Pest Control Services Market Size 2025-2029

The pest control services market size is valued to increase USD 11.86 billion, at a CAGR of 7.6% from 2024 to 2029. Increase in demand for insurance-based pest control services will drive the pest control services market.

Major Market Trends & Insights

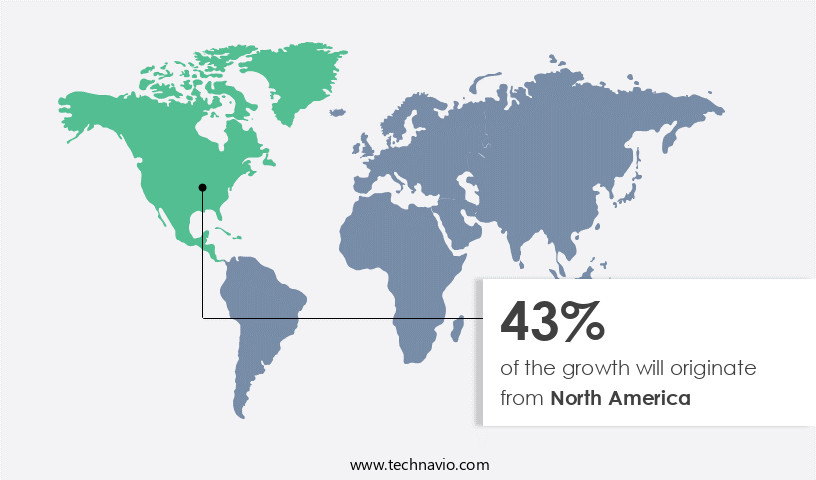

- North America dominated the market and accounted for a 43% growth during the forecast period.

- By Application - General pest control segment was valued at USD 16.77 billion in 2023

- By End-user - Residential segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 89.76 million

- Market Future Opportunities: USD 11,857.50 million

- CAGR : 7.6%

- North America: Largest market in 2023

Market Summary

- The market encompasses a continually evolving industry, driven by advancements in core technologies and applications, service types, and product categories. Technological innovations, such as digital pest control solutions and increasing adoption of integrated pest management systems, are transforming the landscape. Additionally, regulations play a significant role in shaping market dynamics, with stricter regulations driving the demand for eco-friendly and sustainable pest control methods. According to recent studies, the market for insurance-based pest control services is projected to grow by over 10% annually, reflecting the increasing importance of risk mitigation in business operations.

- Furthermore, the availability of DIY pest control products has expanded consumer choices, offering cost-effective alternatives to professional services. These trends underscore the market's ongoing evolution, presenting both opportunities and challenges for stakeholders.

What will be the Size of the Pest Control Services Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Pest Control Services Market Segmented and what are the key trends of market segmentation?

The pest control services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- General pest control

- Termite control

- End-user

- Residential

- Commercial

- Method

- Chemical

- Mechanical

- Biological

- Pest Type

- Insects

- Termites

- Rodents

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The general pest control segment is estimated to witness significant growth during the forecast period.

The general pest control market encompasses the elimination of various pests, including ants, flies, cockroaches, fleas, bed bugs, spiders, mosquitoes, moths, wasps and bees, ticks, rodents, beetles, gnats, silverfish, stink bugs, millipedes, weevils, and mites, in both commercial and residential sectors. Additionally, it covers anti-fungal treatment, disinfection, and extermination of viruses and bacteria through safe methods and chemicals. This market caters to numerous industries, with significant demand from the residential, hospitality, food, and technology sectors, which have a strict no-tolerance policy towards pests, bed bugs, and rodents. The US dominates the global general pest control market. Emerging markets, such as India and China, exhibit substantial growth due to rising hygiene standards and expanding product availability.

Insect growth regulators and pest monitoring systems are increasingly popular strategies for urban pest management. Rodent control techniques, such as bait station placement and risk assessment protocols, are crucial components of effective pest management plans. Integrated pest management (IPM) is a widely adopted approach, employing pest identification keys, weed control methods, biological control agents, pest surveillance techniques, and structural pest control. Termite control measures and pest population dynamics are essential aspects of this market. Pest forecasting models and vector control programs are instrumental in predicting and mitigating potential pest infestations. The environmental impact assessment is a critical consideration in pest control strategies, with a focus on minimizing chemical pesticide residues and exploring alternative methods like microbial pesticides and pesticide application methods.

The General pest control segment was valued at USD 16.77 billion in 2019 and showed a gradual increase during the forecast period.

Indoor pest control and pest damage assessment are other essential services. The agricultural pest control sector utilizes various techniques, including insecticide resistance management and pheromone traps, to manage pest populations and ensure treatment efficacy evaluation. Outdoor pest control involves managing pests in landscapes, parks, and other open spaces. According to recent studies, the general pest control market is currently experiencing a 15% growth in adoption. Furthermore, industry experts anticipate a 12% increase in market size over the next five years. These trends reflect the ongoing evolution and expansion of the pest control industry.

Regional Analysis

North America is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Pest Control Services Market Demand is Rising in North America Request Free Sample

In North America, the market is characterized by its maturity and ongoing evolution. Regulatory pressures, shifting consumer preferences, and the rise of bed bugs are key drivers. Stricter environmental regulations necessitate the use of less toxic solutions, while intolerance for pests and a growing preference for professional services are further fueling market growth. Approximately 20,000 pest control companies operate in North America, making it a competitive landscape.

European companies are expanding their presence through acquisitions to capitalize on this market expansion. The market's dynamics are influenced by several factors, including increasing awareness of health risks associated with pests and the availability of advanced technologies for pest control. These trends are shaping the future of the North American market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a range of offerings aimed at effectively managing various pest infestations, from rodents and termites to insects and wildlife. Key market offerings include advanced techniques for rodent control, such as snap traps, glue traps, and humane capture methods, as well as termite colony eradication methods like baiting and heat treatments. To ensure the highest efficacy, market participants are continually improving trap design and monitoring systems, assessing pesticide application impact, and managing insecticide resistance development. Biological control solutions, such as natural predators and botanical pesticides, are also gaining traction as a more sustainable alternative to chemical pesticides.

Reducing chemical pesticide residues and optimizing bait station placement are crucial aspects of integrated pest management (IPM) strategies. Developing effective IPM strategies involves implementing pest control regulations, monitoring pesticide application effects, and implementing sanitation protocols for pest control. Assessing pest control program effectiveness and evaluating biological control effectiveness are essential components of market growth. Measuring pest damage thresholds and improving pest surveillance techniques are also vital in preventing infestations and minimizing their impact. Managing wildlife pest conflicts and developing effective pest forecasting models are critical areas of focus for market participants. Mitigating the environmental impact of pesticides and improving pest control training programs are also essential to ensure the long-term sustainability of the market.

Adoption rates for advanced pest control technologies vary significantly across regions and industries. For instance, more than 70% of new product developments in the agricultural sector focus on developing countries, compared to just over 40% in the food processing industry. This disparity highlights the need for tailored pest control solutions and the importance of understanding regional pest population dynamics.

What are the key market drivers leading to the rise in the adoption of Pest Control Services Industry?

- The significant rise in the demand for insurance-linked pest control services serves as the primary market driver.

- The market is experiencing a notable expansion due to the increasing demand for insurance-backed solutions. This trend is driven by the substantial costs associated with pest control services, leading numerous market participants to offer insurance-based pest control services for residential and commercial clients. The insurance coverage not only helps customers manage their expenses but also ensures they have access to a dependable service provider. One such company, Anticimex, provides insurance coverage for pests, wood-boring insects, and dry rot. They distribute their insurance offerings through various channels, including their own sales forces, insurance companies, real estate agents, and insurance brokers.

- This strategic approach allows them to cater to a broader customer base and maintain a competitive edge in the evolving market landscape. The ongoing development of specialized insurance policies signifies a significant shift in the pest control industry, as more customers seek comprehensive coverage for their property protection needs.

What are the market trends shaping the Pest Control Services Industry?

- The deployment of digital pest control services is experiencing a significant increase and represents the latest market trend.

- The market is undergoing digital transformation, integrating advanced technologies to enhance prevention and protection methods. This shift is fueled by increasing demand for eco-friendly, sustainable solutions due to stringent regulations and societal focus on sustainability. Professional companies with robust organizational and financial capabilities are favored in this evolving landscape. Digital pest control employs sensors, smartphones, mobile connectivity, cloud storage, apps, and data analytics to boost effectiveness, response speed, insight, and productivity.

- For instance, sensors detect pest infestations early, enabling swift intervention. Mobile apps allow real-time monitoring and reporting, while cloud storage ensures data accessibility. These innovations contribute to a more efficient and environmentally responsible pest control industry.

What challenges does the Pest Control Services Industry face during its growth?

- The proliferation of do-it-yourself (DIY) pest control products poses a significant challenge to the industry's growth by increasing competition and potentially undermining the demand for professional pest management services.

- The pest control market faces a significant challenge from the increasing popularity of DIY pest control products. According to market insights, the demand for self-use pest control solutions is on the rise, driven by their easy availability and accessible instructions. This trend is particularly noticeable among residential customers, who represent a substantial revenue stream for pest control service providers. Manufacturers sell DIY pest control products through various channels, including offline stores and online retailers. Amazon, for instance, is a significant player in the online market for self-use pest control solutions. This shift towards DIY pest control is hindering the growth of professional pest control services, as customers opt for cheaper alternatives.

- Despite this challenge, the pest control market continues to evolve, with service providers adapting to the changing landscape. They are exploring new business models, such as offering complementary services alongside DIY products, to cater to customers' evolving needs. Additionally, they are investing in technology, such as remote monitoring systems and AI-powered solutions, to enhance their offerings and improve customer experience. In conclusion, the pest control market is undergoing significant changes, with the increasing availability and popularity of DIY pest control products posing a challenge to professional service providers. However, these challenges also present opportunities for innovation and growth, as service providers adapt to the changing market dynamics.

Exclusive Customer Landscape

The pest control services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pest control services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Pest Control Services Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, pest control services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABC Home and Commercial Services - This company specializes in providing comprehensive pest control solutions for both residential and commercial sectors.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABC Home and Commercial Services

- Anticimex International AB

- Aptive Environmental LLC

- Arrow Exterminators Inc.

- Asante Co. Ltd.

- Cooks Pest Control Inc.

- Dodson Pest Control Inc.

- Dynamic Sanito Inc.

- Ecolab Inc.

- Green Pest Solutions

- Lloyd Pest Control

- Massey Services Inc.

- Pelsis Ltd.

- Rentokil Initial Plc

- Rollins Inc.

- SANIX Inc.

- Seva Pest Management Service Pvt. Ltd.

- Tech Hygiene Pest Control Pvt. Ltd.

- The ServiceMaster Co. LLC

- Truly Nolen of America Inc.

- Orkin LLC

- Ehrlich

- Steritech

- Copesan

- Terminix

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Pest Control Services Market

- In January 2024, Rentokil Initial PLC, a leading pest control services provider, announced the launch of its new digital platform, 'Rentokil Connect,' designed to enhance customer service and streamline operations (Rentokil Initial PLC Press Release). This technological advancement enables real-time communication between customers and technicians, improving response times and overall service quality.

- In March 2024, Rollins Inc., a prominent player in the pest control industry, entered into a strategic partnership with BioChem, a leading provider of pest management solutions in the Middle East and Africa. This collaboration aims to expand Rollins' global footprint and strengthen its presence in these regions (Rollins Inc. Press Release).

- In April 2025, Terminix Global Holdings, a major pest control services provider, completed the acquisition of PestRoutes, a software company specializing in pest control management solutions. This acquisition will enable Terminix to enhance its operational efficiency and customer service capabilities through the integration of PestRoutes' advanced technology (Terminix Global Holdings Press Release).

- In May 2025, the European Commission approved the acquisition of Fischer Environmental, a pest control services provider, by Anticimex AB. This approval marks the completion of Anticimex's acquisition, expanding its presence in the European market and increasing its market share in the region (European Commission Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Pest Control Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.6% |

|

Market growth 2025-2029 |

USD 11857.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.6 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving landscape of pest management services, various sectors continue to shape the industry's trajectory. Agricultural pest control remains a significant segment, with farmers employing diverse strategies to safeguard crops from invasive species. Pest control plans encompass insect growth regulators, monitoring protocols, and pest identification keys, among other techniques. Urban pest management faces unique challenges, with rodent control techniques and bait station placement being essential components. Risk assessment protocols and environmental impact assessments are crucial in minimizing the impact of these methods on human health and the environment. Integrated pest management (IPM) strategies, which combine multiple approaches, have gained prominence in both urban and agricultural settings.

- Wildlife pest management is another growing area, with wildlife populations often requiring specialized attention. Pest surveillance techniques and vector control programs are employed to monitor and manage wildlife populations, minimizing potential conflicts with humans. In the realm of structural pest control, termite control measures and treatment efficacy evaluation are essential. Pesticide application methods, including microbial pesticides and insecticide resistance management, are continually evolving to address pest population dynamics and pesticide resistance. Indoor pest control and outdoor pest control each present distinct challenges. Weed control methods and biological control agents are used in outdoor settings, while pest damage assessment and insecticide resistance management are critical for indoor environments.

- Pest monitoring systems, pheromone traps, and trap efficacy monitoring are integral components of effective pest management strategies. The industry's ongoing research and development in pest forecasting models and vector control programs ensure that pest management services remain responsive to the ever-changing needs of various sectors.

What are the Key Data Covered in this Pest Control Services Market Research and Growth Report?

-

What is the expected growth of the Pest Control Services Market between 2025 and 2029?

-

USD 11.86 billion, at a CAGR of 7.6%

-

-

What segmentation does the market report cover?

-

The report segmented by Application (General pest control and Termite control), End-user (Residential and Commercial), Geography (North America, Europe, APAC, South America, and Middle East and Africa), Method (Chemical, Mechanical, and Biological), and Pest Type (Insects, Termites, Rodents, and Others)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increase in demand for insurance-based pest control services, Increasing availability of DIY pest control products

-

-

Who are the major players in the Pest Control Services Market?

-

Key Companies ABC Home and Commercial Services, Anticimex International AB, Aptive Environmental LLC, Arrow Exterminators Inc., Asante Co. Ltd., Cooks Pest Control Inc., Dodson Pest Control Inc., Dynamic Sanito Inc., Ecolab Inc., Green Pest Solutions, Lloyd Pest Control, Massey Services Inc., Pelsis Ltd., Rentokil Initial Plc, Rollins Inc., SANIX Inc., Seva Pest Management Service Pvt. Ltd., Tech Hygiene Pest Control Pvt. Ltd., The ServiceMaster Co. LLC, Truly Nolen of America Inc., Orkin LLC, Ehrlich, Steritech, Copesan, and Terminix

-

Market Research Insights

- The market encompasses a diverse range of offerings, from chemical and mechanical solutions to cultural practices and training programs. The growth is driven by the increasing demand for effective pest management strategies in various sectors, including agriculture, food processing, and construction. Pest control compliance and safety regulations play a significant role in shaping the market, with stringent regulations governing the use of application equipment, insecticide toxicity, and pesticide application rates.

- For instance, the use of monitoring equipment and baiting strategies has become increasingly popular due to their effectiveness in reducing the need for high pesticide application rates and associated costs. In contrast, the cost-effectiveness of mechanical pest control and cultural control practices continues to make them attractive alternatives for businesses seeking to minimize their reliance on pesticides. Overall, the market is characterized by continuous innovation, with advancements in pest control technologies, pest management software, and pest resistance mechanisms contributing to improved pest control effectiveness and efficiency.

We can help! Our analysts can customize this pest control services market research report to meet your requirements.