Pipe Coating Market Size 2024-2028

The pipe coating market size is forecast to increase by USD 2.22 billion at a CAGR of 5.09% between 2023 and 2028.

- The market is experiencing significant growth, driven by the innovation of mobile coating technologies and the increasing popularity of water-based pipe coating solutions. These advancements address the need for cost-effective, efficient, and environmentally friendly alternatives to traditional pipe coating methods. Additionally, the oversupply of crude oil and the subsequent reduction in demand for new rigs have created a surplus of pipe production, increasing competition and driving down prices. This market analysis report delves into these trends and the challenges they present for the market participants in North America. The report also explores potential opportunities and strategies for companies to navigate this dynamic market landscape.

What will be the Size of the Market During the Forecast Period?

- The market is a significant segment of the industrial coatings industry, playing a crucial role in ensuring the durability, integrity, and longevity of pipelines. This market encompasses a wide range of products, including abrasion-resistant overlays (AROs), corrosion inhibitors, sustainable coatings, and eco-friendly coatings, among others. Abrasion-resistant overlays (AROs) and erosion-resistant coatings are essential for pipeline design and construction, as they protect against the damaging effects of external forces. These coatings are particularly important in harsh environments, such as those found in marine and industrial applications. Sustainable coatings and corrosion inhibitors are gaining increasing attention in the market due to their environmental benefits.

- These coatings not only provide excellent corrosion mitigation but also contribute to infrastructure protection and pipeline integrity management. Pipeline engineering and pipeline maintenance are critical aspects of the market. Coating application methods, such as liquid coatings, powder coatings, and high-velocity oxy fuel (HVOF), are continually evolving to improve coating performance and durability. Surface preparation plays a vital role in the success of any coating application. Proper surface preparation ensures optimal coating adhesion and longevity. Coating inspection and maintenance are also essential to ensure pipeline performance and safety. Cathodic protection and sacrificial anodes are often used in conjunction with pipe coatings to provide additional corrosion mitigation.

How is this market segmented and which is the largest segment?

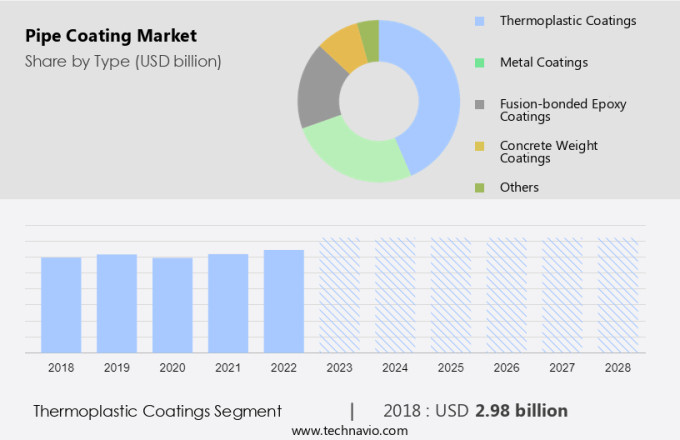

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Thermoplastic coatings

- Metal coatings

- Fusion-bonded epoxy coatings

- Concrete weight coatings

- Others

- Application

- Oil and gas

- Industrial and chemical processing

- Municipal water supply

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Middle East and Africa

- South America

- North America

By Type Insights

- The thermoplastic coatings segment is estimated to witness significant growth during the forecast period.

In the realm of pipe coating, thermoplastic options such as polyvinyl chloride (PVC), polypropylene (PP), and polyethylene (PE) have gained significant traction due to their effectiveness in providing corrosion protection. These coatings are primarily used for pipes employed in various sectors including mining, drainage, and water treatment. Compared to epoxy, polyester, and vinyl ester-based pipes, thermoplastic pipes offer several advantages, such as being lightweight, cost-effective, and more durable. These pipes are extensively utilized in applications like irrigation, construction, mining, sewage, and chemical processing. Their eco-friendliness is another significant advantage, as they can be effortlessly recycled for reuse. Among the various thermoplastic coatings, polyethylene (PE) stands out for its corrosion resistance.

This type of coating is commonly used for the supply of cold water in both external and internal plumbing systems. The pipeline industry in countries like the United States, Germany, Canada, and France is subject to stringent regulations and policies. The increasing emphasis on eco-friendly alternatives is expected to fuel the demand for pipes with thermoplastic coatings in these markets. Other applications, such as shale gas development and exploration and production, also rely on these coatings for their durability and resistance to corrosion. Concrete and zinc-plated coatings are also used in specific applications, but thermoplastic coatings offer superior advantages in terms of longevity and ease of application.

Get a glance at the market report of share of various segments Request Free Sample

The thermoplastic coatings segment was valued at USD 2.98 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

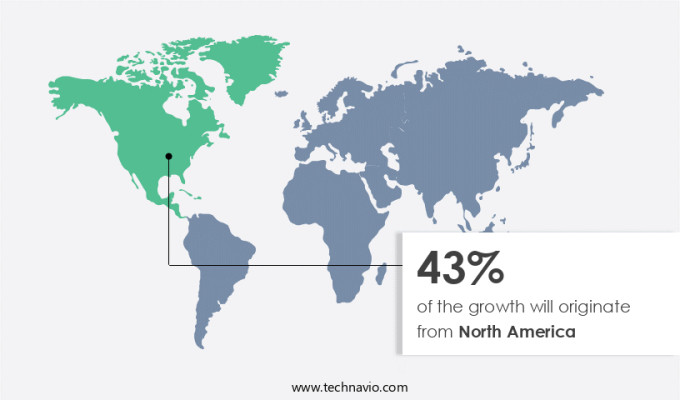

- North America is estimated to contribute 43% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In 2023, North America held a substantial portion of The market. The US, in particular, has witnessed significant growth in its oil and gas industry due to advancements in technologies such as hydraulic fracturing and horizontal drilling. These techniques have allowed the US to extract large quantities of oil and gas from unconventional sources, including shale formations. The US has over 117,000 fracking wells across more than 20 states, making it a major contributor to global oil and gas production. In 2022, the US exported a record-breaking 6.90 trillion cubic feet (Tcf) of natural gas. To ensure the longevity and efficiency of these oil and gas infrastructure projects, the use of pipe coatings is essential.

Cold conditions and harsh environments necessitate the application of specialized coatings, such as those made from rock shield materials, to protect against corrosion. Mechanical bedding and padding, as well as portable coating technology, are also utilized for external coatings to provide extra-thick protection. Sand bedding and sand bedding & padding are common techniques used for enhancing the bonding of coatings to pipes. As the US continues to invest in infrastructure development, the demand for pipe coatings is expected to grow. Technological advancements, such as innovative anti-corrosion coatings, will play a crucial role in maintaining the structural integrity of pipelines and other oil and gas infrastructure. The market in North America is poised for continued growth as the region's oil and gas industry remains a significant contributor to the global energy landscape.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Pipe Coating Market?

Innovation of mobile coating technologies is the key driver of the market.

- The market encompasses various types of coatings used to protect pipes in water and wastewater treatment, exploration and production, and infrastructure development. These coatings include 3LPP and 3LPE coatings, metallic coatings such as Hardide and FBE, abrasion-resistant coatings like PU and PP, and thermoplastic polymer coatings such as PE and PVC. The demand for pipe coatings is driven by the need for corrosion protection in pipelines, particularly in unfavorable terrain, rocky soil, and harsh weather conditions. The oil & gas industry, including shale gas development, is a significant market for pipe coatings due to the corrosive nature of hydrocarbons and the need for chemical resistance and flow efficiency.

- Municipal water supply and sewer lines also require pipe coatings for corrosion protection. Coating technologies, including powder and fusion-bonded epoxy, play a crucial role in providing protection against abrasive materials and external damage. Infrastructure spending, including infrastructure development for roads and construction pipes, is another growing market for pipe coatings. The use of non-solvent coatings and extra-thick anti-corrosion coatings in remote areas and steep slopes is also increasing. The market for pipe coatings is expected to grow due to the increasing demand for pipeline integrity and the need for cost-effective solutions for pipeline corrosion protection. The market for pipe coatings is expected to grow significantly due to the increasing demand for pipeline integrity and the need for cost-effective solutions for pipeline corrosion protection.

- Mobile coating technology, which allows for onsite application of coatings, is gaining popularity due to its ability to optimize logistics and reduce transportation and handling damage. The equipment of the mobile concrete coating plant can be loaded in 8-12 standard 6m (meter) containers, and the mobile coating plant can start operating within two weeks of onsite arrival. This technology is particularly useful in oil and gas fields, rail sites, trucking routes, and marine waterways, where pipelines are often located in challenging environments. The use of VOC regulations and the need for eco-friendly coatings are also driving innovation in the market.

What are the market trends shaping the Pipe Coating Market?

The increasing popularity of water-based pipe coating is the upcoming trend in the market.

- The market encompasses various types of coatings used to protect and enhance the performance of pipelines in water and wastewater treatment, exploration and production, and infrastructure development. These coatings include 3LPP coatings, metallic coatings such as Hardide and FBE, PU and PP coatings, and thermoplastic polymer coatings like PE and polyolefin. The market is driven by the need for corrosion protection in pipelines, particularly in unfavorable terrain and weather conditions, as well as the requirement for chemical resistance and flow efficiency in chemical processing. Pipe coatings are also used in potable water facilities, sewer lines, and construction pipes to ensure infrastructure integrity.

- Environmentally-friendly coatings, such as waterborne and high solids, are increasingly popular due to their reduced carbon footprint and improved application efficiency. Coating services are in demand for pipeline corrosion protection, with external coatings applied to prevent abrasion and shield against external factors like rocky soil, rivers, and harsh weather. The use of coated carbon steel instead of stainless steel can decrease total carbon dioxide emissions by 30%. Coating-enabled energy savings, such as lightweight substrates, heat dissipation, drag reduction, and heat reflection, are expected to drive market growth. Key applications include oil & gas, shale gas development, mining, and municipal water supply.

- VOC regulations have led to the adoption of non-solvent coatings and powder coatings, such as zinc-plated and hot-dip galvanized, in place of cadmium and solvent-based coatings. The market is expected to grow due to infrastructure spending, particularly in remote areas with steep slopes and challenging terrain. Extra-thick anti-corrosion coatings are also in demand for pipelines in harsh environments.

What challenges does Pipe Coating Market face during the growth?

Oversupply of crude oil and reduction in demand for new rigs is a key challenge affecting the market growth.

- The market in the US has been significantly impacted by the oil and gas industry, particularly in the context of water and wastewater treatment, exploration and production, and infrastructure development. With the rise of unconventional reserves such as shale gas and the use of horizontal drilling and fracking techniques, there has been an increase in the production of crude oil. However, this oversupply has led to a decrease in demand for new rigs, resulting in fewer pipes required for transporting heavy liquids. External factors, such as unfavorable weather conditions, steep slopes, and rocky soil, further challenge the market. In addition, the need for corrosion protection in pipelines, particularly in harsh chemical processing environments, drives the demand for coatings.

- Various types of coatings are used, including 3LPP coatings, metallic coatings, FBE coatings, and thermoplastic polymer coatings, among others. These coatings offer benefits such as chemical resistance, flow efficiency, and improved pipeline integrity. The infrastructure spending in the US, including municipal water supply and sewer lines, also contributes to the market. Coating services are essential for ensuring the longevity of pipelines and preventing corrosion. VOC regulations have led to the adoption of non-solvent coatings and powder coatings, which have gained popularity due to their environmental benefits. Moreover, the mining industry and agricultural sector also utilize pipe coatings for corrosion protection and abrasion resistance.

- The terrain and infrastructure development, including roads and construction, also require pipe coatings for mechanical bedding and padding, sand bedding, and external coatings. In conclusion, the market in the US is driven by various industries and applications, including water and wastewater treatment, oil and gas, and infrastructure development. The demand for corrosion protection, chemical resistance, and flow efficiency are key factors driving the market. External factors, such as unfavorable weather conditions and terrain, also impact the market. The adoption of non-solvent coatings and powder coatings, along with the development of extra-thick anti-corrosion coatings, will continue to shape the market in the future.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Aegion Corp

- Akzo Nobel NV

- Arabian Pipe Coating Co.

- Arkema Group

- Axalta Coating Systems Ltd.

- BASF SE

- Celanese Corp.

- Covestro AG

- Dow Chemical Co.

- Hempel AS

- Jotun AS

- LyondellBasell Industries N.V.

- PPG Industries Inc.

- Tenaris SA

- The Sherwin Williams Co.

- A.W. Chesterton Co.

- Perma Pipe International Holdings Inc.

- Wasco Berhad

- LB Foster Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for corrosion protection in various industries, particularly water & wastewater treatment and exploration and production. The use of pipe coatings in these sectors is essential to ensure the longevity and integrity of pipelines, which transport liquids such as water, hydrocarbons, and chemicals. Corrosion is a major concern in pipelines, especially in unfavorable terrain, external coatings are crucial to prevent damage caused by abrasion, chemical processing, and exposure to unfavorable weather conditions. The market caters to various industries, including oil & gas, mining, and construction, among others. Three-layer polypropylene (3LPP) coatings, fusion-bonded epoxy, and hardide coatings are popular choices for pipeline corrosion protection. These coatings offer superior chemical resistance and flow efficiency, making them ideal for transporting liquids in harsh environments. Metallic coatings, such as zinc-plated and cadmium, are also used for corrosion protection, particularly in sewer lines and construction pipes. The demand for pipe coatings is driven by infrastructure development, especially in remote areas and steep slopes, where the terrain poses challenges for pipeline construction. Infrastructure spending in the oil & gas sector, particularly in shale gas development, is expected to fuel the growth of the market.

Moreover, the use of non-solvent coatings and portable coating technology has gained popularity due to their ease of application and lower VOC emissions. Thermoplastic polymer coatings, such as polyethylene and polyurethane, are widely used for pipeline corrosion protection due to their excellent chemical resistance and mechanical bedding properties. Pipeline integrity is a critical concern in the oil & gas industry, and the use of extra-thick anti-corrosion coatings and sand bedding & padding is becoming increasingly common. In the water & wastewater treatment sector, the focus is on potable water facilities, where the use of epoxy pipe coatings is mandatory to ensure the safety and quality of drinking water. The market is expected to grow at a steady pace due to the increasing demand for corrosion protection in various industries. The market is also driven by regulatory requirements, particularly with regards to VOC emissions, which have led to the development of low-emission coatings. The use of pipe coatings is not limited to pipelines; they are also used in infrastructure development, such as roads and bridges, to ensure their durability and longevity. The market for pipe coatings is expected to remain competitive, with various players offering a range of coatings to cater to the diverse needs of different industries.

In conclusion, the market is a dynamic and growing industry, driven by the increasing demand for corrosion protection in various industries. The use of advanced coatings, such as 3LPP, fusion-bonded epoxy, and thermoplastic polymer coatings, is expected to continue to gain popularity due to their superior properties. The market is expected to remain competitive, with various players offering a range of coatings to cater to the diverse needs of different industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

188 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.09% |

|

Market growth 2024-2028 |

USD 2.22 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.52 |

|

Key countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch