Planting Equipment Market Size 2024-2028

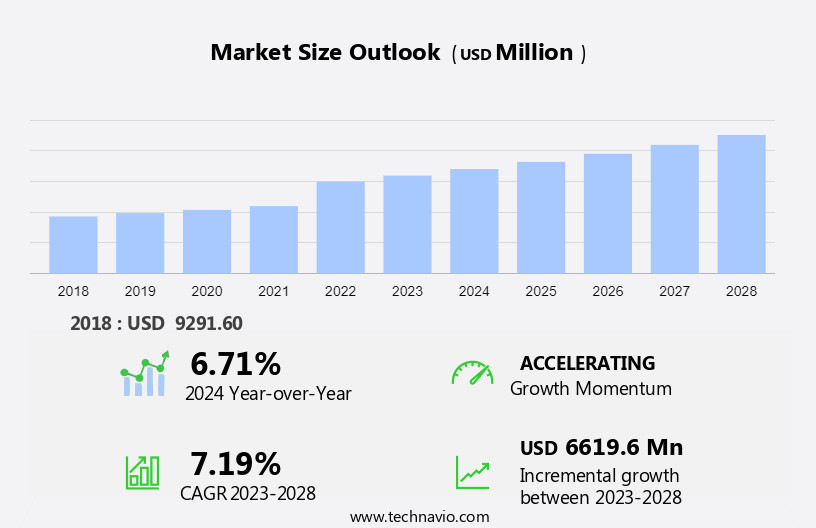

The planting equipment market size is forecast to increase by USD 6.62 billion at a CAGR of 7.19% between 2023 and 2028.

What will be the Size of the Planting Equipment Market during the Forecast Period?

How is this Planting Equipment Industry segmented and which is the largest segment?

The planting equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Mechanical

- Automatic

- Product

- Seed drills

- Planters

- Air seeders

- Geography

- APAC

- China

- North America

- US

- Europe

- France

- South America

- Brazil

- Middle East and Africa

- APAC

By Type Insights

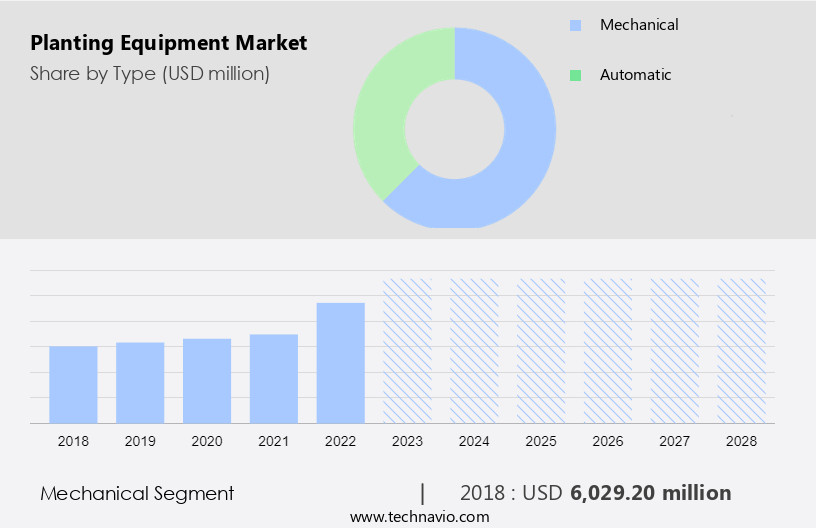

The mechanical segment is estimated to witness significant growth during the forecast period. The market is experiencing steady growth due to various factors. Government initiatives, such as favorable financing schemes for farmers investing in modern farm machinery, are driving market expansion. Additionally, the shift towards mechanized farming, particularly In the agriculture industry, is increasing the demand for advanced planting tools. These include seed drills, seed metres, fluted rollers, and furrow openers, which improve efficiency and ensure uniform seed distribution. Precision farming techniques, utilizing cutting-edge features like machining centres and robotic systems, are also gaining popularity. The market encompasses a wide range of machinery, including air seeders, seed drills, planters, and trans planters, catering to various cultivable lands, such as those used for oilseeds and pulses, fruits and vegetables, and other crops.

Despite the heavy investment required for these machines, the potential for improved machine performance and increased farming productivity is attracting farmers. However, the lack of finance remains a challenge for some farmers, limiting their ability to invest in mechanized planting equipment. Overall, the market is poised for growth, with technological advancements and government support providing significant opportunities.

Get a glance at the market report of various segments Request Free Sample

The Mechanical segment was valued at USD 6.03 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

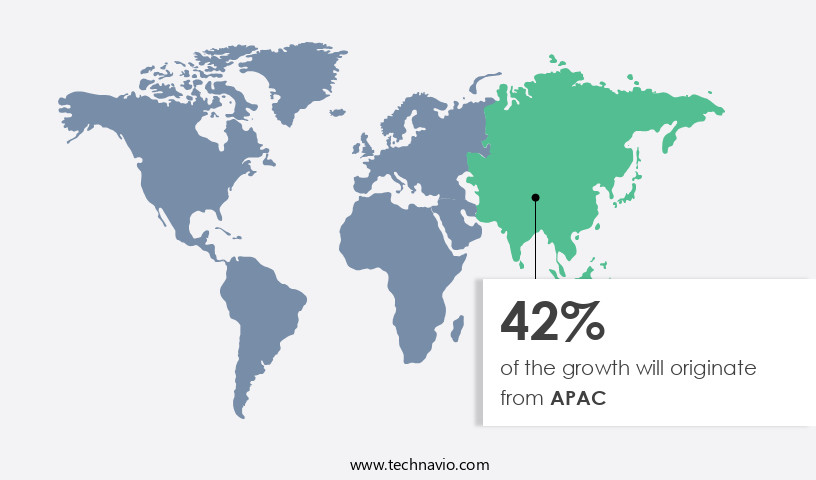

APAC is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in APAC is significant, with China, India, Japan, and Australia being key regions. Government initiatives promoting sustainable agricultural practices are driving market growth. For instance, the Indian government, in collaboration with international organizations, focuses on enhancing soil health, water management, irrigation, seed varieties, integrated pest management, credit financing, and farm mechanization. Various governments provide subsidies for farmers to procure farm and agricultural equipment, including planting equipment. In December 2023, India's Sub Mission on Agriculture Mechanization (SMAM) allocated approximately USD14 million for drone usage in agriculture. Modern planting techniques, such as seed drills, seed metres, fluted rollers, furrow openers, and air seeders, are essential for efficient farming tasks.

These cutting-edge planting tools enable uniform seed distribution, improved efficiency, and machine performance. In the agricultural and horticultural contexts, mechanical planting equipment is increasingly replacing manual sowing techniques for crops like oilseeds and pulses, fruits and vegetables, and cereals. Precision farming, a modern farming approach, integrates cutting-edge features for optimal crop yield and resource utilization.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of market?

Growing government support for agricultural practices globally is the key driver of the market.In the agriculture industry, modern farm machinery plays a significant role in enhancing planting techniques and increasing farming productivity. The market encompasses a range of equipment for planting, including seed drills, air seeders, planters, and broadcast seeders. These machines facilitate uniform seed distribution and improved efficiency In the sowing and planting process. Farmers in various agricultural contexts, such as those cultivating oilseeds and pulses, fruits and vegetables, or horticultural crops, rely on cutting-edge planting tools like seed drills with seed metres, fluted rollers, and furrow openers to optimize their farming tasks. Traditional methods like hand sowing have given way to mechanized farming equipment for enhanced machine performance and reduced physical labor.

Government initiatives, such as funding and loans for young farmers, contribute to the growth of the market. For instance, the European Union provides financial support to young farmers for up to five years after the start of their farming operations, encouraging the purchase and deployment of planting machinery. Similarly, the Canadian Agricultural Loans Act (CALA) Program offers agricultural loans to farmers to finance their farming activities, including the acquisition of planting equipment. In summary, the market plays a crucial role In the agricultural industry by providing farmers with advanced machinery for planting and optimizing their farming tasks. Government initiatives aimed at supporting young farmers contribute to the growth of this market by enabling farmers to invest in modern planting equipment.

What are the market trends shaping the Planting Equipment market?

Growing number of M and A activities is the upcoming market trend.The market is witnessing significant growth due to the increasing focus of companies on expanding their product offerings and geographic presence. In 2023, AGCO Corporation acquired an 85% stake in Trimble Inc. For USD2 billion to enhance its product line, while Plant and Equipment acquired Global Equipment Trading in UAE in 2024 to broaden its construction equipment offerings. These mergers and acquisitions enable companies to gain competitive advantages, increase market shares, and expand their customer base. The market is expected to grow at a steady pace during the forecast period, driven by the adoption of modern farm machinery and advanced planting techniques for various field crops.

Machines such as seed drills, air seeders, planters, and trans planters are increasingly being used for sowing seeds in designated rows, ensuring uniform seed distribution and improved efficiency. Additionally, the integration of cutting-edge features like mechanized farming equipment, precision farming, and robotic systems in planting machinery is further boosting market growth. The farming industry's shift towards mechanized farming and the need for improved machine performance are key factors driving the demand for planting equipment in agricultural and horticultural contexts.

What challenges does the market face during its growth?

