Phosphate Rock Market Size 2025-2029

The phosphate rock market size is valued to increase by USD 5.34 billion, at a CAGR of 4% from 2024 to 2029. Rising demand for phosphate fertilizers will drive the phosphate rock market.

Major Market Trends & Insights

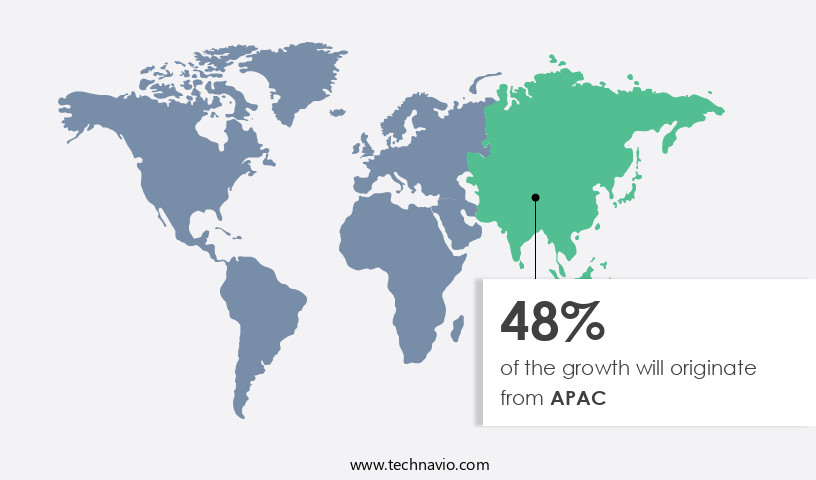

- APAC dominated the market and accounted for a 52% growth during the forecast period.

- By Source - Marine phosphate deposits segment was valued at USD 14.49 billion in 2023

- By Application - Fertilizer segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 35.85 million

- Market Future Opportunities: USD 5338.50 million

- CAGR from 2024 to 2029 : 4%

Market Summary

- Phosphate rock, a critical resource for the global fertilizer industry, experienced significant growth in recent years due to the increasing demand for phosphate-based fertilizers. According to the United States Geological Survey, global phosphate rock production reached approximately 162 million metric tons in 2020. This surge in production can be attributed to the expanding agricultural sector, driven by population growth and the need to increase food production. However, the market faces challenges, including environmental concerns and the potential health hazards associated with phosphate-based fertilizers. Regulations and consumer awareness are pushing the industry towards more sustainable and eco-friendly practices, such as the use of organic fertilizers and improved fertilizer application techniques.

- Additionally, advancements in technology, like precision agriculture and controlled-release fertilizers, are helping to mitigate the environmental impact of phosphate fertilizers while maintaining their effectiveness. As the market continues to evolve, stakeholders must navigate these challenges and capitalize on emerging opportunities to ensure long-term success.

What will be the Size of the Phosphate Rock Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Phosphate Rock Market Segmented ?

The phosphate rock industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Source

- Marine phosphate deposits

- Igneous phosphate deposits

- Metamorphic deposits

- Biogenic deposits

- Weathered deposits

- Application

- Fertilizer

- Animal feed supplement

- Others

- Grade Type

- Fertilizer grade

- Feed grade

- Industrial grade

- Geography

- North America

- US

- Canada

- Europe

- Poland

- Russia

- Spain

- APAC

- China

- India

- Indonesia

- Vietnam

- South America

- Brazil

- Rest of World (ROW)

- North America

By Source Insights

The marine phosphate deposits segment is estimated to witness significant growth during the forecast period.

The market is characterized by the continuous evolution of mining techniques and processing technologies to meet the growing demand for phosphate-based products in various industries. Marine phosphate deposits, which account for over 80% of the global phosphate rock reserves, remain the dominant segment due to their vast resources and versatile applications. These deposits yield phosphoric acid and phosphorus-based compounds, serving as the backbone of the market. The demand for phosphate rock is driven by its extensive use in fertilizers, feed additives, industrial chemicals, and other sectors. The mining and processing of phosphate rock involve various techniques, including mine reclamation, sustainable agriculture practices, and wastewater treatment.

To ensure quality control and regulatory compliance, mining equipment and processing technology undergo constant optimization. The acidulation process, flotation separation, and particle size distribution analysis are crucial steps in phosphate beneficiation. Safety protocols and energy consumption reduction are essential considerations in the mining and processing of phosphate rock. For instance, the carbon footprint of phosphate rock mining can be minimized through the implementation of sustainable practices and efficient mine rehabilitation. The phosphorus content analysis and nutrient management are essential aspects of fertilizer production, while granulation techniques ensure product specifications are met. The market is subject to supply chain optimization, economic viability, and environmental impact assessments.

The industry's focus on phosphorus recovery, impurity removal, and process optimization contributes to its ongoing growth and development.

The Marine phosphate deposits segment was valued at USD 14.49 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 52% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Phosphate Rock Market Demand is Rising in APAC Request Free Sample

In The market, APAC held the largest share in 2024. Population expansion and the escalating demand for grains serve as significant growth catalysts for this market in the Asia Pacific region. The agricultural sector's expansion, driven by the increasing awareness of livestock health and hygiene, propels the utilization of phosphate in cattle feed. China, the world's leading phosphate producer, underpins this trend.

With an extensive reserve of phosphate deposits, China is a major supplier. The Chinese government's export restrictions aim to stabilize domestic fertilizer prices, indicating the immense demand for phosphate due to the burgeoning population and its agricultural sector's growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a critical sector in global agriculture, with phosphorus being an essential nutrient for plant growth. Mining practices for phosphate rock extraction have an impact on the environment, making sustainable management of phosphorus cycles a priority. The optimization of rock phosphate beneficiation techniques and wet process phosphoric acid production efficiency are key areas of focus to enhance the economic viability of phosphate rock mining operations. Geological exploration is crucial for the discovery of new rock phosphate reserves, ensuring a sustainable supply chain for phosphorus fertilizer production. Soil phosphorus dynamics and plant uptake mechanisms play a significant role in determining phosphorus bioavailability and crop yield response. Sustainable phosphate fertilizer production methods, such as nutrient management strategies and agricultural practices that improve phosphorus use efficiency, are essential to minimize the environmental impact of phosphate rock mining. Phosphate rock processing waste management strategies and water quality impact assessments are crucial to mitigate the environmental consequences of phosphate rock mining activities. The implementation of phosphorus recovery technologies in waste streams is a promising solution for reducing the environmental footprint of the phosphate rock industry. Sustainable use of phosphate rock resources requires a holistic approach that considers the entire phosphorus supply chain, from mining to application. Phosphorus fertilizer application rates and crop response studies are essential to optimize fertilizer use efficiency and minimize excess phosphorus runoff. Economic viability and environmental sustainability must be balanced in phosphate rock mining operations to ensure long-term success in this market.

What are the key market drivers leading to the rise in the adoption of Phosphate Rock Industry?

- The surge in demand for phosphate fertilizers serves as the primary catalyst for market growth.

- Phosphorus is an essential macronutrient for plant growth, alongside potassium and nitrogen. In agriculture and horticulture, phosphorus plays a crucial role in plant development, particularly in seed formation, root growth, and promoting flowering. Phosphate rock, a primary source of phosphorus, is extensively used to produce phosphate fertilizers. These fertilizers are integral to improving agricultural productivity and crop quality worldwide. Various types of phosphate fertilizers are available in the market, including single superphosphates, triple superphosphates, mono ammonium phosphates, and diammonium phosphates.

- These fertilizers enrich the soil by providing essential nutrients for plant growth, ensuring healthy crop yields and optimal plant development.

What are the market trends shaping the Phosphate Rock Industry?

- The increasing population trend is a significant market development. Market trends indicate a notable growth due to population expansion.

- The global population's continuous growth, projected to reach approximately 9 billion by mid-2030, necessitates an increase in food production. This demand for food will subsequently drive the need for fertilizers, thereby boosting the utilization of phosphate rock. Phosphate rock is a vital resource in the production of phosphoric acid, which is a fundamental ingredient in fertilizers. Consequently, the market is anticipated to experience significant growth in the upcoming years due to this increasing demand for food production.

- The agricultural sector's reliance on phosphate rock is substantial, with it accounting for over 75% of the total phosphate rock consumption. Additionally, phosphate rock finds applications in various industrial sectors, including manufacturing, construction, and nuclear energy, further expanding its market potential.

What challenges does the Phosphate Rock Industry face during its growth?

- The growth of the fertilizer industry faces significant challenges due to the health hazards posed by phosphate-based fertilizers. These hazards, which are a concern for both workers and consumers, necessitate stringent safety measures and regulatory compliance in the production and application of these fertilizers.

- Phosphate rock, a primary source of phosphorus for fertilizers, plays a pivotal role in agriculture and various industries. Inorganic phosphates, derived from phosphate rock, account for 75%-95% of its water-soluble content. While these fertilizers boost crop yields, their overuse can lead to environmental concerns. For instance, single superphosphate, an inorganic phosphate fertilizer, can contaminate water resources when excessively applied. Phosphorus, a key nutrient for plant growth, can accumulate in natural water systems, negatively impacting aquatic ecosystems. Despite these challenges, phosphate rock remains indispensable due to its high nutrient value.

- Its use extends beyond agriculture to industries like food processing, pharmaceuticals, and detergents. Adhering to sustainable farming practices and proper fertilizer application techniques can mitigate environmental risks associated with phosphate rock use.

Exclusive Technavio Analysis on Customer Landscape

The phosphate rock market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the phosphate rock market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Phosphate Rock Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, phosphate rock market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Deep Mineral - This international mining company specializes in the production and supply of high-quality phosphate rock, including EuroChem's offering. Their expertise in sourcing and processing phosphate minerals provides essential resources for various industries, such as agriculture and fertilizer production.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Deep Mineral

- EuroChem Group AG

- Fertoz Ltd.

- Guizhou Chanhen Chemical Corp.

- Hubei Xingfa Chemicals Group Co. Ltd.

- Innophos Holdings Inc.

- Israel Chemicals Ltd.

- Jordan Phosphate Mines Co. PLC

- Manidharma Biotech Pvt. Ltd.

- Nutrien Ltd.

- OCP Group

- Oracle Chemicals Pvt. Ltd.

- PhosAgro Group of Companies

- Saudi Arabian Mining Co.

- Solanki Minerals

- Solvay SA

- Surya Min Chem

- The Mosaic Co.

- Yunnan Phosphate Haikou Co. Ltd.

- Yuntianhua Group Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Phosphate Rock Market

- In January 2024, Mosaic Company, a leading phosphate rock producer, announced the successful commissioning of its new phosphate mine in Florida, increasing its annual production capacity by 10%. This expansion was disclosed in their Q4 2023 earnings report. (Mosaic Company Press Release)

- In March 2024, OCP Group, the Moroccan phosphate producer, entered into a strategic partnership with Yara International, a leading fertilizer company, to jointly develop and market phosphate-based fertilizer solutions. The partnership was announced during a press conference at the 2024 Fertilizer Africa conference. (Reuters)

- In May 2025, PotashCorp, a major agribusiness company, completed the acquisition of IFC Fertilizers, a leading Indian phosphate fertilizer producer. The deal, valued at USD1.5 billion, was announced in a press release and approved by both companies' boards of directors. (PotashCorp Press Release)

- In the same month, the Chinese government announced a new policy initiative to increase domestic phosphate rock production and reduce reliance on imports. The policy includes tax incentives for new phosphate rock mines and investments in technology upgrades for existing mines. (Xinhua News Agency)

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Phosphate Rock Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4% |

|

Market growth 2025-2029 |

USD 5338.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.6 |

|

Key countries |

US, China, India, Russia, Vietnam, Canada, Poland, Indonesia, Brazil, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by the diverse applications of this essential mineral across various sectors. Mineral processing techniques play a crucial role in extracting phosphorus from rock phosphate reserves, with a focus on maximizing efficiency and reducing the carbon footprint of mining operations. For instance, the acidulation process and flotation separation are commonly used in phosphate beneficiation, resulting in a higher phosphorus content in the final product. Sustainable agriculture is another significant market for phosphate rock, with nutrient management being a key concern. Soil phosphorus dynamics are vital in ensuring optimal plant uptake efficiency, and the elemental composition of fertilizer production is essential to meet the specifications of various crops.

- Quality control measures are also crucial in the production process to ensure regulatory compliance and economic viability. Mine reclamation and land rehabilitation are increasingly important aspects of phosphate rock mining, with a focus on minimizing environmental impact. Process optimization and supply chain optimization are also critical in reducing energy consumption and improving impurity removal. The mining equipment used in phosphate rock mining must adhere to safety protocols and undergo regular environmental impact assessments. According to industry reports, the market is expected to grow at a robust pace in the coming years, with an estimated increase of over 5% annually.

- This growth is attributed to the ongoing demand for phosphorus in agriculture, food production, and other industries. However, resource depletion remains a concern, with the need for sustainable mining practices and phosphorus recovery becoming increasingly important. Wastewater treatment and phosphorus content analysis are also crucial areas of research to minimize the environmental impact of phosphate rock mining and processing.

What are the Key Data Covered in this Phosphate Rock Market Research and Growth Report?

-

What is the expected growth of the Phosphate Rock Market between 2025 and 2029?

-

USD 5.34 billion, at a CAGR of 4%

-

-

What segmentation does the market report cover?

-

The report is segmented by Source (Marine phosphate deposits, Igneous phosphate deposits, Metamorphic deposits, Biogenic deposits, and Weathered deposits), Application (Fertilizer, Animal feed supplement, and Others), Grade Type (Fertilizer grade, Feed grade, and Industrial grade), and Geography (APAC, North America, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rising demand for phosphate fertilizers, Health hazards associated with phosphate-based fertilizers

-

-

Who are the major players in the Phosphate Rock Market?

-

Deep Mineral, EuroChem Group AG, Fertoz Ltd., Guizhou Chanhen Chemical Corp., Hubei Xingfa Chemicals Group Co. Ltd., Innophos Holdings Inc., Israel Chemicals Ltd., Jordan Phosphate Mines Co. PLC, Manidharma Biotech Pvt. Ltd., Nutrien Ltd., OCP Group, Oracle Chemicals Pvt. Ltd., PhosAgro Group of Companies, Saudi Arabian Mining Co., Solanki Minerals, Solvay SA, Surya Min Chem, The Mosaic Co., Yunnan Phosphate Haikou Co. Ltd., and Yuntianhua Group Co. Ltd.

-

Market Research Insights

- The market is a dynamic and ever-evolving entity, driven by market demand and technological advancements. Phosphate rock, a key component in the production of phosphorus fertilizers, plays a crucial role in agriculture by improving soil health and enhancing nutrient use efficiency. According to industry reports, the market demand for phosphate rock is projected to grow by 2.5% annually over the next decade. Moreover, the industry is witnessing significant advancements in water quality parameters, energy efficiency, and operational safety. For instance, the implementation of waste minimization and emission control technologies has led to a reduction in the environmental footprint of phosphate rock production.

- Additionally, the development of more efficient transportation logistics and material handling processes has streamlined the supply chain and improved product quality. Despite these advancements, the market faces challenges such as price volatility and regulatory frameworks that impact production capacity and mining methods. For example, a recent study showed that phosphate rock prices experienced a 15% increase in the last quarter due to supply disruptions. However, industry experts anticipate a steady supply outlook in the long term, as new production facilities come online and existing ones expand their capacity. Overall, the market continues to evolve, with a focus on cost-benefit analysis, process efficiency, and sustainability.

- The integration of technology, resource management, and regulatory frameworks will be essential in ensuring the long-term viability and success of the industry.

We can help! Our analysts can customize this phosphate rock market research report to meet your requirements.