Osteosynthesis Devices Market Size 2024-2028

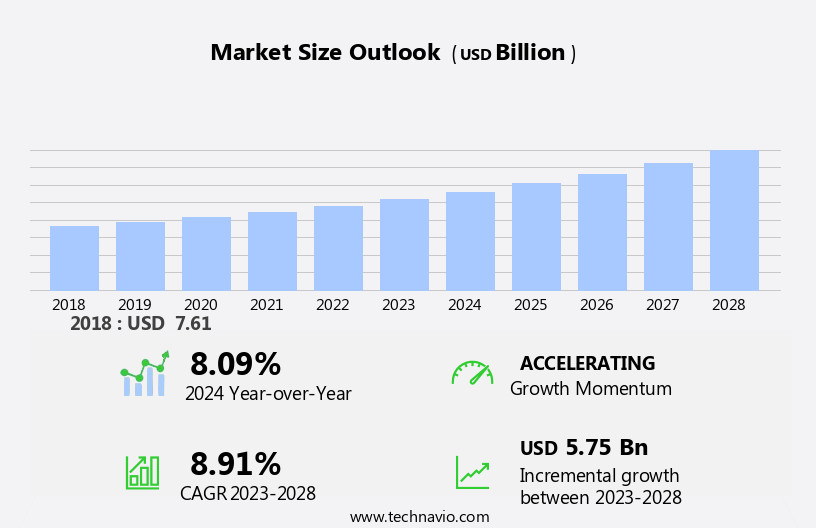

The osteosynthesis devices market size is forecast to increase by USD 5.75 billion, at a CAGR of 8.91% between 2023 and 2028.

- The market is experiencing significant growth, driven by the rising global aging population and increasing awareness of preventive orthopedic care. The elderly demographic, with its higher prevalence of bone-related disorders, presents a substantial market opportunity. Moreover, the shift towards minimally invasive surgeries and the growing preference for early intervention in orthopedic conditions further fuel market expansion. However, the market faces challenges, including concerns associated with metal allergies and biocompatibility. As the demand for implants and fixation devices continues to rise, ensuring the safety and effectiveness of these products becomes crucial.

- Manufacturers must invest in research and development to create biocompatible materials and address the potential risks of allergic reactions. By addressing these challenges and capitalizing on the market's growth drivers, companies can effectively position themselves in this dynamic and evolving market.

What will be the Size of the Osteosynthesis Devices Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in surgical planning, post-operative care, and material science. Image-guided surgery and dynamic compression plates are revolutionizing fracture fixation, enabling more precise and effective interventions. Infection prevention remains a key focus, with minimally invasive surgery and stress shielding gaining popularity. Small fragment screws and fracture reduction techniques are essential for managing complex fractures. Bone screws, surgical instruments, and polyaxial screws are integral components of these procedures. Bone healing and bone density are critical considerations, leading to the development of patient-specific implants, bone substitutes, and bioabsorbable materials. Implant stability and fracture classification systems are continually refined to optimize surgical techniques.

Osteotomy plates, intramedullary nails, and external fixators offer various solutions for fracture treatment. Titanium alloys and biocompatible materials are widely used due to their biomechanical properties and tissue regeneration capabilities. Three-dimensional printed implants and computer-assisted surgery are emerging trends, offering customized solutions for individual patient needs. The ongoing unfolding of market activities underscores the dynamic nature of the osteosynthesis devices industry, with continuous innovation and evolution shaping its future applications.

How is this Osteosynthesis Devices Industry segmented?

The osteosynthesis devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Internal

- External

- Material

- Degradable

- Non-degradable

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- China

- Rest of World (ROW)

- North America

By Type Insights

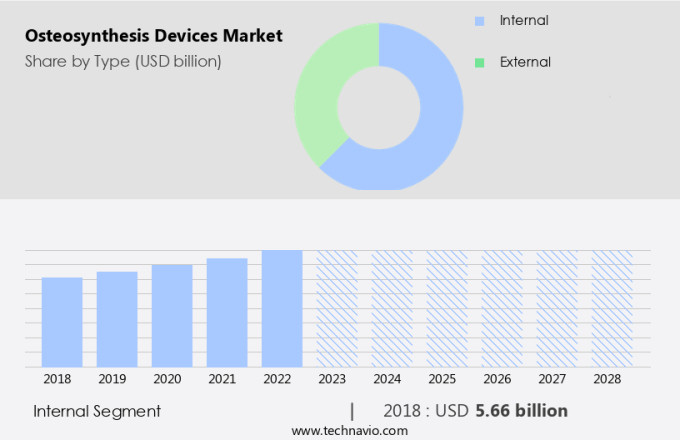

The internal segment is estimated to witness significant growth during the forecast period.

Osteosynthesis devices are essential medical implants or instruments used in orthopedic surgery to support and facilitate bone healing following fractures or orthopedic conditions. These devices, including locking compression plates, intramedullary nails, cannulated screws, and fragment screws, offer enhanced stability to fractured bones, maintaining proper alignment and preventing unwanted movement at the fracture site. This stability promotes an optimal healing environment, reducing the risk of malunion or nonunion. Internal fixation devices, such as plates and screws, facilitate bone regeneration by providing compression at the fracture site and enabling the natural process of bone remodeling. Advanced technologies, like patient-specific implants, image-guided surgery, and computer-assisted surgery, enhance the precision and effectiveness of osteosynthesis procedures.

Infection prevention, minimally invasive surgery, and stress shielding are also crucial considerations in the design and application of these devices. Bioabsorbable materials, titanium alloys, and biocompatible materials are commonly used to ensure implant stability and compatibility with the body. Bone density assessment and bone grafts may be necessary in some cases to ensure successful healing and implant integration. Despite the advancements, implant failure remains a concern, necessitating ongoing research and development in the field. Three-dimensional printed implants and external fixators offer alternative solutions for complex fractures and non-healing injuries. Surgical techniques and implant classification systems continue to evolve, reflecting the dynamic nature of this market.

The Internal segment was valued at USD 5.66 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

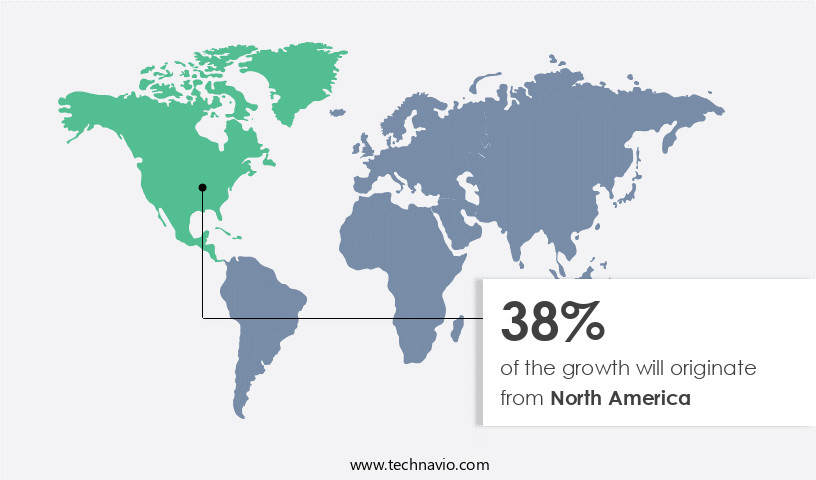

North America is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market for osteosynthesis devices is experiencing notable growth due to the increasing prevalence of orthopedic conditions among the aging population. Fractures, osteoporosis, and degenerative bone diseases are common in this demographic, leading to a higher demand for surgical interventions that utilize osteosynthesis devices for stabilization and bone healing. Advancements in orthopedic technology, including the development of innovative materials, designs, and minimally invasive surgical techniques, are driving the adoption of these devices. Patients and healthcare providers seek advanced solutions that offer improved outcomes, faster recovery, and reduced postoperative complications. The market is witnessing significant advancements in areas such as patient-specific implants, image-guided surgery, and computer-assisted surgery, which enable more precise and effective treatments.

Additionally, the use of bioabsorbable materials, titanium alloys, and biocompatible materials in osteosynthesis devices enhances implant stability and bone remodeling. The ongoing trend toward minimally invasive surgical procedures and infection prevention measures is also influencing the market dynamics. Overall, the North American market for osteosynthesis devices is poised for continued growth due to the increasing demand for advanced solutions that address the unique needs of patients with orthopedic conditions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a range of medical devices designed to facilitate the healing of fractured bones. These devices, including plates, screws, rods, and nails, are essential tools for orthopedic surgeons focusing on bone reconstruction and trauma care. With considerations like increasing prevalence of bone disorders and road traffic accidents, the market is witnessing significant growth. Through methods such as internal fixation, external fixation, and minimally invasive surgeries, osteosynthesis devices play a crucial role in restoring bone structure and functionality. Key areas involve the development of biocompatible materials, advanced coating technologies, and innovative designs to enhance patient comfort and recovery. Moreover, the integration of advanced technologies like 3D printing and smart implants is transforming the market. These technologies offer customized solutions, improved accuracy, and enhanced patient outcomes. For instance, 3D-printed implants can be tailored to fit specific bone structures, ensuring a perfect fit and reducing the risk of complications. Innovations in biomaterials, such as bioactive glass and nanotechnology, are also gaining traction in the market. These materials promote bone growth and integration, leading to faster healing and better patient outcomes. Furthermore, the adoption of robotic systems and computer-assisted surgeries is streamlining the surgical process and improving the precision and accuracy of osteosynthesis procedures. In conclusion, the market is witnessing significant advancements driven by technological innovations, increasing demand for minimally invasive procedures, and the growing prevalence of bone disorders. As the market continues to evolve, it is expected to offer numerous opportunities for manufacturers, researchers, and healthcare providers.

What are the key market drivers leading to the rise in the adoption of Osteosynthesis Devices Industry?

- The escalating global aging population serves as the primary catalyst for market growth.

- Osteosynthesis devices are essential tools in the orthopedic field, playing a significant role in the treatment of various bone conditions, including fractures and degenerative diseases. With an aging population, the incidence of these conditions is on the rise. According to the World Health Organization, by 2030, one in every six people worldwide will be 60 or older, increasing the demand for orthopedic interventions. During surgical procedures, osteosynthesis devices, such as locking compression plates, intramedullary nails, cannulated screws, and fragment screws, are used for fracture fixation. These devices provide stability and support during the bone healing process. In some cases, patient-specific implants are utilized for enhanced accuracy and improved patient outcomes.

- Bone substitutes may also be employed to supplement the healing process. Post-operative care is crucial to ensure proper bone healing and the effective use of these devices. The market dynamics for osteosynthesis devices are influenced by factors such as advancements in surgical planning techniques, the increasing prevalence of bone diseases, and the growing emphasis on minimally invasive procedures. In summary, the aging population and the increasing incidence of bone conditions necessitate the use of osteosynthesis devices for fracture fixation and bone healing. Advancements in surgical planning, post-operative care, and materials, such as bone substitutes and patient-specific implants, continue to drive market growth.

What are the market trends shaping the Osteosynthesis Devices Industry?

- The growing awareness of the importance of preventive orthopedic care is a notable trend in the current market. This shift in focus towards proactive measures for joint and bone health is becoming increasingly prevalent among healthcare professionals and consumers alike.

- Osteosynthesis devices are essential tools in orthopedic surgery, providing stability and facilitating bone healing. With a focus on preventive orthopedics, early intervention through non-surgical methods is encouraged. However, when surgical intervention is necessary, osteosynthesis devices continue to play a crucial role. Minimally invasive surgical procedures align with this trend, utilizing smaller implants and incisions. These approaches reduce trauma to surrounding tissues and promote faster recovery. Image-guided surgery and advanced technologies, such as dynamic compression plates, stress shielding, small fragment screws, fracture reduction, bone screws, surgical instruments, and polyaxial screws, are integral to minimally invasive procedures.

- Infection prevention is a significant concern, and these devices are designed with features to minimize the risk. Preventive orthopedics emphasizes educating individuals on maintaining musculoskeletal health through lifestyle modifications. This includes maintaining a healthy weight, proper posture, and regular exercise, all contributing to reducing the risk of fractures and orthopedic conditions. The adoption of these measures, in conjunction with advanced osteosynthesis devices, can lead to improved patient outcomes and reduced healthcare costs.

What challenges does the Osteosynthesis Devices Industry face during its growth?

- Metal allergies and biocompatibility concerns represent a significant challenge to the industry's growth, as ensuring the safety and suitability of metal components for various applications is essential to avoid adverse health effects and ensure user confidence.

- Osteosynthesis devices, used in tissue regeneration and surgical techniques for the treatment of fractures and osteotomies, are essential in orthopedic care. Implant stability is crucial for successful bone remodeling, and the choice of materials plays a significant role. While titanium alloys and biocompatible materials are commonly used due to their biocompatibility and mechanical strength, hypersensitivity reactions can occur. Nickel, cobalt, and chromium, common metals in orthopedic devices, can cause allergic reactions, leading to inflammation and potential implant failure. Hypersensitivity reactions can impact implant stability and integration with bone tissue, increasing the risk of complications and the need for additional medical interventions.

- Bioabsorbable materials, an alternative to traditional implants, offer potential solutions by eliminating the risk of metal allergies and promoting natural bone regeneration. The focus on developing advanced materials and surgical techniques for enhancing implant integration and reducing the risk of complications continues to drive market growth.

Exclusive Customer Landscape

The osteosynthesis devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the osteosynthesis devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, osteosynthesis devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arthrex Inc. - The company specializes in osteosynthesis devices, providing solutions for ACL reconstruction and repair. Their product range includes the ACL Backup Fixation System, offering implants and instruments to reinforce ACL graft sutures.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arthrex Inc.

- B.Braun SE

- Conmed Corp.

- Globus Medical Inc.

- Integra Lifesciences Corp.

- Johnson and Johnson

- Lepu Medical Technology Beijing Co. Ltd.

- Medtronic Plc

- MicroPort Scientific Corp.

- Neosteo SA

- Olympus Corp.

- Orthofix Medical Inc.

- Precision Spine Inc.

- Smith and Nephew plc

- Stryker Corp.

- Zimmer Biomet Holdings Inc.

- Life Spine Inc.

- GS Solutions Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Osteosynthesis Devices Market

- In January 2024, Stryker Corporation announced the launch of its new CranioMaxx System, an advanced cranial and maxillofacial fixation system, designed to improve surgical efficiency and patient outcomes. (Stryker Corporation Press Release)

- In March 2024, Smith & Nephew and Medtronic signed a strategic partnership to co-develop and commercialize orthopedic trauma and extremities products. This collaboration aimed to expand their offerings and strengthen their positions in the competitive market. (Smith & Nephew Press Release)

- In May 2024, DePuy Synthes, a Johnson & Johnson company, received FDA approval for its new SYNBONE 3D-Printed Titanium Tibial Plate System. This innovative product is designed to provide better fit and fixation for complex tibial fractures. (DePuy Synthes Press Release)

- In February 2025, Zimmer Biomet completed the acquisition of OrthoSensor, a leader in real-time, sensor-based orthopedic surgery solutions. This acquisition was expected to enhance Zimmer Biomet's portfolio with advanced technology, enabling more precise implant positioning and improved patient outcomes. (Zimmer Biomet Press Release)

Research Analyst Overview

- The market encompasses a diverse range of implants and instrumentation used in orthopedic surgery. Polymer implants and ceramic implants are key product categories, with material science and implant design playing crucial roles in ensuring implant longevity and biocompatibility. Preoperative planning and surgical simulation are essential for optimizing surgical outcomes, while finite element analysis and failure analysis aid in understanding the mechanical properties and fatigue strength of these devices. Biocompatibility testing and corrosion resistance are critical factors in ensuring patient safety and implant success. Surgical instrumentation, including screws and plates, must exhibit high strength and stiffness, while hydroxyapatite and titanium nitride coatings enhance implant integration and reduce complication rates.

- Clinical trials and regulatory approvals are necessary steps in bringing new osteosynthesis devices to market. Postoperative rehabilitation and surgical training are essential components of successful implant integration, with surgical instrumentation playing a vital role in facilitating these processes. Implant retrieval and complication rate analysis provide valuable insights into device performance and inform future design iterations.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Osteosynthesis Devices Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

150 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.91% |

|

Market growth 2024-2028 |

USD 5.75 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.09 |

|

Key countries |

US, Canada, Germany, UK, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Osteosynthesis Devices Market Research and Growth Report?

- CAGR of the Osteosynthesis Devices industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the osteosynthesis devices market growth of industry companies

We can help! Our analysts can customize this osteosynthesis devices market research report to meet your requirements.