Orthopedic Implants Market Size 2025-2029

The orthopedic implants market size is forecast to increase by USD 13.38 billion at a CAGR of 5.8% between 2024 and 2029.

- The market is witnessing significant growth, driven by the high prevalence of osteoporosis and an aging population. According to the National Osteoporosis Foundation, an estimated 54 million Americans have low bone density or osteoporosis, and this number is projected to increase as the population ages. This presents a substantial opportunity for market participants, as orthopedic implants are a critical component in treating osteoporosis-related conditions. However, market growth is not without challenges. Regulatory hurdles impact adoption, as stringent regulations require extensive clinical trials and approvals for new orthopedic implant technologies. Additionally, the high costs associated with orthopedic implants and procedures can limit accessibility and affordability for some patients.

- Moreover, the orthopedic implants and devices market encompasses a range of medical devices, including orthopedic prosthetics and biomaterials such as orthobiologics. To mitigate these challenges, companies are forming strategic alliances to collaborate on research and development efforts, share resources, and expand their reach. These partnerships can help reduce costs, accelerate innovation, and improve patient outcomes. Despite these challenges, the market holds immense potential for growth, with opportunities in emerging markets and the development of advanced, cost-effective implant technologies. Companies that can navigate these challenges effectively and capitalize on market opportunities will be well-positioned for success.

What will be the Size of the Orthopedic Implants Market during the forecast period?

- The market is experiencing significant advancements, driven by the integration of technology and value-based care. Implant design optimization and surface modification are key areas of focus, enhancing functional recovery and clinical outcomes. Bioresorbable implants and smart implants are gaining traction, aligning with the shift towards minimally invasive procedures and patient-centric care. Ethical considerations and quality of life are paramount, leading to rigorous sterilization techniques and stringent packaging and labeling regulations. Machine learning and artificial intelligence are revolutionizing implant manufacturing, enabling personalized treatment plans and predictive maintenance. Health economics and supply chain management are critical factors, requiring innovative distribution channels and cost-effective solutions.

- Patient education and advocacy are essential, with remote patient monitoring and pain management strategies improving patient empowerment. Tissue engineering and biomaterials science are driving the development of advanced implant materials, while computational modeling and clinical outcomes research ensure their safety and efficacy. The market is also embracing the potential of big data analytics, enabling more accurate diagnosis and treatment plans. In summary, the market is evolving, with a strong focus on innovation, value, and patient-centric care. The market's size is significant, with a steady increase in procedures, such as knee replacement surgeries, and a growing demand for orthobiologics.

How is this Orthopedic Implants Industry segmented?

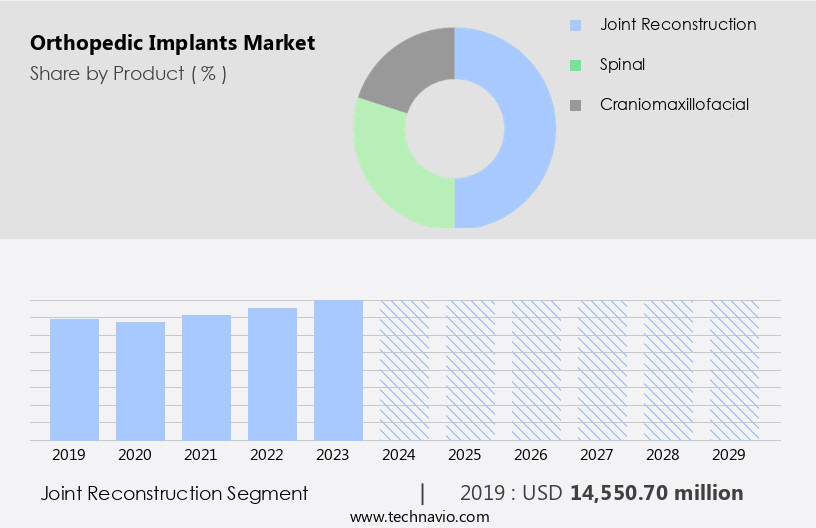

The orthopedic implants industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Joint reconstruction

- Spinal

- Craniomaxillofacial

- End-user

- Hospitals

- Orthopedic clinics

- Others

- Device

- Internal

- External

- Type

- Open surgery

- Minimally invasive surgery

- Others

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Product Insights

The joint reconstruction segment is estimated to witness significant growth during the forecast period. Joint reconstruction implants hold a significant share in the market, encompassing solutions for knee, hip, trauma, and extremities conditions. Factors such as the rising incidence of orthopedic disorders, including osteoporosis, arthritis, hip and knee injuries, and bone deformities, fuel demand. New product launches, the emergence of robotic surgeries, and a robust product portfolio from established players further propel growth. The trend towards personalized medicine and patient-specific implants, enabled by technologies like additive manufacturing and image-guided surgery, is transforming the industry. Regulatory approvals for innovative implantable devices, such as those using biocompatible materials like stainless steel, cobalt chrome alloys, and titanium alloys, and the integration of bone growth factors, are driving advancements. Additionally, the trend toward digital technology integration in orthopedic surgeries, such as robotic procedures and remote monitoring, is expected to further boost market expansion.

The market also caters to sports medicine applications and orthopedic trauma, including revision and minimally invasive surgeries. Insurance coverage for these procedures and the increasing popularity of ambulatory surgery centers further expand the market scope. The focus on infection control, patient satisfaction, and post-operative care are crucial considerations in the market. Joint replacement solutions for hips and knees, spinal implants, and stem cell therapy are among the key offerings.

The Joint reconstruction segment was valued at USD 14.55 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing steady growth, driven by the increasing prevalence of orthopedic conditions, regulatory approvals, and advancements in technology. Orthopedic conditions, including osteoporosis, arthritis, spinal disorders, and sports injuries, are on the rise, fueling demand for implants. For instance, arthritis, according to the Centers for Disease Control and Prevention (CDC), is projected to affect over 78 million adults in the US by 2040. Healthcare providers are increasingly adopting biocompatible materials, such as stainless steel, cobalt chrome alloys, and titanium alloys, for implant production. These materials offer improved wear resistance and longevity, addressing the issue of implant failure due to wear and tear.

Additionally, the integration of advanced technologies, such as 3D printing, image-guided surgery, and robotic surgery, enables the production of patient-specific implants, enhancing patient satisfaction and clinical outcomes. Regulatory approvals for new implant technologies and the expansion of ambulatory surgery centers facilitate market growth. Furthermore, initiatives to promote physical therapy and rehabilitation, as well as insurance coverage for orthopedic implants, are expected to boost market penetration. The ongoing research in regenerative medicine, including the use of bone growth factors and stem cell therapy, offers potential for the development of innovative implantable devices. Sports medicine and orthopedic trauma applications also contribute to market growth.

Minimally invasive surgical techniques and the use of implant fixation systems, such as bone cement and screws, enable faster recovery and reduced post-operative care. Despite these advancements, infection control remains a significant challenge, necessitating ongoing research and development efforts. In summary, the North American market is witnessing growth due to the rising prevalence of orthopedic conditions, regulatory approvals, technological advancements, and increasing focus on patient-centric care.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Orthopedic Implants market drivers leading to the rise in the adoption of Industry?

- The high prevalence of osteoporosis serves as the primary market driver, given its significant impact on healthcare expenditures and the growing demand for effective treatments. Osteoporosis, a disease characterized by the gradual loss of bone density, affects millions of adults in the US each year. This condition, often referred to as a silent disease, results in bones that are porous, brittle, and prone to fractures. The most common fractures related to osteoporosis occur at the spine, hip, and wrist. With age, the risk of these fractures increases for both men and women. In the US, approximately 1-3 million adults experience osteoporosis-related fractures annually. During surgical procedures to treat osteoporosis, such as joint replacement or orthopedic trauma, various implants are used to stabilize the affected area and promote healing.

- These implants include bone cement, 3D printed materials, and instruments used in image-guided surgery and robotic procedures. Infection control is a critical factor in the success of these surgeries, and implant manufacturers are continually developing new technologies to reduce the risk of infection. Orthopedic surgeons rely on advanced surgical techniques, such as image-guided surgery and robotic assistance, to ensure precise placement of implants and minimize invasiveness. Revision surgeries, which involve replacing previously implanted devices, are also common in the treatment of osteoporosis. As the population ages, the demand for orthopedic implants is expected to grow, making it a significant market.

- Infection control is a critical concern in the use of orthopedic implants, and manufacturers are continually developing new technologies to minimize the risk of infection. These include the use of antibiotic-loaded bone cement and advanced sterilization techniques. Additionally, the use of 3D printing and image-guided surgery in orthopedic procedures is increasing, providing surgeons with greater precision and accuracy in implant placement. Robotic surgery and image-guided procedures are becoming increasingly common in orthopedic surgeries, providing surgeons with greater precision and minimally invasive options. These advanced techniques allow for more accurate implant placement and reduced recovery times for patients. Orthopedic trauma, including fractures and dislocations, is another area where implants play a crucial role in treatment and recovery.

- Revision surgeries, which involve replacing previously implanted devices, are also common in the treatment of osteoporosis and other orthopedic conditions. The use of orthopedic implants is essential in the treatment of various orthopedic conditions, including osteoporosis, trauma, and joint replacement. The market for these implants is expected to grow as the population ages and the demand for minimally invasive and precise surgical techniques increases. Infection control remains a critical concern, and manufacturers are continually developing new technologies to address this challenge.

What are the Orthopedic Implants market trends shaping the Industry?

- The increasing prevalence of strategic alliances represents a significant market trend. This trend reflects the growing recognition among businesses that collaboration can lead to mutually beneficial outcomes. The market is driven by strategic alliances that enable equipment manufacturers to expand their product lines and reach a wider customer base, without incurring a significant financial burden. These collaborations, which focus on product development and commercialization, offer advantages such as cost savings, extended product offerings, and increased geographical reach. One recent example is Stryker's acquisition of SERF SAS, a French company specializing in joint replacement, which bolstered Stryker's European presence and enhanced its implant portfolio. Minimally invasive surgery, a key trend in orthopedics, is driving demand for advanced implantable devices.

