Drug Delivery Devices Market Size 2024-2028

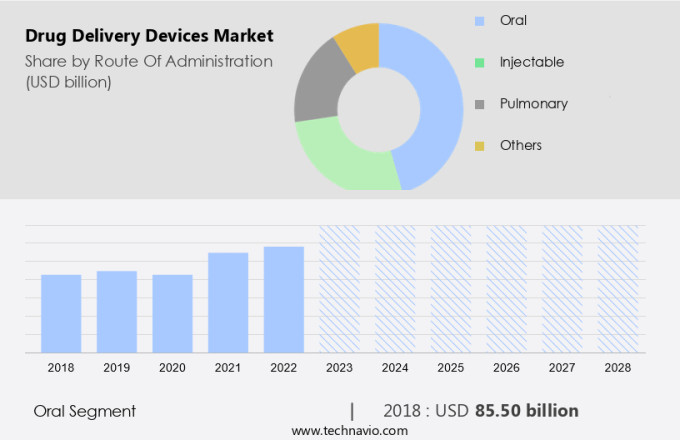

The drug delivery devices market size is forecast to increase by USD 85.1 billion at a CAGR of 6.2% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing prevalence of chronic conditions and the rising adoption of self-administering systems. Self-injectable devices, including auto-injectors and jet-injectors, are gaining popularity for their convenience and effectiveness in delivering drugs directly to the target site. However, bioavailability hurdles remain a challenge in oral delivery systems, leading to the increasing use of injectable routes. Pharmaceutical companies are investing heavily in research and development to address these challenges and create more efficient drug delivery systems.In healthcare, Retail pharmacies and hospital pharmacies are key distribution channels for these devices, ensuring easy access for patients. Stringent government regulations ensure the safety and efficacy of these devices, making them a reliable option for patients. The market is expected to continue growing as technology advances and new applications for drug delivery systems emerge.

What will be the Size of the Market During the Forecast Period?

- The market represents a significant segment within the pharmaceutical industry, offering innovative solutions for the effective and efficient administration of active pharmaceutical ingredients (APIs) in various therapeutic areas. These devices cater to both chronic diseases and non-chronic diseases, and their usage extends to home-care environments, retail pharmacies, hospital pharmacies, and online pharmacies. Advanced technology plays a crucial role in the development of drug delivery devices. Next-generation technologies, such as self-administering systems, auto-injectors, pen injectors, jet-injectors, prefilled syringes, and smart sensors, have gained popularity due to their patient-friendly designs and improved accuracy. In the context of chronic diseases, drug delivery devices have proven to be essential for targeted medication delivery.

- Biologics drugs, which often require specific delivery methods, have particularly benefited from these advancements. The pharmaceutical industry's focus on diagnosis and treatment has led to the integration of drug delivery devices in various vaccination drives and therapeutic areas. Oral drug delivery and injectable drug delivery systems have shown remarkable progress, offering enhanced patient compliance and convenience. Homecare solutions have emerged as a key area of growth within the market. These devices enable patients to administer medications in the comfort of their homes, reducing the need for frequent hospital visits and improving overall patient care.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Route Of Administration

- Oral

- Injectable

- Pulmonary

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- Rest of World (ROW)

- North America

By Route Of Administration Insights

- The oral segment is estimated to witness significant growth during the forecast period.

The market for Drug Delivery Devices encompasses various types of devices used for administering drugs, including Injection Devices, Oral Drug Delivery, Topical Drug Delivery, Ophthalmic Drug Delivery, and Nasal Drug Delivery. Among these, the segment for Oral Drug Delivery is significant due to its ease of use, non-invasive nature, and cost-effectiveness. This segment includes drugs in the form of capsules, tablets, syrups, solutions, and suspensions

Furthermore, orally administered drugs can be targeted to specific areas within the gastrointestinal tract to treat various conditions, including cancer, inflammation, infections, and bowel diseases. Advancements in pharmaceutical technologies and oral drug delivery systems, such as lipid-based carriers, nanocarriers, and micelles, are enhancing oral drug absorption, thereby improving therapeutic effectiveness. Hence, such factors are fuelling the growth of this segment during the forecast period.

Get a glance at the market report of share of various segments Request Free Sample

The oral segment was valued at USD 85.50 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 52% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America held the largest market share in the global industry in 2023. The US and Canada were the primary contributors to this region's dominance. Factors driving the market's expansion include the high incidence of chronic diseases like cancer, diabetes, and arthritis, increasing adoption of treatments for these conditions, a significant number of pharmaceutical companies, and new product launches. According to The World Bank Group, healthcare spending in North America rose from 14.10% of the GDP in 2005 to 16.41% in 2018. In 2020, healthcare expenditure in the US grew by 9%. This growth is attributed to the large and advanced healthcare infrastructure, which supports the development and implementation of innovative drug delivery devices.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Drug Delivery Devices Market ?

The growing prevalence of chronic conditions is the key driver of the market.

- Chronic diseases, including diabetes, chronic kidney disease, cancer, arthritis, and Alzheimer's disease, are on the rise in developed countries like the US, Canada, the UK, Australia, France, and Germany. Next-generation drug delivery devices, such as prefilled syringes and pen injectors, are gaining popularity in home-care environments due to their patient-friendly designs. In the oncology and infectious diseases sectors, these devices offer significant benefits. Next-generation technologies, such as nanotechnology and biodegradable polymers, are being integrated into drug delivery devices to improve efficacy and patient compliance. Thus, such factors are driving the growth of the market during the forecast period.

What are the market trends shaping the Drug Delivery Devices Market?

The rising adoption of self-injectable devices is the upcoming trend in the market.

- The self-administering market in the US is experiencing significant growth due to several factors enhancing patient convenience and ensuring medication adherence. Self-injectable devices, including autoinjectors and pen injectors, enable patients to administer their medications at home, which has gained prominence during the COVID-19 pandemic as people aim to minimize healthcare facility visits. The prevalence of chronic conditions such as diabetes, cancer, and autoimmune disorders necessitates regular medication administration, leading to a growing demand for these devices. Injectable routes remain a popular drug delivery application due to their ability to improve bioavailability and ensure precise dosing. Pharmaceutical companies and retail pharmacies in the US are increasingly stocking these devices to cater to the growing demand from patients. Drug Delivery Systems, including self-administering devices, play a crucial role in enhancing patient care and improving treatment outcomes.

What challenges does Drug Delivery Devices Market face during the growth?

Stringent government regulations is a key challenge affecting the market growth.

- Drug delivery devices play a crucial role in addressing various health conditions, including respiratory diseases, diabetes, cardiovascular diseases, autoimmune diseases, neurology, and hospital-acquired infections. The effectiveness of these devices relies on precise drug distribution and optimal patient experience. Molecular interactions and target-based drug discovery have led to the development of advanced drug delivery systems. However, stringent regulatory requirements pose significant challenges for market growth. Regulatory bodies, such as the US Food and Drug Administration (FDA), enforce rigorous standards to ensure safety, efficacy, and quality. Extensive clinical trials and comprehensive documentation are necessary for product approval, which can delay market entry for innovative devices.

- The complexity of regulatory frameworks varies across regions, making it essential for manufacturers to navigate a patchwork of guidelines. In home care settings, these devices offer convenience and improved patient outcomes. As the healthcare industry continues to evolve, drug delivery devices will remain a vital component of disease management strategies.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- AbbVie Inc.

- Antares Pharma Inc.

- AptarGroup Inc.

- Becton Dickinson and Co.

- Biocorp

- Elcam Medical Group

- F. Hoffmann La Roche Ltd.

- Insulet Corp.

- Johnson and Johnson Inc.

- Koch Industries Inc.

- Merck KGaA

- Nemera Group

- Novartis AG

- Pfizer Inc.

- SHL Medical AG

- Teva Pharmaceutical Industries Ltd.

- uniQure NV

- West Pharmaceutical Services Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Drug delivery is a critical aspect of the pharmaceutical industry, focusing on delivering active pharmaceutical ingredients (APIs) to the target site in the body effectively and safely. Advanced technology plays a significant role in the development of next-generation drug delivery systems, addressing bioavailability hurdles and improving therapeutic effectiveness. These devices cater to various therapeutic areas, including oncology, infectious diseases, respiratory diseases, diabetes, cardiovascular diseases, autoimmune diseases, and neurology. Home-care environments have witnessed a surge in demand for patient-friendly devices such as prefilled syringes, pen injectors, auto-injectors, jet-injectors, and self-administering systems. The use of drug delivery systems extends beyond hospitals to retail pharmacies, hospital pharmacies, online pharmacies, vaccination drives, and e-pharmacies.

Additionally, patient experience is a crucial factor in the design and development of these devices, ensuring ease of use, minimal side effects, and compatibility with chronic and non-chronic diseases. Advanced delivery systems, such as targeted medication delivery using smart sensors, are revolutionizing the landscape, enabling biosimilar products to replicate the efficacy of conventional systems while offering improved patient outcomes. The pharmaceutical industry continues to invest in research and development, focusing on molecular interactions, target-based drug discovery, and drug delivery applications across various routes, including oral, injectable, topical, ophthalmic, nasal, pulmonary, transmucosal, and implantable drug delivery systems.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.2% |

|

Market Growth 2024-2028 |

USD 85.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.8 |

|

Key countries |

US, Canada, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch