Pharmaceutical Analytical Testing Outsourcing Market Size 2024-2028

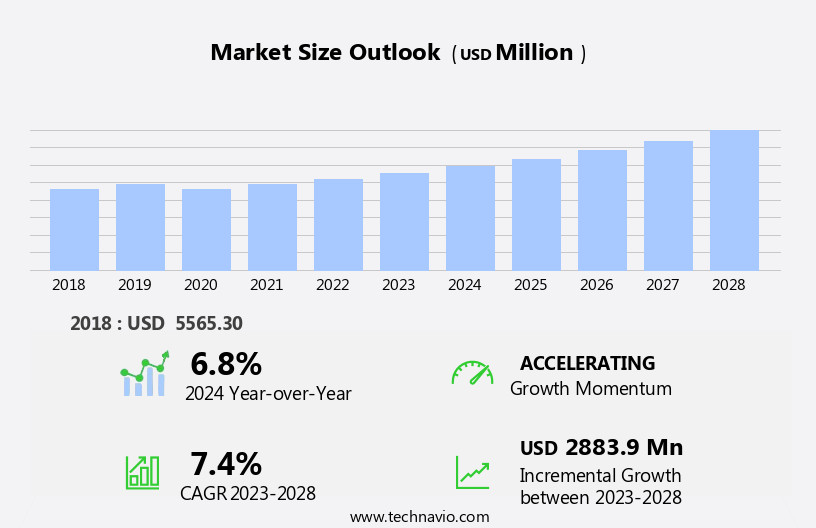

The pharmaceutical analytical testing outsourcing market size is forecast to increase by USD 2.88 billion at a CAGR of 7.4% between 2023 and 2028.

- The market is experiencing significant growth due to several key drivers. The increasing number of FDA-approved manufacturing facilities in developing nations is expanding the market's reach and providing cost-effective solutions for pharmaceutical companies. Additionally, the rising trend of mergers and acquisitions in the industry is leading to consolidation and increased demand for outsourcing services. However, the market is not without challenges. The shortage of trained professionals in analytical testing poses a significant barrier to growth, requiring companies to invest in training programs and partnerships to meet the demand for skilled labor.

- To capitalize on market opportunities and navigate challenges effectively, companies must stay informed of regulatory changes, invest in technology and automation, and build strategic partnerships to address the talent shortage. By doing so, they can position themselves as industry leaders and provide high-quality, cost-effective solutions to their clients.

What will be the Size of the Pharmaceutical Analytical Testing Outsourcing Market during the forecast period?

- The pharmaceutical analytical testing market encompasses a range of services, including in vitro and in vivo testing for drugs and biopharmaceuticals. This market plays a crucial role in ensuring the safety, purity, and therapeutic efficacy of pharmaceutical and biotech products. Analytical testing is integral to various stages of drug development, from Research and Development (R&D) to clinical trials and post-approval. Services encompass bioanalytical testing for assessing drug molecule concentration in biological matrices, stability testing for evaluating drug stability under various conditions, and environmental monitoring for ensuring product quality. The market caters to the testing needs of various sectors, including generic drugs, biosimilars, and clinical trials.

- Analytical testing methods employ diverse techniques, such as hyphenated techniques, kinetic methods, and electrochemical techniques, to assess drug properties like dosage, bloodstream absorption, metabolism, non-toxicity, and detect contaminants. Contract Research Organizations (CROs) and other service providers contribute significantly to this market by offering specialized expertise and advanced testing capabilities. The pharmaceutical analytical testing market continues to grow, driven by the increasing demand for new drug discoveries, regulatory requirements, and the expanding biotech industry.

How is this Pharmaceutical Analytical Testing Outsourcing Industry segmented?

The pharmaceutical analytical testing outsourcing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Service

- Bioanalytical

- Method development and validation

- Stability testing

- Raw Material Testing

- Microbiological Testing

- Extractables and Leachables Testing

- Physical and Chemical Testing

- Regulatory Support/Compliance Testing

- Batch Release Testing

- Environmental Monitoring

- Packaging Testing

- Others

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Middle East and Africa

- UAE

- Rest of World (ROW)

- North America

By Service Insights

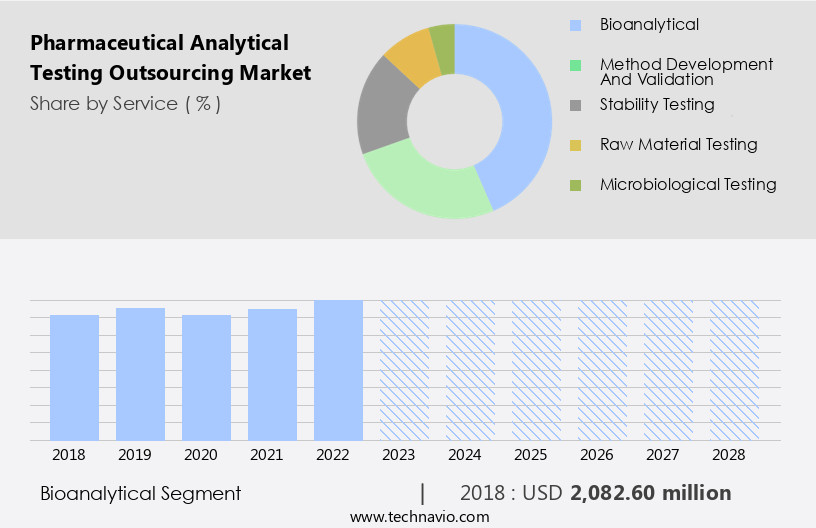

The bioanalytical segment is estimated to witness significant growth during the forecast period.

The pharmaceutical analytical testing market experiences growth due to the expanding pharmaceutical and biotechnology industries. These sectors' companies are significant consumers of analytical testing services, ensuring their products meet regulatory requirements, including drug purity, dosage, and safety. The rise in chronic diseases, such as cancer, necessitates increased drug production, leading to a higher demand for analytical testing. Analytical testing plays a crucial role in every stage of drug development, from discovery to manufacturing. Biotech firms and contract research organizations rely on various analytical testing methods, including hyphenated techniques, kinetic methods, and electrochemical techniques, to assess drug molecules' therapeutic efficacy, bioavailability, metabolism, non-toxicity, and the presence of contaminants.

Pharmaceutical and biopharmaceutical companies invest heavily in research and development to discover and treat life-threatening diseases. This investment fuels the demand for advanced analytical testing technologies, such as automation and personalized medicine, to ensure drug safety, stability, and bioanalytical testing. Additionally, the growing importance of microbial manufacturing technology and toxicity testing in healthcare infrastructure further propels the market's growth.

Get a glance at the market report of share of various segments Request Free Sample

The Bioanalytical segment was valued at USD 2.08 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

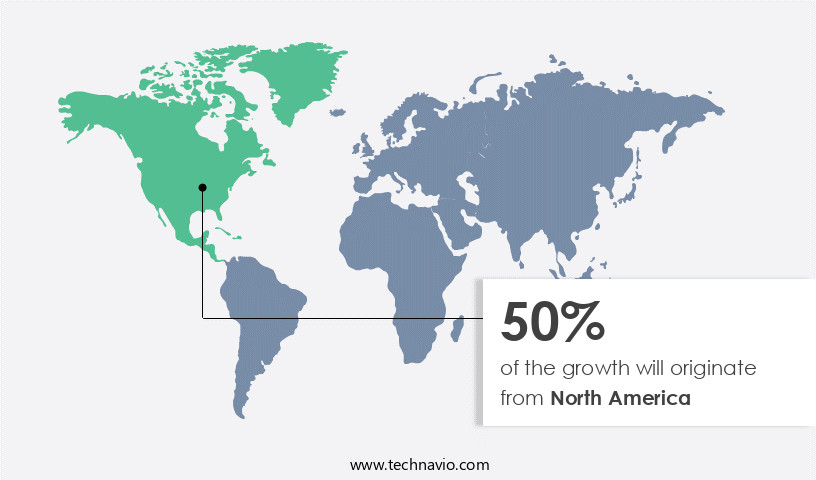

North America is estimated to contribute 50% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American the market is witnessing significant expansion due to escalating drug research and development activities, intricate drug formulations, and stringent regulatory mandates. Pharmaceutical firms in the US and Canada are outsourcing analytical testing to specialized contract research organizations (CROs) to optimize their operations, cut costs, and concentrate on their primary competencies, such as drug discovery and manufacturing. This outsourcing model offers access to sophisticated technologies, specialized expertise, and advanced laboratories, which are essential for ensuring regulatory compliance and boosting drug safety. The region's rigorous regulatory landscape, spearheaded by the US Food and Drug Administration (FDA), necessitates extensive testing procedures for drug efficacy, safety, and quality.

In Vitro and In Vivo tests, Bioanalytical testing, stability testing, and toxicity testing are among the critical analytical testing methods used to assess the drug molecule's purity, therapeutic efficacy, bloodstream absorption, metabolism, non-toxicity, and the presence of contaminants. Automation technology, hyphenated techniques, and electrochemical techniques are some of the advanced analytical testing methods employed to enhance drug assessment. The biopharmaceutical sector, particularly in the field of chronic diseases, is a significant contributor to the market's growth. The increasing prevalence of chronic diseases, such as cancer, cardiovascular diseases, and neurological disorders, necessitates the development of new and innovative drugs.

Consequently, pharmaceutical companies require extensive analytical testing to ensure the safety, efficacy, and quality of these drugs. The market's growth is further fueled by the emergence of personalized medicine, biotechnology, and microbial manufacturing technology. These advancements enable the development of targeted therapies and complex biologics, which require rigorous analytical testing to ensure safety, purity, and efficacy. The North American the market is poised for continued growth due to the increasing demand for advanced analytical testing services in the pharmaceutical and biopharmaceutical industries.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Pharmaceutical Analytical Testing Outsourcing Industry?

- Increased number of FDA-approved manufacturing facilities in developing nations is the key driver of the market.

- Pharmaceutical analytical testing outsourcing is a significant segment of the pharmaceutical industry, with companies seeking overseas manufacturing partners that meet stringent regulatory requirements, such as US FDA approval, and offer a skilled workforce at cost-effective prices. India, for instance, has a substantial number of FDA-approved manufacturing plants and adheres to the World Health Organization's Goods Manufacturing Practices (WHO-GMP), making it an attractive destination for pharmaceutical companies looking to outsource their analytical testing needs. This trend is driven by the need for cost savings and access to a large talent pool while maintaining regulatory compliance.

- The global market for pharmaceutical analytical testing outsourcing is growing as more companies recognize the benefits of partnering with reputable, cost-effective laboratories to ensure the quality and accuracy of their products.

What are the market trends shaping the Pharmaceutical Analytical Testing Outsourcing Industry?

- Rising mergers and acquisitions is the upcoming market trend.

- Pharmaceutical companies are increasingly turning to outsourcing services due to budget constraints and the need for cost-effective solutions. With consolidated infrastructure and decreasing revenue growth, many pharmaceutical firms have reduced their in-house research and development and operations spending. This trend has led to a surge in demand for outsourced services, particularly in drug discovery. Contract Development and Manufacturing Organizations (CDMOs) have emerged as key players in this market, offering strategic partnerships and one-stop solutions to pharmaceutical companies. These CDMOs are investing in expanding their service offerings, including advertisement investments and client approach, to provide comprehensive solutions to clients.

- The strategic partnerships between pharmaceutical companies and CDMOs have also led to a decrease in government spending on manufacturing. Overall, the outsourcing of pharmaceutical analytical testing is a significant trend driven by budget constraints, infrastructure consolidation, and the need for efficient and cost-effective solutions.

What challenges does the Pharmaceutical Analytical Testing Outsourcing Industry face during its growth?

- Shortage of trained professionals is a key challenge affecting the industry growth.

- Pharmaceutical analytical testing is a critical process in ensuring the quality and safety of drugs. However, the pressure to bring products to market quickly has led to non-compliance among laboratory professionals. This issue is compounded by the lack of expertise among these professionals in performing analytical testing. From a regulatory standpoint, any irregularity in testing steps or data reporting can result in improper data collection, leading to product failures. When regulatory bodies discover non-compliant products, biopharmaceutical companies face significant financial losses and the challenge of relaunching the drug or revising testing procedures. To mitigate these risks, outsourcing pharmaceutical analytical testing to specialized companies is becoming increasingly popular.

- This approach allows companies to leverage the expertise and resources of these companies, ensuring regulatory compliance and improving overall product quality. Outsourcing also enables companies to focus on their core competencies, streamline operations, and reduce costs. The need for stringent regulatory compliance and the lack of expertise among in-house laboratory professionals make outsourcing pharmaceutical analytical testing an attractive option for biopharmaceutical companies.

Exclusive Customer Landscape

The pharmaceutical analytical testing outsourcing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pharmaceutical analytical testing outsourcing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, pharmaceutical analytical testing outsourcing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agno Pharma - The company specializes in pharmaceutical analytical testing services, providing solutions for clients in the industry. Our offerings encompass analytical testing and microbiology testing, ensuring regulatory compliance and product quality. By outsourcing these critical functions, businesses can focus on their core competencies while benefiting from our expertise and advanced technology. Our commitment to accuracy, precision, and timely reporting sets US apart, enabling clients to bring their products to market efficiently and effectively.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agno Pharma

- Alcami Corp.

- AptarGroup Inc.

- Boston Analytical

- Cambrex Corp.

- Catalent Inc.

- Charles River Laboratories International Inc.

- Cotecna Inspection SA

- Element Materials Technology Group Ltd.

- Eurofins Scientific SE

- Intertek Group Plc

- Laboratory Corp. of America Holdings

- Merck KGaA

- Pace Analytical Services LLC

- Seikagaku Corp.

- SGS SA

- Source BioScience

- Thermo Fisher Scientific Inc.

- West Pharmaceutical Services Inc.

- WuXi AppTec Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Pharmaceutical analytical testing plays a crucial role in ensuring the quality, safety, and efficacy of drugs and biologics in the global healthcare industry. This process involves various types of testing, including in vitro and in vivo assessments, to evaluate the drug molecule's purity, dosage, therapeutic efficacy, non-toxicity, and metabolism. In vitro tests, which are carried out in a test tube or a laboratory dish, are used to evaluate the drug's interaction with various biological systems, such as enzymes and cells. On the other hand, in vivo tests, which are conducted in living organisms, provide more accurate and comprehensive data on the drug's pharmacodynamic and pharmacokinetic properties.

The demand for pharmaceutical analytical testing services is driven by the increasing number of new drug entities and biosimilars entering the market. Generic drugs and biosimilars require extensive analytical testing to demonstrate their equivalence to the reference drug in terms of quality, safety, and efficacy. Bioanalytical testing is a critical component of pharmaceutical analytical testing, as it involves the quantitative analysis of biological samples to assess the drug's concentration and its pharmacokinetic properties. Stability testing is another essential aspect of pharmaceutical analytical testing, which ensures that the drug maintains its quality, safety, and efficacy under various storage conditions.

Pharmaceutical and biopharmaceutical companies are increasingly outsourcing their analytical testing requirements to contract research organizations (CROs) to reduce costs, improve efficiency, and gain access to specialized expertise and technologies. The use of automation technology and hyphenated techniques, such as liquid chromatography-mass spectrometry (LC-MS), has revolutionized pharmaceutical analytical testing by increasing throughput, reducing analysis time, and improving accuracy and sensitivity. The adoption of personalized medicine and biotechnology has further expanded the scope of pharmaceutical analytical testing. Personalized medicine requires the development of targeted therapies based on an individual's genetic makeup, which necessitates extensive analytical testing to evaluate the drug's efficacy and safety in different patient populations.

Microbial manufacturing technology and toxicity testing are other critical areas of pharmaceutical analytical testing, ensuring the safety of drugs and biologics by evaluating their microbial contamination and toxicity profiles. The pharmaceutical analytical testing market is expected to grow significantly due to the increasing demand for new drugs and biosimilars, the rising adoption of automation technology, and the growing focus on drug safety and quality. The market dynamics are influenced by various factors, including regulatory requirements, technological advancements, and competition among CROs. Pharmaceutical analytical testing plays a vital role in ensuring the quality, safety, and efficacy of drugs and biologics.

The increasing demand for new drugs and biosimilars, the adoption of automation technology, and the growing focus on drug safety and quality are driving the growth of the pharmaceutical analytical testing market. CROs are well-positioned to benefit from this trend by providing specialized expertise and technologies to pharmaceutical and biopharmaceutical companies.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

145 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.4% |

|

Market growth 2024-2028 |

USD 2883.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.8 |

|

Key countries |

US, Germany, China, UK, Japan, Canada, India, South Korea, Brazil, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Pharmaceutical Analytical Testing Outsourcing Market Research and Growth Report?

- CAGR of the Pharmaceutical Analytical Testing Outsourcing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, Middle East and Africa, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the pharmaceutical analytical testing outsourcing market growth of industry companies

We can help! Our analysts can customize this pharmaceutical analytical testing outsourcing market research report to meet your requirements.