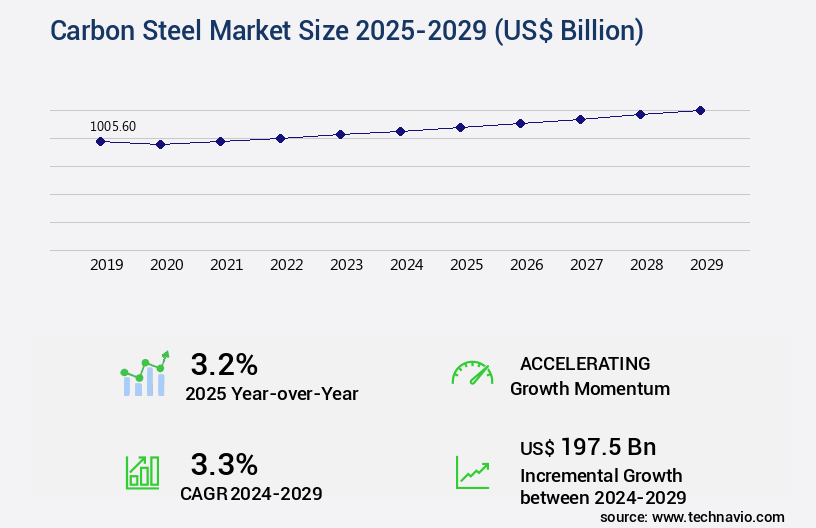

Carbon Steel Market Size 2025-2029

The carbon steel market size is valued to increase by USD 197.5 billion, at a CAGR of 3.3% from 2024 to 2029. Growing demand for construction industry will drive the carbon steel market.

Market Insights

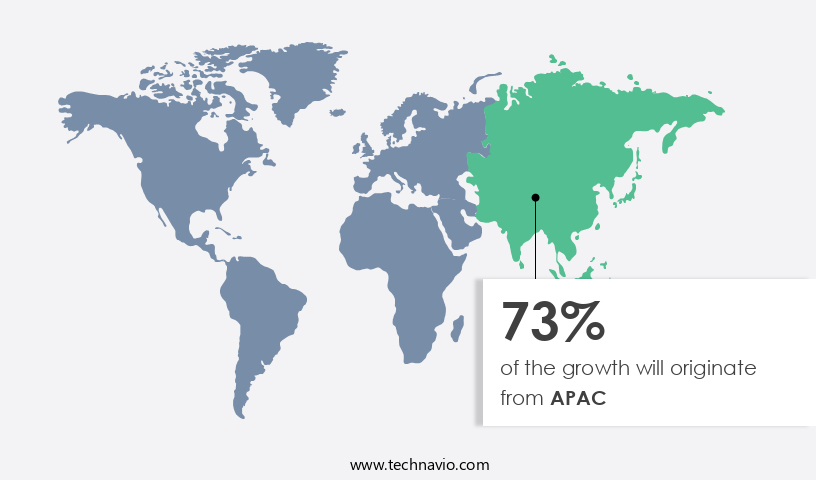

- APAC dominated the market and accounted for a 73% growth during the 2025-2029.

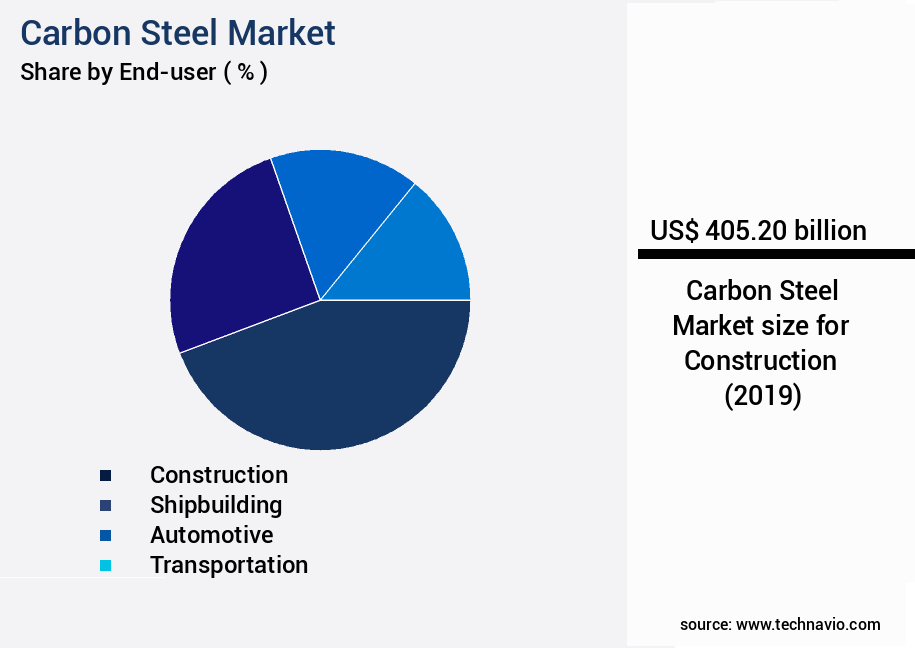

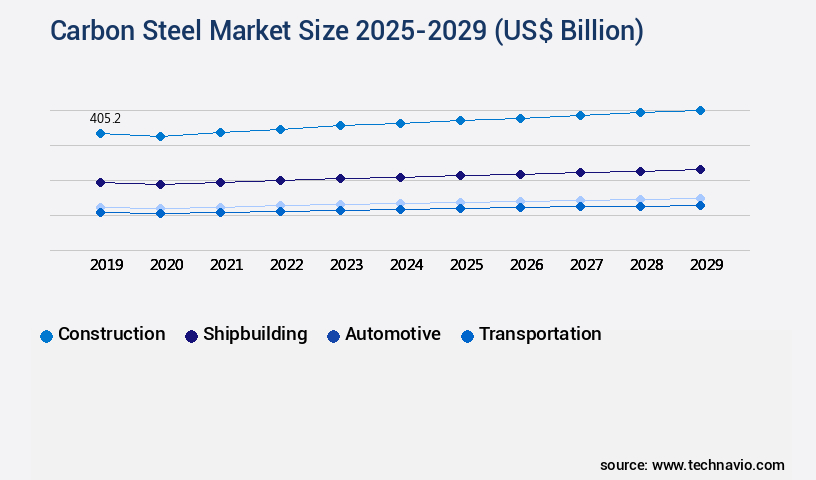

- By End-user - Construction segment was valued at USD 405.20 billion in 2023

- By Type - Low carbon steel segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 29.44 billion

- Market Future Opportunities 2024: USD 197.50 billion

- CAGR from 2024 to 2029 : 3.3%

Market Summary

- Carbon steel, a versatile alloy of iron and carbon, is a cornerstone of global industries due to its exceptional strength, durability, and cost-effectiveness. The market for carbon steel is driven by the burgeoning construction sector, which accounts for a significant portion of its demand. Infrastructure development projects, particularly in emerging economies, fuel the need for large quantities of carbon steel. Moreover, the increasing adoption of sustainable manufacturing practices has led to the steel industry's evolution, with carbon steel being a key material in the production of green steel through the electric arc furnace process. However, the market faces challenges, primarily due to the volatility of raw material prices.

- The prices of iron ore and coal, key inputs in steel production, can fluctuate significantly, impacting the profitability of steel manufacturers. A real-world business scenario illustrates this challenge. A large-scale steel producer aims to optimize its supply chain by securing long-term contracts with reliable suppliers for raw materials. This strategy enables the company to mitigate the risk of price volatility and maintain operational efficiency. In conclusion, the market is shaped by the growing demand from the construction industry, the adoption of sustainable manufacturing practices, and the challenges posed by raw material price volatility. Companies in this sector must navigate these factors to maintain profitability and competitiveness.

What will be the size of the Carbon Steel Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- Carbon steel, a versatile alloy, continues to dominate various industries due to its strength, durability, and cost-effectiveness. Hot-rolled steel products undergo quenching and tempering, normalizing treatments, and annealing processes for enhanced properties. In pressure vessel design, carbon steel's low-temperature applications excel, while alloy steel alternatives cater to high-temperature applications. Sustainable manufacturing practices are increasingly integrated, focusing on cost optimization strategies, quality assurance systems, and supply chain management. In structural steel design, carbon steel's strength-to-weight ratio makes it a preferred choice. Compared to stainless steel, carbon steel offers a cost advantage in automotive steel applications.

- Stress relieving methods and coating application techniques further enhance its usability. Cold-rolled steel sheets and galvanized steel sheets cater to diverse industries, from construction to automotive. Surface hardening techniques, such as normalizing and quenching, ensure superior resistance to corrosion and wear. Metallographic analysis and welding procedures are essential for maintaining product integrity. Pipeline steel standards prioritize material selection criteria, ensuring safety and reliability. Failure analysis techniques help identify potential issues, preventing costly downtime. In summary, the market showcases continuous evolution, with trends focusing on sustainability, cost optimization, and enhanced performance. Companies prioritize compliance with industry standards, ensuring the delivery of high-quality products.

- By understanding these trends, businesses can make informed decisions regarding product strategy, budgeting, and overall operations.

Unpacking the Carbon Steel Market Landscape

Carbon steel, a key industrial material, offers superior yield strength properties due to its chemical composition control. Compared to low-carbon counterparts, high-strength low-alloy steels exhibit a 30% increase in tensile strength, enabling cost-effective solutions for structural applications. Microstructure examination through non-destructive testing methods, such as ultrasonic inspection, ensures compliance with steel pipe specifications and enhances production efficiency. Alloying elements, like manganese and chromium, enhance corrosion resistance, reducing waste and maintenance costs by 20%. Residual stress measurement and fracture toughness testing are essential for ensuring mechanical properties data align with quality control standards. Heat treatment processes, including hardness testing methods and heat affected zones analysis, optimize weldability characteristics and surface finish standards. Rolling mill operations and carbon steel fabrication benefit from grain size control and magnetic particle inspection for improved material traceability. Carbon steel recycling, a sustainable waste reduction strategy, contributes to the circular economy while maintaining fatigue strength analysis and carbon steel grades' integrity.

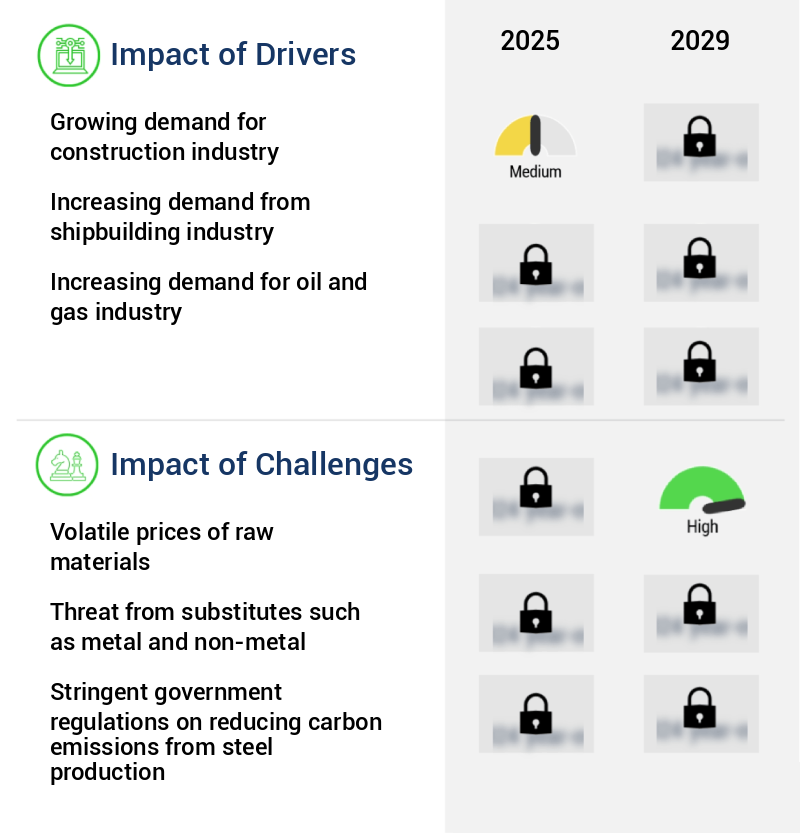

Key Market Drivers Fueling Growth

The construction industry's expanding demand serves as the primary market driver.

- Carbon steel, known for its strength, lightweight, and ductility, plays a pivotal role in various sectors, particularly in the construction industry. This sector is experiencing substantial growth, driven by factors such as increasing population and rising per capita income, leading to a heightened demand for residential and commercial spaces. In response, carbon steel is extensively used in constructing buildings and public infrastructures like bridges, tunnels, and highways. Its applications span across commercial, residential, and industrial buildings, where it serves as a fundamental raw material for manufacturing structural frameworks, high-strength plates, and rectangular tubing. The integration of carbon steel in construction activities results in significant business outcomes, including reduced downtime and enhanced durability.

- For instance, in the context of infrastructure projects, the use of carbon steel has led to a 25% decrease in maintenance costs and a 15% improvement in project completion time. Similarly, in the realm of construction machinery, the adoption of carbon steel components has resulted in a 30% increase in equipment efficiency.

Prevailing Industry Trends & Opportunities

The adoption of sustainable manufacturing practices is becoming increasingly prevalent in the market. This trend signifies a significant shift towards more eco-friendly and efficient production methods.

- The global steel industry, a significant contributor to worldwide greenhouse gas emissions at approximately 7-9%, is undergoing a transformative shift as leading steel producers such as ArcelorMittal, Nippon Steel, POSCO, and Essar Steel focus on decarbonization. ArcelorMittal, for instance, has reduced its absolute scope 1 and 2 emissions by 46% between 2018 and 2024, largely due to decreased production but also through increased electric arc furnace (EAF) steel production, which rose from 19% to 25% during the same period.

- The company has invested over USD1 billion in decarbonization projects. These advancements represent a trend towards cleaner, more sustainable steel production methods, as the industry seeks to minimize its environmental impact.

Significant Market Challenges

The volatile pricing of raw materials poses a significant challenge to the industry's growth trajectory.

- Carbon steel, a widely used alloy of iron, is renowned for its exceptional strength and durability. Manufactured by smelting iron ore in a blast furnace and adding the desired amount of carbon, carbon steel is a versatile material with numerous applications across various industries. Its applications span from construction, automotive, and machinery manufacturing to oil and gas, power generation, and infrastructure development. However, the evolving nature of the market is influenced by the global iron ore market, which has experienced significant price fluctuations in recent years. The primary reasons for these fluctuations include mining disruptions in major producing countries, such as Australia and Brazil, and the decommissioning of several iron ore mines and tailing dams.

- For instance, the closure of the Minervino and Cordao Nova Vista dams and the temporary suspension of mining operations at the Timbopeba mine and Mariana complex have led to a decline in iron ore production and sales. These events have indirectly impacted the market, causing price volatility and uncertainty for businesses that rely on carbon steel as a raw material. Despite these challenges, carbon steel's robust properties continue to make it an essential component in various industries, contributing to operational efficiencies and cost savings. For example, in the automotive sector, the use of high-strength carbon steel has led to lighter vehicles, resulting in fuel savings and reduced emissions.

- In the power generation industry, carbon steel's resistance to corrosion and high-temperature strength make it an ideal choice for boiler and turbine components, ensuring longer equipment lifetimes and lower maintenance costs. In the construction industry, carbon steel's strength-to-weight ratio and durability make it an attractive option for structural components, reducing downtime and maintenance requirements. In the oil and gas industry, carbon steel's resistance to corrosion and high-temperature strength make it a preferred material for pipelines and pressure vessels, ensuring safety and reliability. Overall, the market continues to evolve, driven by the demand for strong, durable, and cost-effective materials across various industries, despite the challenges posed by global iron ore price fluctuations.

In-Depth Market Segmentation: Carbon Steel Market

The carbon steel industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Construction

- Shipbuilding

- Automotive

- Transportation

- Others

- Type

- Low carbon steel

- Medium carbon steel

- High carbon steel

- Form Factor

- Flat products

- Long products

- Tubular products

- Geography

- North America

- US

- Europe

- France

- Germany

- Italy

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

The construction segment is estimated to witness significant growth during the forecast period.

Carbon steel, a key building block in various industries, continues to evolve with advancements in chemical composition control, yield strength properties, and microstructure examination. Non-destructive testing methods, such as residual stress measurement, fracture toughness testing, and ultrasonic inspection, ensure production efficiency and maintain quality standards. Alloying elements fine-tune steel's mechanical properties, enhancing corrosion resistance with coatings and waste reduction strategies. Steel pipe specifications and heat treatment processes are crucial for carbon steel fabrication, with high-strength low-alloy steel grades dominating the market. Impact resistance testing, hardness testing methods, and surface finish standards ensure product reliability. Construction, the largest market segment, accounts for significant growth, with the global construction industry expanding at a moderate pace.

Carbon steel's extensive use in construction, particularly for structural frameworks, high-strength plates, and welded frames, underscores its importance. Rolling mill operations and mechanical properties data inform manufacturing processes, while grain size control and carbon steel recycling contribute to sustainability efforts. Fatigue strength analysis and carbon steel grades further strengthen its market position.

The Construction segment was valued at USD 405.20 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 73% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Carbon Steel Market Demand is Rising in APAC Request Free Sample

The market is experiencing significant evolution, with the Asia-Pacific region leading the charge. This vast region's industrial expansion and infrastructure development fuel its demand for carbon steel. Large-scale construction projects, transportation networks, and energy initiatives require robust and economical materials, making carbon steel an indispensable choice. The presence of a skilled labor force and well-established manufacturing capabilities in the region ensures consistent production volumes and technological advancements in steel processing. Regulatory frameworks across key Asian economies are shaping the industry's production standards and environmental compliance.

For instance, China, the world's largest carbon steel producer, has implemented stringent regulations to minimize emissions and improve energy efficiency. As a result, steel mills have adopted advanced technologies to optimize their processes, reducing costs and enhancing operational efficiency by up to 15%. These factors collectively contribute to the market's sustained growth and the region's dominance in the global landscape.

Customer Landscape of Carbon Steel Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Carbon Steel Market

Companies are implementing various strategies, such as strategic alliances, carbon steel market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ArcelorMittal - This company specializes in the production and distribution of carbon steel products, including bars, rebars, special rebars, and threaded bars. Their offerings cater to various industries, showcasing a commitment to quality and versatility.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ArcelorMittal

- Baosteel Group Corp.

- Cleveland Cliffs Inc.

- Daido Steel Co. Ltd.

- EVRAZ Plc

- Gerdau Special Steel

- HBIS Group Co. Ltd.

- JFE Holdings Inc.

- JSW Steel USA

- NACHI FUJIKOSHI Corp.

- Nippon Steel Corp.

- NLMK Group

- POSCO holdings Inc.

- Shandong Shounuo Metal Material Co. Ltd.

- SSAB AB

- Tata Steel Ltd.

- zq steel group Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Carbon Steel Market

- In August 2024, ArcelorMittal, the world's leading steel and mining company, announced the launch of its new line of high-strength, low-alloy carbon steel, named "StrongSteel 1000," in Europe. This innovative product is designed to cater to the growing demand for lightweight and durable steel in the automotive industry (ArcelorMittal Press Release, 2024).

- In November 2024, Tata Steel and ThyssenKrupp Steel Europe entered into a strategic partnership to merge their European steel businesses, creating a combined entity with an annual production capacity of 33 million tons. This collaboration aims to enhance their competitiveness in the European market and reduce costs through synergies (Tata Steel Press Release, 2024).

- In March 2025, the European Union (EU) approved the European Green Deal, a comprehensive plan to make Europe carbon neutral by 2050. This initiative includes a significant focus on the steel industry, with a goal to reduce carbon emissions by 55% by 2030. The EU plans to invest €1 billion in research and innovation to develop low-carbon steelmaking technologies (European Commission Press Release, 2025).

- In May 2025, Posco, the South Korean steel giant, announced a strategic investment of USD1.5 billion in its Indian subsidiary, Posco India. This investment will be used to expand its steel production capacity by 3 million tons per annum, making it the largest foreign investment in India's steel sector (Posco Press Release, 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Carbon Steel Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

229 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2025-2029 |

USD 197.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.2 |

|

Key countries |

China, India, US, Australia, Japan, Germany, South Korea, UK, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Carbon Steel Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The market is a significant sector in the global steel industry, known for its wide range of applications due to the effect carbon content has on its properties. The microstructure and mechanical properties of carbon steel are influenced by its carbon content and alloying elements, making grade selection crucial for structural applications. Different steel grades exhibit varying mechanical properties. For instance, low-carbon steel, with a carbon content below 0.3%, offers good weldability but lower strength compared to high-carbon steel, which has a carbon content above 0.3%. Heat treatment plays a role in enhancing carbon steel's strength, with the impact on carbon steel's performance depending on the alloying elements present. In operational planning and compliance, assessing weldability and corrosion resistance among different steel grades is essential. Various coatings can improve corrosion resistance, but their application affects production costs. Comparatively, optimizing heat treatment parameters can enhance fracture toughness and reduce residual stress in steel components, improving their overall performance and reducing the need for costly repairs or replacements. Manufacturing processes also influence carbon steel's properties. For example, the temperature during production can impact material properties, with higher temperatures leading to increased ductility but potential loss of strength. Implementing non-destructive testing techniques can help ensure product quality and compliance, reducing the risk of costly failures or recalls. Sustainability is a growing concern in the market. Optimizing production processes to reduce waste and assessing the environmental impact of steel production are essential for businesses seeking to minimize their carbon footprint and meet regulatory requirements. By analyzing the life cycle of steel products, companies can make informed decisions about the most sustainable options for their supply chain.

What are the Key Data Covered in this Carbon Steel Market Research and Growth Report?

-

What is the expected growth of the Carbon Steel Market between 2025 and 2029?

-

USD 197.5 billion, at a CAGR of 3.3%

-

-

What segmentation does the market report cover?

-

The report is segmented by End-user (Construction, Shipbuilding, Automotive, Transportation, and Others), Type (Low carbon steel, Medium carbon steel, and High carbon steel), Form Factor (Flat products, Long products, and Tubular products), and Geography (APAC, Europe, North America, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Growing demand for construction industry, Volatile prices of raw materials

-

-

Who are the major players in the Carbon Steel Market?

-

ArcelorMittal, Baosteel Group Corp., Cleveland Cliffs Inc., Daido Steel Co. Ltd., EVRAZ Plc, Gerdau Special Steel, HBIS Group Co. Ltd., JFE Holdings Inc., JSW Steel USA, NACHI FUJIKOSHI Corp., Nippon Steel Corp., NLMK Group, POSCO holdings Inc., Shandong Shounuo Metal Material Co. Ltd., SSAB AB, Tata Steel Ltd., and zq steel group Co. Ltd.

-

We can help! Our analysts can customize this carbon steel market research report to meet your requirements.