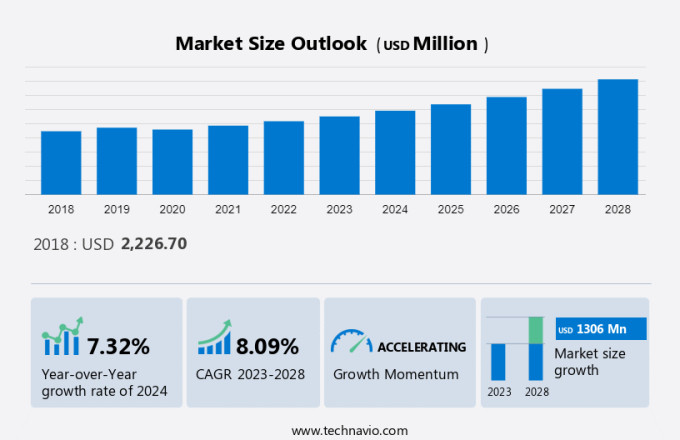

Sensitive Toothpaste Market Size 2024-2028

The Sensitive Toothpaste Market is projected to increase by USD 1.30 billion at a CAGR of 8.09% from 2023 to 2028. The market is experiencing significant growth, driven by several key factors. Innovations and product line extensions continue to be a major growth driver, with companies introducing advanced formulations and new flavors to cater to diverse consumer preferences. These carrageenan-free formula suitable for sensitive teeth and gums, made of natural ingredients such as aloe, white tea, ayurvedic neem, and Australian tea tree oil. Another trend is the introduction of multifunctional sensitive toothpastes, which offer additional benefits such as whitening, tartar control, and fresh breath. Furthermore, the high adoption of homemade remedies and alternative products, fueled by consumer interest in natural and organic solutions, poses a challenge to market players. However, the market is expected to continue expanding due to the increasing prevalence of tooth sensitivity and the growing awareness of oral care.

Market Overview

To get additional information about the market, Buy Report

Market Dynamics

The market caters to individuals seeking relief from dental issues caused by tooth sensitivity. Personal health and dental hygiene are crucial aspects of overall well-being, and sensitive toothpaste addresses specific dental concerns. These toothpastes offer deep cleaning, whitening, repair, and refreshing mint flavors for adults and kids alike. Factors contributing to the market growth include the prevalence of dental caries, tooth sensitivity, recessed gums, and weakened enamel. Alcohol consumption and tobacco use can exacerbate these issues, further increasing the demand for sensitive toothpaste. The market serves various customer segments, including hypermarkets and independent retail stores. It includes a wide range of products, from herbal multi-care toothpastes to rapid relief formulas for highly sensitive teeth. The market caters to both adults and kids, providing solutions for oral sensitivity, sharp pain, and cavities. In summary, the market is a significant player in the dental care industry, addressing the needs of consumers seeking relief from dental issues and maintaining refreshing breath. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers, trends, and challenges will help stakeholders in the value chain refine their marketing strategies to gain a competitive advantage.

Significant Market Trend

The introduction of multifunctional sensitive toothpaste is a major trend in the market. Companies are now offering products with multiple benefits, such as teeth whitening and overall repair and protection, due to the increasing awareness of oral health among consumers. Sensodyne, Colgate-Palmolive, Procter and Gamble, and Unilever are some of the brands offering multifunctional products.

Furthermore, Sensodyne's teeth whitening products like ProNamel Gentle Whitening and Sensodyne True White brighten teeth and protect them from dietary acid erosion. Colgate TotalSF Advanced Whitening Toothpaste removes stains and protects the teeth, tongue, cheeks, and gums from bacteria. Crest Sensitivity Complete Protection Toothpaste blocks sensitivity and offers superior protection from plaque, gingivitis, and tartar. The demand for multifunctional toothpaste is rising due to its numerous benefits over conventional toothpaste, and players are adopting suitable marketing strategies to attract customers and expand their base.

Major Market Challenge

The high adoption of homemade remedies and alternative products is hindering market growth. The global market faces challenges due to the availability of alternative oral care products. The popularity of homemade remedies and natural alternatives for dental and oral health creates a serious obstacle for manufacturers of commercial oral hygiene products. Natural remedies are commonly used in rural areas of developing countries, presenting an opportunity for Companies to target this population.

However, traditional oral care products hinder sales, leading companies to raise awareness about modern oral care practices to expand their customer base and increase revenue. Alternatives to modern dental care, such as charcoal, sesame, coconut oil, and the leaves of Azadirachta indica (neem), are prevalent in APAC countries such as India, Pakistan, Bangladesh, Myanmar, Maldives, and Sri Lanka. The adoption of these alternative oral care products by rural populations in developing countries may limit the market's growth during the forecast period.

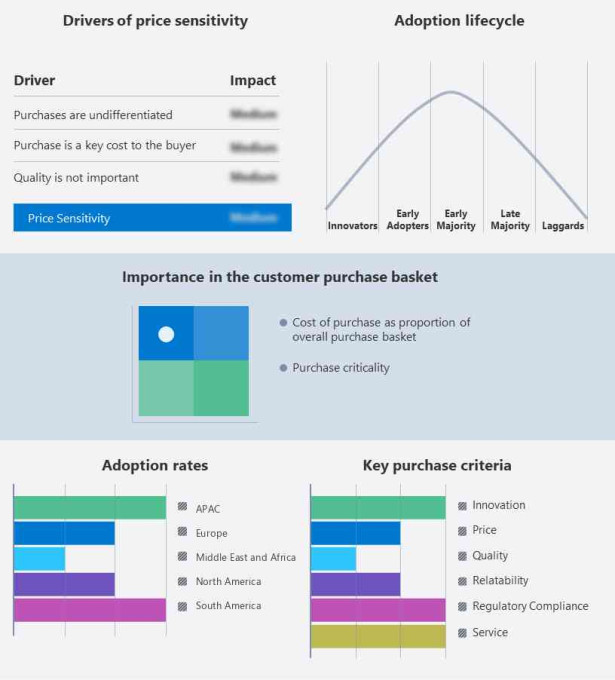

Market Customer Landscape

The report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Global Market Customer Landscape

Company Overview

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Key Offering- Colgate offers sensitive toothpaste under its brand called Colgate Sensitive Pro-Relief whitening toothpaste.

- Key Offering- Dabur offers sensitive toothpaste called Dabur Meswak with herbal extract.

- Key Offering- Lion Corp offers two types of sensitive toothpaste, namely, Systema Natural Mint flavor and Systema Whitening toothpaste.

The report also includes detailed analyses of the competitive landscape of the market and information about 15 market Companies, including:

- BioMin USA

- Church and Dwight Co. Inc.

- Coswell Spa

- GlaxoSmithKline Plc

- Group Pharmaceuticals Ltd.

- Henkel AG and Co. KGaA

- Optima Naturals S.r.l

- Oriflame Holding AG

- Patanjali Ayurved Ltd.

- Sheffield Pharmaceuticals LLC

- Splat Global UK Ltd.

- Spotlight Oralcare EU

- Sunstar Suisse SA

- The Himalaya Drug Co.

- The Honest Co. Inc.

- The Procter and Gamble Co.

- Vicco Laboratories

Qualitative and quantitative analysis of Companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize Companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize Companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

By Application

Low-sensitive toothpaste is a type of oral care product that aids in the prevention or exacerbation of symptoms related to dentin hypersensitivity. Low-sensitivity toothpaste can be bought without a prescription and may be obtained from supermarkets, medical shops, and grocery stores, among other places. It contains potassium nitrate, which helps to delay the nerve's sensitivity to temperature fluctuations. It is used as an abrasive to remove dental plaque and food from the teeth, decrease halitosis, and provide active substances that help prevent tooth decay and gum disease. Low-sensitive variant accounted for the highest market share in 2022, and it is expected to maintain its dominance during the forecast period due to the huge market coverage and the cost-effectiveness of low-sensitive segment. Therefore, this segment contributes to the growth of the global market during the forecast period.

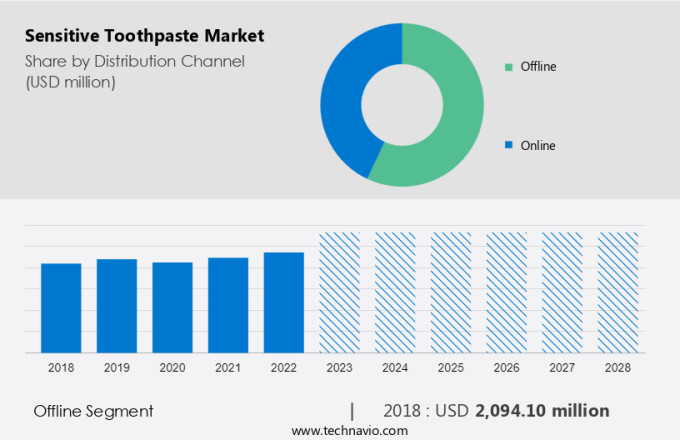

By Distribution Channel

The market share growth by the offline segment will be significant during the forecast period. Offline distribution channels include hypermarkets and supermarkets, department stores, drug stores, and pharmacies. Factors such as business expansion and a rise in the number of hypermarkets, supermarkets, convenience stores, and warehouse clubs of major retailers add to the sales through these retail formats.

For a detailed summary of the market segments BUY REPORT

The offline segment was valued at USD 2.09 billion in 2018. Hypermarkets, supermarkets, convenience stores, and clubhouse stores were the largest sub-segment of the offline distribution channel segment of the market. Hypermarkets and supermarkets offer various brands and stock-keeping units (SKUs) at competitive prices. Factors considered by consumers while purchasing products from hypermarkets, supermarkets, convenience stores, and clubhouse stores include convenience, large SKUs, and wide brand variety. Additionally, in 2022, the departmental stores' segment accounted for the second-largest share of the offline distribution channel segment of the market. Department stores are one-stop solutions for shopping. The availability of all products in a single place is a major factor for consumers to select department stores for buying products. Therefore, all of the abovementioned factors will influence segment growth during the forecast period.

By Region

For further insights about regional markets,Request PDF Sample now!

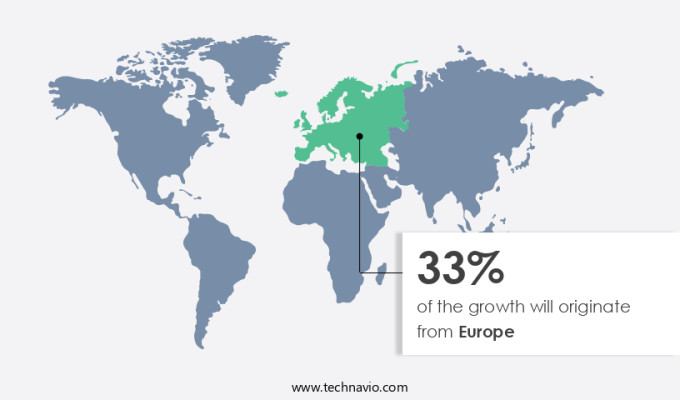

Europe is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional market growth and trends that shape the market during the forecast period.

Europe accounted for the largest share of the global market. The growth of the regional market can be attributed to the high penetration of oral hygiene products, particularly primary oral hygiene products such as toothbrushes and toothpaste. Additionally, the increasing demand for multifunctional-sensitive variant is another key factor contributing to the growth of the market.

Furthermore, other factors that will have a positive impact on the regional market during the forecast period include the growing awareness of oral health disorders, such as teeth sensitivity, periodontal diseases, and tooth decay; the rising number of patients with dental and oral disorders; and the increasing adoption of technologically advanced oral care products. In Europe, the UK, Germany, France, Russia, and Italy are the key leading markets. These economies focus on improving healthcare facilities to provide adequate dental care services. Therefore, all these factors will contribute to the regional market growth during the forecast period.

Segment Overview

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Distribution Channel Outlook

- Offline

- Online

- Application Outlook

- Low sensitive toothpaste

- Highly sensitive toothpaste

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Chile

- Brazil

- Argentina

- North America

Market Analyst Overview

The market caters to personal health and dental hygiene needs, focusing on deep cleaning, whitening, repair, herbal multi-care, and refreshing mint flavors. This market is significant as it addresses oral sensitivity issues caused by various factors such as alcohol consumption, tobacco usage, unhealthy dietary habits, and poor oral care. Tooth sensitivity, a common dental problem, can lead to discomfort and pain. Rapid relief toothpastes, available at convenience stores, pharmacies, and online sales channels, offer quick solutions for those experiencing oral sensitivity issues. Natural ingredients, including herbal toothpaste and Ayurvedic ingredients, are increasingly popular choices for consumers seeking chemical-free options. Specialized products cater to different sensitivity levels, with highly sensitive and low sensitive formulations available for adults and kids. Key ingredients like potassium nitrate and polishing agents help alleviate dentin hypersensitivity. The oral health sector continues to grow, with government support and the availability of specialized products driving market expansion. In conclusion, the market plays a crucial role in maintaining proper oral care for individuals dealing with oral sensitivity issues. With a focus on natural ingredients, convenience, and effective solutions, this market is poised for continued growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market growth 2024-2028 |

USD 1.30 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Regional analysis |

Europe, North America, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

Europe at 33% |

|

Key countries |

US, UK, China, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

BioMin USA, Church and Dwight Co. Inc., Colgate Palmolive Co., Coswell Spa, Dabur India Ltd., GlaxoSmithKline Plc, Group Pharmaceuticals Ltd., Henkel AG and Co. KGaA, Lion Corp., Optima Naturals S.r.l, Oriflame Cosmetics S.A., Patanjali Ayurved Ltd., Sheffield Pharmaceuticals LLC, Splat Global UK Ltd., Spotlight Oral Care Ltd., Sunstar Suisse SA, The Himalaya Drug Co., The Honest Co. Inc., The Procter and Gamble Co., and Vicco Laboratories |

|

Market dynamics |

Parent market analysis, Market Forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2024 and 2028

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market's competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this report to meet your requirements. Get in touch