Decreasing availability of agricultural land is a key challenge affecting the industry growth.The market plays a crucial role In the agriculture industry, providing modern farm machinery for planting techniques that ensure uniform seed distribution and improved efficiency. With the decline In the availability of cultivable land due to industrialization and urbanization, the demand for mechanized farming equipment has surged. Planting equipment, including seed drills, air seeders, and planters, facilitates the sowing of seeds in designated rows, preserving soil quality and reducing the need for physical labor. Cutting-edge planting tools, such as seed drills with advanced features like fluted rollers and furrow openers, enhance machine performance and precision farming in various agricultural and horticultural contexts.

Seed drills, seed metres, and other seeding machinery enable farmers to optimize their farming tasks and achieve better crop yields. Traditional methods like hand sowing and broadcast sowing have given way to mechanized methods, resulting in increased efficiency and uniform seed distribution. The farming industry relies heavily on planting machinery to maintain machine performance and address the challenges of soil degradation and erosion. Machines like machining centres and robotic systems are increasingly being adopted to streamline the sowing and planting process. The seeding process is a critical aspect of farming, and the use of precision farming techniques and cutting-edge features in planting equipment is essential to meet the growing demand for oilseeds and pulses, fruits and vegetables, and other crops.

Exclusive Customer Landscape

The planting equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the planting equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, planting equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AGCO Corp. - The market encompasses a range of machinery and technology utilized in agricultural processes for sowing seeds and cultivating crops. This sector experiences continuous advancements, driven by the increasing demand for efficient and productive farming solutions. Equipment offerings include planters, seed drills, and transplanters, among others. Market growth is influenced by factors such as agricultural expansion, technological innovations, and government initiatives promoting sustainable farming practices. Companies in this domain focus on providing integrated solutions that cater to diverse farming conditions and crop types, ensuring optimal crop yields and reduced operational costs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AGCO Corp.

- Bourgault Industries Ltd.

- Bucher Industries AG

- Buhler Industries Inc.

- CLAAS KGaA mBH

- Clean Seed Capital Group Ltd.

- CNH Industrial NV

- Deere and Co.

- Greaves Cotton Ltd.

- ISEKI and Co. Ltd.

- Kasco Manufacturing Inc.

- Kinze Manufacturing Inc.

- Kubota Corp.

- Mahindra and Mahindra Ltd.

- Morris Industries Ltd.

- Redlands Ashlyn Motors PLC

- SeedMaster

- Stara SA Industria De Implementos Agricolas

- Vaderstad AB

- Yanmar Holdings Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of machinery and tools designed to facilitate the sowing of seeds in cultivable land. This essential aspect of modern farm machinery plays a significant role In the agriculture industry, enabling farmers to plant designated rows with precision and uniformity. The seeding process is a critical farming task, as it sets the foundation for a successful crop yield. In the agricultural context, planting equipment refers to machines that employ cutting-edge features to optimize the sowing technique. These machines include seed drills, seed metres, and fluted rollers, among others. The conventional sowing technique involves human tool changes, which can be time-consuming and labor-intensive.

However, mechanized farming equipment has revolutionized the process, improving efficiency and machine performance. Heavy machinery, such as air seeders, seed drills, and planters, are integral components of modern planting equipment. These machines cater to various agricultural contexts, including the cultivation of oilseeds and pulses, fruits and vegetables, and other crops. Seed drills, for instance, are designed to drill seed into the soil, ensuring uniform distribution and optimal germination. Broadcast seeders, on the other hand, scatter seeds across the field, making them suitable for certain horticultural contexts. The transition from manual sowing techniques to mechanized planting has led to significant advancements In the agricultural industry.

Machines have replaced physical labor, reducing the need for extensive workforce and increasing productivity. Moreover, precision farming techniques have become increasingly popular, enabling farmers to optimize their crop yields by closely monitoring and managing various factors, such as soil conditions and seed placement. The market is continually evolving, with ongoing research and development leading to new innovations. Machines now feature advanced components, such as machining centres and robotic systems, which enhance their performance and capabilities. Despite these advancements, the lack of finance remains a challenge for many farmers, limiting their access to modern planting equipment and hindering their ability to adopt mechanized farming practices.

In conclusion, planting equipment plays a crucial role In the agriculture industry, enabling farmers to efficiently and effectively sow seeds and cultivate crops. The market for planting machinery is diverse, catering to various agricultural contexts and offering a range of cutting-edge features to optimize the sowing process. Continuous innovation and advancements in technology are driving the growth of the market, making it an essential sector for the agricultural industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.19% |

|

Market growth 2024-2028 |

USD 6619.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.71 |

|

Key countries |

US, China, Australia, France, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Planting Equipment Market Research and Growth Report?

- CAGR of the Planting Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the planting equipment market growth of industry companies

We can help! Our analysts can customize this planting equipment market research report to meet your requirements.