Phosphorus Fertilizers Market Size 2024-2028

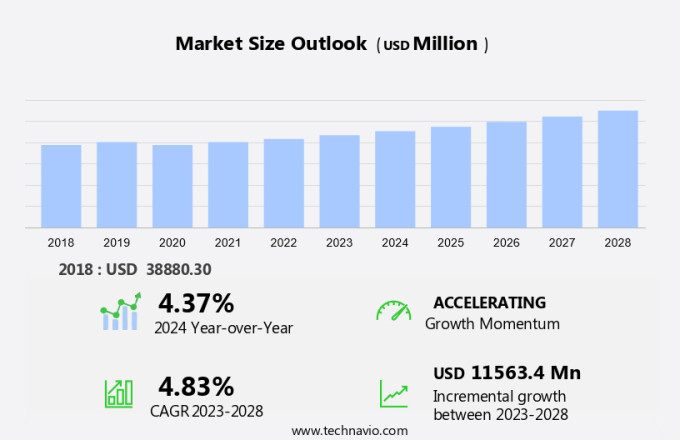

The phosphorus fertilizers market size is forecast to increase by USD 11.56 billion at a CAGR of 4.83% between 2023 and 2028. The market is experiencing significant growth due to several key drivers. The shrinking arable land, a result of rapid urbanization, is leading to an increased demand for phosphorus-based fertilizers such as TSP (Triple Super Phosphate) and DAP (Di-Ammonium Phosphate), particularly in regions with high grains and oilseeds production like Serra do Salitren.

Furthermore, the trend toward vertical integration among agrochemical companies is boosting the consumption volume of these fertilizers in metric tons. However, the market faces challenges, including stringent regulations and policies concerning the use of watersoluble P and pure phosphate-based fertilizers due to environmental concerns. Despite these challenges, the market for phosphorus fertilizers is expected to continue its growth trajectory due to the essential role these fertilizers play in enhancing crop yield.

Phosphorus fertilizers play a crucial role in enhancing agricultural productivity by providing essential phosphorus nutrients to crops. These fertilizers are primarily used by agricultural producers to cultivate various crops such as fruits, vegetables, cereals, pulses, grains, oilseed crops, and more. Phosphorus rocks, the primary source of phosphorus for fertilizer production, contain approximately 16% phosphorus pentoxide (P2O5). Phosphorus fertilizers, including TSP (Triple Super Phosphate), DAP (Diammonium Phosphate), and SSP (Single Super Phosphate), are essential for crops that require a high phosphorus content, such as fruits and vegetables. Nitrogen fertilizers, which are often used in conjunction with phosphorus fertilizers, provide nitrogen nutrients, while phosphorus fertilizers offer calcium nutrients and sulfur trace elements.

Furthermore, the global food demand is projected to increase due to the growing world population, leading to a potential uptick in phosphorus fertilizer usage. However, challenges such as labor shortages, shrinking fields, urbanization, and urban areas encroaching upon arable land may impact phosphorus fertilizer production and usage. Despite these challenges, farmers continue to rely on phosphorus fertilizers to maintain crop health and productivity.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Grain and oilseed

- Fruits and vegetables

- Others

- Geography

- APAC

- China

- India

- South America

- Brazil

- North America

- US

- Europe

- Middle East and Africa

- APAC

By Type Insights

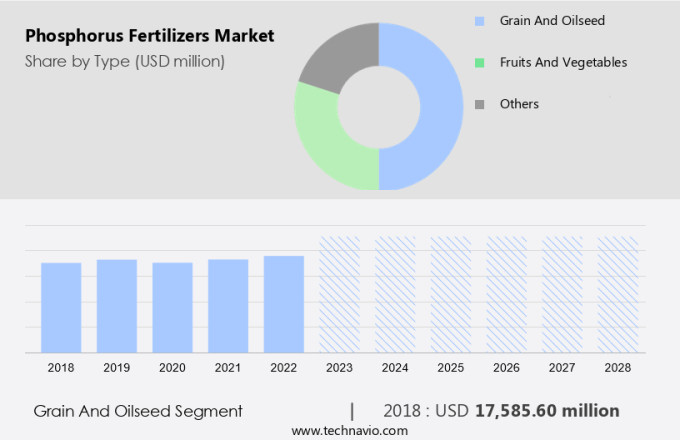

The grain and oilseed segment is estimated to witness significant growth during the forecast period. Phosphorus fertilizers play a crucial role in the productive cultivation of arable land used for growing grains, which constitute a significant portion of the world's food supply. Farmers rely on these fertilizers to optimize the growth of field crops such as rice, wheat, corn, and cotton. Phosphorus is a vital macronutrient that contributes to the proper development of grains, ensuring seed formation and enhancing their nutritional value. Grains, including wheat, rice, corn, and cottonseed, are essential food sources for millions of people worldwide, providing energy and essential nutrients like vitamins, minerals, and protein. The agricultural workforce depends on these fertilizers to maintain optimal crop yields, ensuring food security and sustenance for the global population.

Get a glance at the market share of various segments Request Free Sample

The grain and oilseed segment accounted for USD 17.58 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

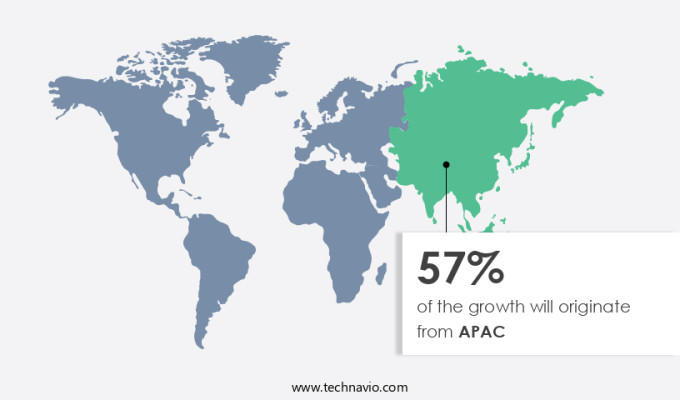

APAC is estimated to contribute 57% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Phosphorus fertilizers play a crucial role in enhancing crop production on arable lands across Asia-Pacific (APAC). In 2023, China emerged as the leading consumer of phosphorus fertilizers in APAC due to the burgeoning agriculture sector. India and Indonesia rank second and third, respectively, in the region's phosphorus fertilizer consumption. The agricultural workforce in these countries focuses on the cultivation of staple crops like rice, wheat, corn, and cotton, which require adequate phosphorus for optimal growth. Phosphorus fertilizers significantly contribute to the nutrient supply for these crops, especially for nitrogen-deficient soils. Key crops produced in APAC, including corn, maize, wheat, soybeans, cotton, rice, peanuts, canola, sunflower, sugarcane, sugar beet, beans, peas, and legumes, benefit significantly from the use of phosphorus fertilizers.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Shrinking arable land due to rapid urbanization is the key driver of the market. The market is experiencing a potential uptick due to the increasing demand for food production in the context of shrinking arable land and a growing world population. Urbanization and industrialization have led to the conversion of agricultural land for other purposes, such as construction. For instance, China witnessed a significant decline of approximately 15 million hectares of arable land between 1979 and 1995. Developing countries like China and India are projected to require an additional 120 million hectares of land by 2030 to meet their food demands. To maintain crop productivity, farmers increasingly rely on phosphorus fertilizers, which contain essential nutrients like Calcium and Sulfur trace elements.

Furthermore, these nutrients are crucial for the growth of oilseed crops, which are a significant source of protein and oil for human consumption. Despite labor shortages, the demand for nitrogen fertilizers, a major component of phosphorus fertilizers, remains high due to their role in enhancing crop yield.

Market Trends

Increasing preference for vertical integration among companies is the upcoming trend in the market. Phosphorus fertilizers, specifically Single Superphosphate (SSP), play a crucial role in enhancing crop productivity, particularly for oilseed crops that require sulfur trace elements and calcium nutrients. The global population's potential uptick, coupled with labor shortages, shrinking fields, and urbanization, necessitates an increase in agricultural productivity. However, the production of phosphorus fertilizers relies heavily on the cost of raw material procurement. To mitigate this expense, phosphorus fertilizer manufacturers are adopting vertical integration strategies, such as backward integration, to produce the necessary raw materials in-house. This approach reduces operational costs, enhances process efficiency, and strengthens the company's bargaining power in the market.

Moreover, the integration of supply, distribution, and retail operations allows manufacturers to control the entire value chain, ensuring a consistent and reliable supply of phosphorus fertilizers to meet the growing demand.

Market Challenge

Stringent regulations and policies is a key challenge affecting the market growth. The market is subject to stringent regulations to ensure sustainable use and management. The United Nations Food and Agriculture Organization (FAO) and the US Environmental Protection Agency (EPA) are key international and domestic bodies responsible for establishing and enforcing these policies. The International Code of Conduct for the Sustainable Use and Management of Fertilizers by FAO and FIFRA in the US set the regulatory framework. In Europe, Regulation (EC) No 1272/2008 (CLP) by the European Parliament and the Council governs the classification, labeling, and packaging of phosphorus fertilizers. These regulations aim to maintain food security while addressing labor shortages, urbanization, and shrinking agricultural lands.

Furthermore, phosphorus fertilizers, including Single Superphosphate (SSP), play a crucial role in enhancing the productivity of oilseed crops by providing essential nutrients like sulfur trace elements and calcium. The potential uptick in world population growth necessitates increased agricultural productivity, making phosphorus fertilizers indispensable in the global agricultural sector.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Coromandel International Ltd: The company offers phosphorus fertilizers that provides insecticides, pesticides, weedicides and fungicides which includes nitrogen, phosphatic and potassic, water soluble fertilizer, sulfur products, micro nutrients and organic manure.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AgroLiquid

- CF Industries Holdings Inc.

- Corteva Inc.

- Crop Quest Inc.

- EuroChem Group AG

- Haifa Negev technologies Ltd.

- Hubei Xingfa Chemicals Group Co. Ltd.

- Indorama Corp.

- Israel Chemicals Ltd.

- Jordan Phosphate Mines Co. PLC

- Nutrien Ltd.

- OCP Group

- Peptech Biosciences Ltd.

- PhosAgro Group of Companies

- Saskatchewan

- Saudi Arabian Mining Co.

- The Mosaic Co.

- Yara International ASA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Phosphorus fertilizers play a crucial role in the growth and development of various crops, including fruits, vegetables, cereals, pulses, grains, oilseeds, and legumes. The global demand for phosphorus fertilizers is driven by the increasing food demand and the nutrient requirements of leading agricultural crops such as rice, wheat, corn, cotton, soybean, and others. Phosphorus is a primary nutrient that is essential for metabolic processes in plant tissues, including cell membranes, chlorophyll production, and energy transfer. Phosphorus fertilizers are derived from phosphorus rocks, and the most common forms are diammonium phosphate (DAP), monoammonium phosphate (MAP), and triple superphosphate (TSP). Watersoluble P and pure phosphate-based fertilizers are also gaining popularity due to their high phosphate content and efficacy.

Moreover, the consumption volume of phosphorus fertilizers is expected to increase due to the potential uptick in agrochemical demand, shrinking arable land, labor shortages, urbanization, and urban areas' expanding populations. The prominent crops that require phosphorus fertilizers include oilseed crops, which require sulfur trace elements and calcium nutrients, and field crops such as rice, wheat, corn, cotton, soybean, and others. The world population's growth and the need to increase agricultural productivity to meet the food demand put pressure on farmers to use more fertilizers. However, severe flooding in Texas, Houston, and other regions can impact the production and distribution of phosphorus fertilizers, potentially disrupting the supply chain.

Furthermore, the USDA reports that crops such as rapeseed, sorghum, and others also require phosphorus fertilizers to thrive. The nutrient requirements of these crops vary, with some requiring higher phosphorus content than others. Overall, phosphorus fertilizers remain a vital input for farmers to ensure optimal crop yields and meet the growing food demand on a global scale.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

139 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.83% |

|

Market growth 2024-2028 |

USD 11.56 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.37 |

|

Regional analysis |

APAC, South America, North America, Europe, and Middle East and Africa |

|

Performing market contribution |

APAC at 57% |

|

Key countries |

China, India, US, Brazil, and Indonesia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AgroLiquid, CF Industries Holdings Inc., Coromandel International Ltd., Corteva Inc., Crop Quest Inc., EuroChem Group AG, Haifa Negev technologies Ltd., Hubei Xingfa Chemicals Group Co. Ltd., Indorama Corp., Israel Chemicals Ltd., Jordan Phosphate Mines Co. PLC, Nutrien Ltd., OCP Group, Peptech Biosciences Ltd., PhosAgro Group of Companies, Saskatchewan, Saudi Arabian Mining Co., The Mosaic Co., and Yara International ASA |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, South America, North America, Europe, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch