Paint Plasticizers Market Size 2024-2028

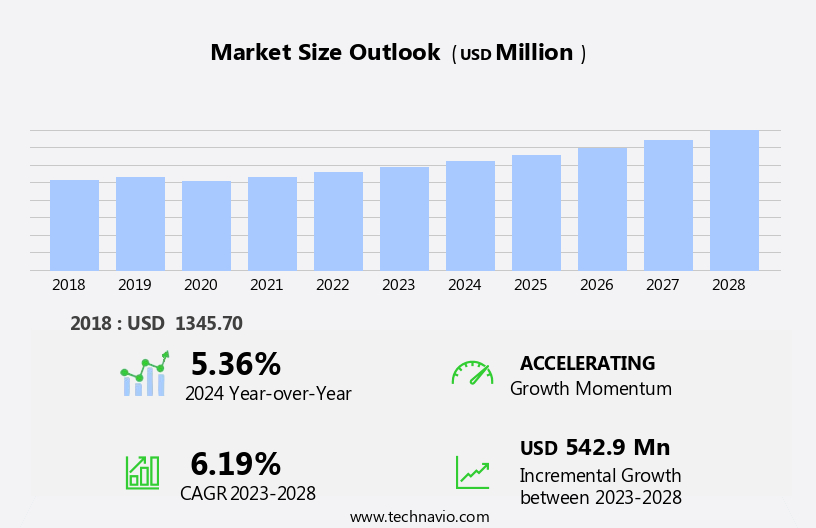

The paint plasticizers market size is forecast to increase by USD 542.9 million at a CAGR of 6.19% between 2023 and 2028.

- The market is witnessing significant growth due to several key factors. The expanding real estate and construction industry, particularly in developing regions, is driving market demand.

- Furthermore, there is a notable trend towards the use of eco-friendly plasticizers, which are gaining popularity due to their reduced environmental impact. Additionally, stringent regulations on the emissions of volatile organic compounds (VOCs) in paints and coatings are compelling manufacturers to shift towards low-VOC and zero-VOC plasticizers. These factors are expected to fuel market growth in the coming years.

What will be the Size of the Paint Plasticizers Market During the Forecast Period?

- The market encompasses the production and supply of additives used to enhance the properties of paint, coatings, and flexible polymers. These substances, available in both water-based and solvent-based forms, contribute significantly to the coatings industry by improving viscosity, softness, flexibility, and other essential characteristics. The market caters to various sectors, including consumer goods, textiles, automotive components, medical equipment, toys, and infrastructure projects. Non-phthalate plasticizers have gained traction due to increasing environmental concerns and regulatory pressures. Solvent-based paint plasticizers continue to dominate the market, offering superior durability, adhesion, and flow and leveling properties. However, water-based alternatives are gaining ground due to their lower volatility and environmental friendliness.

- Key applications of paint plasticizers span across industries, including automotive technology, for improved impact resistance, scratch resistance, and chip resistance, and the construction sector for infrastructure projects requiring high durability and workability. Overall, the market is expected to grow steadily, driven by increasing demand for high-performance coatings and the expanding consumer goods sector.

How is this Paint Plasticizers Industry segmented and which is the largest segment?

The paint plasticizers industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Phthalate

- Non-phthalate

- End-user

- Construction

- Automotive

- Consumer goods

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- Middle East and Africa

- South America

- APAC

By Type Insights

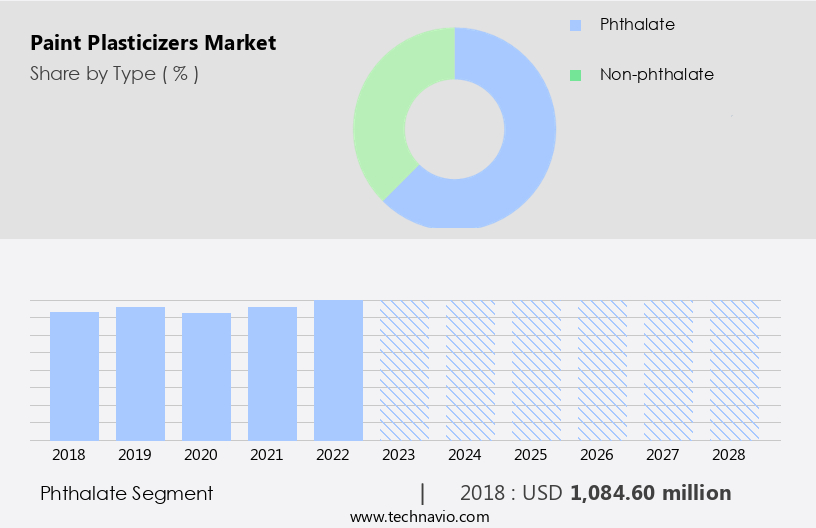

- The phthalate segment is estimated to witness significant growth during the forecast period.

The phthalate segment holds a significant share In the market. Phthalates are a type of compound used in paints to enhance their workability, flexibility, and durability. Their popularity is attributed to their superior characteristics, including low volatility, high stability, excellent resistance to UV radiation and extreme temperatures, and cost-effectiveness compared to other plasticizer materials. However, health and environmental concerns regarding certain phthalates, such as diisononyl phthalate (DINP) and di(2-ethylhexyl) phthalate (DEHP), have emerged as challenges. These phthalates are classified as potentially harmful to human health and are subject to regulations and restrictions in various regions. Phthalates are extensively used In the coatings industry, particularly in flexible polymers, to produce water-based and solvent-based coatings.

They find applications in various sectors, including consumer goods, textiles, automotive components, medical equipment, and toys. Phthalates are also used in urbanization and construction projects for infrastructure development, where durability, adhesion, and impact resistance are crucial factors. In addition to traditional phthalates, eco-friendly alternatives, such as bio-based plasticizers and terephthalates, are gaining traction due to their sustainability and environmental benefits. These alternatives are used in various applications, including films, cables, wood, iron products, windows, floorings, doors, pipes, wires and cables, electrical devices, flooring, roofing, cladding, films and sheets, packed food, and beverages. Phthalates are also used in the production of Dioctyl adipate (DOA), Diisononyl adipate (DINA), Trioctyl trimellitate (TOTM), Triisononyl trimellitate (TINTM), Dibutyl maleate (DBM), and Dioctyl maleate (DOM). The market is expected to grow due to the increasing demand for sustainable construction materials, digitalization, and customer interactions In the coatings industry.

Get a glance at the Paint Plasticizers Industry report of share of various segments Request Free Sample

The Phthalate segment was valued at USD 1.08 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

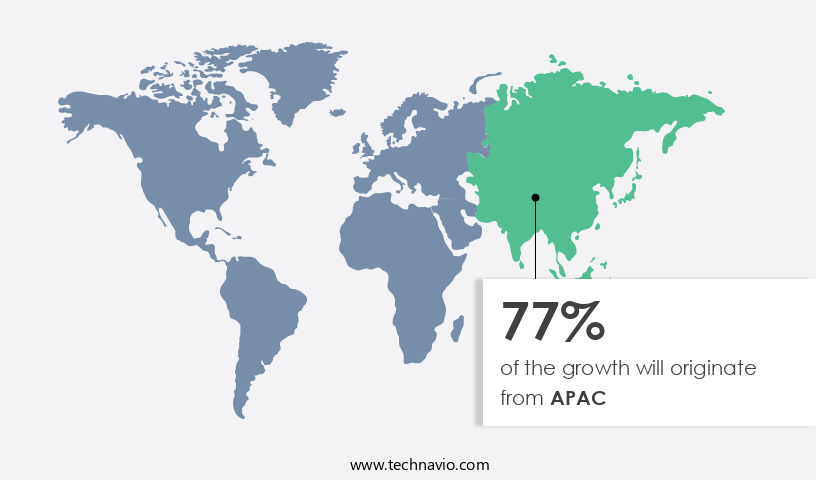

- APAC is estimated to contribute 77% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market In the Asia Pacific (APAC) region is experiencing significant growth due to the increasing focus on construction activities and urbanization. Rapid industrialization in countries like China and India is driving the demand for paint plasticizers, particularly in the automotive, architectural, and defense industries. China and India are major automotive manufacturers globally, leading to a high demand for automotive components, which require paint plasticizers for production. These plasticizers enhance the viscosity, softness, and flexibility of paints and coatings, making them essential in various industries, including consumer goods, textiles, and the coatings industry. Key plasticizers include phthalates such as Dioctyl phthalate (DOP), Diisononyll phthalate (DINP), Dioctyl terephthalate (DOTP), and Dibutyl phthalate (DBP), as well as bio-based plasticizers, terephthalates, epoxies, aliphatics, and eco-friendly alternatives.

The market is also witnessing an increasing trend towards sustainable construction materials and digitalization, leading to the development of new applications for paint plasticizers in infrastructure projects, flooring, roofing, cladding, films and sheets, and packed food and beverages. Key applications include wires and cables, films and sheets, automotive parts, and pipes. The market is expected to continue growing due to the demand for durability, adhesion, flow and leveling, workability, impact resistance, and scratch resistance in various industries.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Paint Plasticizers Industry?

Growing real estate and construction industry is the key driver of the market.

The paint plasticizers market is witnessing significant growth due to several key factors. The expanding real estate and construction industry, particularly in developing regions, is driving market demand. Furthermore, there is a notable trend towards the use of eco-friendly paint plasticizers, which are gaining popularity due to their reduced environmental impact. Additionally, stringent regulations on the emissions of volatile organic compounds (VOCs) in paints are compelling manufacturers to shift towards low-VOC and zero-VOC plasticizers. These factors are expected to fuel market growth in the coming years.

The real estate and construction sector is experiencing significant expansion in the global market. This industry's growth can be attributed to various factors, including increasing population, urbanization, and economic development. The demand for residential and commercial properties continues to rise, leading to a surge in construction projects. Additionally, advancements in technology and construction methods have streamlined the building process, making it more efficient and cost-effective. Furthermore, government initiatives and incentives aimed at boosting the housing market and infrastructure development are also contributing to the industry's growth. As a result, the real estate and construction sector is expected to continue its upward trajectory in the foreseeable future.

What are the market trends shaping the Paint Plasticizers Industry?

Shift toward eco-friendly paint plasticizers is the upcoming market trend.

The paint plasticizers market is witnessing significant growth due to several key factors. The expanding real estate and construction industry, particularly in developing regions, is driving market demand. Furthermore, there is a notable trend towards the use of eco-friendly paint plasticizers, which are gaining popularity due to their reduced environmental impact. Additionally, stringent regulations on the emissions of volatile organic compounds (VOCs) in paints are compelling manufacturers to shift towards low-VOC and zero-VOC plasticizers. These factors are expected to fuel market growth in the coming years.

Businesses are increasingly turning to eco-friendly alternatives for paint plasticizers to reduce their environmental impact, with global demand for these sustainable solutions projected to grow significantly. These alternatives, such as renewable plant-based materials and biodegradable chemicals, offer a more sustainable and responsible option compared to traditional plasticizers derived from fossil fuels. By adopting these eco-friendly solutions, companies can enhance their corporate social responsibility efforts and appeal to consumers who prioritize sustainability in their purchasing decisions. Additionally, the use of eco-friendly paint plasticizers can contribute to the reduction of greenhouse gas emissions and the minimization of waste in the manufacturing process. Overall, the shift towards eco-friendly paint plasticizers represents a significant trend in the global paint and coatings industry, driven by increasing consumer awareness and regulatory requirements.

What challenges does the Paint Plasticizers Industry face during its growth?

Regulations on emissions of VOCs in paints is a key challenge affecting the industry growth.

The paint plasticizers market is witnessing significant growth due to several key factors. The expanding real estate and construction industry, particularly in developing regions, is driving market demand. Furthermore, there is a notable trend towards the use of eco-friendly paint plasticizers, which are gaining popularity due to their reduced environmental impact. Additionally, stringent regulations on the emissions of volatile organic compounds (VOCs) in paints are compelling manufacturers to shift towards low-VOC and zero-VOC plasticizers. These factors are expected to fuel market growth in the coming years.

Compliance with regulations governing volatile organic compound (VOC) emissions in the paint industry is essential. Strict enforcement of these regulations has led to the development of low-VOC and zero-VOC paint formulations, which are increasingly popular among consumers due to their environmental benefits. Manufacturers have responded by investing in research and development to produce these eco-friendly alternatives, thereby expanding the market for sustainable paint solutions. This trend is expected to continue, as more governments and consumers prioritize reducing their carbon footprint and improving air quality.

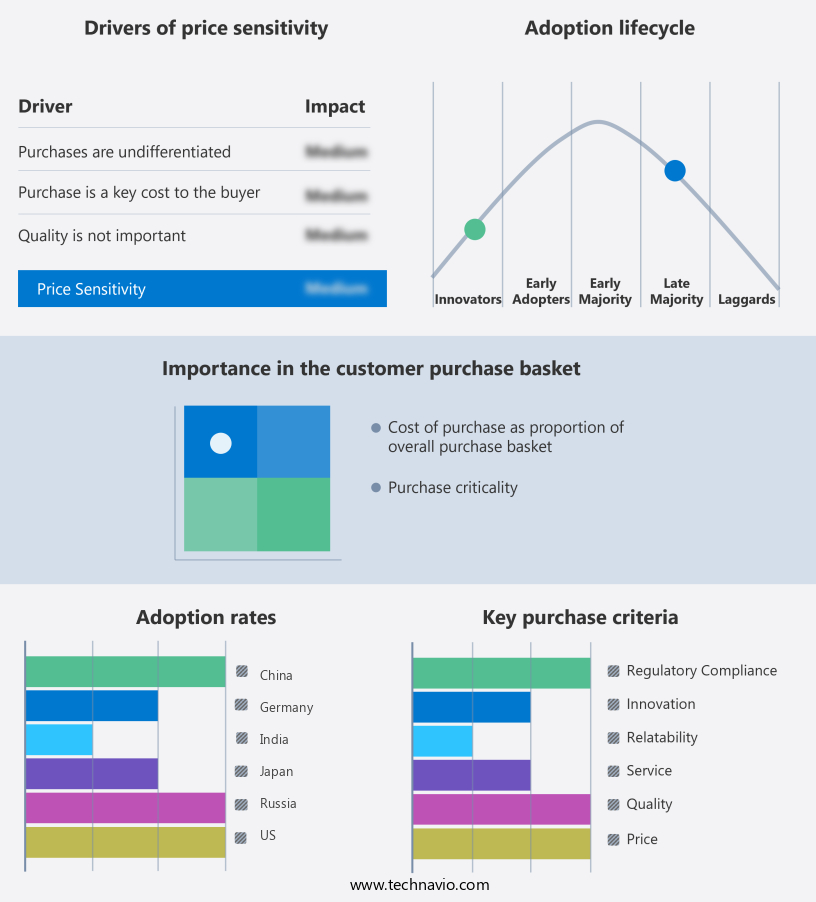

Exclusive Customer Landscape

The paint plasticizers market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the paint plasticizers market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, paint plasticizers market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ADD Chem Germany - The company specializes in providing a range of paint plasticizers, including Acetyl Triethyl Citrate, Diisobutyl Phthalate, Dioctyl Adipate, and Dibutyl Phthalate. These plasticizers are essential additives used to enhance the flexibility, durability, and workability of paint and coatings.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ADD Chem Germany

- ARDIN CHEMICAL CO.

- BASF SE

- Eastman Chemical Co.

- Guangzhou Xiongxing Plastic Products Co. Ltd.

- Henan GP Chemicals Co. Ltd.

- India Glycols Ltd.

- KLJ Group

- Kraton Corp.

- Lanxess AG

- Nayakem

- New Japan Chemical Co. Ltd

- Perstorp Holding AB

- Polynt Spa

- Prakash Chemicals International Pvt. Ltd.

- Shandong Aojin Chemical Technology Co. Ltd.

- Suntek

- Swastik Plasticizer and PVC Pipe Indore Pvt. Ltd.

- Vinyl Group.

- Witmans Industries PVT. LTD.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market plays a crucial role In the coatings industry, contributing significantly to the production of flexible polymers used in various sectors. These organic compounds, often esters or phthalates, are added to paints and coatings to enhance their properties, such as viscosity, softness, and flexibility. Water-based and solvent-based paint plasticizers serve distinct functions In the coatings industry. Water-based plasticizers are preferred for their eco-friendly characteristics, making them suitable for consumer goods and textiles. In contrast, solvent-based plasticizers offer superior performance in terms of durability, adhesion, and workability, making them a popular choice for automotive components, medical equipment, and construction projects.

Flexible polymers, including PVC, are extensively used in various industries, such as automotive, construction, and consumer goods. Phthalates, such as dioctyl phthalate (DOP), diisononyl phthalate (DINP), dioctyl terephthalate (DOTP), and dibutyl phthalate (DBP), are commonly used plasticizers In these applications. However, due to environmental concerns, the market is shifting towards bio-based plasticizers and eco-friendly alternatives, such as terephthalates, epoxies, aliphatics, and eco-friendly plasticizers. The coatings industry's growth is influenced by several factors, including urbanization, infrastructure projects, and digitalization. The construction sector's expansion, driven by urbanization and sustainable construction materials, is a significant contributor to the demand for paint plasticizers.

Additionally, the increasing use of plasticizers in films, cables, wood, iron products, windows, floorings, doors, pipes, and wires and cables further boosts market growth. The consumer goods sector, including food and beverages, also utilizes paint plasticizers in packaging applications. For instance, dioctyl adipate (DOA) and diisononyl adipate (DINA) are commonly used as plasticizers in food packaging due to their excellent properties, such as high clarity, flexibility, and good heat stability. The automotive industry's demand for paint plasticizers is driven by the need for durable, high-performance coatings for automotive parts. Solvent-based plasticizers are often preferred for their superior performance in automotive applications due to their excellent flow and leveling properties, impact resistance, scratch resistance, and chip resistance.

The medical equipment industry's growth is another factor contributing to the market's expansion. Plasticizers are used In the production of medical devices and equipment due to their ability to enhance the flexibility and durability of the materials used In these applications. In conclusion, the market is a dynamic and diverse industry that plays a crucial role in various sectors, including the coatings industry, consumer goods, textiles, automotive, construction, and medical devices. The market's growth is driven by factors such as urbanization, infrastructure projects, digitalization, and the increasing demand for eco-friendly and sustainable plasticizers. The market's future looks promising, with ongoing research and development efforts aimed at producing more efficient, cost-effective, and eco-friendly plasticizers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

193 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.19% |

|

Market growth 2024-2028 |

USD 542.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.36 |

|

Key countries |

China, US, Germany, India, Japan, and Russia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Paint Plasticizers Market Research and Growth Report?

- CAGR of the Paint Plasticizers industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the paint plasticizers market growth of industry companies

We can help! Our analysts can customize this paint plasticizers market research report to meet your requirements.