Ball Valves Market Size 2024-2028

The ball valves market size is forecast to increase by USD 4.7 billion at a CAGR of 9.1% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for efficient resource management in various industries, including transportation and natural catastrophe recovery. The integration of technology, such as the Internet of Things (IoT) and the Industrial Internet of Things (IIoT), into industrial processes is driving the market. Smart cities are also investing heavily in infrastructure development, leading to increased demand for reliable valve systems. However, challenges such as valve failure and intense pricing pressure from local, low-priced alternatives persist. To mitigate these challenges, companies are focusing on improving valve efficiency through remote monitoring and predictive maintenance. Natural catastrophes and transportation sectors continue to require these valves for critical applications, making their reliability and performance essential.

What will be the Size of the Ball Valves Market During the Forecast Period?

- The market is a significant segment of the industrial landscape, playing a crucial role in various industries such as water treatment, pulp and paper, transportation, and energy. This market is driven by the need for efficient fluid control systems in industrial processes and the aging infrastructure requiring replacement valves. This market known for their quarter-turn operation, are widely used in applications where clean gas or compressed air needs to be controlled. The market for these valves is subjected to several trends and challenges that are shaping its growth.

- One of the primary trends In the ball valve market is the integration of technology. Smart valves, remote control, and IoT (Internet of Things) technology are increasingly being adopted to enhance valve efficiency and enable remote monitoring. This integration allows for improved resource management and better response to industrial processes' demands. Another trend is the use of 3D printing technology for prototyping and manufacturing the valves. This technology offers several advantages, including reduced production time, lower costs, and increased design flexibility. However, the ball valve market also faces several challenges. High pricing pressure due to raw material costs and increasing competition are major concerns.

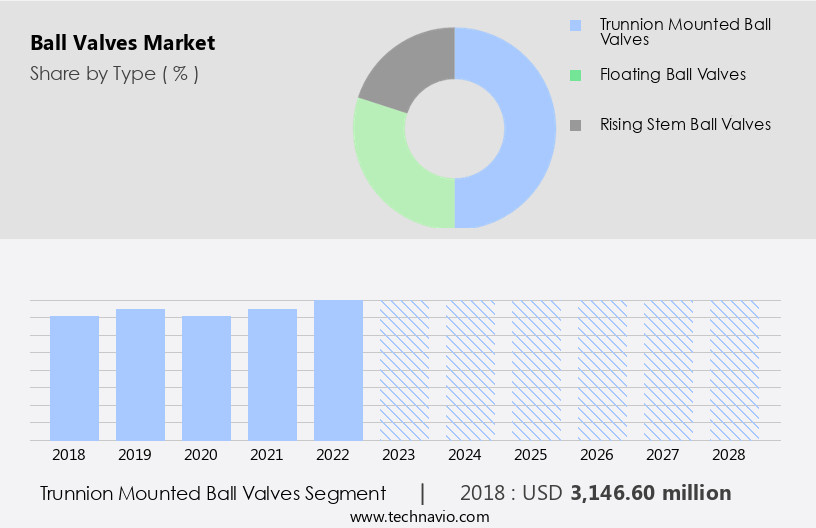

How is this Ball Valves Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Trunnion mounted ball valves

- Floating ball valves

- Rising stem ball valves

- Geography

- APAC

- China

- India

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By Type Insights

- The trunnion mounted ball valves segment is estimated to witness significant growth during the forecast period.

Ball valves are essential components in various industries, particularly in the transportation and processing sectors. These valves, which consist of a spherical closure mechanism, facilitate the control of fluid flow by enabling it to be turned on or off. These valves are predominantly designed as two-way devices, allowing unidirectional flow from the entry point to the exit. The size of ball valves determines their classification, including fully-welded, side or end-entry, split-body, and top-entry types. The expansion of infrastructure In the oil and gas sector and other industrial processes fuels the increasing demand for these valves. Their high durability makes them suitable for shut-off applications even during extended periods of inactivity.

Furthermore, advancements in technology integration, such as the Internet of Things (IoT) and Industrial Internet of Things (IIoT), enable remote monitoring and improved valve efficiency. Natural catastrophes and the need for resource management in smart cities also contribute to the growing importance of these valves. In the context of transportation, these valves ensure the safe and efficient movement of fluids, while in industrial processes, they help maintain optimal conditions and prevent potential hazards.

Get a glance at the Ball Valves Industry report of share of various segments Request Free Sample

The trunnion-mounted ball valves segment was valued at USD 3.15 billion in 2018 and showed a gradual increase during the forecast period.

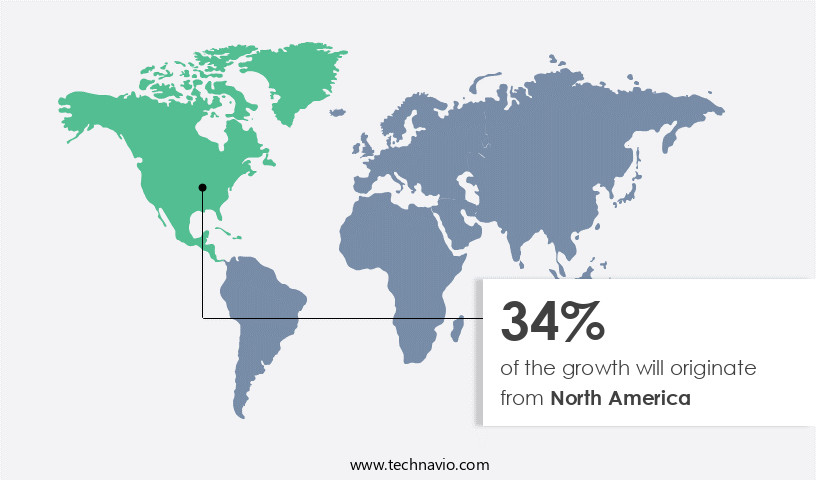

Regional Analysis

- North America is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in Asia-Pacific (APAC) is experiencing significant growth due to several factors, including population growth, increasing urbanization, and expanding middle-income population. In the energy sector, both coal and renewable energy are driving the demand for these valves. In coal energy, these valves are used for clean gas and slurry service, ensuring secure shutoff during power generation. In contrast, renewable energy applications require these valves for liquid service and compressed air, enabling efficient energy transfer. Control valves, specifically these valves, are essential components in various industries, including oil and gas. Their quarter-turn operation ensures secure shutoff and makes them ideal for applications requiring precise flow control.

In the manufacturing sector, these valves are used in various processes, such as chemical, food and beverage, and pharmaceuticals. The adoption of energy-efficient technologies and green building initiatives in countries like China and India is further fueling the demand for these valves. These initiatives require the use of energy-efficient HVAC systems, which rely on these valves for efficient operation. Overall, the market in APAC is expected to continue its growth trajectory, driven by the increasing demand for energy-efficient solutions and infrastructure development.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Ball Valves Industry?

Rising focus on industrialization, urbanization, and smart city development is the key driver of the market.

- The global infrastructure market, encompassing both residential and commercial sectors, is experiencing substantial growth due to population expansion and regulatory encouragement for construction projects. This population growth necessitates an increase in residential spaces, fueling the development of smart city projects. Developing countries, including the UAE, Saudi Arabia, and China, are witnessing a rapid expansion of residential and commercial buildings, thereby driving the demand for ball valves throughout the forecast period. Ball valves, a crucial component of valve technology, are extensively used in various industries, including fuel gas systems and oil refining.

- Their corrosion-resistant and stainless steel properties make them ideal for applications in low-pressure pipelines. With the growing emphasis on automation, energy efficiency, and emissions reduction, smart valves are gaining popularity. In addition, the sanitary ball valves sector caters to the hygiene requirements of industries such as food and beverage and pharmaceuticals. The market is expected to grow significantly due to these factors.

What are the market trends shaping the Ball Valves Industry?

Rising investments in chemical manufacturing facilities in emerging economies is the upcoming market trend.

- The market is experiencing notable growth due to the expanding industrial sector, particularly in emerging economies such as India, China, and Southeast Asian countries. Industrial development and increasing domestic consumption In these regions have led to a heightened demand for sophisticated fluid control systems. Ball valves serve a vital function In these systems, managing the flow of various fluids, including water, chemicals, and gases. The chemical industry is thriving In these economies, fueled by supportive government policies, accessible raw materials, and reduced production expenses. For instance, India is poised to become a significant player In the global chemical manufacturing landscape, with the sector anticipated to expand substantially over the next decade.

- Moreover, the aging infrastructure In the US and North America is driving the need for replacement valves. Smart valves, equipped with remote control capabilities, are gaining popularity In the market due to their ability to optimize performance and reduce operational costs. Innovative technologies such as 3D printing are being employed for prototyping and manufacturing trunnion-mounted ball valves, offering advantages in terms of cost savings and production efficiency. However, high pricing pressure and energy crises in industrial infrastructure continue to pose challenges for market growth.

What challenges does the Ball Valves Industry face during its growth?

Intense pricing pressure due to the availability of local, low-priced valves is a key challenge affecting the industry growth.

- The market is witnessing significant growth due to its extensive applications in various industries, including packaged food, oil extraction, water treatment facilities, and automobiles. With a focus on food security and industrial automation, processors are increasingly adopting intelligent ball valves that offer networking capabilities to optimize production processes. Investments from companies like BASF are driving the demand for advanced ball valve technologies.

- In the logistics sector, road haulage companies require leak-proof ball valves to ensure safe transportation of goods. Automobiles also utilize ball valves in their fuel systems for efficient performance. The affordability of manufacturing in Asian countries has led to increased competition In the market, with many companies offering cost-effective solutions. However, American businesses need to prioritize quality and reliability over cost when selecting ball valve suppliers.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amco Industrial Valve

- Amtech

- Assured Automation

- Christian Burkert GmbH and Co. KG

- Changdel Industrial Co. Ltd.

- DK-LOK USA

- Flowserve Corp.

- Hawa Valves and Tubes Pvt. Ltd

- Hyper Valve

- International Polymer Solutions

- Kerotest Manufacturing Corp.

- Kirloskar Brothers Ltd.

- Larsen and Toubro Ltd.

- MOGAS Industries Inc.

- Oswal Industries Ltd.

- Proline Industrial Valves

- Racer Valves Pvt. Ltd.

- Steelstrong Valves Pvt. Ltd.

- VIP Valves Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Ball valves are essential components of fluid control systems, playing a crucial role in various industries such as water treatment, pulp and paper, energy and power, oil and gas, and transportation. The aging infrastructure In these sectors necessitates frequent replacement of valves, driving the market growth. Smart valves, equipped with remote control and IoT capabilities, are gaining popularity due to their energy efficiency and emissions reduction capabilities. The integration of technology, including 3D printing technology for prototyping and digital transformation, is revolutionizing valve manufacturing. Industrial processes in sectors like oil refining, fuel gas systems, and clean gas require strong valves that can withstand high pricing pressure, energy crises, natural catastrophes, and unplanned downtime.

Moreover, ball valves, with their secure shutoff and quarter-turn operation, are preferred for their reliability and efficiency. Material types, such as stainless steel, offer corrosion resistance, making them ideal for slurry service and sanitary applications. Ball valves find applications in various industries, including water treatment facilities, wastewater treatment, sanitation, and even in industries like automobiles and road haulage. Their leak-proof nature and hygiene benefits make them essential in industries dealing with food security and industrial automation. The future of valve technology lies in intelligent ball valves with networking capabilities, enabling predictive maintenance and optimizing resource management.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

131 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.1% |

|

Market growth 2024-2028 |

USD 4.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.1 |

|

Key countries |

China, US, Germany, India, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Ball Valves Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.