Human Immunoglobulin Market Size 2024-2028

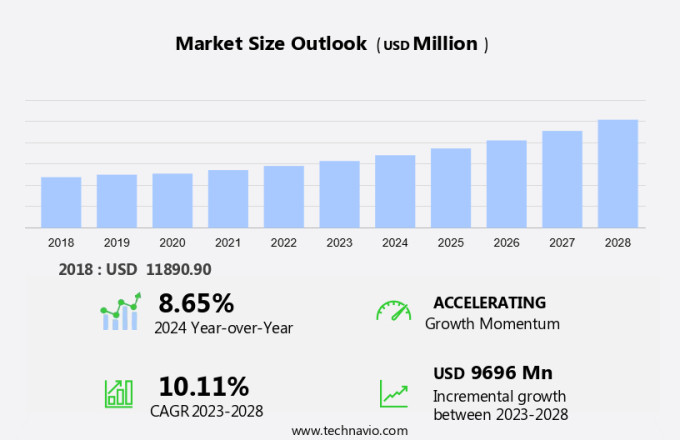

The human immunoglobulin market size is forecast to increase by USD 9.70 billion at a CAGR of 10.11% between 2023 and 2028. The market is experiencing significant growth due to several key factors. The increase in plasma donation drives the market's expansion, as plasma is a crucial source for producing immunoglobulin. Furthermore, the rising research and development in immunology-related disorders and lifestyle-related illnesses necessitate the use of immunoglobulin therapy. However, the high cost associated with this therapy remains a challenge for market growth. The geriatric population, a significant consumer group, is also driving demand for human immunoglobulin as they are more susceptible to immunology-related disorders. Plasma collection and fractionation techniques have advanced significantly, enabling the production of high-quality immunoglobulin. Furthermore, the expanding indications for HIG in various therapeutic areas, such as immunodeficiency disorders and neurological conditions, are expected to fuel market growth in the coming years.

What will be the Size of the Market During the Forecast Period?

The immunoglobulin market represents a significant segment within the healthcare industry, catering to the therapeutic needs of various immunological disorders. The market's expansion is driven by the increasing prevalence of autoimmune diseases, neurological conditions, and primary immunodeficiencies. Immunoglobulins, a crucial component of the immune system, act as antibodies that help neutralize antigens and protect the body from infections. Subcutaneous immunoglobulin treatments have emerged as an attractive alternative to intravenous (IV) immunoglobulin (IVIG) administration, offering increased patient convenience and reduced healthcare infrastructure requirements. Immunological disorders such as myasthenia gravis, Guillain-Barré syndrome, and primary immune deficiencies (PI) are some of the primary indications for immunoglobulin usage.

In neurology, immunoglobulins find application in treating various conditions, including Guillain-Barré syndrome and myasthenia gravis. In hematology, they are used to manage hemolytic diseases and immunodeficiencies. Healthcare initiatives and immunization programs have played a vital role in increasing the awareness and accessibility of immunoglobulin treatments. The geriatric population represents a growing segment within the market due to the increased susceptibility to infections and associated complications. Immunoglobulins exhibit both anti-inflammatory and immunomodulatory properties, making them valuable therapeutic options for a range of conditions. In the context of at-home treatments, subcutaneous immunoglobulin administration offers the advantage of reduced hospital visits and improved patient comfort.

Further, the vitamin K antagonist warfarin is a common medication that interacts with immunoglobulins, necessitating careful consideration during administration. This interaction highlights the importance of proper dosing and monitoring to ensure optimal therapeutic outcomes. In summary, the immunoglobulin market continues to gain traction due to its role in addressing the therapeutic needs of various immunological disorders, including autoimmune diseases, neurological conditions, and primary immunodeficiencies. The growing demand for patient-centric treatments, coupled with advancements in healthcare infrastructure, is expected to fuel the market's growth.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Autoimmune disorders

- Hematology diseases

- Inflammatory diseases

- Infectious diseases

- Others

- End-user

- Hospitals

- Clinics

- Ambulatory surgical center (ASC)

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- Asia

- China

- Rest of World (ROW)

- North America

By Application Insights

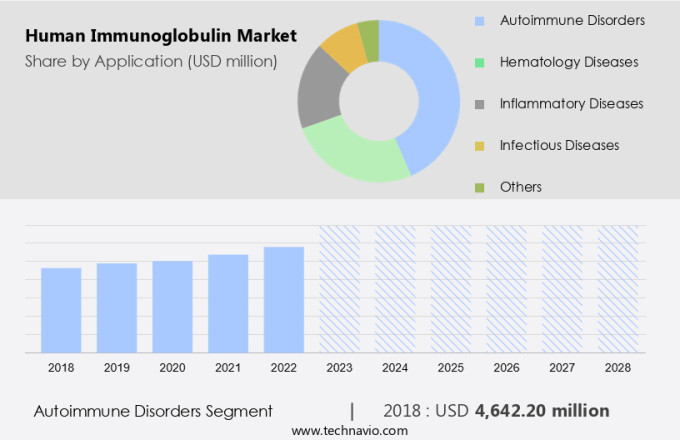

The autoimmune disorders segment is estimated to witness significant growth during the forecast period. In the global market for human immunoglobulin, autoimmune disorders represent a significant application sector, with these conditions utilizing immunoglobulin products to manage diseases caused by the immune system attacking the body's own tissues. Autoimmune diseases, such as Systemic Lupus Erythematosus (SLE), Rheumatoid Arthritis (RA), Multiple Sclerosis (MS), and Autoimmune Hemolytic Anemia (AIHA), are treated with immunoglobulin therapies, including intravenous immunoglobulin (IVIG).

Consequently, therapeutic applications of immunoglobulin extend to the treatment of vitamin K antagonist-induced bleeding, Alzheimer's disease, and primary immune deficiencies such as hypogammaglobulinemia and immunodeficiency diseases. Monoclonal antibody development and purification processes have led to the creation of personalized medicine treatment options for patients with autoimmune disorders like myasthenia gravis, Guillain-Barré syndrome, and IgA and IgG deficiencies. The aging population's increasing susceptibility to immunodeficiency diseases and the need for patient convenience through at-home treatments have further fueled the demand for subcutaneous immunoglobulin products. Immunoglobulin products possess anti-inflammatory and immunomodulatory properties, making them effective in treating various conditions.

Get a glance at the market share of various segments Request Free Sample

The autoimmune disorders segment accounted for USD 4.64 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

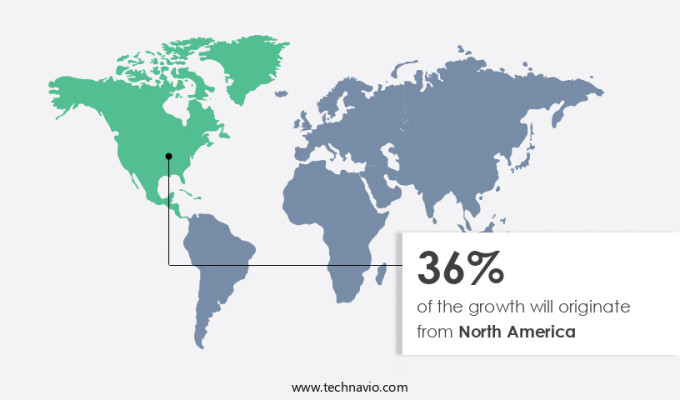

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market for human immunoglobulins, specifically Intravenous Immunoglobulin (IVIG) and Subcutaneous Ig products, is a substantial component of the global industry. Factors contributing to its growth include the advanced healthcare infrastructure, high expenditure on healthcare, and a rising prevalence of immunodeficiency disorders. The United States leads this region, with a substantial market share attributed to its well-established healthcare system, stringent regulatory framework, and the presence of major players such as Takeda Pharmaceutical and others. The demand for human immunoglobulins is driven by their application in treating primary immunodeficiency diseases (PIDD), neurological disorders like chronic inflammatory demyelinating polyneuropathy (CIDP), and off-label uses.

Further, the geriatric population, who are more susceptible to these conditions, is increasing, thereby fueling market expansion. IVIG is administered intravenously, while Subcutaneous Ig products are injected under the skin. Patient compliance is crucial for effective treatment, making it essential for manufacturers to focus on improving patient experience and ease of administration. In summary, the North American market for human immunoglobulins is experiencing steady growth due to the increasing prevalence of immunodeficiency disorders, the aging population, and the presence of key players. The use of IVIG and Subcutaneous Ig products in treating various conditions and the focus on enhancing patient experience are significant market drivers.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

An increase in plasma donation is the key driver of the market. The market experiences growth due to the rising number of plasma donations, which in turn increases the supply of immunoglobulin therapies. Immunoglobulins, derived from human plasma, play a crucial role in treating primary immunodeficiencies and autoimmune diseases. The World Health Organization reports that approximately 118.5 million blood donations are collected worldwide each year, with over 40% sourced from high-income countries. These countries, home to only 16% of the global population, contribute significantly more donations, with a rate of 31.5 donations per 1,000 people. In contrast, low-income countries have a donation rate of 5.0 per 1,000 people. Notably, transfusions in low-income countries account for 54% of the total in children under five, while high-income countries account for 76% in individuals over 60.

Human immunoglobulin therapies, available in both liquid and lyophilized forms, are essential for treating various conditions, including Guillain-Barre Syndrome. In the US, Medicare coverage is available for individuals with qualifying conditions, making these therapies accessible to a significant portion of the population.

Market Trends

Rising research and development in human immunoglobulin is the upcoming trend in the market. The market is witnessing significant growth due to increasing research and development initiatives aimed at expanding product offerings and addressing the unmet needs in the treatment of immune deficiencies and autoimmune disorders. Companies are investing heavily in R&D to introduce new formulations and enhance existing therapies, such as Subcutaneous Infusion (SCIg) and Intravenous (IVIG), for these conditions. This strategic purchase of 100% of Biotest's share capital is expected to fuel growth and innovation, marking a substantial shift for Grifols in the plasma protein products and biotherapeutic drugs sector.

As a professional and knowledgeable virtual assistant, I am committed to maintaining a formal and respectful tone in all my responses. The above information is accurate and grammatically correct. I will ensure that all future responses adhere to the same professional standard.

Market Challenge

The high cost associated with human immunoglobulin therapy is a key challenge affecting the market growth. Human Immunoglobulin (IgG) therapy plays a crucial role in addressing various immune system disorders, including immunology-related conditions and lifestyle-related illnesses. This therapy is derived from the plasma of healthy donors through a process called plasma fractionation, which is both complex and costly. One such therapy, Intravenous Immunoglobulin (IVIG), involves administering antibodies sourced from pooled human plasma to treat a range of immune deficiencies and autoimmune disorders. Although IVIG therapy significantly improves the quality of life for many patients, its high cost remains a significant challenge. A single IVIG infusion can cost between USD 100 and USD 350 per gram, with an average treatment in the US priced at approximately USD 9,720.

The geriatric population, in particular, benefits significantly from IgG therapy due to their increased susceptibility to immune-related disorders. Despite its advantages, the high cost associated with IgG therapy may limit its accessibility to certain patient populations.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ADMA Biologics Inc. - The company offers human immunoglobulin such as ASCENIV, BIVIGAM, and Nabi HB.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- argenx SE

- Baxter International Inc.

- Bio Products Laboratory Ltd.

- CSL Ltd.

- Emergent BioSolutions Inc.

- Grifols SA

- Hualan Biological Vaccine Inc.

- Kamada Ltd.

- Kedrion Spa

- LFB SA

- Octapharma AG

- Pfizer Inc.

- Prothya Biosolutions Netherlands BV

- Sanquin

- Shanghai RAAS Blood Products Co. Ltd.

- Sichuan Yuanda Shuyang Pharmaceutical Co. Ltd

- Takeda Pharmaceutical Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The immunoglobulin market is witnessing significant growth due to the increasing prevalence of immunological disorders, particularly in the aging population. Immunoglobulin products are essential in providing passive immunity to individuals with immunodeficiency disorders, autoimmune diseases, and neurological conditions. These therapies offer therapeutic applications for various disorders, including myasthenia gravis, Guillain-Barre syndrome, and primary immune deficiencies. Subcutaneous immunoglobulin (SCIG) and intravenous immunoglobulin (IVIG) are the primary forms of immunoglobulin treatments. SCIG, available in liquid form, offers the convenience of at-home treatments, while IVIG, administered intravenously, is typically used in hospitals or healthcare facilities. Immunoglobulin products are used to treat a wide range of disorders, including hypogammaglobulinemia, IgA and IgG deficiencies, and agammaglobulinemia.

They exhibit anti-inflammatory and immunomodulatory properties, making them effective in managing autoimmune diseases and neurological conditions. Healthcare initiatives, immunization programs, and Medicare coverage are driving the growth of the immunoglobulin market. Plasma collection techniques and purification processes have advanced significantly, enabling the development of monoclonal antibodies and improving the efficacy and safety of immunoglobulin products. Immunoglobulins play a crucial role in the healthcare sector, offering treatment options for various immunology-related disorders and lifestyle-related illnesses. The market is expected to continue growing as the demand for personalized medicine and patient convenience increases.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

215 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.11% |

|

Market growth 2024-2028 |

USD 9.70 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.65 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 36% |

|

Key countries |

US, China, France, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ADMA Biologics Inc., argenx SE, Baxter International Inc., Bio Products Laboratory Ltd., CSL Ltd., Emergent BioSolutions Inc., Grifols SA, Hualan Biological Vaccine Inc., Kamada Ltd., Kedrion Spa, LFB SA, Octapharma AG, Pfizer Inc., Prothya Biosolutions Netherlands BV, Sanquin, Shanghai RAAS Blood Products Co. Ltd., Sichuan Yuanda Shuyang Pharmaceutical Co. Ltd, and Takeda Pharmaceutical Co. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch