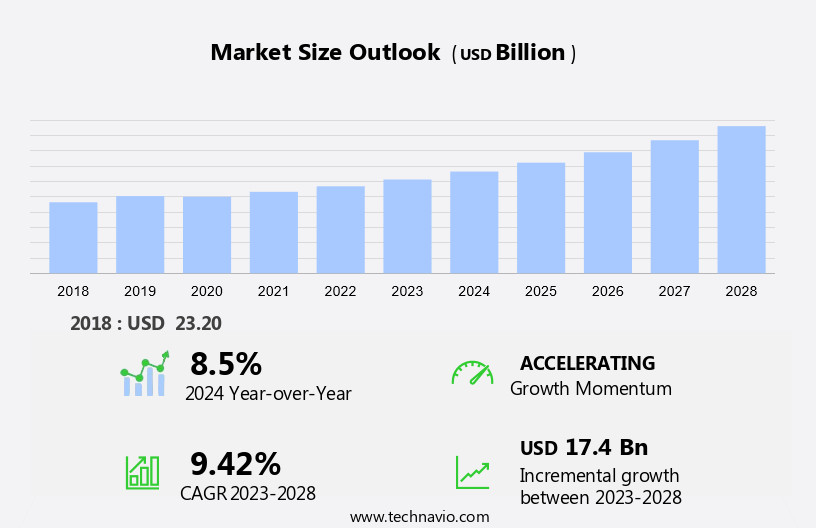

Pediatric Medical Devices Market Size 2024-2028

The pediatric medical devices market size is forecast to increase by USD 17.4 billion at a CAGR of 9.42% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. The increasing prevalence of preterm births and the global adoption of advanced treatment solutions are major drivers. In the realm of diagnostics, in-vitro diagnostics, immunohistochemistry, and genetic testing are gaining traction. Artificial intelligence and immunodiagnostics are revolutionizing the diagnostic landscape, with immunoassays playing a crucial role. Infection control remains a top priority, driving the demand for medical devices that ensure safety and hygiene. Telemedicine is another trend that is transforming pediatric healthcare, making diagnosis and treatment more accessible. Cerebral palsy and other pediatric conditions are being diagnosed earlier and more accurately due to advancements in diagnostic imaging and the availability of in-vitro diagnostics instruments. Insurance coverage for pediatric medical devices is also expanding, making treatments more affordable for families. Biomarkers are increasingly being used to identify and monitor various pediatric conditions, further fueling market growth. Stringent regulatory requirements ensure the safety and efficacy of these devices, maintaining the trust and confidence of healthcare providers and patients alike.

What will be the Size of the Pediatric Medical Devices Market During the Forecast Period?

- The market encompasses a diverse range of technologies designed to address the unique healthcare needs of children, including those with chronic diseases such as asthma and cancer. This market is driven by the increasing prevalence of chronic conditions among pediatric patients, with respiratory disorders being a significant focus. Hospitals and clinics play a crucial role In the market, as they serve as major points of care for children with complex medical needs. Pediatric medical devices span various applications, from diagnostic imaging devices like MRI scans and X-ray imaging, to cardiology devices and anesthesia equipment. Newborns, kids, and teenagers all benefit from these technologies, which enable early detection, accurate diagnosis, and effective treatment.

- Innovations in areas like artificial intelligence, asthma biomarkers, and disease monitoring continue to shape the market. Off-label indications for medical devices in pediatric applications are also gaining traction, expanding the potential market size. Advancements in technology are addressing the challenges of treating inherited and acquired gene mutations, providing new opportunities for medical device manufacturers. Blood sampling procedures and pulse oximeters are essential devices In the market, enabling precise monitoring and diagnosis for various conditions. The market is expected to grow as the demand for advanced, child-friendly medical devices continues to increase.

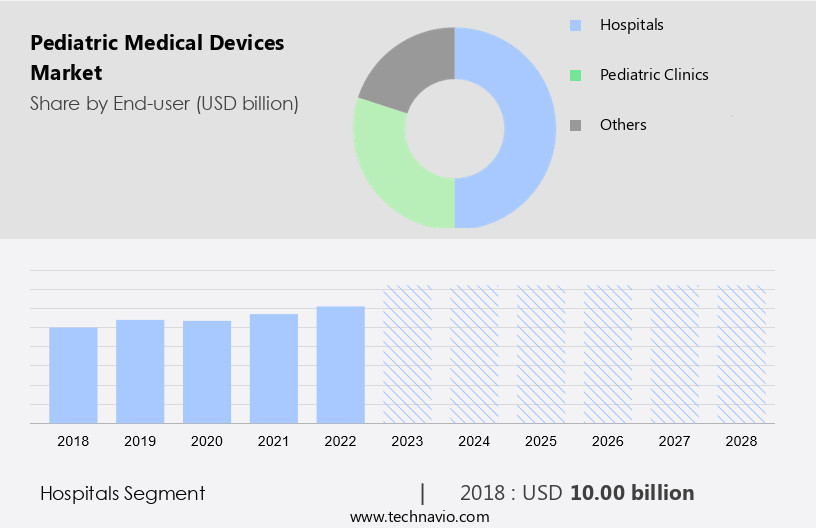

How is this Pediatric Medical Devices Industry segmented and which is the largest segment?

The pediatric medical devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Hospitals

- Pediatric clinics

- Others

- Product

- In vitro diagnostic devices

- Cardiology devices

- Anesthesia and respiratory care devices

- Neonatal ICU devices

- Others

- Geography

- North America

- Canada

- US

- Asia

- China

- Japan

- Europe

- Germany

- Rest of World (ROW)

- North America

By End-user Insights

- The hospitals segment is estimated to witness significant growth during the forecast period.

The hospital segment holds a prominent position In the market, driven by the increasing prioritization of pediatric healthcare and the requirement for advanced medical devices to diagnose and manage various pediatric conditions. Hospitals serve as the primary consumers of pediatric medical devices, playing a pivotal role In their development and implementation. The segment's dominance is anticipated to continue throughout the forecast period due to the rising number of pediatric hospitals and the escalating demand for specialized pediatric care. This segment is further categorized into sub-segments, including pediatric intensive care units (PICUs), neonatal intensive care units (NICUs), and pediatric emergency departments.

Get a glance at the market report of share of various segments Request Free Sample

The hospitals segment was valued at USD 10.00 billion in 2018 and showed a gradual increase during the forecast period.

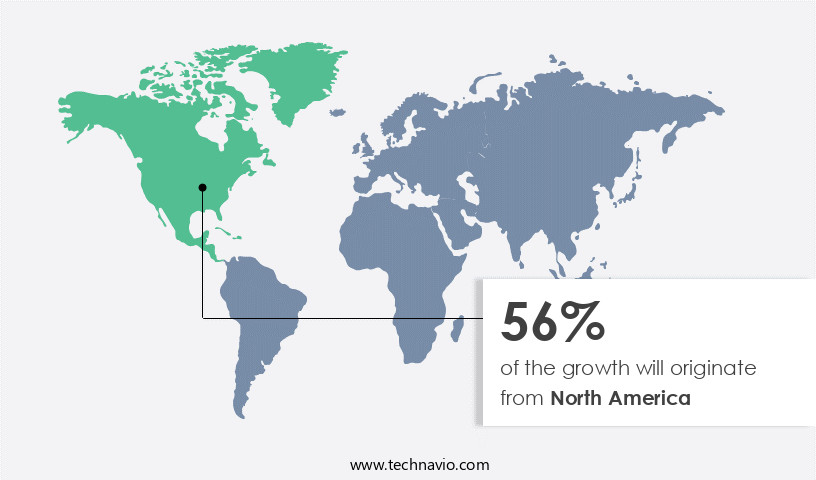

Regional Analysis

- North America is estimated to contribute 56% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market for pediatric medical devices held a significant market share in 2023, driven primarily by the US. Factors contributing to this growth include increased insurance coverage, rising research and development expenditure, and a growing geriatric population with chronic diseases. According to the Centers for Disease Control and Prevention (CDC), chronic diseases are the leading cause of death and disability for six in ten adults In the US. In the in-vitro diagnostics instruments market, immunodiagnostics dominates due to the demand for effective reagents and instrument solutions for disease diagnosis. Pediatric patients, including children, kids, teenagers, and newborns, require specialized medical devices for managing health issues such as respiratory disorders, asthma, cardiology, anesthesia care, respiratory care, diagnostic imaging, neonatal ICU, infection, anemia, leukemia, measles, mumps, pneumonia, tuberculosis, and diabetes.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Pediatric Medical Devices Industry?

Increasing prevalence of preterm birth is the key driver of the market.

- Every year, approximately 15 million babies are born prematurely, according to the World Health Organization (WHO), which is defined as before 37 weeks of gestation. Factors contributing to premature birth include short intervals between pregnancies, in-vitro fertilization, infections in amniotic fluid and lower genital tract, multiple miscarriages or abortions, multiple pregnancies, and chronic conditions like diabetes and high blood pressure during delivery. Premature birth can lead to high neonatal mortality within the first 28 days of life and long-term morbidities, including cerebral palsy, sensory impairments, learning disabilities, breathing problems, developmental delays, and respiratory illnesses. Pediatric patients with chronic diseases, such as asthma, cancer, anemia, leukemia, measles, mumps, pneumonia, tuberculosis, and diabetes, also require specialized medical devices.

- These include cardiology devices, anesthesia care devices, respiratory care devices, diagnostic imaging devices, neonatal ICU devices, and monitoring devices. Pediatric clinics and hospitals rely on these devices for clinical trial enrollments, parental approval, and disease monitoring using technologies like artificial intelligence, asthma biomarkers, and diagnostic imaging technologies. Pediatric patients, ranging from newborns to teenagers, require various medical devices for check-ups, vaccinations, and treatment of health issues, including infections, overweight, injuries or trauma, and disabilities.

What are the market trends shaping the Pediatric Medical Devices Industry?

Global adoption of advanced treatment solutions is the upcoming market trend.

- The market encompasses a range of technologies used to diagnose, monitor, and treat health issues in children, including those with chronic diseases such as asthma, cardiology conditions, and cancer. Respiratory care devices, like pulse oximeters and ventilators, are in high demand due to the prevalence of respiratory disorders in pediatric patients. Anesthesia care devices and critical care devices, such as warmers and monitors, are essential for hospital and clinic settings. In the realm of diagnostics, advanced technologies like MRI scans and X-ray imaging play a crucial role in identifying abnormalities in internal organs, infections, and injuries or trauma. Neonatal ICU devices are specifically designed for newborns and premature infants, addressing their unique health needs.

- The adoption of medical devices in pediatric care is driven by the increasing clinical trial enrollments and parental approval for safer and more effective treatments. Artificial intelligence and disease monitoring technologies, such as asthma biomarkers, enable more precise and personalized care for kids, teenagers, and those with chronic illnesses like anemia, leukemia, measles, mumps, pneumonia, tuberculosis, and diabetes. The market for specialty testing, including infectious diseases, genetic mutations (abnormal, inherited, and acquired), and diagnostic imaging technologies, is growing rapidly. Laboratories increasingly prefer partnering with trusted providers for bulk purchases of medical devices, as the demand for accurate and efficient diagnostic tools continues to increase.

What challenges does the Pediatric Medical Devices Industry face during its growth?

Stringent regulatory requirements is a key challenge affecting the industry growth.

- The market encompasses a range of equipment designed to address the unique health needs of children, including those with chronic diseases such as asthma, cardiology conditions, and cancer. Respiratory disorders, particularly asthma, are common health issues for pediatric patients, leading to high clinical trial enrollments and parental approval for respiratory care devices like pulse oximeters, ventilators, and warmers. Hospitals and clinics rely on these devices for critical care, diagnostics, and monitoring, ensuring accurate clinical information for pediatric patient admissions. Regulatory bodies, such as the US Food and Drug Administration (FDA), play a crucial role In the approval process for pediatric medical devices.

- Strict regulations govern the manufacture and marketing of devices, ensuring safety and efficacy. These requirements include considerations for infection control, neonatal ICU devices, and monitoring devices for anemia, leukemia, and other health conditions. Artificial intelligence and telemedicine technologies are increasingly integrated into home-use medical devices for disease monitoring and anesthesia care. Pediatric patients face various health issues, including infections, abnormalities in internal organs, and injuries or trauma. Diagnostic imaging devices, such as MRI scans and X-ray imaging, are essential for identifying and treating these conditions. Blood sampling procedures, warmers, and monitoring devices are crucial for managing chronic illnesses like diabetes, high blood pressure, and disability.

Exclusive Customer Landscape

The pediatric medical devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pediatric medical devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, pediatric medical devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Abbott Laboratories

- Atom Medical Corp.

- Baxter International Inc.

- Boston Scientific Corp.

- Cardinal Health Inc.

- Dragerwerk AG and Co. KGaA

- Fritz Stephan GmbH

- General Electric Co.

- Hamilton Medical AG

- Johnson and Johnson Services Inc.

- Koninklijke Philips N.V.

- Medtronic Plc

- Ningbo David Medical Device Co. Ltd.

- Novonate Inc.

- Pega Medical Inc.

- Phoenix Medical Systems P Ltd.

- Siemens AG

- Stryker Corp.

- Trimpeks

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The pediatric medical devices market encompasses a wide range of technologies designed to address the unique healthcare needs of children with chronic diseases and various health issues. This market is characterized by continuous innovation and growth, driven by the increasing prevalence of chronic conditions among pediatric patients and advancements in medical technology. Pediatric patients, including children, teenagers, and newborns, often require specialized medical devices due to their distinct physiological differences compared to adults. Respiratory disorders, such as asthma, are among the most common chronic conditions affecting pediatric patients. Hospitals and clinics rely on a variety of devices, including pulse oximeters and ventilators, to monitor and manage respiratory diseases in this population.

In addition, cardiology devices, anesthesia care devices, and respiratory care devices are essential components of pediatric healthcare. These devices enable accurate diagnosis and effective treatment of various health issues, including cardiovascular conditions, anesthesia administration, and respiratory disorders. Neonatal ICU devices, such as warmers and monitors, are specifically designed for the care of premature infants and newborns with complex health needs. Infection is a significant concern in pediatric healthcare, leading to increased demand for infection prevention and control devices. Diagnostic imaging devices, such as MRI scans and X-ray imaging, play a crucial role in identifying and monitoring various health conditions, including abnormalities of internal organs and infections.

Furthermore, pediatric patient admissions to hospitals and clinics often involve a range of medical procedures, including blood sampling, disease monitoring, and vaccinations. Anemia, leukemia, cancer, and various infectious diseases are among the health issues that may necessitate these procedures. Home-use medical devices, such as telemedicine and anesthesia, enable pediatric patients to receive care in a more convenient and accessible manner. Artificial intelligence (AI) is increasingly being integrated into pediatric medical devices to improve accuracy, efficiency, and patient outcomes. For instance, AI-powered pulse oximeters can provide real-time analysis of oxygen saturation levels and heart rate, allowing for early detection and intervention of respiratory issues.

In addition, Asthma biomarkers and disease monitoring systems are other examples of AI applications in pediatric medical devices. Pediatric clinics serve as essential points of care for children and teenagers, providing check-ups, vaccinations, and ongoing management of chronic conditions. Clinical information systems and electronic health records are essential tools for healthcare providers In these settings, enabling efficient and effective care delivery. The market is characterized by continuous innovation and advancements in medical technology, with a focus on addressing chronic conditions, infection prevention, and improving patient outcomes. Pediatric medical devices play a crucial role in enabling accurate diagnosis, effective treatment, and convenient care delivery for pediatric patients.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

176 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.42% |

|

Market growth 2024-2028 |

USD 17.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.5 |

|

Key countries |

US, China, Japan, Germany, and Canada |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Pediatric Medical Devices Market Research and Growth Report?

- CAGR of the Pediatric Medical Devices industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Asia, Europe, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the pediatric medical devices market growth of industry companies

We can help! Our analysts can customize this pediatric medical devices market research report to meet your requirements.