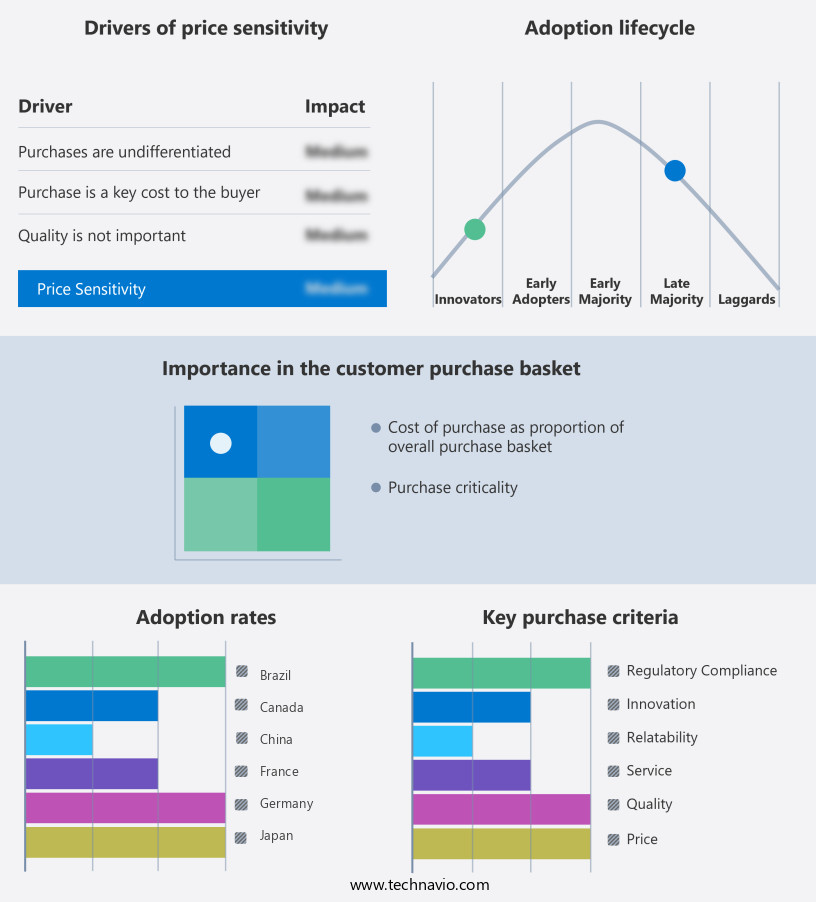

Exclusive Customer Landscape

The regenerative medicine market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the regenerative medicine market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Regenerative Medicine Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, regenerative medicine market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AbbVie Inc. - This company specializes in regenerative medicine, providing innovative solutions through products like Alloderm Select and Alloderm. These offerings utilize advanced technology to promote tissue regeneration and healing. The company's commitment to research and development drives the creation of effective, high-quality treatments in the field.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AbbVie Inc.

- Amgen Inc.

- Baxter International Inc.

- Becton Dickinson and Co.

- Cook Group Inc.

- F. Hoffmann La Roche Ltd.

- Integra LifeSciences Holdings Corp.

- Johnson and Johnson

- Medtronic Plc

- Merck and Co. Inc.

- MiMedx Group Inc.

- Novartis AG

- NuVasive Inc.

- Organogenesis Holdings Inc.

- Smith and Nephew plc

- Thermo Fisher Scientific Inc.

- Vericel Corp.

- Zimmer Biomet Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Regenerative Medicine Market

- In January 2024, Moderna Therapeutics, in collaboration with Merck KGaA, announced the initiation of a clinical trial for their investigational regenerative medicine product, mRNA-3651, for the treatment of osteoarthritis. This collaboration marks a significant strategic partnership in the field, combining Moderna's mRNA technology and Merck KGaA's expertise in orthopedics (Moderna Therapeutics Press Release, 2024).

- In March 2024, Vericel Corporation completed the acquisition of Tissue Repair Company, a leading regenerative medicine company specializing in advanced cell therapies for sports injuries. This acquisition expanded Vericel's product portfolio and capabilities, positioning the company as a key player in the sports injury treatment market (Vericel Corporation Press Release, 2024).

- In May 2024, the European Medicines Agency (EMA) granted marketing authorization for Magnetis' Magnetothermal Tissue Regeneration System for the treatment of deep and complex bone defects. This approval represents a significant regulatory milestone for the regenerative medicine industry, paving the way for the commercialization of this innovative technology in Europe (Magnetis Press Release, 2024).

- In April 2025, Fujifilm Corporation announced a strategic investment of approximately USD300 million in Cytosorbents Corporation, a leader in therapeutic apheresis and regenerative medicine. This investment will support the expansion of Cytosorbents' manufacturing capabilities and the development of new regenerative medicine products (Fujifilm Corporation Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Regenerative Medicine Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

225 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 28.1% |

|

Market growth 2025-2029 |

USD 125827 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

25.3 |

|

Key countries |

US, Germany, Canada, Japan, China, UK, France, South Korea, Brazil, The Netherlands, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving landscape, driven by ongoing research and innovation in various areas. One key focus lies in cell signaling pathways, which play a crucial role in cellular processes such as senescence and apoptosis. These pathways are being explored to develop novel therapies and bioinks for 3D bioprinting applications. Cellular senescence, a state of irreversible growth arrest, is a critical aspect of tissue aging and regeneration. Bioink compositions are being engineered to mimic the extracellular matrix and support cellular functions during tissue engineering and 3D bioprinting. Apoptosis assays and cell viability assays are essential tools in assessing the health and survival of cells during these processes.

- Cell sheet engineering, another promising approach, involves growing cells on temperature-sensitive substrates, allowing for the formation of cell sheets that can be easily transferred and integrated into tissues. Techniques like 3D bioprinting and scaffold degradation rate optimization are crucial for creating functional tissue constructs. Translational research in regenerative medicine is advancing, with gene therapy, stem cell differentiation, and drug delivery systems showing significant promise. Implant integration, organoid cultures, and disease modeling are essential components of preclinical testing and clinical trial design. Personalized medicine and immunomodulation therapy are also gaining attention, with bioprinting resolution and decellularized matrices being explored for their potential in creating patient-specific treatments.

- In vivo imaging and bioreactor systems are crucial for monitoring and optimizing regenerative end points. Biomaterial scaffolds and tissue engineering continue to evolve, with ongoing research focusing on improving scaffold properties and optimizing tissue integration. The market is characterized by a continuous unfolding of activities and evolving patterns, with a strong emphasis on innovation and research.

What are the Key Data Covered in this Regenerative Medicine Market Research and Growth Report?

-

What is the expected growth of the Regenerative Medicine Market between 2025 and 2029?

-

USD 125.83 billion, at a CAGR of 28.1%

-

-

What segmentation does the market report cover?

-

The report segmented by Application (Oncology, Orthopedic, Musculoskeletal Disorders, Diabetes, Dermatology, Neurology, Cardiovascular, Ophthalmology, Wound Healing, Autoimmune Diseases, and Others), Technology (Stem Cell Technology, Biomaterials, Cell and tissue-based, Gene therapy, Tissue Engineering, 3D Bioprinting, Nanotechnology, and Immunotherapy), End-user (Hospitals, Clinics, Research Institutes, Ambulatory Surgical Centers, Academic Institutions, and Others), and Geography (North America, Europe, Asia, Middle East and Africa, South America, and Rest of World (ROW))

-

-

Which regions are analyzed in the report?

-

North America, Europe, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Increasing prevalence of chronic diseases, Uncertain regulatory approval for regenerative medicine products

-

-

Who are the major players in the Regenerative Medicine Market?

-

Key Companies AbbVie Inc., Amgen Inc., Baxter International Inc., Becton Dickinson and Co., Cook Group Inc., F. Hoffmann La Roche Ltd., Integra LifeSciences Holdings Corp., Johnson and Johnson, Medtronic Plc, Merck and Co. Inc., MiMedx Group Inc., Novartis AG, NuVasive Inc., Organogenesis Holdings Inc., Smith and Nephew plc, Thermo Fisher Scientific Inc., Vericel Corp., and Zimmer Biomet Holdings Inc.

-

Market Research Insights

- The market encompasses a diverse range of technologies and applications, driven by advancements in inflammation markers, surgical techniques, and bioreactor optimization. According to industry estimates, the global market for regenerative medicines is projected to reach USD150 billion by 2025, growing at a compound annual growth rate of 12%. This expansion is fueled by the clinical applications of regenerative medicine in areas such as orthopedics, neurology, and cardiology. Cytotoxicity assays and biomaterial characterization play crucial roles in ensuring the safety and efficacy of regenerative medicine products. Regulatory approval processes, including stringent ethical considerations and immune response assessments, further contribute to the market's complexity.

- Technological innovations, such as CRISPR technology and gene editing, hold promise for enhancing therapeutic efficacy and long-term outcomes. Scale-up manufacturing and commercialization strategies are essential for bringing these advanced treatments to market. Microenvironment control, cell homing, and functional recovery are key considerations for optimizing patient outcomes. Adverse effects and biocompatibility testing are ongoing areas of research to mitigate risks and improve safety. The integration of image-guided surgery, genetic engineering, and bioprinting materials further expands the potential applications and opportunities within the market.

We can help! Our analysts can customize this regenerative medicine market research report to meet your requirements.