Positive Displacement Pumps Market Size 2024-2028

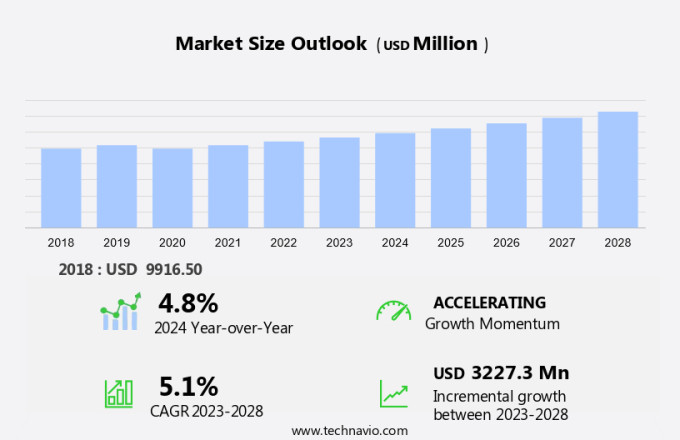

The positive displacement pumps market size is forecast to increase by USD 3.23 billion at a CAGR of 5.1% between 2023 and 2028.

- The market is experiencing significant growth, driven by the chemical industry's increasing demand for high-pressure output and precise fluid handling. Smart pump technologies, which include advanced monitoring and diagnostics, are gaining popularity in high-viscosity fluid transfer applications. The oil reserves exploration and production sector also contribute to market growth due to the need for reliable and efficient pumping systems.

- However, market trends are influenced by the volatility in raw material prices, which can impact the cost of manufacturing and ultimately, the price of pumps. The market analysis report highlights these factors and more, providing insights into the market's future growth prospects. Reciprocating pumps, which use pistons to displace fluid, are ideal for high-pressure applications.

What will be the Size of the Market During the Forecast Period?

- Positive displacement pumps (PDPs) are essential components in various industrial processes, including chemical processing plants and wastewater treatment. These pumps operate by displacing a fixed volume of fluid with each pump cycle, making them ideal for handling high-viscosity fluids, hydraulic systems, and crude oil transfer. In the chemical processing sector, PDPs play a crucial role in chemical dosing, ensuring accurate and efficient delivery of chemicals. They are also widely used in the oil and gas industry for fluid transfer during the production and processing of hydrocarbon assets. In wastewater treatment, PDPs help maintain infrastructure development by effectively moving viscous fluids and ensuring energy efficiency.

- Additionally, PDPs are indispensable in numerous industries, including chemical manufacturing, personal care, dairy processing, and mining activities. The market is experiencing significant growth due to the increasing demand for these pumps in various applications. Rotary pumps and reciprocating pumps are the two primary types of positive displacement pumps. Rotary pumps, which use rotating impellers to move fluid, are commonly used for handling corrosive and abrasive fluids. The demand for PDPs in industrial operations is driven by several factors. Firstly, the increasing focus on energy efficiency and reducing operational costs has led to the adoption of PDPs, which offer higher energy efficiency compared to centrifugal pumps.

- Secondly, the need for handling high-viscosity fluids and ensuring precise fluid transfer has resulted in the widespread use of PDPs in various industries. PDPs are also essential in oil and gas applications, particularly in crude oil transfer. The growing oil reserves and the need for efficient and reliable fluid transfer solutions have fueled the demand for PDPs in this sector. Moreover, PDPs play a critical role in wastewater treatment by effectively handling contaminated fluids and ensuring the efficient operation of treatment plants. The increasing focus on environmental regulations and the need for effective wastewater management have further boosted the demand for PDPs in this sector.

- In conclusion, the market is witnessing significant growth due to the increasing demand for these pumps in various industries, including chemical processing, oil and gas, and wastewater treatment. The ability of PDPs to handle high-viscosity fluids, ensure energy efficiency, and offer precise fluid transfer makes them an indispensable component in industrial operations.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Oil and gas

- Water and wastewater

- Chemical and petrochemical

- Others

- Product

- Rotary pumps

- Reciprocating pumps

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By End-user Insights

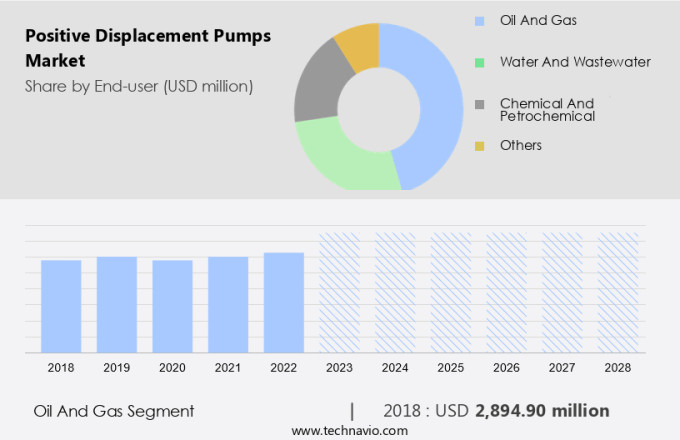

- The oil and gas segment is estimated to witness significant growth during the forecast period.

Positive displacement pumps play a significant role in various industries, including Chemical Manufacturing, Personal Care, Dairy Processing, and Hydrocarbon assets, among others. In the Chemical processing plants sector, these pumps are utilized for transferring fluids with accuracy and efficiency. Within the Personal Care industry, positive displacement pumps are employed for transferring viscous and non-viscous fluids in the production of cosmetics and other personal care products. In the Dairy Processing industry, positive displacement pumps are essential for handling milk and other dairy products due to their ability to maintain consistent flow rates and pressure.

Moreover, these pumps are crucial in Hydrocarbon assets for applications such as Wastewater treatment, where they ensure the efficient and effective removal of contaminants. Despite the recent challenges faced by the oil and gas industry due to fluctuating crude oil and natural gas prices, the sector's gradual recovery is leading to increased investments in new projects. Positive displacement pumps are indispensable in upstream oil and gas applications, such as drilling fluid circulation, hydraulic fracturing, deep-sea pumping, and cementing operations. Furthermore, they are also utilized in midstream transportation and downstream refineries. The Global PDP market is expected to grow steadily, driven by the increasing demand for these pumps in various industries. Companies in the sector are focusing on innovation and technology to improve the efficiency and performance of positive displacement pumps. Some of the key players in the market include Chemical processing plants, Wastewater treatment facilities, Dairy Processing companies, and Hydrocarbon asset owners.

Get a glance at the market report of share of various segments Request Free Sample

The oil and gas segment was valued at USD 2.89 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 49% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In Asia Pacific (APAC), the significant presence of oil-consuming and industrial countries, as well as the world's largest automotive manufacturing hub, positions this region as a major contributor to The market. The region's diverse economy, consisting of both developed and developing countries, results in varying demand for these pumps across different nations. The oil and gas sector in APAC is witnessing expansion, leading to anticipated investments in the region during the forecast period. These investments are projected to generate demand for positive displacement pumps, particularly in the energy generation sector, including shale gas reserves and refinery capacities. Furthermore, the increasing adoption of Industrial Internet of Things (IIoT) technology in APAC's industrial sector is expected to further boost the demand for these pumps. Positive displacement pumps, such as peristaltic pumps, play a crucial role in moving fluids efficiently and reliably, making them indispensable in various industries, including oil and gas, chemical, and industrial manufacturing.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Positive Displacement Pumps Market?

Developments in the water and wastewater industry are the key drivers of the market.

- The global need for clean water continues to escalate due to population growth and increasing demands for domestic, commercial, and industrial uses. This requirement is driving significant investments in the enhancement and establishment of water treatment facilities worldwide. These investments are anticipated to generate new prospects for the expansion of the market. The demand for clean water has been steadily increasing over the past few decades, particularly in developing countries, where urbanization and economic growth are leading to increased investments in new water treatment infrastructure. Positive Displacement Pumps are essential components in various industries, including Chemical Processing Plants, Wastewater Treatment, Oil and Gas, and Hydraulic Systems, due to their ability to handle high-viscosity fluids effectively.

- As a result, the market is poised for substantial growth. Key industries such as Oil and Gas, Chemical Processing, and Wastewater Treatment are significant contributors to the market. These industries rely heavily on Positive Displacement Pumps for transferring crude oil, processing chemicals, and treating wastewater, respectively. As these industries continue to expand, the demand for Positive Displacement Pumps is expected to grow accordingly. In conclusion, the global demand for clean water is fueling investments in water treatment facilities, which in turn, are creating new opportunities for the market. The ability of Positive Displacement Pumps to handle high-viscosity fluids makes them indispensable in various industries, including Oil and Gas, Chemical Processing, and Wastewater Treatment.

What are the market trends shaping the Positive Displacement Pumps Market?

Rising demand for pump repair and remanufacturing from high-performance applications is the upcoming trend in the market.

- In the realm of large-scale and critical applications, such as offshore oil and gas exploration, chemical processing, and petrochemicals, the cost of investing in pumping systems can be substantial. Given the high financial stakes, many end-users prefer to repair or remanufacture worn-out or degraded components instead of opting for costly replacements. In industries with corrosive and harsh environments, material deposition technologies, including plasma arc welding and laser cladding, are commonly used for the repair and renovation of mechanical components. These techniques, classified as material processing and coating methods, play a pivotal role in restoring the functionality and durability of pumps and pumping systems.

- Additionally, high-pressure output pumps, a crucial component in various industries, are subjected to the rigors of handling high-viscosity fluids, making them prone to wear and tear. Smart pump technologies, such as precision fluid handling systems, are increasingly being adopted to mitigate the challenges posed by these applications. These advanced technologies offer enhanced efficiency, reliability, and reduced maintenance costs. The oil and gas sector, with its vast oil reserves, is a significant consumer of high-pressure pumps. The demand for these pumps is driven by the need to transport crude oil from remote locations to refineries and processing facilities. The use of smart pump technologies in this sector is expected to increase, given the benefits they offer in terms of improved efficiency, reduced downtime, and extended component life.

- In summary, the use of advanced material deposition technologies and smart pump solutions is transforming the landscape of pumping systems in industries that require high-pressure output and handling of high-viscosity fluids. These innovations are enabling end-users to reduce costs, enhance efficiency, and ensure reliable operations.

What challenges does Positive Displacement Pumps Market face during the growth?

Volatility in raw material prices is a key challenge affecting the market growth.

- Positive displacement pumps, including rotary and reciprocating types, play a crucial role in chemical dosing and handling viscous fluids in various industries. Infrastructure development and the pursuit of energy efficiency have driven the demand for these pumps.

- However, the market faces challenges due to the price volatility of raw materials, such as cast iron, bronze, stainless steel, aluminum, and copper. This can hinder the adoption of positive displacement pumps in price-sensitive regions. The recent instability in raw material prices is due to increased taxes, duties, and tariffs, as well as production disruptions in metal ore-producing countries. These factors can disrupt the entire supply chain, increasing the cost of the final product.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alfa Laval AB

- Ampco Pumps Co.

- Bailey International LLC

- Borger GmbH

- Bosch Rexroth AG

- Cat Pumps

- CIRCOR International Inc.

- Dover Corp.

- Flowserve Corp.

- Grundfos Holding AS

- HYDAC International GmbH

- IDEX Corp.

- ITT Inc.

- NOV Inc.

- Parker Hannifin Corp.

- Pentair Plc

- SPX FLOW Inc.

- Sulzer Ltd.

- The Weir Group Plc

- Xylem Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Positive displacement pumps (PDPs) play a vital role in various industries, including chemical processing plants and wastewater treatment, where handling high-viscosity fluids is a common requirement. PDPs, such as rotary pumps and reciprocating pumps, are widely used in hydraulic systems, oil and gas industries for crude oil transfer, chemical dosing, and fluid handling. Infrastructure development and energy efficiency are key drivers for the global PDP market. PDPs are essential for handling high-pressure output fluids in chemical manufacturing processes, particularly in industries like personal care, dairy processing, and food and beverage. The oil and gas sector relies heavily on PDPs for fluid transfer in hydrocarbon assets, power generation, and shale gas reserves.

In summary, smart pump technologies, including IoT-enabled pump monitoring systems, have gained significant traction in industrial operations to ensure energy efficiency and minimize waste. PDPs are also crucial in wastewater treatment to prevent contamination and maintain water quality. Mining activities and energy demand further expand the application scope of PDPs. PDPs are indispensable in handling high-viscosity fluids, making them an integral part of various industries, including oil and gas, power generation, and chemical processing. Precision fluid handling and pulsation dampeners are essential features that enhance the performance and reliability of PDPs. Peristaltic pumps are another type of PDPs gaining popularity due to their flexibility and ability to handle a wide range of fluids.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2024-2028 |

USD 3.23 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.8 |

|

Key countries |

China, US, Germany, Japan, and Russia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch