Plasma Therapeutics Market Size 2024-2028

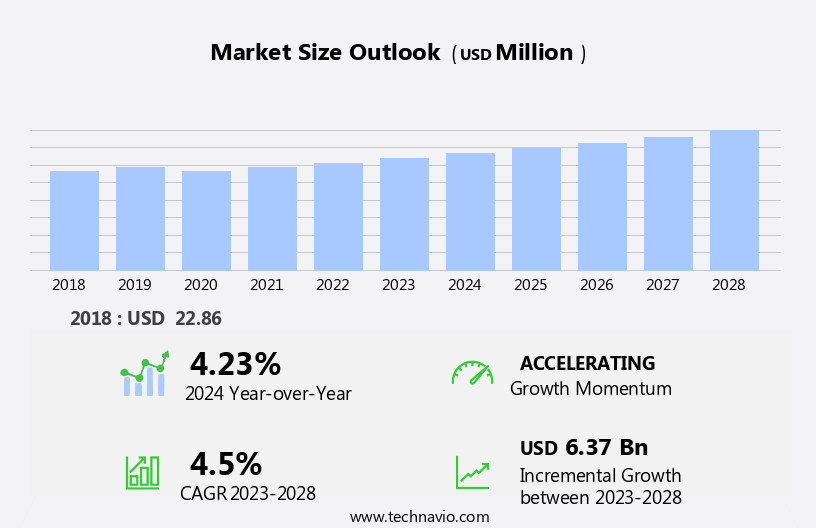

The plasma therapeutics market size is forecast to increase by USD 6.37 at a CAGR of 4.5% between 2023 and 2028.

What will be the Size of the Plasma Therapeutics Market During the Forecast Period?

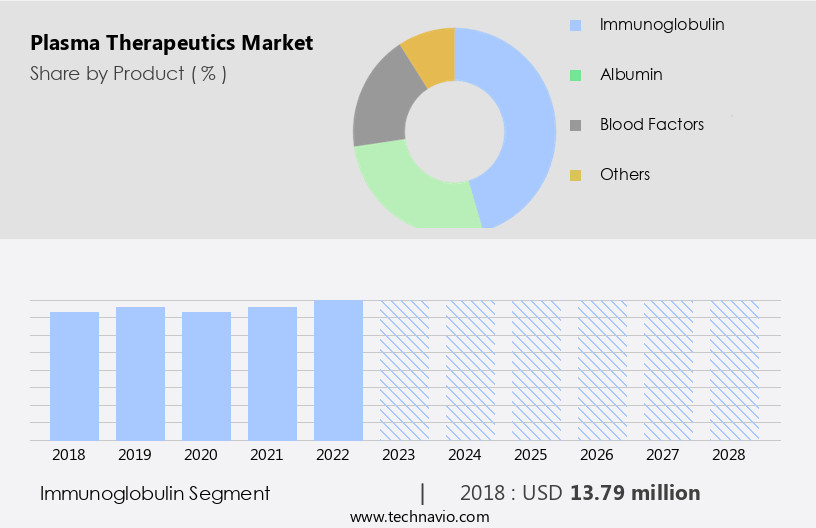

How is this Plasma Therapeutics Industry segmented and which is the largest segment?

The plasma therapeutics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Immunoglobulin

- Albumin

- Blood factors

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By Product Insights

- The immunoglobulin segment is estimated to witness significant growth during the forecast period.

Plasma therapeutics encompass various treatments derived from plasma, including water, platelets, white blood cells, red blood cells, plasma proteIn therapies, and enzymes. These therapies find applications in treating chronic diseases, life-threatening conditions, and rare genetic disorders. Plasma proteins such as immunoglobulins, salts, antibodies, and proteins are produced through advanced processing methods, including source plasma collection and therapeutic options like animal bites, autoimmune disorders, immune deficiencies, neurological disorders, bleeding disorders, shocks, burns, blood transfusion, and hospital settings. The market for plasma therapeutics is driven by the increasing prevalence of immune deficiency disorders, geriatric population, hereditary autoimmune diseases, and reimbursement policies. Key conditions addressed by these therapies include cardiovascular diseases, neurological diseases, Alpha 1 Antitrypsin Deficiency, Von Willebrand Disease, Antithrombin III Deficiency, cardiopulmonary disease, hepatitis, organ transplants, liver surgery, pediatric HIV, trauma, and various inherited bleeding disorders like Hemophilia A and Hemophilia B.

Novel therapeutics and source plasma continue to expand the therapeutic options. The market is segmented into immunoglobulin and biologics, with the immunoglobulin segment further divided into subcutaneous immunoglobulin and intravenous immunoglobulin. Key therapeutic areas include oncology, immunology, liver cirrhosis, hepatitis B, clotting factor VIII, and various coagulation factors. Fibrinogen, fibrogammin, C1 esterase inhibitors, and hyperimmune immunoglobulins are among the prominent products. Neuropathic pain, myasthenia gravis, post-polio syndrome, liver disease, malaria, sepsis, Alzheimer's disease, and subcutaneous immunoglobulin are some of the applications.

Get a glance at the Plasma Therapeutics Industry report of share of various segments Request Free Sample

The Immunoglobulin segment was valued at USD 13.79 in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

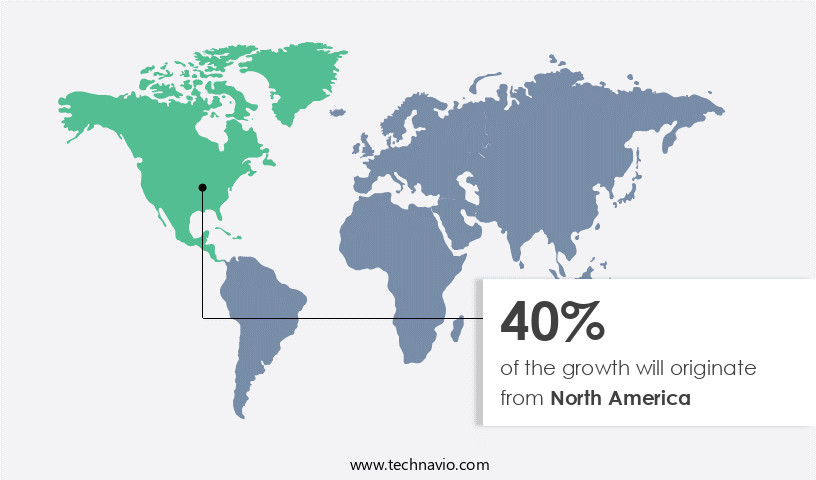

- North America is estimated to contribute 40% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is projected to expand at a steady rate due to the presence of a significant number of major players, including CSL Ltd., ADMA Biologics, Inc., and Pfizer Inc. The region's growth is driven by the increasing demand for plasma therapeutics in treating chronic diseases, life-threatening conditions, and rare diseases. In February 2021, the US Food and Drug Administration (FDA) approved PANZYGA, an immune globulin-based plasma therapy, for neurological disorders such as Chronic Inflammatory Demyelinating Polyneuropathy (CIDP). Similarly, in August 2021, the National Institute of Allergy and Infectious Diseases (NIAID) initiated a phase-3 clinical trial for immune globulin products from Emergent BioSolutions Inc.

Plasma therapeutics are used to treat various conditions, including autoimmune disorders, immune deficiencies, bleeding disorders, shocks, burns, and transfusion reactions. These therapies consist of water, platelets, white blood cells, red blood cells, plasma proteIn therapies, enzymes, salts, antibodies, and proteins. Production methods and processing techniques include source plasma, therapeutic options, and novel therapeutics. Plasma therapeutics are used to treat conditions such as cardiovascular diseases, neurological diseases, Alpha 1 Antitrypsin Deficiency, Von Willebrand Disease, Antithrombin III Deficiency, cardiopulmonary disease, hepatitis, organ transplants, liver surgery, pediatric HIV, trauma, and immunoglobulin segment. The market is segmented into immunoglobulin and biologics, with the immunoglobulin segment holding the largest market share.

Key conditions treated with immunoglobulin include hemostasis, coagulation factor deficiency, autoimmune disorders, cancer, fibrinogen, hemorrhagic diathesis, dysfibrinogenemia, afibrinogenemia, hypofibrinogenemia, albumin, and immunoglobulin. The geriatric population, hereditary autoimmune diseases, and reimbursement policies are among the significant risk factors influencing the market's growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Plasma Therapeutics Industry?

High demand for albumin in China is the key driver of the market.

What are the market trends shaping the Plasma Therapeutics Industry?

Establishment of plasma fractionation facilities in developing economies by global players is the upcoming market trend.

What challenges does the Plasma Therapeutics Industry face during its growth?

Existence of plasma fractionation supply and demand gap is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The plasma therapeutics market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the plasma therapeutics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, plasma therapeutics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ADMA Biologics Inc. - The market involves the production and supply of human immunoglobulin derived from donated human plasma. This protein solution is purified using a modified classical Cohn-Oncley fractionation process, ensuring high-quality and efficacy. The resulting immunoglobulin is utilized in various medical applications, including the prevention and treatment of immunodeficiencies and infectious diseases. The production process adheres to stringent regulations and quality standards, ensuring safety and reliability for healthcare providers and patients.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ADMA Biologics Inc.

- Bio Products Laboratory Ltd.

- BIOPHARMA PLASMA

- CSL Ltd.

- Emergent BioSolutions Inc.

- Evolve Biologics Inc.

- Grifols SA

- Kamada Ltd.

- Kedrion Spa

- Octapharma AG

- Pfizer Inc.

- Prothya Biosolutions Netherlands BV

- SK Inc.

- Takeda Pharmaceutical Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Plasma, a vital component of the human body, is a liquid part of blood that carries essential nutrients, proteins, and other elements. Plasma proteins, including antibodies, enzymes, and clotting factors, play a significant role in maintaining the body's immune response and hemostasis. Plasma therapeutics, derived from plasma, have emerged as effective treatments for various chronic diseases, life-threatening conditions, and rare genetic disorders. The market encompasses a wide range of applications, primarily focused on immune deficiency disorders, autoimmune disorders, neurological disorders, bleeding disorders, and shock conditions. Chronic diseases such as cardiovascular diseases, neurological diseases, and liver diseases are among the primary indications for plasma proteIn therapies.

Plasma proteIn therapies are increasingly being used to address the complex medical needs of the geriatric population, who are more susceptible to various chronic diseases due to aging. These therapies offer significant benefits, including improved patient outcomes, reduced hospital stays, and lower healthcare costs. Plasma proteIn therapies are produced using advanced production and processing methods, ensuring the highest quality and safety standards. These methods include source plasma collection, fractionation, purification, and formulation. The production process ensures the preservation of essential proteins, including immunoglobulins, clotting factors, and albumin. Plasma proteIn therapies have proven effective in addressing various medical conditions.

For instance, they are used to treat autoimmune disorders such as rheumatoid arthritis and myasthenia gravis, immune deficiency disorders like primary immunodeficiency diseases, and bleeding disorders such as hemophilia and von Willebrand disease. Plasma proteIn therapies are also used to manage shock conditions, including sepsis and trauma, and to prevent complications in organ transplants and liver surgery. Plasma proteIn therapies offer significant therapeutic benefits for patients with chronic diseases. For instance, they help manage neuropathic pain, improve hemostasis in coagulation factor deficiency, and provide immunoglobulin replacement therapy for patients with primary immunodeficiency diseases. Plasma proteIn therapies are also used to treat rare genetic disorders, such as alpha 1 antitrypsin deficiency and dysfibrinogenemia.

The plasma proteIn therapies market is segmented into various product segments, including immunoglobulins, clotting factors, and albumin. The immunoglobulin segment is further segmented into IgG, IgM, and IgA antibody agonists. The clotting factor segment includes factors VIII, IX, X, XI, and XIII. The albumin segment is used for volume replacement therapy and wound healing. Plasma proteIn therapies offer significant therapeutic benefits for various medical conditions. However, they come with certain risks, including allergic reactions, anaphylaxis, and transmission of infectious diseases. Reimbursement policies and risk factors associated with plasma proteIn therapies are critical considerations for healthcare providers and payers.

In conclusion, plasma proteIn therapies offer significant therapeutic benefits for various medical conditions, including immune deficiency disorders, autoimmune disorders, neurological disorders, bleeding disorders, and shock conditions. The plasma proteIn therapies market is expected to grow significantly due to the increasing prevalence of chronic diseases and the aging population. Advanced production and processing methods ensure the highest quality and safety standards, making plasma proteIn therapies an essential component of modern medicine.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 6.37 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, Germany, UK, Canada, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Plasma Therapeutics Market Research and Growth Report?

- CAGR of the Plasma Therapeutics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the plasma therapeutics market growth of industry companies

We can help! Our analysts can customize this plasma therapeutics market research report to meet your requirements.