- Titanium alloys, a popular material for implant fixation, are preferred due to their biocompatibility and strength. Post-operative care and stem cell therapy are other areas of focus in the market. Insurance coverage for implantable devices continues to be a significant factor influencing market growth. Overall, these factors contribute to the dynamic growth of the market.

How does Orthopedic Implants market faces challenges face during its growth?

- The orthopedic industry faces significant growth challenges due to the high costs associated with implants and procedures. These expenses, which encompass both manufacturing and treatment costs, pose a substantial hurdle for industry expansion. The market faces a significant hurdle in the form of high costs associated with the implants and related procedures. Orthopedic implants serve a crucial role in treating various orthopedic conditions, encompassing joint, spine, and maxillofacial injuries. The cost of these implants is contingent upon their applications and features. For instance, the price of pedicle screw implants falls between USD 900 and USD 1,000 per screw.

- The cost disparity between implant types is substantial. Absorbable implants, for example, carry a higher price tag than metallic implants. The cost escalation across the orthopedic implants value chain amounts to 130%-150%. The geriatric population and patients with arthritic conditions are major consumer groups for orthopedic implants.

Exclusive Customer Landscape

The orthopedic implants market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the orthopedic implants market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, orthopedic implants market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amplitude SAS - The company offers orthopedic implants such as the Score prosthesis, the Anatomic prosthesis, and the Integrale stem.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amplitude SAS

- Arthrex Inc.

- Auxein Medical Inc.

- B.Braun SE

- Conmed Corp.

- Corin Group Plc

- Enovis Corp.

- Globus Medical Inc.

- icotec AG

- Johnson and Johnson Services Inc.

- Medtronic Plc

- Narang Medical Ltd.

- Naton Medical Group

- Orthofix Medical Inc.

- OrthoPediatrics Corp.

- Pega Medical Inc.

- RTI Surgical Inc.

- Smith and Nephew plc

- Stryker Corp.

- Zimmer Biomet Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Orthopedic Implants Market

- In February 2024, Stryker Corporation announced the launch of its innovative Triathlon Elite Total Hip System, featuring a modular design and advanced bearing technology. This new product aims to improve patient outcomes and enhance surgical efficiency (Stryker Corporation Press Release, 2024).

- In July 2024, Zimmer Biomet Holdings, Inc. and Medtronic plc entered into a definitive agreement to combine their Orthopedics businesses in a strategic partnership. This merger is expected to create a leading orthopedic solutions provider, strengthening their product portfolios and expanding their global reach (Business Wire, 2024).

- In November 2025, Smith & Nephew will receive FDA approval for its REDAPT 3D 3D-printed total hip replacement system. This technological advancement marks the first 3D-printed total hip replacement system to receive regulatory approval in the US, positioning Smith & Nephew at the forefront of additive manufacturing in orthopedics (Smith & Nephew Press Release, 2025).

- In March 2025, DePuy Synthes, a Johnson & Johnson company, announced a significant investment in its orthopedic manufacturing facility in Warsaw, Indiana. This expansion will increase the company's capacity to produce orthopedic implants and instruments, enabling it to meet the growing demand for its products and services (Johnson & Johnson Press Release, 2025).

Research Analyst Overview

The market continues to evolve, driven by advancements in materials science, biotechnology, and surgical techniques. Orthopedic implants, including bone screws, hip implants, and dental implants, are integral components in the treatment of degenerative joint disease and orthopedic trauma. These implants are made from various materials, such as stainless steel, cobalt chrome alloys, and biocompatible materials, ensuring longevity and minimizing wear and tear. Healthcare providers are increasingly focusing on patient-centric care, leading to the adoption of personalized medicine and patient-specific implants. Regulatory approvals, clinical trials, and physical therapy are essential components of the orthopedic implant value chain. Sports medicine and regenerative medicine are emerging sectors, with applications in joint replacement, stem cell therapy, and additive manufacturing.

Robotic surgery, image-guided surgery, and minimally invasive surgery are transforming the landscape of orthopedic procedures. Infection control and implant fixation are critical concerns, with ongoing research in antibiotic-coated implants and advanced surgical instruments. Ambulatory surgery centers and insurance coverage are also shaping the market dynamics. The ongoing development of implantable devices, such as bone growth factors and spinal implants, is revolutionizing the treatment of various orthopedic conditions. Titanium alloys and bone cement remain popular choices for implant fixation and fracture fixation. Post-operative care and implant longevity are key considerations for patient satisfaction. Overall, the market is characterized by continuous innovation and evolving patterns, reflecting the dynamic nature of healthcare and the ongoing quest for improved patient outcomes.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Orthopedic Implants Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

234 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2025-2029 |

USD 13.37 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.5 |

|

Key countries |

US, Canada, UK, Germany, France, China, Mexico, Japan, Italy, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Orthopedic Implants Market Research and Growth Report?

- CAGR of the Orthopedic Implants industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the orthopedic implants market growth and forecasting

We can help! Our analysts can customize this orthopedic implants market research report to meet your requirements.