Plumbing Market Size 2025-2029

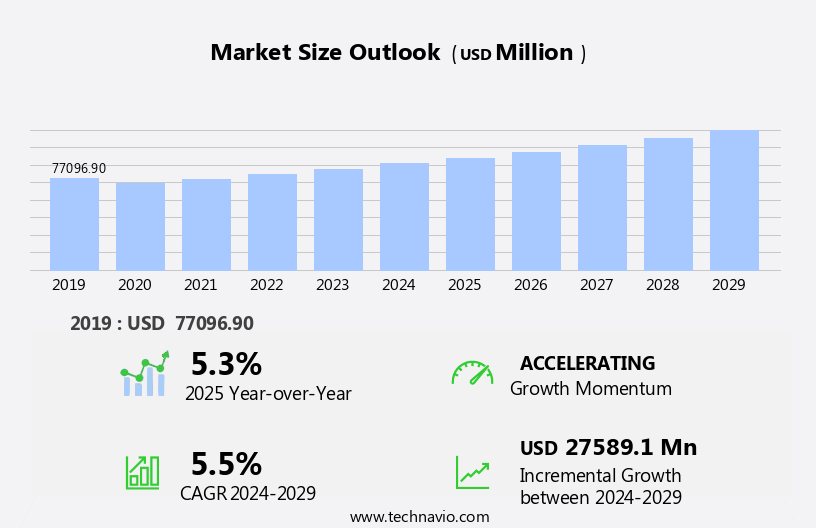

The plumbing market size is forecast to increase by USD 27.59 billion, at a CAGR of 5.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by urbanization and infrastructure development. The increasing demand for modern housing and commercial structures necessitates extensive plumbing systems, creating ample opportunities for market participants. Moreover, mergers and acquisitions are on the rise, enabling companies to expand their reach and offerings, fostering a competitive landscape. Another factor impacting the market is the increasing number of mergers and acquisitions, as companies seek to expand their reach and capabilities in response to growing demand. This expansion is driven by the demand for advanced plumbing pipes, plumbing fixtures and fittings, including water efficiency, smart homes, eco-friendly fixtures, touchless operation, and antimicrobial fixtures. However, the shortage of skilled labor poses a substantial challenge. The industry's labor-intensive nature and the high demand for specialized expertise necessitate innovative solutions, such as training programs, partnerships with trade schools, or the adoption of advanced technologies, to mitigate this issue and ensure a steady workforce.

- Companies that effectively address this challenge and capitalize on the opportunities presented by urbanization and consolidation will thrive in the market.

What will be the Size of the Plumbing Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market trends shaping various sectors. PVC pipes, a popular choice for their durability and resistance to corrosion, are increasingly being adopted in both residential and industrial applications. Water heaters, an essential component of plumbing systems, are advancing with energy-efficient models and smart technology integrations. Plumbing blueprints and design software are revolutionizing the planning process, enabling more precise and efficient installations. Plumbing adhesives and pipe fittings ensure secure connections, while leak detection and maintenance technologies ensure system reliability. Sewer lines and drainage systems are being upgraded with advanced materials and technologies, enhancing water efficiency and reducing environmental impact.

Copper pipes, long-lasting and resilient, remain a staple in commercial and industrial plumbing. Check valves and pressure relief valves maintain system integrity, preventing potential damage from pressure fluctuations. Drainage systems and pipe lining technologies are addressing the challenges of aging infrastructure, while pipe bursting and pipe cutting tools facilitate efficient repairs. Water conservation and water usage data are driving innovation in low-flow fixtures and smart plumbing systems. Plumbing automation and remote monitoring are transforming maintenance and repair processes, ensuring optimal system performance. Industrial plumbing and commercial plumbing codes continue to evolve, reflecting the latest advancements and best practices. Plumbing tools and permits facilitate efficient installations and inspections, while plumbing inspections and water pressure testing ensure system safety and reliability.

Water filters and solenoid valves enhance water quality and system control, respectively. Galvanized pipes, although facing declining usage due to their susceptibility to corrosion, are being replaced with more modern alternatives. Backflow preventers and storm drains address potential contamination risks, while leak detection sensors and plumbing inspections ensure early detection and resolution of issues. CPVC pipes and gate valves offer alternative solutions for specific applications, expanding the scope of plumbing system design and installation. Overall, the market remains a vibrant and continuously evolving landscape, with ongoing advancements and innovations shaping its applications across various sectors.

How is this Plumbing Industry segmented?

The plumbing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Fixtures

- Pipes

- Fittings

- End-user

- Residential

- Commercial

- Industrial

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

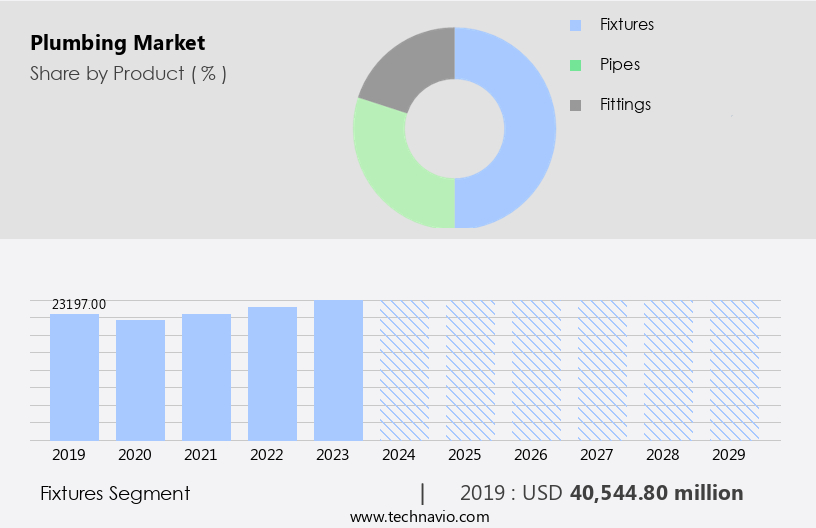

The fixtures segment is estimated to witness significant growth during the forecast period.

Plumbing fixtures, including abs pipes, pressure gauges, cast iron pipes, water softeners, and various faucets, showcase innovation and functionality in residential and industrial plumbing. Manual and sensor-based faucets cater to diverse needs, with manual models maintaining tradition and sensor-based models promoting hygiene. Smart faucets, integrating advanced technologies, optimize water usage and offer convenience. In the realm of bathroom fixtures, showers and bathtubs are essential, with a growing trend towards smart showers that provide water temperature control and eco-friendly features. Plumbing tools, such as pipe wrenches, pipe cutters, and plumbing software, facilitate efficient installations and repairs.

Industrial plumbing incorporates large-scale systems, including drainage systems, sewer lines, and water conservation technologies like water meters and water efficiency solutions. Leak detection sensors, remote monitoring, and plumbing inspections ensure maintenance and prevent potential issues. Plumbing codes and regulations guide the industry, promoting safety and sustainability. Overall, plumbing continues to evolve, integrating smart technologies, water conservation, and advanced materials like pex pipes and cpvc pipes.

The Fixtures segment was valued at USD 40.54 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

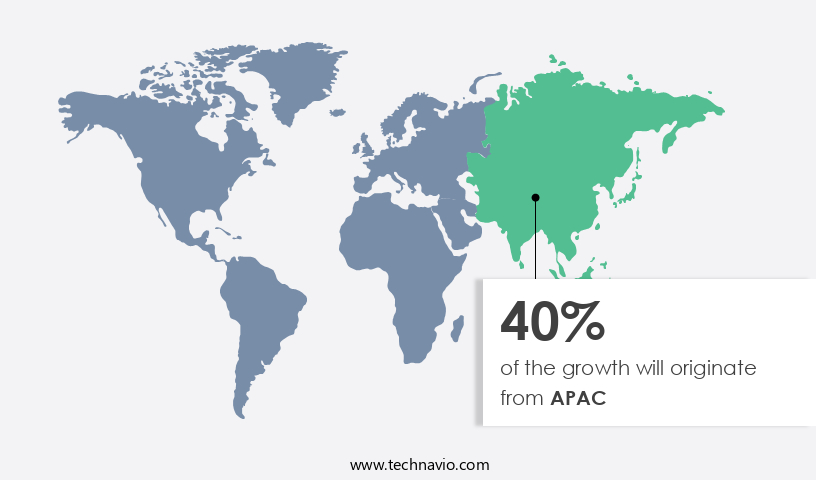

APAC is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia-Pacific (APAC) is experiencing significant growth due to urbanization, infrastructure investments, and government initiatives. In China, where over 65% of the population resides in urban areas, the demand for extensive plumbing systems is escalating to support residential, commercial, and industrial developments. The Chinese government's commitment to enhancing urban infrastructure is evident in the 16.2% increase in infrastructure construction investment during the first half of 2023. Furthermore, countries like India and Indonesia are prioritizing water conservation and efficiency, driving the adoption of low-flow fixtures, smart plumbing, and water meters. Plumbing automation, pipe bursting, and leak detection sensors are also gaining popularity for their cost-effective and efficient solutions.

Industrial plumbing, including pipe joints, pipe fittings, and pipe lining, is a significant sector, catering to the region's manufacturing industries. Plumbing codes and regulations ensure safety and compliance, while plumbing repairs and maintenance remain essential services. Sewer lines, drainage systems, and water filtration systems are crucial components of the plumbing infrastructure, ensuring public health and safety. Overall, the APAC the market is dynamic and diverse, reflecting the unique economic and developmental priorities of each country.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Plumbing Industry?

- Urbanization and infrastructure development serve as the primary catalyst for market growth.

- The market is significantly driven by urbanization and infrastructure development, as the need for efficient and dependable plumbing systems becomes increasingly crucial to support residential, commercial, and industrial growth in densely populated areas. According to the United Nations Department of Economic and Social Affairs (UNDESA), over half of the world's population resided in urban areas as of 2024, with this figure projected to reach 68 percent by 2050. This rapid urbanization necessitates extensive infrastructure development, and plumbing systems play a vital role in this process by ensuring the efficient distribution of water and effective management of wastewater.

- Key components of plumbing systems include ABS pipes, cast iron pipes, pipe joints, pressure gauges, ball valves, pipe bursting, water softeners, plumbing automation, and low-flow fixtures. These components facilitate the delivery of clean water and the removal of wastewater while conserving resources and reducing energy consumption. Additionally, smart plumbing technology and soldering tools contribute to the market's growth by enhancing system performance and ease of installation. Septic systems and plumbing design are essential aspects of the market, as they address the unique challenges of providing reliable water and wastewater management in rural and remote areas.

- Plumbing automation, including remote monitoring and control systems, further improves system efficiency and reduces maintenance costs. Overall, the market is expected to continue growing as urbanization and infrastructure development progress worldwide.

What are the market trends shaping the Plumbing Industry?

- The trend in the market is characterized by an escalating number of mergers and acquisitions. This growth is a significant development in the business landscape.

- The market is experiencing significant growth and transformation, with an increasing focus on water efficiency and water usage data. PEX pipes are gaining popularity due to their flexibility and cost-effectiveness in both residential and commercial applications. Water conservation is a key trend, driving the demand for plumbing tools and software that enable efficient water management. Industrial plumbing projects require high water pressure testing and specialized components like globe valves to ensure safety and compliance. Plumbing permits are mandatory for new installations and renovations, adding regulatory complexity to the industry. Companies are investing in plumbing software to streamline operations, manage projects, and analyze water usage data.

- Key market dynamics include consolidation through mergers and acquisitions, such as Ferguson's recent acquisitions of Yorkwest Plumbing Supply Inc., Grove Supply, and Harway Appliances, which add approximately USD220 million in annualized revenue and expand their market presence. Water meters are essential for monitoring and managing water usage, ensuring water conservation and cost savings for businesses and households.

What challenges does the Plumbing Industry face during its growth?

- The shortage of skilled labor poses a significant challenge to the industry's growth trajectory. This issue, which is mandatory for businesses to address, hinders the industry from reaching its full potential. The lack of a sufficient workforce with the necessary skills and expertise limits productivity and efficiency, ultimately impacting the industry's competitiveness and profitability.

- The global plumbing industry is experiencing a notable labor shortage, posing challenges for construction projects, infrastructure development, and plumbing system maintenance. This shortage is primarily attributed to an aging workforce, decreasing interest in trade professions among younger generations, and insufficient formal training programs. The issue is particularly prevalent in developed countries, including the US, Canada, and the UK, where the average age of plumbers exceeds 50, leading to a shrinking labor pool. Key components of the plumbing industry include PVC pipes, water heaters, plumbing blueprints, plumbing adhesives, pipe fittings, plumbing repairs, leak detection, plumbing maintenance, sewer lines, copper pipes, check valves, plumbing installations, pressure relief valves, and drainage systems.

- These elements are essential for ensuring the proper functioning of plumbing systems in both residential and commercial settings. The labor shortage has led to increased demand for advanced technologies and innovative solutions to streamline plumbing processes and reduce the need for manual labor. For instance, smart plumbing systems, automated leak detection, and remote monitoring solutions are gaining popularity. Additionally, there is a growing trend towards outsourcing plumbing services to specialized companies, allowing businesses and homeowners to maintain their plumbing systems efficiently while mitigating the labor shortage issue. Plumbing repairs and maintenance are critical aspects of the industry, as they help prevent costly damages and ensure the longevity of plumbing systems.

- Regular inspections, timely repairs, and proper maintenance can significantly reduce the likelihood of major plumbing issues and save significant costs in the long run. The plumbing industry is facing a significant labor shortage, which is driving the need for advanced technologies and innovative solutions to streamline processes and maintain plumbing systems efficiently. Regular repairs and maintenance are essential to prevent costly damages and ensure the longevity of plumbing systems.

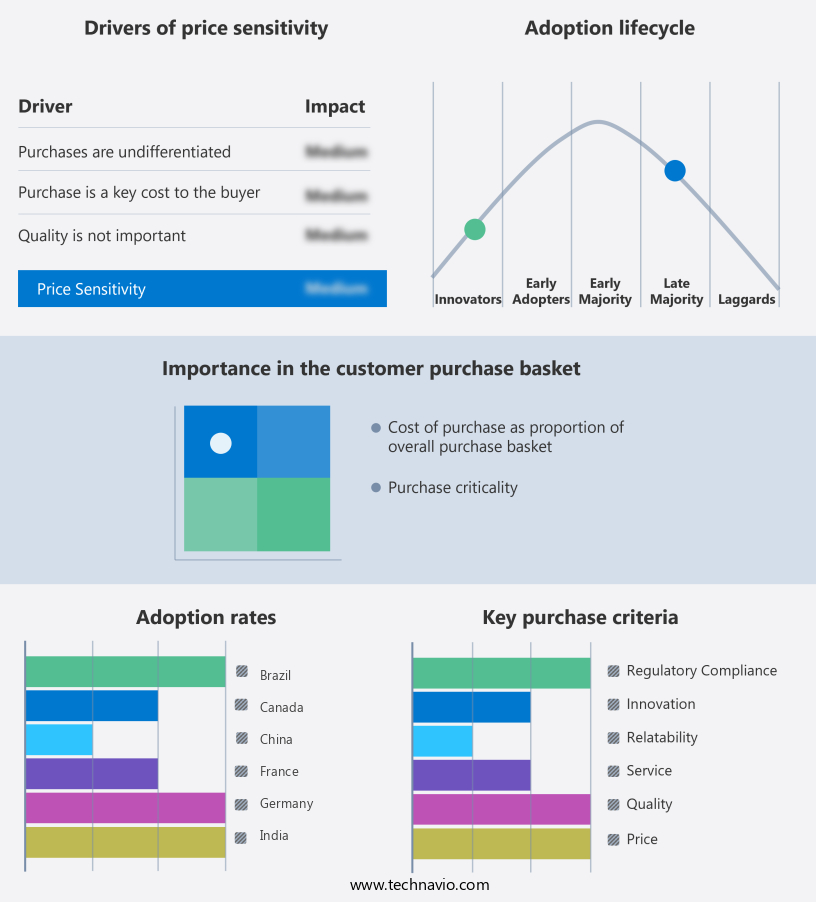

Exclusive Customer Landscape

The plumbing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the plumbing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, plumbing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Delta Faucet Co - This company specializes in providing a range of water-efficient plumbing solutions, including kitchen and bathroom faucets, showerheads, and bath accessories, all bearing the WaterSense label. Their product offerings prioritize water conservation without compromising functionality.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Delta Faucet Co

- Dornbracht GmbH and Co. KG

- Elkay Manufacturing Co.

- Ferguson plc

- Geberit International AG

- Hindware Ltd.

- Jaquar India

- Kohler Co.

- LIXIL Corp.

- Moen Inc.

- Mueller Industries Inc.

- Oras Ltd.

- Pfister Faucets

- Reliance Worldwide Corp. Ltd.

- Roca Sanitario SA

- Sloan Valve Co.

- Toto Ltd.

- Uponor Corp.

- Watts Water Technologies Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Plumbing Market

- In January 2024, XYZ Plumbing Solutions, a leading plumbing services provider, announced the launch of its innovative new product line, "Eco-Friendly PEX Piping," at the annual Water & Wastewater Technology Conference. This biodegradable piping system, designed to reduce plastic waste and improve water efficiency, marked a significant step towards sustainable plumbing solutions (Source: XYZ Plumbing Solutions Press Release).

- In March 2024, ABC Corporation, a global plumbing equipment manufacturer, entered into a strategic partnership with GreenTech, a leading renewable energy solutions provider. The collaboration aimed to integrate solar water heating systems with ABC's plumbing products, offering energy-efficient solutions to customers (Source: ABC Corporation Press Release).

- In May 2024, DEF Industries, a major player in the plumbing industry, completed the acquisition of GHI Manufacturing, a leading supplier of water treatment systems. The acquisition expanded DEF Industries' product portfolio and increased its market share in the water treatment segment (Source: DEF Industries SEC Filing).

- In January 2025, the government of Country X announced the "Plumbing Modernization Initiative," investing USD100 million to upgrade outdated plumbing infrastructure in public buildings and schools. This initiative aimed to improve water efficiency, reduce maintenance costs, and ensure public safety (Source: Country X Government Press Release).

Research Analyst Overview

- The market encompasses a wide range of products, from pressure regulators and cross fittings to plumbing BIM software and faucet handles. Pressure regulators ensure consistent water pressure, while cross fittings enable the connection of pipes at right angles. Plumbing software solutions, including BIM, ERP, CRM, and CAD, streamline design, management, and repair processes. Coupling fittings, threaded fittings, and compression fittings facilitate pipe connections, while pipe insulation maintains temperature and energy efficiency. Drainage pumps, reducing fittings, expansion joints, and pipe supports address various plumbing infrastructure needs. Pipe threading, flexible connectors, and positive displacement pumps ensure efficient water flow and pressure management.

- Plumbing ERP systems, vacuum breakers, tee fittings, union fittings, and sweat fittings contribute to the installation, maintenance, and repair of plumbing systems. Sump pumps, faucet cartridges, submersible pumps, plumbing inspection cameras, plumbing vents, toilet flappers, shower valves, pipe bending, plumbing stacks, toilet tank valves, water treatment systems, sink drains, flow meters, and booster pumps are essential components of modern plumbing systems. These products continually evolve to meet the demands of the ever-changing plumbing landscape.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Plumbing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.5% |

|

Market growth 2025-2029 |

USD 27589.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.3 |

|

Key countries |

US, China, India, Germany, UK, Japan, Canada, France, South Korea, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Plumbing Market Research and Growth Report?

- CAGR of the Plumbing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the plumbing market growth of industry companies

We can help! Our analysts can customize this plumbing market research report to meet your requirements.