Personal Accident And Health (Pa And H) Insurance Market Size 2024-2028

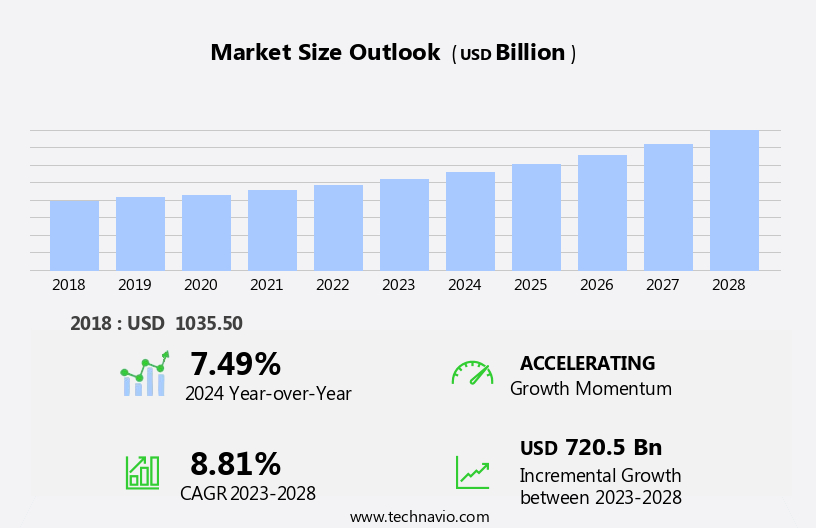

The personal accident and health insurance market size is forecast to increase by USD 720.5 billion at a CAGR of 8.81% between 2023 and 2028.

- The Personal Accident and Health insurance market is experiencing significant growth, driven by the increasing awareness and understanding of the benefits this type of coverage provides. The market is witnessing a surge in demand as more individuals recognize the importance of protecting themselves from financial losses due to unforeseen accidents or health issues. Furthermore, the availability of insurance products and services through digital channels is expanding accessibility and convenience, making it easier for consumers to purchase policies. However, the market is not without challenges. The Pa&H insurance industry faces vulnerabilities toward cybercrime and cybersecurity , as the digitalization of insurance processes increases the risk of data breaches and cyber attacks.

- This threat not only poses a potential financial risk to insurers but also jeopardizes consumer trust and confidence in the industry. As such, companies must prioritize cybersecurity measures to mitigate these risks and ensure the protection of sensitive customer information. In summary, the Pa&H insurance market is witnessing strong growth driven by increased awareness and digital accessibility, but insurers must address cybersecurity challenges to maintain consumer trust and effectively capitalize on market opportunities.

What will be the Size of the Personal Accident And Health (Pa And H) Insurance Market during the forecast period?

- The Personal Accident and Health (PA&H) insurance market continues to evolve, driven by the ever-rising healthcare costs and the growing need for financial security. Digital health and online insurance platforms are transforming the industry, offering convenience and accessibility to consumers. Employee benefits and individual insurance policies are increasingly integrating health management and wellness programs to promote preventative care. Policy comparison tools and artificial intelligence enable consumers to make informed decisions, while regulatory landscape shifts address risk management and data privacy concerns. Disability benefits, financial planning, and accident coverage remain key components of comprehensive insurance solutions. Life insurance and health insurance are intertwined, with retirement planning and critical illness cover essential elements of long-term financial security.

How is this Personal Accident And Health (Pa And H) Insurance Industry segmented?

The personal accident and health (pa and h) insurance industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Personal health insurance

- Personal accidental insurance

- Age Group

- Adults

- Senior citizens

- Children

- Distribution Channel

- Agents & Brokers

- Direct Sales

- Online Platforms

- End-User

- Individuals

- Families

- Employers

- Geography

- North America

- US

- Canada

- Europe

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

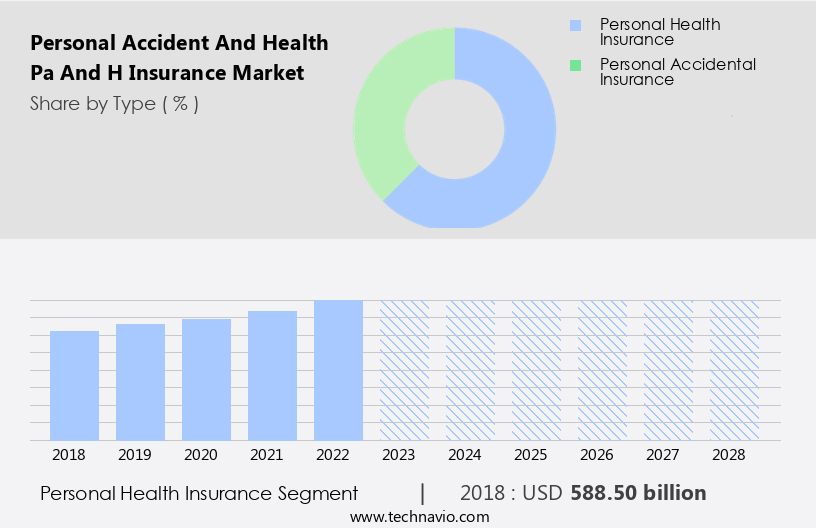

By Type Insights

The personal health insurance segment is estimated to witness significant growth during the forecast period.

The market in the US is witnessing significant growth as individuals and businesses seek financial security against escalating healthcare costs. Digital health and online insurance platforms are transforming the industry, enabling policy comparison, personalized insurance, and claims processing with greater efficiency. Employee benefits, including group insurance and wellness programs, are increasingly popular, while individual insurance offers accident coverage, disability benefits, critical illness cover, and retirement planning. The Affordable Care Act and health care reform have influenced the regulatory landscape, shaping risk management strategies and driving product innovation. Risk aversion and data privacy concerns are key considerations, with technology adoption, including artificial intelligence and machine learning, playing a pivotal role in improving customer experience and claims processing.

Life insurance, a complementary offering, is also evolving, with value-added services, such as financial planning and investment advice, becoming increasingly important. The industry is also embracing corporate social responsibility, with insurers offering policy administration, insurance technology, and distribution channels that cater to diverse consumer needs. Health savings accounts and digital transformation are reshaping the insurance landscape, enabling consumers to take a more active role in managing their healthcare expenses and making informed decisions. Despite the challenges, the market remains dynamic, with insurers and insurance brokers adapting to industry disruptions and evolving consumer preferences. Medical expenses, surgical expenses, and claims processing continue to be key areas of focus, with insurers leveraging data analytics and consumer behavior insights to provide better value to their customers.

The Personal health insurance segment was valued at USD 588.50 billion in 2018 and showed a gradual increase during the forecast period.

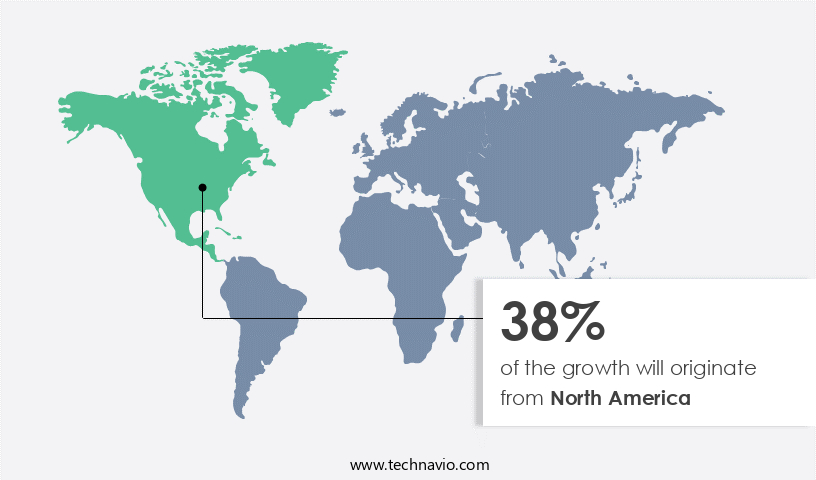

Regional Analysis

North America is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market for personal accident and health insurance has experienced notable growth in recent years, driven by rising consumer awareness and increasing per capita income. Health consciousness is a significant factor fueling this market expansion. The Centers for Disease Control and Prevention (CDC) in the US, for instance, has spearheaded awareness campaigns, inspiring individuals to invest in personal accident and health insurance policies. Digital health and online insurance platforms have gained traction, offering convenience and accessibility. Employee benefits packages increasingly include group insurance policies, while individual insurance policies cater to those not covered by employer-sponsored plans.

Artificial intelligence and machine learning are revolutionizing claims processing, risk management, and policy administration. Healthcare costs continue to escalate, necessitating financial planning and risk aversion. Regulatory landscape shifts, such as the Affordable Care Act, have influenced product innovation, including critical illness cover, disability benefits, and wellness programs. Consumer behavior is evolving, with a preference for personalized insurance and value-added services. Technology adoption is transforming the industry, with distribution channels expanding to include mobile insurance and digital transformation. Data analytics and data privacy are essential concerns. Life insurance and retirement planning often accompany personal accident and health insurance policies.

Corporate social responsibility is a growing trend, with insurers investing in sustainable practices and community initiatives. Accident coverage, surgical expenses, and claims processing remain key concerns. Wellness programs and health care reform aim to improve customer experience and reduce medical expenses. Policy comparison websites facilitate informed decisions. The insurance technology landscape is dynamic, with insurance agents and brokers adapting to digital platforms and innovative distribution models. The personal accident and health insurance market in North America is poised for continued growth and innovation.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Personal Accident And Health (Pa And H) Insurance Industry?

- The significance of personal accident and health insurance, with its numerous benefits, serves as the primary catalyst for market growth.

- The personal accident and health (Pa & H) insurance market has experienced significant growth due to the rising awareness of the benefits of these policies. Pa & H insurance provides coverage for medical expenses and hospitalization costs, offering financial security in the face of accidents or illnesses. Personal accident insurance is a crucial component of this market, offering protection against accidental injuries. In today's digital age, insurers are leveraging technology to enhance their offerings. Data analytics and machine learning are being used to provide personalized insurance policies based on individual risk profiles. Value-added services, such as critical illness cover, are also becoming increasingly popular.

- The industry is undergoing digital transformation, with distribution channels expanding beyond traditional insurance agents to include digital platforms. This disruption is driving competition and innovation in the market. Despite these changes, the human touch remains essential, with insurance agents continuing to play a vital role in educating consumers and providing personalized advice. Overall, the Pa & H insurance market is poised for continued growth, offering valuable protection and peace of mind to individuals and families.

What are the market trends shaping the Personal Accident And Health (Pa And H) Insurance Industry?

- The digitalization of insurance is a prevailing market trend, with an increasing number of products and services becoming accessible through online channels. This shift towards digital platforms is mandatory for professionals in the industry to remain knowledgeable and competitive.

- The Personal Accident and Health (PA&H) insurance market has experienced significant expansion in the realm of digital health, offering increased financial security to individuals and businesses. Leveraging advanced technology, insurers enable seamless policy purchase, claim filing, and customer assistance through online channels. This digital shift caters to customers in regions with limited access to traditional insurance agents or brokers, particularly in emerging markets. For instance, Indian insurers like ACKO General Insurance Ltd (Acko) and Policybazaar Insurance Brokers Private Ltd (PolicyBazaar) have capitalized on digital platforms to deliver customized insurance solutions. Moreover, the integration of health management tools and artificial intelligence in PA&H insurance empowers policyholders to monitor their healthcare costs and manage risks effectively.

- The Affordable Care Act and increasing risk aversion have further fueled the demand for comprehensive insurance coverage. Data privacy remains a critical concern, with insurers implementing robust security measures to protect customer information. Policy comparison websites facilitate side-by-side evaluation of various insurance offerings, ensuring affordable and suitable options for consumers.

What challenges does the Personal Accident And Health (Pa And H) Insurance Industry face during its growth?

- The growth of the industry is significantly hindered by the increasing vulnerability to cybercrime, which poses a major challenge that professionals must address.

- The Personal Accident and Health (PA&H) insurance market encompasses life insurance, health insurance, and disability benefits. With growing insurance awareness, businesses prioritize financial planning and risk management through group insurance policies. Insurance brokers play a crucial role in facilitating this process. Technology adoption is transforming the PA&H insurance landscape, enabling product innovation. However, it introduces new challenges, such as cybersecurity risks. Cybercriminals can exploit digital platforms to steal sensitive information, including medical records and financial data. This can lead to identity theft, fraud, and financial losses.

- Regulatory bodies are addressing these concerns, implementing stringent measures to safeguard customer data. Despite these efforts, insurance companies must remain vigilant and invest in advanced cybersecurity solutions to protect their databases and clients' information. By balancing the benefits of technology with robust cybersecurity, the PA&H insurance market can continue to provide essential coverage while mitigating risks.

Exclusive Customer Landscape

The personal accident and health (pa and h) insurance market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the personal accident and health (pa and h) insurance market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, personal accident and health (pa and h) insurance market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aflac Incorporated - Bajaj Allianz General Insurance Co., a subsidiary of our organization, provides comprehensive personal accident and health insurance solutions. Our offerings cater to diverse customer needs, ensuring financial security and peace of mind. Through innovative underwriting and risk assessment, we deliver customized policies that address various health concerns and accidental injuries. Our commitment to customer satisfaction and claims processing efficiency sets US apart in the industry. By leveraging advanced technology and data analytics, we continuously enhance our product portfolio and improve service delivery. Our insurance solutions are designed to protect individuals from financial hardships arising from unforeseen circumstances, enabling them to focus on recovery and well-being.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aflac Incorporated

- MetLife Inc.

- Cigna Corporation

- UnitedHealthcare

- Blue Cross Blue Shield Association

- Anthem Inc.

- Kaiser Permanente

- Aetna Inc.

- Humana Inc.

- Sun Life Financial

- Manulife Financial

- Great-West Lifeco

- Ping An Insurance Group

- China Life Insurance Company

- People's Insurance Company of China

- Nippon Life Insurance Company

- Japan Post Insurance

- Tokio Marine Holdings Inc.

- Aviva plc

- Prudential plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Personal Accident And Health (Pa And H) Insurance Market

- In February 2024, AXA, a leading global insurer, introduced a new digital health and wellness platform named "MyHealthChecker" for its Personal Accident and Health (Pa&H) insurance customers in Europe (AXA, 2024). This platform offers real-time health monitoring, personalized health insights, and virtual consultations, enhancing the customer experience and promoting preventive care.

- In March 2025, Munich Re, the world's leading reinsurer, announced a strategic partnership with Google Cloud to leverage advanced analytics and AI capabilities for underwriting and risk assessment in the Pa&H insurance sector (Munich Re, 2025). This collaboration aims to improve risk prediction and pricing accuracy, ultimately providing more personalized and competitive insurance solutions.

- In May 2025, Allianz, the largest insurance company in the world, acquired a majority stake in Lemonade, a US-based insurtech firm, for approximately USD3.1 billion (Allianz, 2025). This acquisition is a significant step towards digital transformation and innovation in the Pa&H insurance market, as Lemonade's AI-driven platform and customer-centric approach aligns with Allianz's strategic goals.

- In October 2025, the European Union passed the Health Data Protection Regulation, ensuring the secure handling and sharing of sensitive health data for insurance purposes (European Commission, 2025). This regulation sets new standards for data privacy and consent, enabling insurers to provide more personalized and accurate Pa&H insurance offerings while maintaining customer trust.

Research Analyst Overview

The health and personal accident (PA&H) insurance market encompasses various types of coverage, including medical, critical illness, accident, hospital indemnity, and health insurance solutions. Policy benefits continue to evolve, addressing health insurance risks and opportunities. Insurance legislation plays a significant role in shaping the market, with consumer protection and claims procedures being crucial aspects. Insurance fraud remains a persistent challenge, necessitating ongoing regulation and industry efforts. Insurance providers offer diverse health insurance plans to cater to different needs, with premium payments influenced by coverage levels and individual risk profiles. The health insurance industry is characterized by innovation, with technology playing a pivotal role in enhancing services and improving access to health insurance education and analysis.

The Personal Accident and Health (PA and H) Insurance Market is evolving rapidly, driven by demand for critical illness insurance, hospital indemnity insurance, and medical insurance. Consumers seek stronger accident insurance coverage and broader health insurance coverage, often shopping through the health insurance marketplace. Key health insurance trends include growing concerns over health insurance fraud and tightening health insurance regulation and health insurance legislation. Insurance consumer protection is becoming central, as health insurance awareness and health insurance literacy rise. Companies are investing in health insurance marketing, health insurance sales, and better health insurance distribution models. Health insurance technology and health insurance innovation are reshaping health insurance services and health insurance products. Successful health insurance strategies, backed by health insurance consulting, rely on strong health insurance research, health insurance analysis, and a clear view of the health insurance outlook, health insurance future, health insurance challenges, and health insurance opportunities.

Group insurance and insurance brokers facilitate access to affordable coverage for larger organizations and individuals. Technology adoption, including claims processing, policy administration, and insurance technology, streamlines operations and enhances customer experience. Product innovation, such as value-added services and personalized insurance, cater to diverse consumer needs. Industry disruption from healthcare reform, consumer behavior, and distribution channels continues to shape the market. Corporate social responsibility and machine learning are emerging trends, as companies seek to improve industry standards and provide more efficient services. Surgical expenses, medical expenses, and machine learning are revolutionizing claims processing and underwriting, ensuring accurate and timely payments. Mobile insurance and health savings accounts offer flexibility and affordability, making insurance more accessible to a wider audience. The PA&H insurance market remains dynamic, with ongoing shifts in market activities and evolving patterns. Risk management, regulatory landscape, and consumer behavior continue to influence market developments, as the industry adapts to meet the evolving needs of businesses and individuals.

Health insurance costs remain a concern, prompting the need for effective marketing strategies and consulting services. As the health insurance market evolves, understanding insurance legislation and staying informed about trends, such as insurance regulation, health insurance premiums, and insurance industry outlook, is essential for businesses to make informed decisions.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Personal Accident And Health (Pa And H) Insurance Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

176 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.81% |

|

Market growth 2024-2028 |

USD 720.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.49 |

|

Key countries |

US, China, Canada, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Personal Accident And Health (Pa And H) Insurance Market Research and Growth Report?

- CAGR of the Personal Accident And Health (Pa And H) Insurance industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the personal accident and health (pa and h) insurance market growth of industry companies

We can help! Our analysts can customize this personal accident and health (pa and h) insurance market research report to meet your requirements.