Plastic Decking Market Size 2025-2029

The plastic decking market size is forecast to increase by USD 1.77 billion, at a CAGR of 6.9% between 2024 and 2029.

- The market in the home renovation and construction sector is experiencing significant growth due to several key trends. Innovations in high-performance composite decking, made from resin and other materials, have gained popularity among consumers for their durability and low maintenance requirements. Additionally, the expansion of the e-commerce industry enables easy access to these products, making it more convenient for homeowners to purchase decking materials for their projects. However, the high initial costs associated with plastic decking may hinder market growth. Despite this challenge, the market is expected to continue its upward trajectory, driven by the increasing demand for backyard renovations and outdoor living spaces.

What will be the Size of the Market During the Forecast Period?

- The market is experiencing significant growth due to the increasing demand for durable and low-maintenance outdoor living solutions. Plastic decking offers several advantages over traditional wood decking, including superior moisture resistance, mold resistance, and mildew resistance. These properties make plastic decking an ideal choice for various applications, such as recreational areas, swimming pools, and outdoor living spaces. One of the primary reasons for the growth of the market is the use of recycled materials in its production. High-density polyethylene (HDPE), polypropylene (PP), and polyvinyl chloride (PVC) are commonly used in plastic decking, and the recycled versions offer sustainability benefits without compromising the product's performance.

- Additionally, plastic decking's resistance to humidity, oxidation, and color fading is another significant factor driving market growth. These properties make plastic decking an excellent option for construction activities, repairs, and remodeling projects, particularly in regions with high rainfall or extreme weather conditions. Slip resistance is another essential feature of plastic decking, making it a popular choice for pool decks and other areas where safety is a priority. Additionally, the aesthetic value of plastic decking is increasing, with various colors and textures available to suit different design preferences. Plastic decking's versatility extends beyond outdoor living spaces. It is also used in the construction of docks, elevated flat surfaces, and building facades. Such factors will increase the market growth during the forecast period.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Capped composite

- Uncapped composite

- End-user

- Residential

- Non-residential

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- Spain

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Middle East and Africa

- North America

By Type Insights

- The capped composite segment is estimated to witness significant growth during the forecast period.

Capped composite decking, a fusion of wood fibers and plastic, holds a prominent position in the international market. Manufactured by bonding a protective polymer layer, usually made from PVC or ASA, to the core, this decking offers superior resistance to environmental factors. The polymer layer shields the decking against color fading, stains, scratches, and mold growth. The durability of capped composite decking is a major selling point, as it withstands cracking, splitting, warping, and rotting, making it an ideal choice for areas with severe weather conditions.

Moreover, maintenance is minimal, necessitating only occasional cleaning with soap and water or a gentle detergent, unlike natural wood decking that requires frequent painting, staining, or sealing. Slip resistance is another advantage of capped composite decking, ensuring safety on docks and other outdoor structures. With its slip resistance, color fading resistance, and low maintenance requirements, capped composite decking is an excellent option for repairs and remodeling projects.

Get a glance at the market report of share of various segments Request Free Sample

The capped composite segment was valued at USD 2.19 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 44% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America is witnessing significant expansion due to the rising preference for eco-friendly and low-maintenance options for outdoor living spaces and recreational areas. This strategic alliance extends both companies' market reach and enhances their capacity to cater to customers more efficiently.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Plastic Decking Market?

Innovation in high-performance composite decking is the key driver of the market.

- The market in the United States is experiencing growth due to advancements in high-performance composite decking. This decking is available in four colors - Ironwood, Driftwood, Silverwood, and Dunewood - and various lengths and edge profiles, including solid and grooved edges.

- Additionally, this versatility enables consumers to create customized outdoor spaces that cater to their design preferences and functional requirements. The Vista Composite Decking is manufactured using recycled materials such as HDPE (high-density polyethene), PP (polypropylene), and PVC (polyvinyl chloride). These materials are eco-friendly and durable, making plastic decking an attractive alternative to traditional wooden decks. The use of recycled materials also aligns with the growing trend towards sustainability in construction. In summary, the market in the US is thriving due to innovative products like Vista Composite Decking, which offer enhanced safety, design flexibility, and sustainability.

What are the market trends shaping the Plastic Decking Market?

The growth in the E-commerce industry is the upcoming trend in the market.

- The market is experiencing notable growth due to the rise in home renovation and construction activities. In particular, backyard renovations have gained popularity, leading to increased demand for plastic decking solutions. According to recent market research, the market is expected to expand at a steady pace, driven by the increasing preference for low-maintenance and cost-effective decking options. In the United States, e-commerce sales continue to rise, with a reported 14.9% increase in 2021 compared to the previous year. This trend is expected to continue, with the e-commerce market projected to reach USD 843.1 billion by 2025. As a result, online sales of plastic decking products are anticipated to increase, making it a lucrative business opportunity for manufacturers and retailers.

- Moreover, the European market is also witnessing significant growth in the digital space. The European Union (EU) has seen a steady increase in internet usage, with 92% of the population online as of 2023. This trend is expected to continue, with further growth in e-commerce turnover from 2023 to 2027. As such, the market is poised to benefit from the expanding reach and influence of e-commerce in Europe. In summary, the market is experiencing growth due to the rising trend of home renovation and construction activities, coupled with the increasing popularity of e-commerce. In the US and Europe, the market is expected to expand significantly due to the increasing preference for low-maintenance and cost-effective decking options and the growing e-commerce market.

What challenges does Plastic Decking Market face during the growth?

High initial costs are key challenges affecting the market growth.

- The market encompasses various types of WPC decking, including polyvinyl chloride (PVC) and low-density polyethylene (LDPE) composites. Capped and uncapped decking options are also available, catering to residential and non-residential sectors. While these advanced decking solutions offer superior durability and design versatility, their initial costs are higher than traditional wood alternatives. Basic WPC decking, featuring standard features and minimal design options, is priced between USD 2.50 and USD 4.00 per linear foot.

- However, this entry-level category is an affordable choice compared to other WPC options but still represents a more substantial upfront investment than traditional wood decking. Standard WPC decking, which boasts enhanced aesthetics and durability with a range of colors and textures, falls within the USD 4.00 to USD 6.00 per linear foot price range. This mid-range category offers a balance between affordability and advanced features.

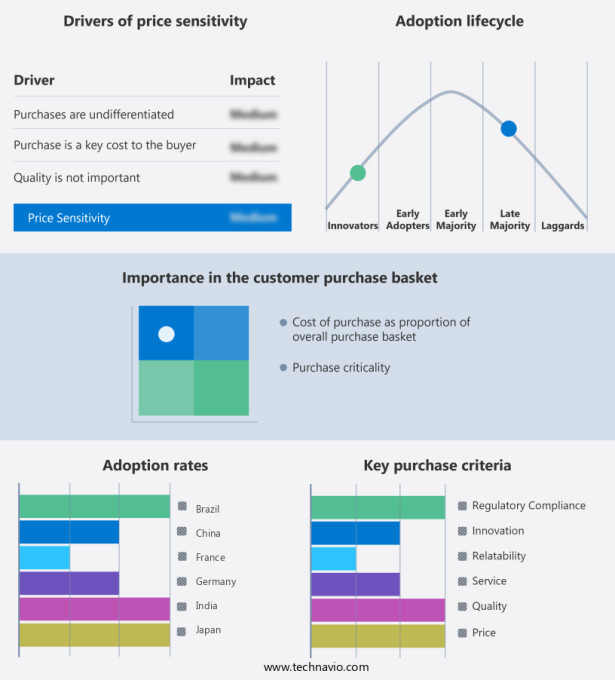

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecasts, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ARCAT Inc.

- BARRETTE OUTDOOR LIVING Inc.

- Cali Bamboo LLC

- Cardinal Home Center

- CertainTeed

- EnviroBuild

- Fiberon

- Floor Monk

- Forestia Group SAS

- Foshan MexyTech Co. Ltd.

- JSW Group

- Mbrico Tile Decks

- NewTechWood America Inc.

- Ocean Color Group Inc.

- Shanghai Seven Trust Industry Co. Ltd.

- Shaw Industries Group Inc.

- The AZEK Co. Inc.

- Trex Co. Inc.

- Virtual Expo Group

- Weyerhaeuser Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Plastic decking has gained significant popularity in recent years as an alternative to traditional wood decking for outdoor living spaces and recreational areas. This type of decking offers several advantages over wood, including superior moisture resistance, mold resistance, and mildew resistance. These properties make plastic decking an ideal choice for areas around swimming pools, making it a popular option in the construction and home renovation industries. Plastic decking is manufactured using various types of polymers such as high-density polyethylene (HDPE), polypropylene (PP), polyvinyl chloride (PVC), and low-density polyethylene (LDPE). Capped and uncapped options are available, with capped decking offering additional benefits like slip resistance, color fading resistance, and oxidation resistance.

In summary, plastic decking is not only used for residential applications but also for non-residential projects such as backyard renovations, construction activities, and commercial projects like docks, marinas, patios, pool areas, hotels, resorts, and building facades. The use of recycled plastic material in plastic decking production adds to its aesthetic value and contributes to sustainability efforts. In hot climatic conditions, plastic decking's humidity resistance and slip resistance make it a preferred choice for outdoor spaces. Its resistance to various weather conditions and low maintenance requirements make it a cost-effective and durable option for creating elevated flat surfaces for various applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

195 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.9% |

|

Market Growth 2025-2029 |

USD 1.77 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.9 |

|

Key countries |

US, China, Germany, UK, France, Spain, Japan, India, South Korea, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the market forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch