Oxygenators Market Size 2024-2028

The oxygenators market size is forecast to increase by USD 100.3 million at a CAGR of 6.2% between 2023 and 2028.

- The market is experiencing significant growth due to several driving factors. The increasing prevalence of respiratory and heart diseases is leading to a higher demand for oxygenators in healthcare applications. Additionally, the rising healthcare expenditure and high costs associated with cardiac and respiratory procedures are making oxygenators an essential investment for medical institutions.

- Furthermore, the shift towards emissions-free and quiet operation technologies in various sectors, such as electric vehicles (EVs), battery-powered lawn mowers, household appliances, electronics, and supplemental batteries, is driving the demand for oxygenators in these industries. The integration of oxygenators in plug-in solar panels is also gaining popularity, as it enables the production of oxygen from renewable energy sources. The spark plug industry is another potential market for oxygenators, as they can improve combustion efficiency and reduce emissions. Overall, the market is poised for growth due to these trends and the increasing demand for oxygen generation technologies in various industries.

What will be the Size of the Market During the Forecast Period?

- The market is witnessing significant growth due to the increasing demand for supplementing the power capacity of various applications, including gas generators, electric vehicles (EVs), battery-powered lawn mowers, household appliances, electronics, and more. These oxygenators play a crucial role in improving the overall efficiency and performance of these devices. Gas generators are one of the primary applications of oxygenators. By introducing oxygen into the combustion process, these devices enhance the power output and reduce emissions. Moreover, they enable quieter operation, making them ideal for residential and commercial applications.

- In the realm of electric vehicles, oxygenators are used to supplement the power of batteries, particularly during high-demand situations. By providing an additional power source, these devices enable longer driving ranges and faster charging times. Battery-powered lawn mowers and other household appliances also benefit from the integration of oxygenators. These devices help extend the runtime of these appliances, enabling users to complete their tasks without frequent interruptions for charging. Plug-in solar panels and other renewable energy systems are another application area for oxygenators. By providing an additional power source during low-light conditions or periods of low solar irradiance, these devices enable uninterrupted power supply and reduce the dependence on traditional power sources.

- Moreover, oxygenators are also essential for electronics, particularly those with high power requirements or those that operate in remote locations. By providing an additional power source, these devices enable longer operating times and improved performance. The market caters to various battery chemistries, including lithium-ion, semisolid state, and lead-acid batteries. These devices are designed to work with different battery types and power capacities, ranging from watt-hours (Wh) to total wattage and running/starting wattage. Moreover, oxygenators come with various features, such as Bluetooth apps for remote monitoring and control, pure sine-wave inverters for efficient power conversion, and USB ports for charging small devices.

- Additionally, these devices offer fast recharge times, long warranties, and high energy density to ensure optimal performance and reliability. In conclusion, the market is witnessing significant growth due to the increasing demand for emissions-free and quiet power solutions across various applications. These devices offer numerous benefits, including improved performance, extended runtime, and uninterrupted power supply, making them an essential component for a wide range of applications.

How is this market segmented and which is the largest segment?

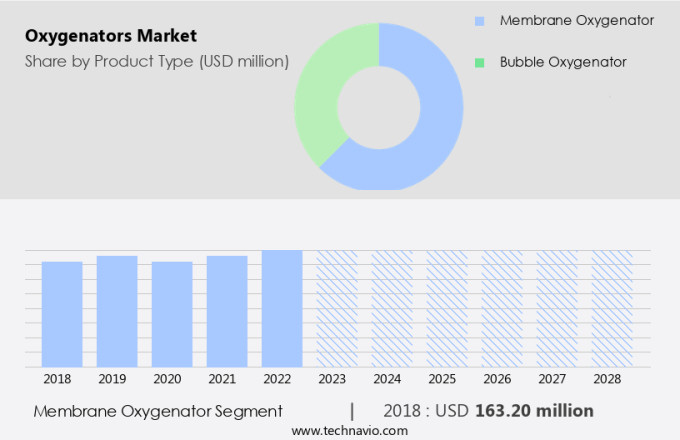

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product Type

- Membrane oxygenator

- Bubble oxygenator

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By Product Type Insights

- The membrane oxygenator segment is estimated to witness significant growth during the forecast period.

The membrane oxygenator segment held the largest market share in The market in 2023, and this trend is anticipated to continue throughout the forecast period. Membrane oxygenators function by infusing oxygen into a fluid and extracting carbon dioxide, making them essential in medical applications such as cardiac surgery and extracorporeal membrane oxygenation (ECMO). ECMO is a widely adopted life-support procedure for patients with cardiac and respiratory failure, as it effectively maintains oxygen supply to the body when the lungs are inactive due to medical conditions or surgical procedures. This method has gained significant acceptance among healthcare professionals due to its unique ability to efficiently deliver oxygen while minimizing emissions and ensuring quiet operation.

In addition to healthcare, membrane oxygenators find applications in various industries such as gas generation for electric vehicles (EVs), battery-powered lawn mowers, and household appliances. Membrane oxygenators are also utilized in electronics, supplemental batteries, and plug-in solar panels to enhance their performance and efficiency. The increasing demand for emissions-free and quiet operation technologies in various sectors is expected to fuel the growth of the membrane oxygenator market during the forecast period.

Get a glance at the market report of share of various segments Request Free Sample

The membrane oxygenator segment was valued at USD 163.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- Europe is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market is projected to lead the global market due to several factors. These include the increasing prevalence of chronic diseases, advancements in technology, product launches, and growing awareness programs for early disease diagnosis. The US and Canada are the primary contributors to the market's revenue in North America. The US market is anticipated to experience substantial growth due to the rising incidence of chronic diseases and high healthcare expenditures. Energy density and recharge time are crucial factors when considering oxygenators. Energy storage capacity, measured in watt-hours (Wh), is essential for determining the total runtime of the device.

Moreover, warranty, transfer switch compatibility, and starting and running wattages are also essential considerations. Energy storage solutions, such as rechargeable batteries, are becoming increasingly popular as power sources for oxygenators. When selecting an oxygenator, it's important to consider the total wattage, which is the sum of the starting and running wattages. The starting wattage is the power required to initiate the oxygenator, while the running wattage is the power needed to maintain its operation. Prospective buyers should ensure that their power source can provide the necessary wattage to operate the oxygenator efficiently.

In conclusion, the market in North America is expected to witness significant growth due to the increasing incidence of chronic diseases, technological advancements, and growing awareness programs for early disease diagnosis. The US is the leading revenue-generating country in the region, with a large and aging population and high healthcare spending. Energy density, recharge time, warranty, total wattage, and watt-hours are essential factors to consider when selecting an oxygenator. Rechargeable batteries are becoming increasingly popular as power sources due to their convenience and efficiency.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Oxygenators Market?

Increasing incidence of respiratory and heart failure is the key driver of the market.

- Oxygenators play a crucial role in providing life-support to individuals suffering from chronic cardiovascular and respiratory diseases. These conditions, such as chronic obstructive pulmonary disease (COPD), acute respiratory distress syndrome (ARDS), and pulmonary embolism, pose a significant risk to people of all age groups worldwide. Factors contributing to these diseases include respiratory infections, smoking, and air pollution. Compact and transportable oxygenators are increasingly popular for outdoor activities, camping trips, and emergency situations.

- Moreover, these devices come with multiple output ports, including AC and DC outlets, enabling users to charge their devices, such as smartphones and laptops while using the oxygenator. The demand for oxygenators is on the rise due to the increasing prevalence of chronic respiratory diseases. Oxygenators are essential medical devices that help patients with respiratory and cardiac failure to breathe properly. With their compact design and portability, they offer flexibility and convenience for both medical professionals and patients.

What are the market trends shaping the Oxygenators Market?

Increasing healthcare expenditure is the upcoming trend in the market.

- The global healthcare industry is experiencing significant growth due to the rising prevalence of cardiovascular diseases (CVDs) and the increasing disposable income of people. This trend is leading to an increase in healthcare expenditure, with developed countries already spending substantial amounts. In contrast, emerging markets such as China, India, and Brazil are witnessing favorable growth in healthcare spending, driven by the rising disposable income of their populations.

- According to The World Bank Group, China's healthcare expenditure is projected to expand at an average annual rate of 8%. This growth is expected to continue as people become more health-conscious and seek early management of CVDs. Solar charging, electrical energy, and various power sources such as gasoline generators and diesel generators are being integrated into healthcare facilities to ensure uninterrupted power supply. Hybrid power stations are also gaining popularity as they offer a cost-effective and sustainable solution for healthcare facilities.

What challenges does Oxygenators Market face during the growth?

High costs associated with cardiac and respiratory procedures are key challenges affecting the market growth.

- Oxygenators play a crucial role in medical settings, enabling healthcare professionals to deliver life-sustaining oxygen to patients dealing with respiratory and cardiac issues. The escalating demand for oxygenators in heart and lung transplant procedures, as well as managing cardiogenic shock and respiratory failures, has fueled their adoption in hospitals, clinics, and ASCs. Medical experts predominantly carry out this procedure, with Extracorporeal Membrane Oxygenation (ECMO) being the preferred method for treating various cardiovascular diseases, including hypothermic cardiocirculatory arrest. Oxygenators serve as an effective alternative for emergency circulatory support during cardiothoracic surgery.

- In addition to traditional power sources, oxygenators are now available with innovative features like lights, fans, and small appliances, which can be plugged into a wall outlet or charged via solar panels and car chargers. These advancements cater to the growing need for electricity generation and the specifications of Lithium-ion cells, enabling portability and flexibility. The capacity of these devices is measured in kilowatt-hours (kWh), ensuring efficient and reliable oxygenation for patients.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Armstrong Medical Ltd.

- Braile Biomedica

- Chalice Medical Ltd.

- CytoSorbents Corp.

- Eurosets Srl

- Fresenius SE and Co. KGaA

- Gen World Medical Devices

- Getinge AB

- Guangdong Ougelsi Technology Co., Ltd.

- LivaNova PLC

- MC3 Cardiopulmonary

- Medtronic Plc

- MicroPort Scientific Corp.

- Nipro Corp.

- Palex Medical SA

- Sechrist Industries Inc.

- Senko Medical Instrument Mfg. Co. Ltd.

- Terumo Corp.

- Xenios AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for gas generators and emissions-free appliances. Gas generators are becoming increasingly popular as they offer a reliable power source for various applications, including electric vehicles (EVs), battery-powered lawn mowers, and household appliances. Electronics, such as laptops and smartphones, require a constant power supply, leading to the increasing demand for supplemental batteries and charging appliances. These appliances are designed to be compact and transportable, making them ideal for outdoor activities, camping trips, and emergency situations.

The use of pure sine-wave inverters, Bluetooth apps, and USB ports in these appliances enhances their functionality and convenience. Lithium-ion batteries, with their high energy density and fast recharge time, are gaining popularity due to their long runtimes and low self-discharge rates. Solar panels and plug-in solar panels are also contributing to the growth of the market. These renewable energy sources offer emissions-free electricity generation, making them an attractive alternative to traditional gasoline and diesel generators. The total wattage and power capacity of these appliances vary, with some offering high power output for heavy-duty applications, while others cater to the needs of small appliances.

Energy storage solutions, such as rechargeable batteries and hybrid power stations, provide an additional boost to the market's growth. The market is expected to continue its growth trajectory due to the increasing demand for energy storage and renewable energy solutions. The market is poised to offer numerous opportunities for manufacturers, with a focus on improving energy density, reducing recharge time, and enhancing the durability and reliability of their products.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

135 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.2% |

|

Market growth 2024-2028 |

USD 100.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.7 |

|

Key countries |

US, Germany, Canada, UK, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch