Pipe Insulation Market Size 2024-2028

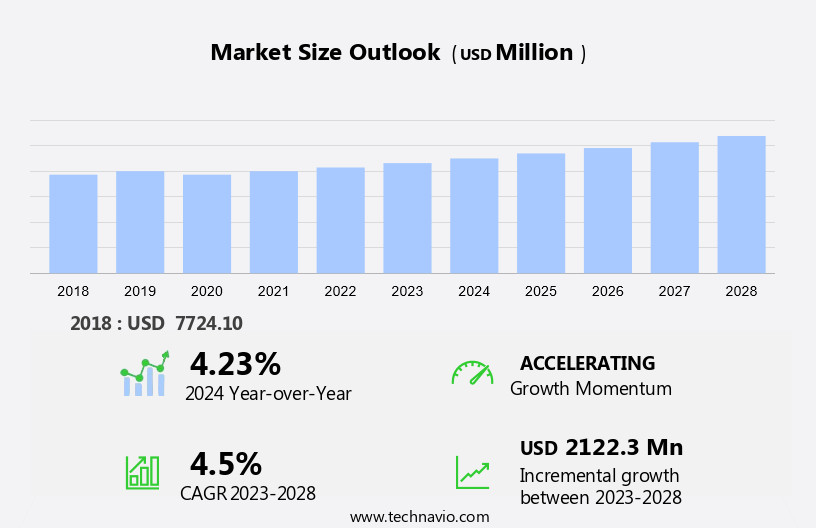

The pipe insulation market size is forecast to increase by USD 2.12 billion at a CAGR of 4.5% between 2023 and 2028.

What will be the Size of the Pipe Insulation Market During the Forecast Period?

How is this Pipe Insulation Industry segmented and which is the largest segment?

The pipe insulation industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Building and construction

- Industrial

- Transportation

- Oil and gas

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Application Insights

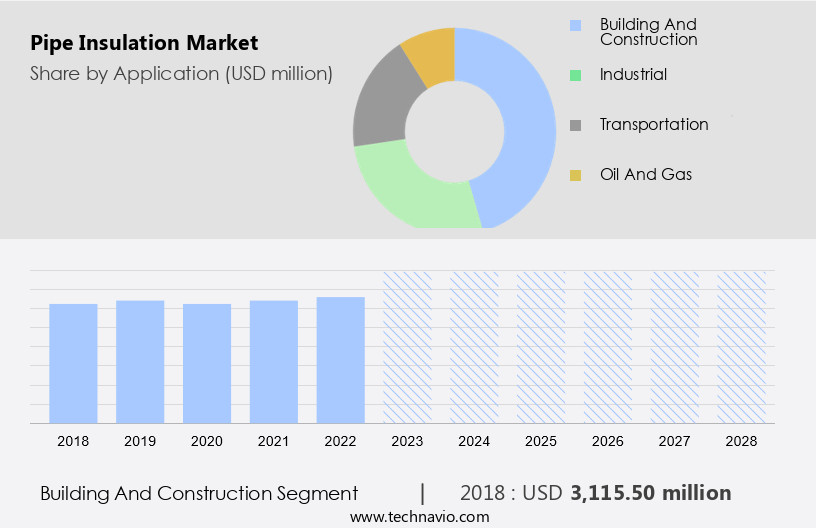

- The building and construction segment is estimated to witness significant growth during the forecast period.

The market is a significant component of the building and construction industry, with applications in various sectors including energy, power generation, oil and gas, chemical, wastewater treatment, and oil pipelines. Pipe insulation serves essential functions such as energy conservation, reducing heat transfer, and minimizing sound pressure. The market is driven by factors like urbanization, increasing awareness of energy efficiency and environmental sustainability, and the expansion of district heating systems and electricity grids. Key raw materials for pipe insulation include cellular glass, fiberglass, elastomeric foam insulation, and polyurethane and polyisocyanurate foams. The production processes involve the use of raw materials like methylene diphenyl diisocyanate, polyols, and fibers.

The market is influenced by economic conditions, crude oil prices, and fiscal resources of oil-producing countries. Reliable suppliers and well-established players with a strong financial base and diverse product portfolios dominate the market. Pipe insulation systems are available in various types, including foam, rubber, mineral wool, prefabricated insulation, rigid board insulation, flexible insulation, and loose fill insulation. The market is also witnessing the adoption of eco-friendly materials and innovative insulation technologies.

Get a glance at the Pipe Insulation Industry report of share of various segments Request Free Sample

The Building and construction segment was valued at USD 3.12 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

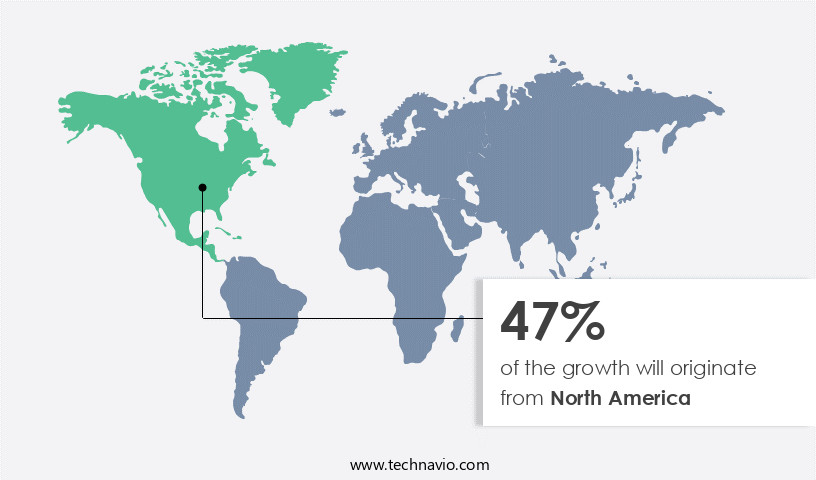

- North America is estimated to contribute 47% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market In the US is experiencing notable growth due to increasing energy consumption in various sectors, particularly in buildings and construction. According to the US Energy Information Administration (USEIA), the construction sector accounts for approximately 20% of global energy usage, with energy consumption projected to rise by 1.4% annually between 2012 and 2040. Space heating is the largest energy consumer in buildings, accounting for over two-thirds of total energy use. To mitigate heat losses and reduce energy consumption, pipe insulation is essential in various applications, including district heating systems, HVAC, and oil pipelines. The market is driven by factors such as urbanization, rising awareness of energy efficiency and environmental concerns, and economic conditions.

Key raw materials used in pipe insulation production include Liquefied Natural Gas (LNG), SunSirs Commodity, Thermacork, Polyurethane, polyisocyanurate foams, Methylene diphenyl diisocyanate, Polyols, and various fibers. Capacity additions, process pipes, and reliable suppliers are also significant market factors. Pipe insulation plays a crucial role in preventing corrosion under insulation, pipe leakage, and piping failure. Eco-friendly materials, such as cellular glass, fiberglass, and elastomeric foam insulation, are gaining popularity due to their low carbon footprint and reduced formaldehyde emissions. The market is served by well-established players with diverse product portfolios, including Insight Publishers, Vantage Market Research, and Juniper Research. The market's growth is influenced by factors such as energy conservation, greenhouse gas emissions, and economic conditions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Pipe Insulation Industry?

Growing demand for green buildings is the key driver of the market.

What are the market trends shaping the Pipe Insulation Industry?

Expansions of vendors is the upcoming market trend.

What challenges does the Pipe Insulation Industry face during its growth?

Volatile raw material prices is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The pipe insulation market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pipe insulation market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, pipe insulation market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Armacell International SA - The market encompasses a range of insulation solutions designed to maintain optimal temperature levels and energy efficiency in industrial and commercial applications. One notable offering in this sector is ArmaFlex, a pipe insulation product from a leading industry provider. ArmaFlex is a flexible, closed-cell, nitrogen-blown, polyethylene foam insulation that delivers excellent thermal performance and durability. Its unique design allows for easy installation around pipes of various shapes and sizes, making it a versatile choice for numerous industries. This insulation solution effectively minimizes heat loss and gains, contributing to overall energy savings and reduced greenhouse gas emissions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Armacell International SA

- BASF SE

- Compagnie de Saint Gobain

- Covestro AG

- Gilsulate International Inc.

- Huntsman Corp

- Johns Manville

- Kingfisher Plc

- Kingspan Group Plc

- Knauf Digital GmbH

- Lydall Inc.

- NMC International SA

- Omkar Puf Insulation Pvt. Ltd.

- Owens Corning

- Paramount Intercontinental

- ROCKWOOL International AS

- Sekisui Foam Australia

- The Supreme Industries Ltd.

- W.W. Grainger Inc.

- Yingsheng Energy Saving Group Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a broad spectrum of insulation solutions designed to maintain optimal temperature levels and prevent energy loss in various industrial and commercial applications. This market is driven by several key factors, including the increasing demand for energy efficiency and the need to reduce greenhouse gas emissions. One of the primary drivers of the market is the growing awareness of energy conservation and the importance of reducing energy consumption in various industries. This trend is particularly prominent In the building and construction sector, where energy-efficiency norms and sustainable building practices are becoming increasingly prevalent. In addition, the chemical processing industry, power generation, oil and gas, and wastewater treatment sectors also rely heavily on pipe insulation to improve energy efficiency and reduce operational costs.

Another significant factor driving the market is the rising demand for eco-friendly materials. As environmental concerns become a priority, there is a growing demand for insulation solutions made from renewable and sustainable materials. This trend is particularly prominent In the production of insulated piping systems, which are increasingly being made from eco-friendly materials such as cellular glass, fiberglass, and elastomeric foam insulation. The market is also influenced by climatic conditions. In colder regions, insulation is essential to prevent heat loss and maintain optimal temperatures. In warmer regions, insulation is used to prevent heat gain and maintain a consistent temperature.

The choice of insulation material depends on the specific application and climatic conditions. The production processes for pipe insulation involve the use of various raw materials, including polyurethane, polyisocyanurate foams, methylene diphenyl diisocyanate, and polyols. These materials are used to produce a range of insulation types, including foam, rubber, mineral wool, prefabricated insulation, rigid board insulation, flexible insulation, and loose fill insulation. Capacity additions In the oil and gas industry, particularly in oil pipelines, are expected to drive demand for pipe insulation. The need to prevent pipe leakage and piping failure, as well as to maintain reliable operation in harsh environments, is a significant factor driving the demand for insulation solutions.

Corrosion under insulation is a common issue In the pipe insulation industry, and insulation solutions that address this issue are in high demand. Carbon and low alloy steel pipes, as well as stainless-steel pipes, are commonly used in industrial applications and require effective insulation solutions to prevent corrosion. The market is highly competitive, with well-established players and small companies vying for market share. Reliable suppliers with a strong financial base and goodwill are preferred by customers, as insulation failures can result in significant downtime and financial losses. In conclusion, the market is driven by several key factors, including the growing demand for energy efficiency, the need for eco-friendly materials, and the importance of preventing pipe leakage and piping failure.

The market is highly competitive, with a range of insulation types and materials available to meet the specific needs of various industries and applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

143 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 2122.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, Germany, UK, Japan, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Pipe Insulation Market Research and Growth Report?

- CAGR of the Pipe Insulation industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the pipe insulation market growth of industry companies

We can help! Our analysts can customize this pipe insulation market research report to meet your requirements.