Periodontal Dental Services Market Size 2024-2028

The periodontal dental services market size is forecast to increase by USD 10.90 billion at a CAGR of 9.9% between 2023 and 2028. The periodontal dental services market is witnessing significant growth due to the rising prevalence of periodontal diseases, such as plaque buildup and tartar formation, leading to inflammation and infection. According to the Centers for Disease Control and Prevention (CDC), nearly half of adults aged 30 and older have some form of periodontal disease. To combat this, there is a growing trend toward collaboration between dental care organizations and insurance providers to offer affordable periodontal services and reduce out-of-pocket costs for patients. However, the prohibitive cost of periodontal treatments, including antibiotics and soft tissue grafts, remains a major challenge for both patients and providers. To maintain healthy gum tissue and prevent tooth sensitivity, regular dental check-ups and proper oral hygiene practices are essential.

Periodontal dental services refer to the various treatments and procedures aimed at preventing and treating gum diseases. These conditions, which include gingivitis and periodontitis, are characterized by inflammation and infection of the gum tissue around the teeth. The primary causes of these diseases are plaque-forming bacteria that accumulate along the gum line, leading to swelling, tissue infection, and potential tooth decay. Gum disease can result in several unpleasant symptoms, such as redness, bleeding, and sensitivity. If left untreated, it may progress to periodontitis, a more severe form of the disease that can lead to bone and tissue loss around the tooth root. This can ultimately result in tooth loss and negatively impact an individual's smile and overall oral health.

To combat gum disease, dentists offer a range of treatment options. Nonsurgical treatments, such as scaling and root planing, are often the first line of defense. Scaling involves removing tartar and plaque from the tooth surface and beneath the gum line, while root planing smooths the root surfaces to prevent bacterial attachment. Antimicrobial medicines and antibiotic medicaments may also be used in conjunction with these procedures to help eliminate infection. For more advanced cases of gum disease, surgical treatments may be necessary. These procedures include gum grafts, dental crown lengthening, and laser treatments. Gum grafts involve using tissue from another part of the mouth or a donor source to reinforce weakened gum tissue. Dental crown lengthening exposes more of the tooth surface to improve the effectiveness of restorative procedures, such as dental crowns.

Additionally, laser treatments offer precision and minimal invasiveness, making them an attractive option for many patients. Regenerative procedures, which promote bone growth and tissue growth, are another aspect of periodontal dental services. These treatments aim to restore lost tissue and support the health of the gum line. By addressing the underlying causes of gum disease and promoting healthy tissue growth, dentists can help improve their patients' oral health and enhance their smiles. In summary, periodontal dental services play a crucial role in preventing and treating gum diseases. From nonsurgical treatments like scaling and root planing to surgical procedures such as gum grafts and laser treatments, dentists offer a range of options to address the unique needs of each patient. By focusing on the health of the gum tissue and promoting tissue and bone growth, these services help improve oral health and enhance smiles.

Market Segmentation

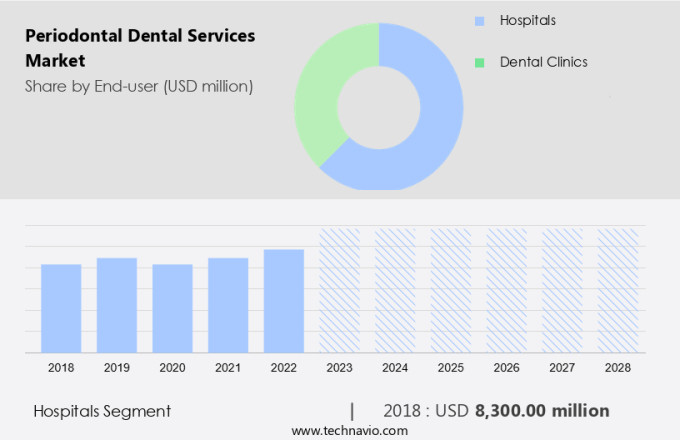

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- End-user

- Hospitals

- Dental clinics

- Service

- Non-surgical

- Surgical

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By End-user Insights

The hospitals segment is estimated to witness significant growth during the forecast period. Hospitals play a crucial role in delivering advanced periodontal dental services to patients dealing with gum disease, oral inflammation, and tissue infection. Dentists in hospitals specialize in treating conditions such as gingivitis and periodontitis, which are caused by plaque-forming bacteria. These dental professionals offer various treatments, including dental scaling or root planning, gum treatment, and periodontal probing. Moreover, hospitals provide periodontal surgeries like tissue scaffolds to restore damaged gum tissue.

Get a glance at the market share of various segment Download the PDF Sample

The hospitals segment was valued at USD 8.3 billion in 2018. Hospitals often collaborate with dental colleges and institutions to ensure access to the latest techniques and technologies. Patients seeking dental care rely heavily on hospitals due to their comprehensive offerings and advanced procedures, despite the higher costs associated with hospital treatments.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

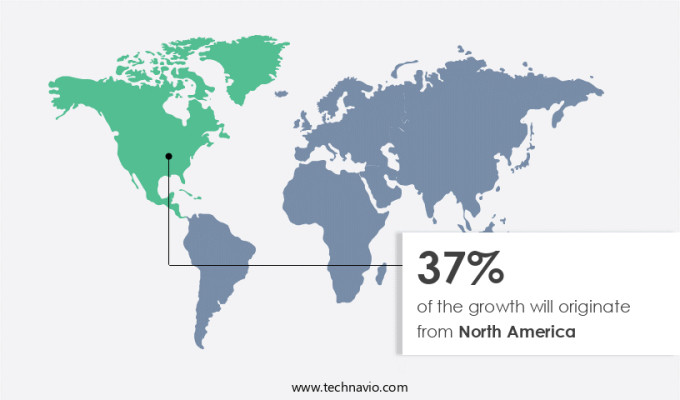

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Periodontal diseases, including gingivitis and periodontitis, are prevalent dental issues in North America, particularly in the US. Approximately half of the population remains untreated for dental caries, while 47.2% of adults aged 30 and above suffer from some form of periodontal disease. This percentage increases significantly among older adults, with 70.1% of those aged 65 and above affected. Periodontal diseases can lead to tissue loss, tooth decay, and the need for dental procedures such as dental crown lengthening or dental implants for replacement teeth. Excess gum tissue can also be a concern for cosmetic purposes. To address these issues, various periodontal pocket reduction procedures, including osseous surgery, are employed. The demand for periodontal dental services is driven by the increasing prevalence of periodontal diseases and the growing awareness of oral health. Dental implants and other advanced dental procedures offer long-term solutions for tooth loss and improved oral health. The market for periodontal dental services is expected to grow, offering opportunities for dental professionals and businesses in the industry.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The rise in prevalence of periodontal diseases is notably driving the market growth. Gum diseases, specifically periodontitis, pose a significant threat to oral health worldwide. In its initial stage, known as gingivitis, the gums exhibit symptoms such as swelling, redness, and bleeding. However, when it progresses, periodontitis causes the gums to pull away from the tooth, leading to bone loss and tooth loosening or loss. This advanced stage of gum disease is a multifactorial condition, with various risk factors contributing to its development. Aging, smoking, poor oral hygiene, socioeconomic status, genetics, and underlying medical conditions are some of the primary risk factors for periodontal diseases.

Also, according to a study published by the National Center for Biotechnology Information (NCBI), India, with its large population, has a high prevalence of periodontal diseases. These diseases not only impact oral health but can also lead to systemic health issues. Periodontists, dental specialists, focus on diagnosing and treating gum and bone diseases. They work to preserve the soft tissue and tooth structure, ensuring optimal oral health. Regular dental check-ups and proper oral hygiene practices are essential to prevent and manage these diseases. By prioritizing oral health, individuals can maintain a healthy smile and potentially avoid the more serious consequences of gum and bone diseases. Thus, such factors are driving the growth of the market during the forecast period.

Significant Market Trends

The collaboration between dental care organizations and insurance providers to reduce service costs is the key trend in the market. The periodontal dental services market prioritizes affordability for individuals and minimizing out-of-pocket expenses. To achieve this goal, dental care organizations are partnering with insurance providers to offer more accessible and cost-effective dental services. Notable insurance companies, such as eHealth, Delta Dental, MetLife, and CIGNA Dental, provide various dental coverage plans. These plans cater to different demographics, including pediatric and older populations, in numerous countries.

For instance, Medicaid and CHIP are popular dental coverage options in the United States for children. Insurance benefits encompass a dental indemnity plan, no waiting period, a 30-day refund policy, and discounted dental procedures, among others. Periodontal disease, a severe form of gum infection, can lead to damaged bone tissue and complications if left untreated. Regular checkups and good oral hygiene habits are essential in preventing periodontal disease. With insurance coverage, individuals can maintain healthy bones and address any potential issues before they escalate, ultimately reducing the need for more extensive and costly treatments, such as bone grafts. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

The prohibitive cost of periodontal services is the major challenge that affects the growth of the market. Periodontal dental services, which address plaque buildup, dental tartar, inflammation, and infection, are essential for maintaining healthy gum tissue and preventing tooth sensitivity. However, the high cost of these services poses a significant barrier for many individuals, particularly those in the lower-income demographic. In the US, the average cost for a dental check-up, including an examination, dental imaging, and cleaning, amounts to approximately USD 288. Periodontal surgical services, which may involve the use of expensive products like crowns and dentures, can cost up to USD 5403.75.

Similarly, the financial burden of dental care forces many individuals to explore alternative, more affordable treatment options. Conventional remedies and non-surgical procedures, such as scaling and root planning, have gained popularity due to their affordability. The lack of access to comprehensive periodontal dental services can result in severe dental issues, leading to further health complications and increased healthcare costs in the long run. To address this challenge, various initiatives, including government programs and non-profit organizations, aim to make dental care more accessible and affordable for all. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

123Dentist Inc.- The company offers periodontal dental services such as gum graft surgery, crown lengthening, and scaling and root planning.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 42 NORTH DENTAL

- Apollo Hospitals Enterprise Ltd

- Aspen Dental Management Inc.

- Birmingham Periodontal and Implant Centre Ltd.

- Brighton Dental Group PLLC

- Burlingame Dental Arts

- Coast Dental Services LLC

- Highland Dental Care

- Integrated Dental Holdings

- Lenga Perio

- Medtronic Plc

- Pacific Dental Services LLC

- PKWY Dental Specialist Practice

- Prevention and Health Services Srl

- Q and M Dental Group Singapore Ltd.

- St. Helena Dental Studio services

- St. Marys Dental

- Sun Lakes Dental

- The Dentists at 650 Heights

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Periodontal dental services encompass a range of procedures aimed at preventing and treating gum diseases. These conditions, including gingivitis and periodontitis, are characterized by inflammation, tissue infection, and plaque-forming bacteria at the gum line. Gum diseases can lead to swelling, tooth sensitivity, and tooth decay if left untreated. Dentists perform dental exams to assess gum health and offer various treatment options. Nonsurgical treatments, such as scaling and root planing, remove tartar and smooth tooth roots to prevent bacterial growth. Antimicrobial and antibiotic medicines may be used in conjunction with these methods. For more advanced cases, surgical treatments like gum grafts, laser treatments, regenerative procedures, bone growth, and tissue growth may be necessary. Periodontal pocket reduction techniques, such as osseous surgery and dental crown lengthening, address excess gum tissue and damaged bone tissue. Dental implants serve as replacement teeth for those experiencing tooth loss. Periodontists specialize in the health of gums, bones, and soft tissue, focusing on maintaining oral health and improving smiles through various dental procedures. Maintaining good oral hygiene habits, including regular checkups, flossing, and brushing, are essential in preventing gum diseases and their complications. Plaque buildup and dental plaque can lead to inflammation, infection, and tooth sensitivity. Antibiotics and soft tissue grafts may be used to treat infected gum tissue and promote the growth of healthy gum tissue.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

149 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.9% |

|

Market growth 2024-2028 |

USD 10.90 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.9 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 37% |

|

Key countries |

US, UK, Germany, China, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

123Dentist Inc., 42 NORTH DENTAL, Apollo Hospitals Enterprise Ltd, Aspen Dental Management Inc., Birmingham Periodontal and Implant Centre Ltd., Brighton Dental Group PLLC, Burlingame Dental Arts, Coast Dental Services LLC, Highland Dental Care, Integrated Dental Holdings, Lenga Perio, Medtronic Plc, Pacific Dental Services LLC, PKWY Dental Specialist Practice, Prevention and Health Services Srl, Q and M Dental Group Singapore Ltd., St. Helena Dental Studio services, St. Marys Dental, Sun Lakes Dental, and The Dentists at 650 Heights |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch