Pick-To-Light Systems Market Size 2024-2028

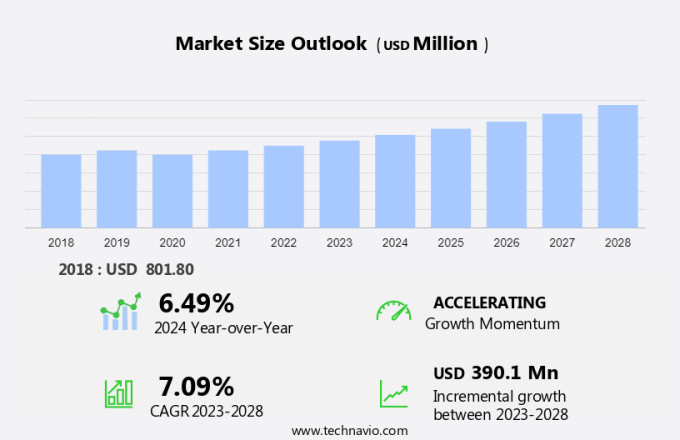

The pick-to-light systems market size is forecast to increase by USD 390.1 million at a CAGR of 7.09% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing number of fulfillment centers and the need for efficient order-picking processes. A key trend in the market is the integration of Autonomous Mobile Robots (AMRs) with PTL systems, enabling automated material handling and streamlined operations. Another emerging trend is the adoption of pick-to-voice systems, which utilize voice recognition technology to guide workers through the picking process, increasing productivity and reducing errors. User-friendly displays, voice assistants, and e-newsletters cater to customer preferences and improve brand visibility. These advancements are transforming the traditional PTL market and positioning it as a crucial component of modern warehouse and distribution operations.

What will be the Size of the Market During the Forecast Period?

- Pick-to-Light systems have revolutionized the warehousing industry by integrating advanced technologies such as IoT sensors, cloud computing, and artificial intelligence. These systems use user-friendly displays and energy-efficient LED lights to guide workers through the warehouse, improving productivity and accuracy. Connectivity with mobile devices and voice assistants enables real-time communication and streamlined operations. The market is segmented based on technology, application, and end-user.

- The bottom-up procedure and data triangulation techniques are used for market engineering and forecasting. Statistics from primary profiles and newsletters provide insights into market trends. Wireless pick-to-light systems are increasingly popular due to their flexibility and ease of installation on warehouse shelves. The industrial revolution and the online shopping trend have led to an increase in automated warehousing facilities, driving the demand for Pick-to-Light systems. LED lights offer energy efficiency and long-lasting performance, making them a preferred choice for Pick-to-Light applications.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Retail and 3PL

- Automotive

- Food and beverage

- Manufacturing

- Others

- Geography

- APAC

- China

- India

- South Korea

- North America

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By Application Insights

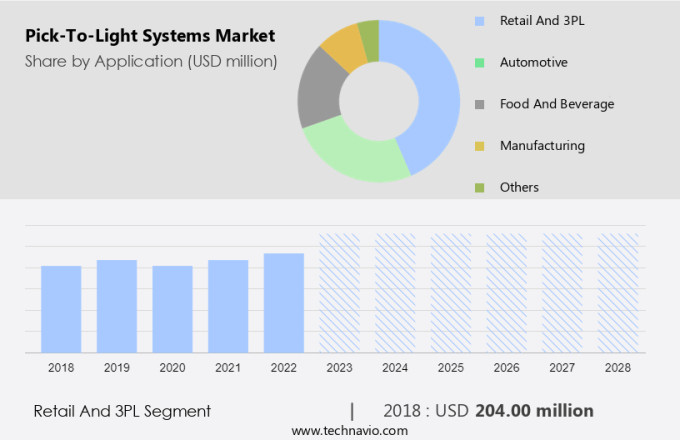

- The retail and 3PL segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the increasing adoption in retail, e-commerce, and 3PL industries. These systems utilize IoT sensors, cloud computing, and artificial intelligence to optimize warehouse operations and enhance user experience. LED technology and energy-efficient light sources are integral to these systems, ensuring workplace safety and ergonomics. Smart lighting, connectivity, and mobile devices enable real-time order processing, improving labor productivity and order accuracy. E-commerce platforms, such as Amazon and eBay, have boosted online retail sales, necessitating efficient order fulfillment solutions like pick-to-light systems.

Logistics systems and customer support are also enhanced through these advanced technologies. Market segmentation, bottom-up procedure, data triangulation, and market engineering processes are employed to analyze market statistics and profile primaries in the market. The modular nature and cloud-based platforms of these systems enable easy integration with various systems, making them a valuable investment for the warehousing industries.

Get a glance at the market report of share of various segments Request Free Sample

The retail and 3PL segment was valued at USD 204.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

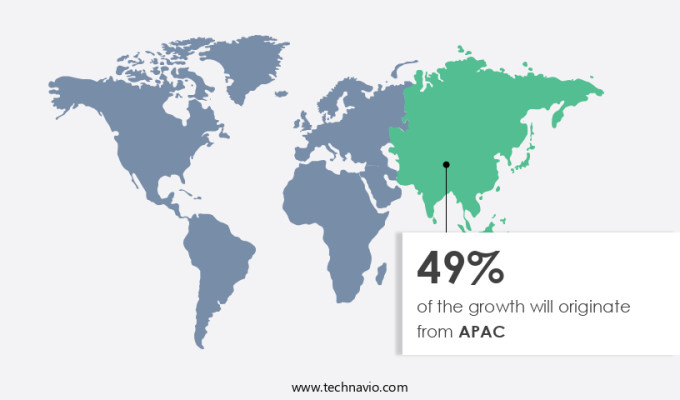

- APAC is estimated to contribute 49% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

IoT sensors play a pivotal role in Pick-To-Light Systems, enabling real-time data transmission and automating warehouse operations. Cloud computing and artificial intelligence technologies enhance system capabilities, allowing for advanced analytics and predictive maintenance. LED technology and energy-efficient light sources ensure workplace safety and energy savings. User-friendly displays and connectivity via mobile devices and voice assistants facilitate order processing and customer support. E-commerce platforms and online shopping trends drive market growth, with customer preferences, online reviews, and ratings influencing brand visibility and marketing campaigns. Logistics systems benefit from order accuracy and labor productivity improvements. The modular nature and cloud-based platforms enable easy integration with various systems.

Ergonomics and workplace safety are essential considerations, with free-standing plates and advanced technologies ensuring efficient warehouse operations. Power source and market segmentation are crucial factors in the market engineering process, with data triangulation procedures and statistics shaping industry profiles. Newsletters and bottom-up procedures provide valuable insights into market trends and growth opportunities.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Pick-To-Light Systems Market?

The growing number of fulfillment centers is the key driver of the market.

- The e-commerce industry's expansion and the increasing trend toward online shopping have driven the need for advanced automated warehousing solutions, such as pick-to-light systems. These systems are essential components of modern fulfillment centers, which enable enterprises, particularly those in retail and e-commerce, to outsource their warehousing and shipping operations. Fulfillment centers provide businesses with the necessary infrastructure for storing their products, streamlining the order fulfillment process, and reducing manual picking methods.

- Pick-to-light systems utilize LED lights on warehouse shelves to guide workers through the picking process, ensuring accuracy and efficiency. Industrial giants like Amazon have implemented these systems in their large-scale automated warehouses, handling heavy products and vast picking areas.\ Post-sale services from hardware manufacturers and the integration of wireless pick-to-light systems further enhance the technology's capabilities. The industrial revolution brought about by these advanced automated warehousing facilities is transforming the way businesses manage their inventory and fulfill orders.

What are the market trends shaping the Pick-To-Light Systems Market?

Integration of autonomous mobile robots (AMRs) with pick-to-light systems is the upcoming trend in the market.

- Pick-to-Light systems have revolutionized the order fulfillment process in automated warehouses and distribution centers, particularly in the retail and e-commerce industry. These systems consist of hardware modules, such as LED lights, installed on shelves or pick locations. When an order is received, the Warehouse Management System (WMS) sends a signal to the Pick-to-Light system, activating the corresponding light for the specific item to be picked. This automated method streamlines the picking process, reducing manual errors and increasing efficiency.

- Hardware manufacturers offer post-sale services, including installation, maintenance, and upgrades, to ensure the smooth functioning of these systems. The e-commerce industry's online shopping trend has led to an increase in demand for Pick-to-Light systems in large picking areas. In the pharmaceutical and cosmetics sector, where heavy products require precise handling, Wireless pick-to-light systems have become indispensable. These systems offer flexibility and mobility, allowing pickers to move around the warehouse without being tethered to a fixed location. Advanced automated warehouses and warehousing facilities are integrating Pick-to-Light systems to optimize their operations and meet the demands of their customers.

What challenges does Pick-To-Light Systems Market face during its growth?

The emergence of pick-to-voice systems is a key challenge affecting the market growth.

- In the dynamic world of distribution, particularly in automated warehouses and e-commerce industries, the order fulfillment process has become increasingly complex. Manual picking methods, such as manual picking from shelves, can lead to errors and inefficiencies, especially in large picking areas or when dealing with heavy products. To address these challenges, pick-to-light systems have emerged as a popular solution. These systems utilize LED lights mounted on warehouse shelves, which illuminate when an order requires picking from that location. Wireless pick-to-light systems offer added flexibility and mobility. The e-commerce industry and retail sectors, including pharma and cosmetics, have significantly benefited from these advanced automated warehousing facilities.

- Hardware manufacturers provide various pick-to-light modules to cater to diverse warehouse requirements. Post-sale services and support are essential to ensure the smooth functioning of these systems. The industrial revolution and the online shopping trend have further fueled the demand for pick-to-light systems in various industries.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Armstrong

- Bossard Holding AG

- Brilliant Info Systems Pvt. Ltd.

- Conveyco

- Cornerstone Automation Systems LLC

- Daifuku Co. Ltd.

- Deltalogic Technologies Pvt. Ltd.

- Dematic Group

- Direct ConneX LLC

- Honeywell International Inc.

- Interlake Mecalux Inc.

- Ioi System Co. Ltd.

- Kardex Holding AG

- Matthews International Corp.

- microSYST Systemelectronic GmbH

- MMCI Automation

- Murata Machinery Ltd.

- Numina Group Inc.

- Pick To Light Systems S.L.

- SSI Schafer IT Solutions GmbH

- Toyota Motor Corp.

- Voodoo Robotics

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Pick-To-Light systems have revolutionized warehouse operations by integrating advanced technologies such as IoT sensors, cloud computing, and artificial intelligence. These systems use user-friendly displays and energy-efficient light sources to guide workers through the warehouse, improving connectivity and enhancing the overall efficiency of logistics systems. With the rise of e-commerce sales and online shopping, the demand for pick-and-pack systems has risen. Customer preferences and online reviews play a significant role in marketing campaigns, driving brand visibility and productivity. Pick-To-Light systems offer modular nature and cloud-based platforms, making them easily adaptable to various market segments. Ergonomics and workplace safety are essential considerations, with free-standing plates and voice assistant integration ensuring a comfortable and productive work environment.

Furthermore, power source is a crucial factor, with many systems offering battery-operated or plug-in options. Warehouse operations in various industries have benefited from these advanced technologies, leading to increased order accuracy, labor productivity, and order processing. Newsletters and market segmentation are essential components of the market engineering process, with data triangulation procedures and statistics used to analyze market trends and profiles of primaries. The bottom-up procedure and product concept are also integral to the development and growth of the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

154 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.09% |

|

Market growth 2024-2028 |

USD 390.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.49 |

|

Key countries |

China, US, Germany, South Korea, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch