US Outdoor Furniture Market Size 2025-2029

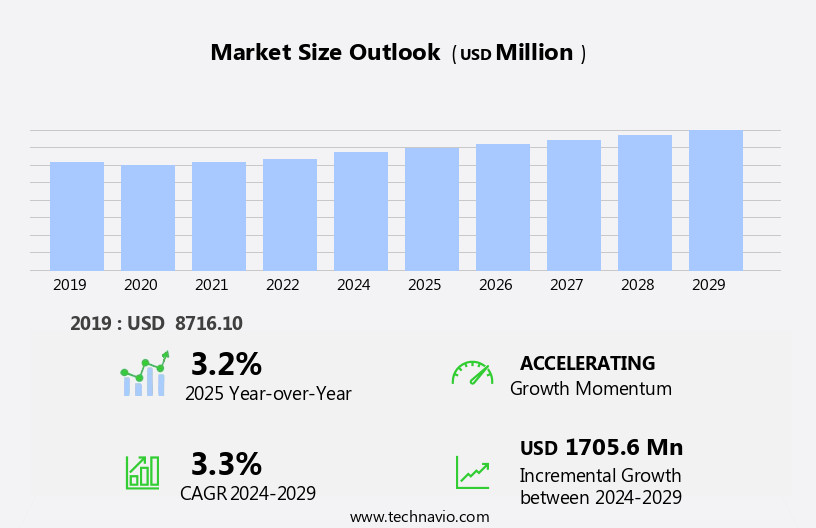

US outdoor furniture market size is forecast to increase by USD 1.71 billion, at a CAGR of 3.3% between 2024 and 2029.

- The outdoor furniture market is undergoing continuous transformation, fueled by the expanding consumer focus on home improvement and the integration of outdoor and indoor living spaces. A key trend shaping this evolution is the growing demand for patio-heating products, which allow consumers to extend the usability of outdoor furniture environments throughout varying seasons. Simultaneously, sustainability has emerged as a major driver, with eco-friendly materials gaining traction as consumers become more environmentally conscious.

- This shift is prompting manufacturers to realign their strategies toward green solutions and ethical sourcing, positioning sustainability as a core differentiator. However, the market is constrained by the long replacement cycle of outdoor furniture, which slows down repeat purchases and impacts inventory turnover. This challenge requires innovative approaches to customer engagement and lifecycle management, as brands attempt to sustain growth and relevance.

- Strategically, companies are aligning offerings with evolving consumer expectations while optimizing product development and cost efficiency. Brands that successfully integrate environmental responsibility with functionality and affordability are likely to lead the segment's growth. The ongoing changes in consumer behavior, especially around lifestyle upgrades and seasonal adaptability, underscore the importance of innovation in design, materials, and marketing. By anticipating shifts and addressing practical challenges, stakeholders can unlock long-term value and shape the trajectory of the outdoor furniture market across multiple consumer segments.

Major Market Trends & Insights

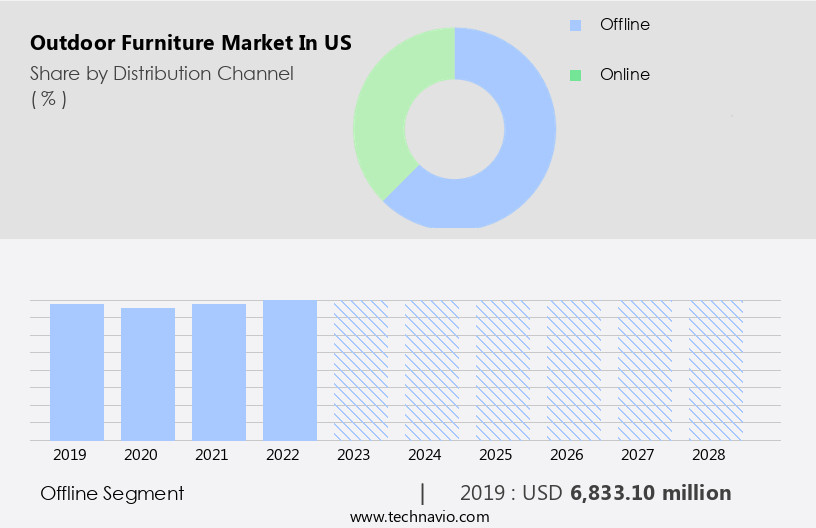

- By the Distribution Channel, the Offline sub-segment was valued at USD 6.83 billion in 2022

- By the End-user, the Residential sub-segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 29.01 billion

- Future Opportunities: USD 1.705 billion

- CAGR : 3.3%

What will be the size of the US Outdoor Furniture Market during the forecast period?

- The outdoor furniture market is advancing through a combination of innovation in materials, evolving consumer expectations, and improved digital commerce strategies. Increasing demand for aesthetically versatile resin wicker furniture, steel furniture fabrication, and weather-adaptive designs continues to define the direction of outdoor furniture design. Buyers are placing heightened importance on furniture comfort features, furniture weight capacity, and furniture dimensional accuracy, driving manufacturers to refine furniture production methods and enforce precise quality control measures. The availability of varied furniture color options and extended outdoor furniture lifespan is closely tied to improved furniture material sourcing and responsive warranty systems addressing furniture warranty claims.

- Recent market data indicates that e-commerce driven sales have risen by 22.3%, attributed to optimized wooden furniture retail channels and the rapid growth of e-commerce furniture sales. Looking ahead, the market is expected to experience a 16.8% increase in demand, driven by improvements in distribution network design, expanded inventory management systems, and adaptive pricing strategies.

- When comparing sales growth and projected demand, a 5.5 percentage point gap emerges between the current online sales performance and future overall market expectations. This comparison highlights the momentum within digital-first retail models and the influence of marketing campaign effectiveness and sales performance indicators in shaping outcomes. Other critical components include customer retention strategies, lower product return rates, and optimized shipping and handling costs supported by sustainable packaging materials and thoughtful furniture packaging design strategies, which increasingly reflect consumer values and operational cost control.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- End-user

- Residential

- Commercial

- Material

- Wood

- Plastic

- Fabric

- Metal

- Others

- Product Type

- Seating

- Tables

- Accessories

- Storage

- Others

- Price

- Economy

- Mid-range

- Premium/luxury

- Geography

- North America

- US

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period, driven by increased consumer interaction and tactile product evaluation at physical retail locations. As shoppers continue to prioritize experiential buying, brick-and-mortar stores allow customers to assess furniture comfort features, furniture weight capacity, and furniture dimensional accuracy before purchase. Retailers offering a diverse selection from resin wicker furniture and teak furniture to steel furniture fabrication are gaining traction by combining in-store engagement with personalized support.

Large format retail chains are enhancing their offerings with trend-driven outdoor furniture design, including lounge chairs, coffee tables, and picnic tables, complemented by side tables, swing sets, and other accessories. These setups integrate well with evolving landscaping preferences, increasing the appeal of comprehensive outdoor living solutions. Major retail formats are also refining distribution network design, optimizing inventory management systems, and maintaining cost efficiency through strategic furniture material sourcing and controlled shipping and handling costs.

Offline sales are further bolstered by effective furniture packaging design, in-store marketing initiatives, and partnerships with wholesale distributors. Retailers are leveraging furniture retail channels to highlight sustainable packaging materials, reducing product return rates while enhancing customer trust. With innovation in furniture style trends, and a growing emphasis on recycling programs, the offline segment remains pivotal to the market's expansion.

The Offline segment was valued at USD 6833.10 million in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

US outdoor furniture market continues to evolve, driven by increasing emphasis on sustainable outdoor furniture materials and long-lasting designs such as aluminum outdoor furniture lifespan and recycled plastic lumber durability. Manufacturers are adopting advanced outdoor furniture manufacturing processes and enhancing furniture supply chain optimization to meet growing demand. The use of high density polyethylene furniture and synthetic wicker furniture cleaning solutions ensures low-maintenance products that appeal to both commercial and residential users.

Comfort remains a core design focus, with innovations in ergonomic outdoor chair design, adjustable patio table height, and folding outdoor chair storage for convenience and usability. Cushion performance is improving through weather resistant outdoor cushions and UV resistant outdoor fabric types, while powder coated steel furniture maintenance practices extend product life. Teak furniture requires specific care, including teak wood furniture oil treatment to preserve its quality.

Retailers now include detailed outdoor furniture assembly instructions and offer insights into product lifecycle assessment furniture to promote transparency. Business clients benefit from extended commercial grade outdoor furniture warranty and robust outdoor furniture logistics management. Rising emphasis on customer satisfaction outdoor furniture continues to shape design and service strategies across modular layouts and flexible modular outdoor furniture configurations that adapt to diverse user needs.

What are US Outdoor Furniture Market drivers leading to the rise in adoption of the Industry?

- The significant rise in consumer preference for patio heating solutions is the primary market driver, fueling the growth of the patio heating products industry.

- US Outdoor Furniture Market exhibits significant growth, driven by the increasing popularity of alfresco living and the desire for comfortable and stylish outdoor spaces. Wicker furniture and resin furniture are prominent choices for their durability and low maintenance, while teak furniture continues to be a preferred option for its natural beauty and longevity. Manufacturing processes have evolved, with an emphasis on sustainability and recycling programs, ensuring eco-friendly production. Side tables, swing sets, coffee tables, outdoor sofas, and outdoor lighting are essential components of the market, catering to various price points and consumer preferences.

- The supply chain has become more streamlined, enabling efficient distribution and timely delivery. Natural gas and propane patio heaters are increasingly demanded in commercial spaces, including pubs, cafes, and restaurants, to create warm temperature zones and enhance the ambiance of outdoor areas. The growing number of establishments in the hospitality industry contributes to the market's expansion.

What are US Outdoor Furniture Market trends shaping the Industry?

- The trend in the outdoor furniture market is shifting towards eco-friendly options due to rising demand. Environmentally conscious consumers are increasingly seeking sustainable furniture solutions for their outdoor spaces.

- US Outdoor Furniture Market is witnessing a significant shift towards eco-friendly materials in response to growing environmental concerns. Traditional materials like teak, rosewood, sal, and deodar are being replaced with sustainable alternatives, such as Moso bamboo. This trend is driven by the negative impacts of deforestation and the health hazards posed by toxic finishes. Moso bamboo, which is stronger and harder than oak, is gaining popularity due to its durability and aesthetic appeal. Moreover, the demand for weather-resistant fabrics and steel furniture is increasing as they offer longevity and require minimal maintenance. Commercial use of outdoor furniture is also on the rise, with sales channels expanding to include e-commerce platforms and specialty stores.

- Distributors are integrating landscaping solutions with outdoor furniture to offer comprehensive solutions to consumers. Plastic furniture continues to be a popular choice due to its affordability and low maintenance requirements. Manufacturing costs are a crucial factor in the outdoor furniture market, with manufacturers focusing on reducing costs while maintaining quality. Color palettes are also an essential consideration, with manufacturers offering a wide range of options to cater to diverse consumer preferences. Overall, US Outdoor Furniture Market is dynamic, with a focus on sustainability, durability, and aesthetics.

How does US Outdoor Furniture Market faces challenges face during its growth?

- The prolonged replacement cycle for outdoor furniture poses a significant challenge to the industry's growth trajectory. This issue, which is a key concern for manufacturers and retailers alike, necessitates continuous innovation and improvement in materials and design to extend the product lifespan and maintain customer satisfaction.

- Outdoor furniture, such as patio furniture dining sets and grill islands, continues to be a significant investment for homeowners due to their long-term use and durability. Superior quality materials, including aluminum and wood, contribute to the extended replacement cycle of these products. However, the high initial cost may hinder market growth. Outstanding customer service and product differentiation are essential marketing strategies for companies offering outdoor furniture.

- E-commerce platforms have become increasingly popular for purchasing smart home décor items, including outdoor furniture, fire pits, and contract furniture. Material innovations, such as weather-resistant fabrics and advanced coatings, further enhance the appeal of these products. Companies focus on offering durable and high-quality products to meet the demands of discerning customers.

Exclusive US Outdoor Furniture Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agio International Co.

- Ashley Global Retail LLC

- Barbeques Galore Aust Pty Ltd.

- Brown Jordan Co.

- Century Furniture LLC

- Ethan Allen Interiors Inc.

- Forever Patio

- Homecrest Outdoor Living LLC

- Inter IKEA Holding BV

- LaZBoy Inc.

- Lebello USA

- Lowes Co. Inc.

- LUXCRAFT

- MillerKnoll Inc.

- Penney IP LLC

- The Home Depot Inc.

- USA Outdoor Furniture

- Wayfair Inc.

- Williams Sonoma Inc.

- Windward Design Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Outdoor Furniture Market In US

- In January 2024, SunCraft Furniture, a leading outdoor furniture manufacturer, announced the launch of its new eco-friendly collection made from recycled plastic, called "GreenVibes," at the International Casual Furnishings Association (ICFA) show (Source: PR Newswire).

- In March 2024, Patio Productions, a major outdoor furniture retailer, entered into a strategic partnership with Amazon to sell its products online, expanding its reach beyond traditional brick-and-mortar stores (Source: BusinessWire).

- In April 2025, Treasure Garden, a prominent outdoor living solutions provider, completed the acquisition of Leisure Creations, a leading manufacturer of outdoor fire pits and fireplaces, significantly expanding its product portfolio (Source: Company Press Release).

- In May 2025, the American Society of Landscape Architects (ASLA) announced the approval of new regulations encouraging the use of sustainable materials in outdoor furniture manufacturing, which is expected to boost demand for eco-friendly products in the US market (Source: ASLA Press Release).

Research Analyst Overview

US Outdoor Furniture Market continues to evolve, with dynamic market trends shaping its various sectors. Rattan furniture, once a staple, gives way to innovations in material usage, such as e-commerce platforms driving the popularity of plastic and aluminum furniture. Lounge chairs and picnic tables remain in demand, with manufacturing costs influenced by raw materials sourcing and production processes. Color palettes reflect consumer preferences, with weather-resistant fabrics offering UV protection and powder-coated finishes ensuring rust resistance. Steel furniture, once synonymous with commercial use, is increasingly integrated into residential landscapes. Product differentiation is key, with decorative accessories and design trends adding value.

Manufacturing processes for wood furniture and resin furniture are undergoing advancements, while recycled materials and recycling programs gain traction. Side tables, coffee tables, and swing sets cater to diverse consumer needs, with price points and distribution channels influencing sales. Outdoor sofas and lighting expand the scope of home décor, with grill islands and fire pits adding functionality. Distribution channels continue to evolve, with wholesale distributors and direct-to-consumer sales shaping the market. Brand positioning and marketing strategies play a crucial role in customer service and satisfaction. The ongoing unfolding of these market activities underscores the continuous dynamism of the outdoor furniture industry.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Outdoor Furniture Market in US insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2025-2029 |

USD 1705.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.2 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch