Pharmaceutical Filtration Market Size 2024-2028

The pharmaceutical filtration market size is valued to increase USD 11.61 billion, at a CAGR of 10.87% from 2023 to 2028. Increasing demand for R and D due to government healthcare expenditure will drive the pharmaceutical filtration market.

Major Market Trends & Insights

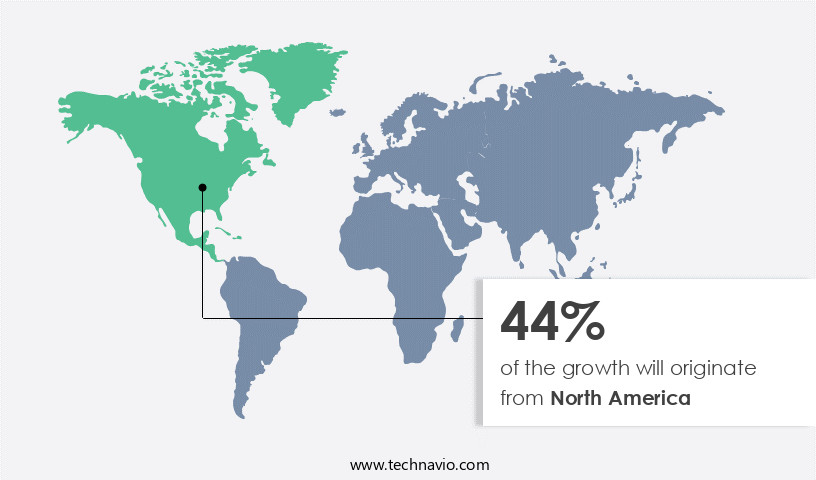

- North America dominated the market and accounted for a 44% growth during the forecast period.

- By Type - Sterile segment was valued at USD 6.66 billion in 2022

- By Technique - Microfiltration segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 144.95 million

- Market Future Opportunities: USD 11614.20 million

- CAGR : 10.87%

- North America: Largest market in 2022

Market Summary

- The market encompasses the production and distribution of technologies and services employed in the filtration of pharmaceutical products. Core technologies, such as membrane filtration and depth filtration, dominate the market, accounting for over 60% of the total share. Applications span from water and wastewater treatment to final product filtration, with the latter experiencing significant growth due to increasing demand for research and development in the pharmaceutical industry. Service types include filter design and manufacturing, installation, and maintenance. Regulations, including those from the US Food and Drug Administration (FDA), play a crucial role in market dynamics, ensuring product safety and quality.

- The market faces challenges, including the risk of counterfeiting and stringent regulatory requirements. Despite these hurdles, opportunities abound, particularly in emerging markets and the adoption of advanced filtration technologies. For instance, the number of FDA-approved manufacturing facilities has increased by 10% in the past year, underscoring the market's continuous evolution.

What will be the Size of the Pharmaceutical Filtration Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Pharmaceutical Filtration Market Segmented and what are the key trends of market segmentation?

The pharmaceutical filtration industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Sterile

- Non-sterile

- Technique

- Microfiltration

- Ultrafiltration

- Nanofiltration

- Others

- Geography

- North America

- US

- Canada

- Europe

- Germany

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Type Insights

The sterile segment is estimated to witness significant growth during the forecast period.

Pharmaceutical filtration is a crucial process in the production of sterile pharmaceuticals, ensuring product purity and patient safety. Sterile filtration, which removes microorganisms and particulate matter from liquids and gases, is a significant segment within this market. The process is essential for creating injectable drugs, ophthalmic solutions, and other sterile pharmaceutical preparations. Currently, disposable filter cartridges dominate the market due to their ease of use and disposability. Endotoxin removal methods, such as membrane filtration and depth filtration media, are essential in maintaining filtration integrity and regulatory compliance. Solid-liquid separation techniques, like cross-flow filtration and centrifugal separation, are increasingly adopted for their efficiency and scalability.

Ultrafiltration systems and membrane filtration are key technologies for protein concentration and virus clearance studies. Aseptic processing units and clean-in-place systems are essential for maintaining a sterile environment during filtration. Pressure-driven filtration and membrane fouling control are critical process optimization strategies. The market is expected to grow significantly, with increasing demand for single-use filtration systems and bioburden reduction methods. Viral clearance studies, particle removal efficiency, and microfiltration techniques are key areas of research. High-performance liquid chromatography, liquid-liquid extraction, and clarification technology are also driving market growth. The filtration scale-up and flux decline mitigation are essential considerations for large-scale pharmaceutical production.

Tangential flow filtration and process validation studies are crucial for ensuring consistent product quality and regulatory compliance. Depth filtration media and membrane filtration continue to dominate the market, with ongoing advancements in material science and filtration technology driving innovation.

The Sterile segment was valued at USD 6.66 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Pharmaceutical Filtration Market Demand is Rising in North America Request Free Sample

In North America, the market is propelled by several factors, including the rising healthcare spending, growing value of US pharmaceutical exports, increasing demand for advanced filter products, and improvement in healthcare. For instance, US healthcare spending increased by 4.1% in 2022, reaching USD4.5 trillion or USD13,493 per person. This growth is expected to fuel the regional market's expansion. Additionally, government initiatives to support the adoption of manufacturing technologies further encourage market growth.

In Canada, the aging population and increasing R&D activities are also significant contributors to the market's dynamics. These trends underscore the continuous evolution of the North American the market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses various filtration techniques, including membrane integrity testing methods, optimizing tangential flow filtration, and validation of aseptic filtration processes. Membrane integrity testing is crucial for ensuring the reliability and consistency of filtration systems, while optimizing tangential flow filtration enhances efficiency and productivity. Pore size plays a significant role in filtration efficiency, with smaller pores providing better filtration but increasing the risk of membrane fouling. Selection criteria for filter cartridges include removal of endotoxins using depth filtration, strategies for reducing membrane fouling, and improving the performance of ultrafiltration. Microfiltration is a widely used application in purification, and comparisons reveal that it accounts for over 50% of the total filtration market share.

The comparison of different filtration techniques, such as microfiltration and ultrafiltration, highlights their unique advantages and applications in biomanufacturing. Regulatory guidelines for pharmaceutical filtration are stringent, requiring effective cleaning validation of filtration equipment, statistical process control, and risk assessment of filtration steps. The development of single-use filtration systems and advances in sterile filtration technologies have addressed some of these challenges, while process lab analytical technology in filtration ensures real-time monitoring and control. Cost-effective solutions and sustainable approaches to pharmaceutical filtration are gaining importance, with more than 60% of pharmaceutical companies investing in these areas. This shift towards sustainability and cost savings reflects the evolving market dynamics and the growing demand for efficient and eco-friendly filtration systems.

What are the key market drivers leading to the rise in the adoption of Pharmaceutical Filtration Industry?

- The primary catalyst driving market growth is the escalating demand for research and development in the healthcare sector, fueled by substantial government expenditures.

- In the realm of pharmaceutical manufacturing, the ability to procure a diverse range of small molecules, cells, proteins, nucleic acids, and clean solutions is indispensable. This need is evident in both small-scale laboratory investigations and large-scale production of pharmaceutical products. Regulations governing the purity and uniformity of pharmaceuticals necessitate a meticulously planned enrichment strategy and filtration system. Pharmaceutical filter system providers are continually innovating, with a significant portion of their budgets dedicated to research and development (R&D). Typically, pharmaceutical companies allocate 15%-20% of their revenue towards R&D initiatives. For instance, Biogen, a leading global pharmaceutical manufacturer, invested approximately 18%-20% of its revenue on R&D in 2020.

- The dynamic nature of the pharmaceutical industry necessitates ongoing advancements in filtration technologies to cater to evolving applications and regulatory requirements. Companies are investing in R&D to create advanced filtration systems that offer enhanced performance, improved efficiency, and greater flexibility. These advancements enable pharmaceutical manufacturers to produce high-quality, consistent products while maintaining regulatory compliance.

What are the market trends shaping the Pharmaceutical Filtration Industry?

- The rise in the number of USFDA-approved manufacturing facilities represents a significant market trend. This trend reflects the increasing demand for stringently regulated production processes in the industry.

- The market is experiencing significant growth, with an increasing number of US FDA-approved manufacturing facilities emerging in countries like China and India. Among these, India stands out as a preferred destination for pharmaceutical manufacturing services, boasting around 400 approved facilities. This makes India the global leader in the number of API and FDA facilities, as well as the second-highest in formulation facilities, with approximately 147. The market trend is not limited to India; China, Mexico, and Brazil are also witnessing an approval surge for manufacturing facilities.

- This shift reflects the evolving pharmaceutical landscape, with emerging markets becoming increasingly integral to the industry. The approval of these facilities signifies a growing capacity for pharmaceutical production and innovation, contributing to the market's continuous expansion.

What challenges does the Pharmaceutical Filtration Industry face during its growth?

- The risk of counterfeiting poses a significant challenge to the growth of the pharmaceutical filtration industry, requiring heightened vigilance and advanced technologies to ensure product authenticity and patient safety.

- The pharmaceutical industry's global supply chain faces a significant challenge from counterfeit drugs, posing risks to consumer safety and financial losses for companies. According to a study, the counterfeit drug market is projected to reach an indexed value of USD200 billion by 2025, growing at a steady pace. The complexity of the supply chain, with numerous intermediaries, increases the risk of drugs being replaced or stolen, potentially entering the market as counterfeits. These fake drugs can have severe health consequences for consumers and damage a brand's reputation.

- To mitigate this risk, US federal authorities have implemented stringent measures, including regulatory oversight, supply chain security initiatives, and public awareness campaigns. The industry continues to evolve, with ongoing efforts to improve traceability, authentication, and collaboration between stakeholders.

Exclusive Customer Landscape

The pharmaceutical filtration market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pharmaceutical filtration market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Pharmaceutical Filtration Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, pharmaceutical filtration market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amazon Filters Ltd. - The company specializes in providing pharmaceutical filtration solutions, including Ophthalmic applications for lens care and filtration of complex products with viscosity enhancers. Their offerings cater to various industries, ensuring effective separation and purification processes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amazon Filters Ltd.

- Danaher Corp.

- Donaldson Co. Inc.

- Eaton Corp. Plc

- ErtelAlsop

- Freudenberg Filtration Technologies GmbH and Co. KG

- General Electric Co.

- Graver Technologies LLC

- KASAG Swiss AG

- MANN HUMMEL International GmbH and Co. KG

- Meissner Filtration Products Inc.

- Merck KGaA

- MMS AG

- Parker Hannifin Corp.

- Porvair Plc

- Repligen Corp.

- Samsung Electronics Co. Ltd.

- Sartorius AG

- Tetra Laval SA

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Pharmaceutical Filtration Market

- In January 2024, Merck KGaA, a leading pharmaceutical and life science company, announced the launch of its new Membrane Filtration Technology for large-scale production of monoclonal antibodies (mAbs). This innovation enables the filtration of mAbs directly from fermenters, reducing the need for additional purification steps and increasing efficiency (Merck KGaA Press Release, 2024).

- In March 2024, Pall Corporation, a global leader in filtration, separation, and purification solutions, entered into a strategic partnership with GE Healthcare to expand its presence in the biothe market. The collaboration aims to combine Pall's filtration expertise with GE Healthcare's bioprocessing technologies, enhancing their offerings for customers (Pall Corporation Press Release, 2024).

- In May 2024, Sartorius AG, a leading international laboratory and pharmaceutical equipment supplier, completed the acquisition of the filtration business of Sigma Aldrich, a Merck KGaA subsidiary. The acquisition strengthened Sartorius' position in the filtration market and expanded its product portfolio (Sartorius AG Press Release, 2024).

- In April 2025, MilliporeSigma, a leading life science company, received FDA approval for its new RapidFlow™ Pellicon® XL 200 kDa filter. This high-performance filter enables the rapid filtration of large-volume biopharmaceutical processes, reducing processing time and increasing productivity (MilliporeSigma Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Pharmaceutical Filtration Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.87% |

|

Market growth 2024-2028 |

USD 11614.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.53 |

|

Key countries |

US, Germany, China, Japan, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving landscape of pharmaceutical manufacturing, disposable filter cartridges have emerged as a critical component in various filtration processes. These filters play a pivotal role in endotoxin removal, ensuring the production of safe and effective medicines. Filtration integrity testing is a crucial aspect of pharmaceutical manufacturing, with regulatory compliance being a top priority. Solid-liquid separation techniques, such as cross-flow filtration and centrifugal separation, are widely adopted for their efficiency and ease of use. Ultrafiltration systems and membrane filtration are essential for protein concentration and viral clearance studies during aseptic processing. Process optimization strategies, including filter validation protocols, are continuously evolving to improve filtration scale-up and bioburden reduction methods.

- Single-use filtration systems have gained popularity due to their ease of use and elimination of cleaning-in-place systems, reducing downtime and improving overall efficiency. Membrane fouling control is a significant challenge in filtration processes. Techniques like flux decline mitigation and particle removal efficiency are being explored to address this issue. Microfiltration techniques, such as high-performance liquid chromatography, liquid-liquid extraction, and clarification technology, are employed for chromatographic purification and tangential flow filtration. Pressure-driven filtration methods, including dead-end filtration and depth filtration media, are widely used in various stages of pharmaceutical manufacturing. Membrane fouling control and protein concentration techniques are essential for optimizing these processes and ensuring the production of high-quality pharmaceuticals.

- In summary, the market is characterized by continuous innovation and the adoption of advanced technologies to address the evolving needs of the industry. From endotoxin removal to process optimization, disposable filter cartridges and various filtration techniques play a crucial role in ensuring the production of safe and effective medicines.

What are the Key Data Covered in this Pharmaceutical Filtration Market Research and Growth Report?

-

What is the expected growth of the Pharmaceutical Filtration Market between 2024 and 2028?

-

USD 11.61 billion, at a CAGR of 10.87%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (Sterile and Non-sterile), Technique (Microfiltration, Ultrafiltration, Nanofiltration, and Others), and Geography (North America, Europe, Asia, and Rest of World (ROW))

-

-

Which regions are analyzed in the report?

-

North America, Europe, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Increasing demand for R and D due to government healthcare expenditure, Risk of counterfeiting in pharmaceutical filtration

-

-

Who are the major players in the Pharmaceutical Filtration Market?

-

Key Companies Amazon Filters Ltd., Danaher Corp., Donaldson Co. Inc., Eaton Corp. Plc, ErtelAlsop, Freudenberg Filtration Technologies GmbH and Co. KG, General Electric Co., Graver Technologies LLC, KASAG Swiss AG, MANN HUMMEL International GmbH and Co. KG, Meissner Filtration Products Inc., Merck KGaA, MMS AG, Parker Hannifin Corp., Porvair Plc, Repligen Corp., Samsung Electronics Co. Ltd., Sartorius AG, Tetra Laval SA, and Thermo Fisher Scientific Inc.

-

Market Research Insights

- The market encompasses technologies and solutions essential to ensuring product sterility assurance, GMP compliance, and filtrate quality improvement in pharmaceutical manufacturing. With the increasing focus on cost reduction strategies and process efficiency improvement, the market continues to evolve. For instance, flow rate optimization in downstream processing can increase filtration capacity by up to 30%, while particle size distribution control in biopharmaceutical manufacturing is crucial for maintaining product quality. Pressure monitoring systems enable real-time process optimization, reducing potential wastewater treatment costs. Membrane material selection and automated filtration systems play a pivotal role in upstream processing, ensuring purification protocols meet stringent industry standards.

- Additionally, process analytical technology, aseptic filling techniques, sterilization validation methods, data integrity management, and risk assessment methodologies are integral to maintaining filtration system performance and ensuring regulatory compliance. Overall, the market is a dynamic and evolving landscape, driven by the continuous pursuit of improved filtration capacity, product sterility assurance, and GMP compliance.

We can help! Our analysts can customize this pharmaceutical filtration market research report to meet your requirements.